Your Weekly Market Snapshot 📈

Trump’s Tariffs Wreak Havoc Across Markets, Layoffs Highest Since 2020, SpaceX Starship Explodes, TSMC’s $100B U.S. Chip Deal, Trump’s Bitcoin Reserve, and CRWD + AVGO + GTLB Earnings

Sunday Morning Markets

Trading Week 10, covering Monday, Mar 3 through Friday, Mar 7. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Trump Tariff Rollout: Markets in flux as policies shift daily.

Job Growth Slows: Feb payrolls miss estimates, layoffs surge.

$100B Chip Deal: Trump & TSMC to build five new fabs in Arizona.

ECB Cuts Rates: Lowers to 2.5%, signals caution ahead.

OPEC+ Boosts Output: Adds 138K bpd despite uncertainty.

Tesla China Sales: Plunge 49% amid fierce BYD competition.

U.S. Bitcoin Reserve: Funded with seized BTC, no new buys.

SpaceX Explosion: Starship fails again, FAA launches probe.

Amazon’s AI Push: ‘Nova’ reasoning model to rival OpenAI by June.

Larry Page’s AI Startup: Dynatomics eyes factory automation.

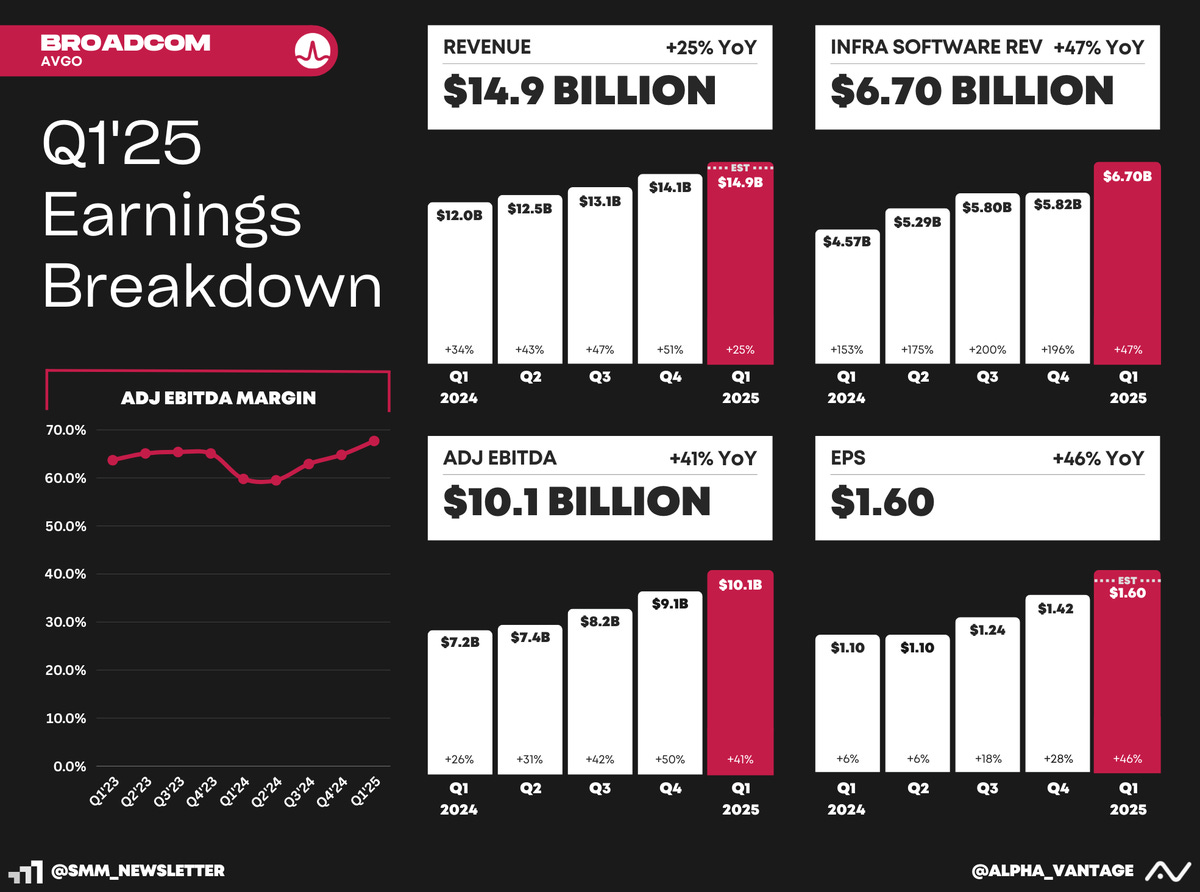

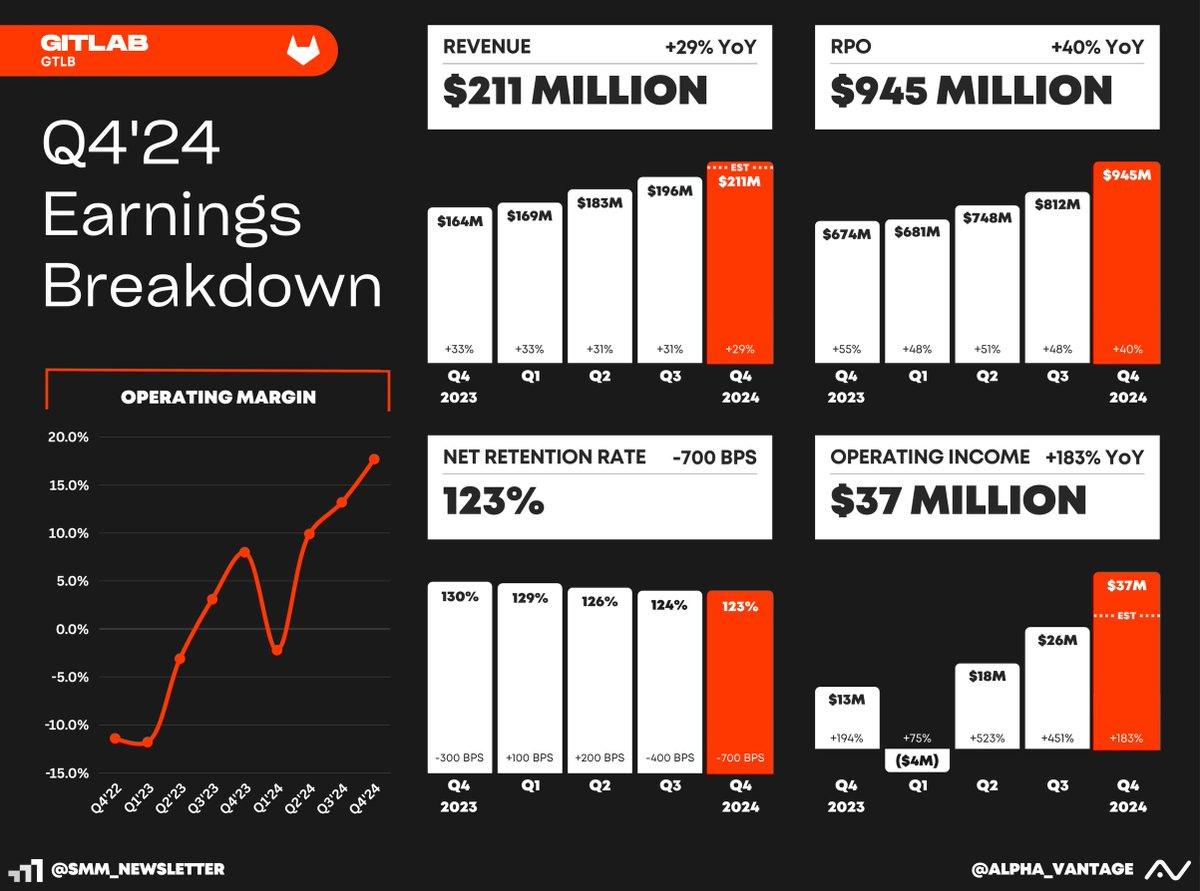

Earnings: CrowdStrike, Broadcom, and GitLab.

US Markets 🇺🇸

Job growth slowed sharply in February, with the DoL reporting 151,000 new payrolls and ADP showing just 77,000 new private-sector jobs—both missing estimates and signaling a cooling labor market.

Trump and TSMC announce $100B U.S. chip investment to build five new chip fabs in Arizona. The move reinforces Trump’s push to boost the domestic production of advanced semiconductors.

U.S. trade deficit surges 34% as imports jumped 10%, far outpacing a 1% rise in exports. The decline in net exports is expected to hurt Q1 GDP, with GDPNow projecting a -2.5% contraction.

Layoff announcements hit their highest since 2020, with 172,017 cuts in February—a 245% jump. DOGE-driven federal layoffs made up over 62,000 as government downsizing accelerated.

Ford’s sales drop 9% in February, signaling weakness in the auto market as gas-powered demand falls 13%, despite a 23% rise in EV sales. The industry is bracing for the impacts of Trump’s tariffs.

IRS plans to cut up to half its workforce through layoffs, attrition, and buyouts under the Trump administration’s federal downsizing efforts, sparking concerns over tax enforcement.

Retailers warn of consumer weakness as spending slows. Target reported soft February sales, Abercrombie issued weak guidance, and consumer confidence fell to its lowest since 2021, adding to economic concerns.

Global Markets 🌏

Trump’s tariffs spark global trade turmoil as he reinstates levies on Mexico, Canada, and China—sparking retaliation threats. Later in the week, he delayed auto tariffs and USMCA goods, adding to market uncertainty.

ECB cuts rates to 2.5%, signaling a “less restrictive” policy but warns of economic risks ahead. With weak growth and trade uncertainty, officials remain cautious on future cuts, opting for a data-driven approach.

China’s factory activity sees fastest growth in months, with February’s Caixin PMI jumping to 50.8. Strong exports drove the gains, but U.S. tariffs could pressure future expansion.

OPEC+ to hike oil output in April despite market uncertainty following Trump's renewed pressure to lower prices. The group will increase production by 138,000 bpd but may adjust based on market conditions.

Tesla’s China-made EV sales plunged 49% in February amid fierce competition from BYD and other local rivals. Price wars and new models challenge Tesla’s dominance as it rolls out software updates to boost demand.

Europe prepares to rearm amid fears of U.S. pullback after Trump-Zelensky fiasco. Defense budgets are set to rise by €150B, driving demand for weapons, ammunition, and military platforms across the continent.

Tech ⚡

Trump establishes a U.S. Strategic Bitcoin Reserve, funded solely by seized Bitcoin. Markets expected more, as BTC dropped 5% due to the plan’s limited scope and exclusion of new purchases.

SpaceX’s Starship suffers another explosive failure, its second this year, scattering debris and prompting an FAA flight halt in Florida. Investigations are underway as safety concerns grow.

Amazon is building a powerful AI ‘reasoning’ model under its Nova brand, set to launch by June. It aims to rival OpenAI and DeepSeek with advanced logic and cost efficiency.

Google co-founder Larry Page to start Dynatomics, a stealth AI startup focused on optimizing product designs for manufacturing. The venture aims to revolutionize factory production with AI-driven innovation.

Chinese buyers evade U.S. curbs to acquire Nvidia’s latest AI chips through third-party resellers. Despite tighter controls, underground networks continue supplying Blackwell and Hopper chips.

Samsung to launch its Apple Vision Pro rival headset this year with AI-powered interactions, gesture controls, and a new Android XR platform developed alongside Qualcomm and Google.

Scale AI lands multimillion-dollar Pentagon deal for "Thunderforge," the DOD’s flagship AI program to enhance military planning and operations. Partners include Microsoft and Anduril.

Earnings Reports 💰

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - Inflation Expectations 🇺🇸

JP - GDP Growth 🇯🇵

Earnings: Oracle, Asana💰

Tuesday

US - JOLTs Job Openings 🇺🇸

Earnings: Kohls, Dicks Sporting Good💰

Wednesday

US - CPI Inflation 🇺🇸

US - 10Y Note Auction 🇺🇸

CA - BoC Interest Rate 🇨🇦

EU - ECB Lagarde Speech 🇪🇺

Earnings: Adobe, UiPath, SentinelOne💰

Thursday

US - PPI Inflation 🇺🇸

US - Jobless Claims 🇺🇸

EU - Industrial Production 🇪🇺

Earnings: DocuSign, Ulta💰

Friday

US - UMich Inflation Expectations 🇺🇸

UK - GDP Growth 🇬🇧

UK - Trade Balance 🇬🇧

DE - CPI Inflation 🇩🇪

Earnings: Li Auto💰

Want to partner with Sunday Morning Markets? Click here to inquire.