Your Weekly Market Snapshot 📈

Inflation Eases to 2.8%, U.S. Deficit Soars 38%, Klarna Files IPO, CoreWeave’s OpenAI Deal, Ceasefire Talks For Ukraine, Meta Tests AI Chips, and ADBE + ORCL + S Earnings

Sunday Morning Markets

Trading Week 11, covering Monday, Mar 10 through Friday, Mar 14. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Inflation Cools: February CPI slows to 2.8%, fueling rate cut bets for 2025.

Deficit Surges: U.S. shortfall tops $1T in five months, up 38% YoY.

Intel Shakeup: Lip-Bu Tan named CEO, aims to reclaim AI leadership.

Ceasefire Talks: U.S. and Ukraine push deal; Putin wants territorial gains.

China Deflation: Consumer prices fall, casting doubt on 5% growth target.

BoC Cuts Rates: Macklem warns of crisis, lowers rates to 2.75% amid tariffs.

Klarna IPO: BNPL firm files under KLAR, eyes $15B valuation post-revenue jump.

CoreWeave + OpenAI: $12B deal fuels IPO plans, revenue jumps 8x to $1.92B.

Meta AI Chips: Tests in-house chips to cut Nvidia costs, boost efficiency.

Earnings: Adobe, Oracle, and SentinelOne

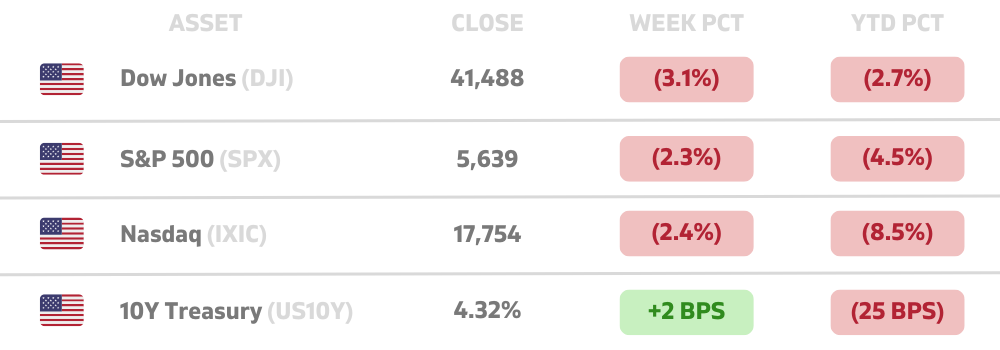

US Markets 🇺🇸

Inflation cools to 2.8% in February, easing concerns as both headline and core rates come in below expectations. The market is now pricing in ~3 rate cuts in 2025, according to CME's FedWatch.

U.S. deficit soars past $1T in five months, up 38% from last year, despite spending cut efforts. Annual deficits swelled in Biden’s final years, rising from $1.38T to $1.83T before Trump took office.

Treasury Sec. Bessent says WH is focused on the ‘real economy’ and not concerned about ‘a little’ volatility, as tariffs shake markets and the Nasdaq slides 13% in a month.

Consumer sentiment plunges to 2022 lows, with policy swings and tariff fears fueling inflation worries. Domestic airlines slashed forecasts due to "demand slump," reinforcing the gloomy outlook.

Rocket Companies to acquire Redfin for $1.75B in an all-stock deal, aiming to enhance its mortgage business with tech and AI. Redfin shares soared 80% on the news.

Intel stock surges as Lip-Bu Tan named new CEO, aiming to reverse losses and reclaim ground in AI. The ex-Cadence CEO succeeds Gelsinger after years of decline and failed turnarounds.

Global Markets 🌏

Global trade war over tariffs intensifies and shifts, as China, Canada, and the EU impose or threaten retaliation. China also signaled openness to cooperate with the U.S. on fentanyl.

U.S. and Ukraine back preliminary ceasefire deal, but Putin resists, demanding territorial concessions and clarity on enforcement. Trump will consider new sanctions if Moscow walks away from the table.

China’s consumer inflation turns negative for the first time in 13 months, raising doubts about its recovery. Weak demand and trade tensions threaten Beijing’s 5% growth target.

UK economy unexpectedly contracts 0.1% in January, driven by a sharp fall in production. The drop raises concerns ahead of the Treasury’s Spring Statement this month.

Bank of Canada cuts rate to 2.75% as trade war escalates, with Macklem warning of a ‘new crisis’. The central bank balances weak economic growth with tariff-driven inflation risks.

Japan cuts Q4 GDP growth to 2.2% as consumer spending widely misses estimates, complicating the BOJ’s rate hike plans. Tepid demand and sticky inflation add to economic uncertainty.

Tech ⚡

Buy now, pay later giant Klarna files for IPO under ticker KLAR. Once valued at $46B in 2021, the company now targets a $15B valuation after growing revenues 24% to $2.8B.

Meta tests its first in-house AI training chip to cut reliance on Nvidia and lower AI infrastructure costs. Success could ease its $65B capex burden and power future AI tools.

CoreWeave inks $12B deal with OpenAI ahead of its IPO, securing a major AI contract and selling $350M in equity. Revenue surged over 8x to $1.92B in 2024 as it targets a $35B valuation.

Amazon, Google and Meta support tripling nuclear power by 2050, backing a global effort to meet soaring AI energy demands as renewables alone can’t ensure reliable supply.

Google debuts Gemma 3 model that runs on one GPU, reaching 98% of DeepSeek’s accuracy with lower hardware needs. It adds vision, video, and support for 140 languages.

Asana Founder and CEO Dustin Moskovitz retires, stock plunges 25% after the surprise announcement. The Facebook co-founder plans to focus on philanthropy as Asana seeks a new leader.

ServiceNow to acquire Moveworks for $2.85B in cash and stock, adding AI assistants and automation to its platform. The deal strengthens its push for enterprise-wide AI adoption.

Meta is launching Community Notes in the US next week, modeled after X’s open-source system, to crowdsource fact-checking and address bias across Facebook, Instagram, and Threads.

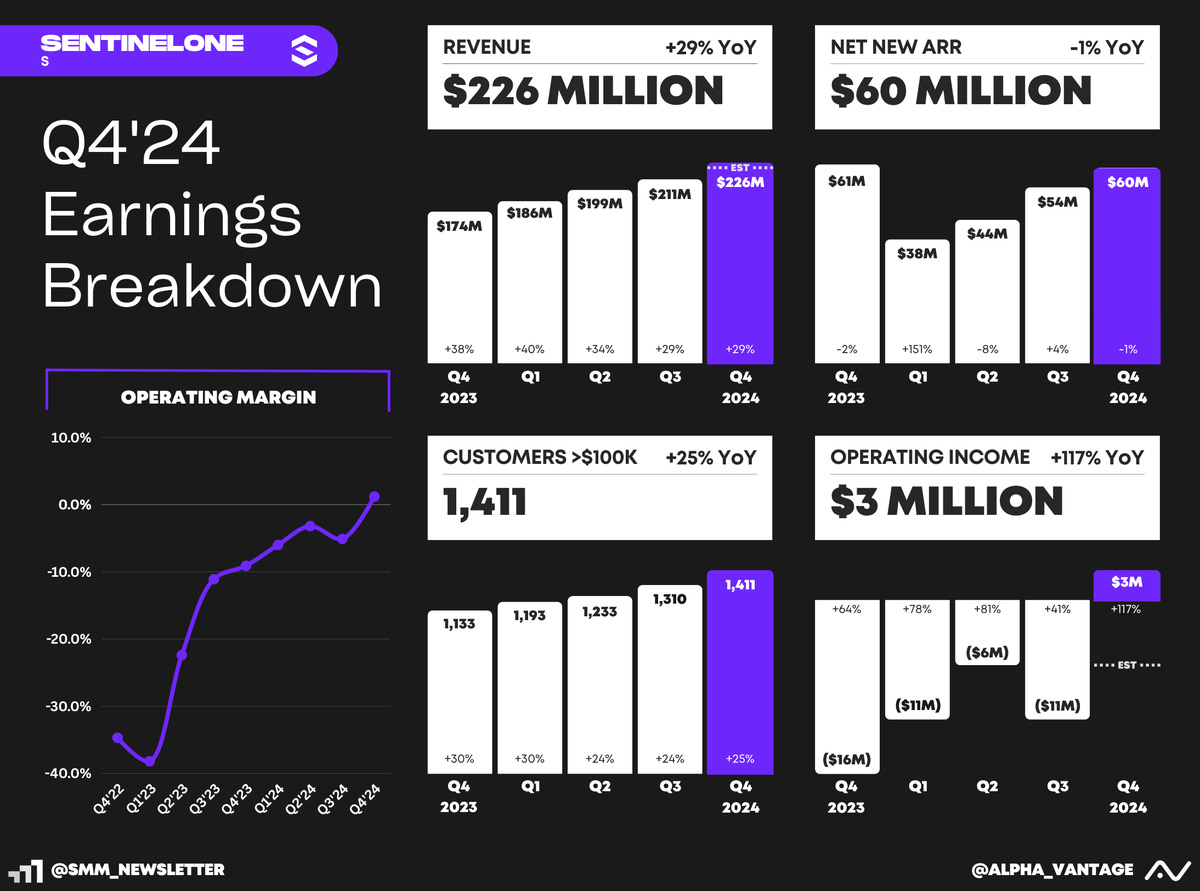

Earnings Reports 💰

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - Retail Sales 🇺🇸

US - Empire State Manf. Index 🇺🇸

CN - Industrial Production 🇨🇳

Tuesday

US - Building Permits 🇺🇸

US - Housing Starts 🇺🇸

US - Industrial Production 🇺🇸

CA - CPI Inflation 🇨🇦

EU - ZEW Economic Sentiment 🇪🇺

EU - Trade Balance 🇪🇺

JP - BoJ Interest Rate Decision 🇯🇵

Earnings: Xpeng💰

Wednesday

US - Fed Interest Rate Decision 🇺🇸

US - FOMC Economic Projections 🇺🇸

EU - CPI Inflation 🇪🇺

CN - PBoC Interest Rate Decision 🇨🇳

Earnings: William Sonoma, Five Below💰

Thursday

US - Jobless Claims 🇺🇸

US - Existing Home Sales 🇺🇸

US - Philly Fed Manf. Index 🇺🇸

UK - BoE Interest Rate Decision 🇬🇧

CH - SNB Interest Rate Decision 🇨🇭

JP - National CPI Inflation 🇯🇵

Earnings: Micron, Nike, FedEx, PinDuoDuo, Accenture, Lennar, Jabil💰

Friday

CA - Retail Sales 🇨🇦

Earnings: Nio, Carnival💰

Want to partner with Sunday Morning Markets? Click here to inquire.