Your Weekly Market Snapshot 📈

U.S. Deficit Soars 40%, Inflation Cools, Israel-Hamas Ceasefire, Meta Layoffs, Trump-Xi Discuss Taiwan, and TSM + JPM + GS Earnings

Sunday Morning Markets

Trading Week 3, covering Monday, Jan 13 through Friday, Jan 17. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Cooling Inflation: CPI at 2.9%, core at 3.2%; markets rally on easing prices.

Budget Deficit: U.S. deficit surges 40% to $710.9B; debt hits $36T.

Trump-Xi Call: Trade, TikTok, and Taiwan discussed ahead of inauguration.

Israel-Hamas Ceasefire: Deal reached after 15 months. Hostages released.

TikTok Ban: App shuts down as Supreme Court upholds ban.

AI Chips Surge: TSMC profits jump 57% on record 3nm chip demand.

Meta Layoffs: Cuts 5%, targeting "low performers" to streamline operations.

Blue Origin: New Glenn rocket reaches orbit despite booster landing failure.

China Stimulates: Economy grew 5.4% as PBOC injects $131B.

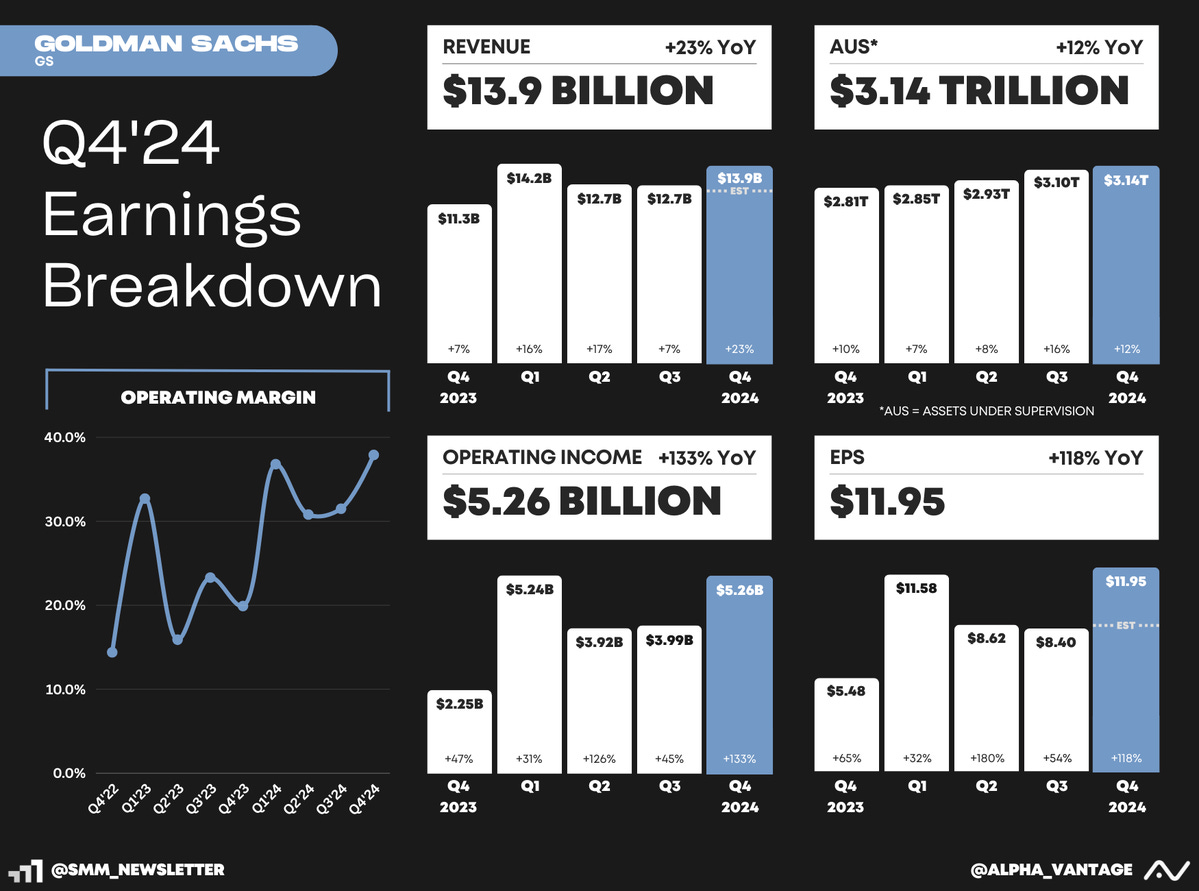

Earnings: TSMC, JPMorgan Chase, Goldman Sachs.

US Markets 🇺🇸

The U.S. budget deficit surged 40% year-over-year, hitting $710.9 billion for the fiscal quarter. Rising interest costs, higher spending, and lower tax revenues pushed debt past $36 trillion.

Consumer inflation rose to 2.9% in December, fueled by rising gas prices, while core inflation eased to 3.2%, below estimates. Markets rallied as cooling price trends lifted investor optimism.

Trump calls China’s Xi ahead of inauguration, discussing trade, TikTok, and Taiwan. Trump emphasized cooperation, while Xi urged caution on Taiwan and sought peaceful ties.

US retail sales broadly advanced in December, capping a solid holiday shopping season. Sales rose 0.4%, with autos, furniture, and sporting goods showing strong gains.

Wholesale inflation cooled in December, with the producer price index rising just 0.2%, below the expected 0.4%. Core PPI was flat, signaling eased inflation pressures.

J&J acquires Intra-Cellular Therapies in $14.6B deal to strengthen its neurological drug portfolio with key treatments like Caplyta, targeting schizophrenia and bipolar disorder.

Biden launches cybersecurity executive order requiring stricter standards for companies selling to the U.S. government, potentially benefiting firms like CrowdStrike, Palo Alto Networks, and Fortinet.

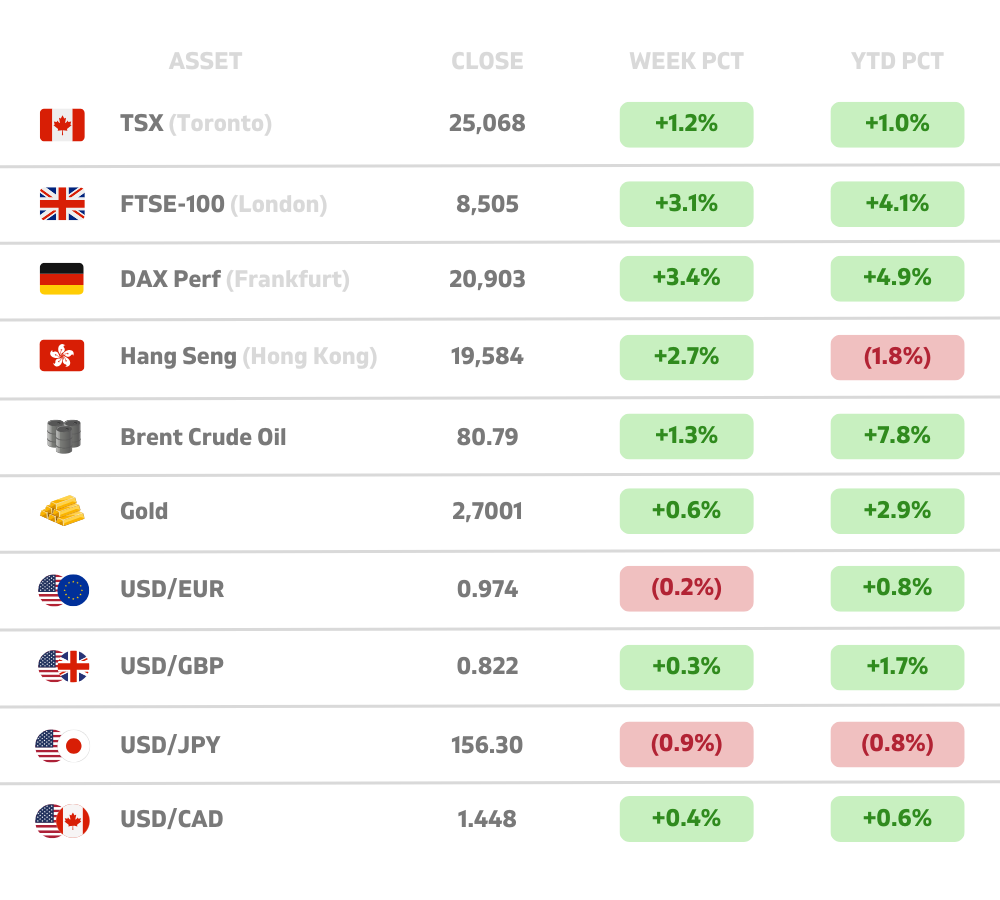

Global Markets 🌏

Israel and Hamas reach Gaza ceasefire and hostage deal after 15 months of war. The three-phase agreement includes a ceasefire, release of hostages, and humanitarian aid, with a Gaza rebuilding plan to follow.

China’s economy grew 5.4% in Q4, driven by stimulus efforts and rising industrial output. Despite the better-than-expected report, soft consumer demand raises concerns for sustained recovery.

South Korea’s President Yoon Suk Yeol arrested, marking a historic first for a sitting leader. Charged with insurrection over a failed martial law decree, Yoon faces potentially severe penalties.

Germany’s economy shrank for a second straight year, contracting 0.2% in 2024 amid high energy costs, weak exports, and EV competition. U.S. tariff threats could worsen the outlook.

U.K. inflation eased to 2.5% in December, its lowest since March 2022. Slower services inflation fueled optimism for more BOE rate cuts, but long-term price pressures persist.

China’s central bank injects $131B into the banking system, its second-largest move ever, to ease cash demand before Lunar New Year and stabilize the yuan amid economic pressures.

Tech ⚡

TikTok shuts down in the U.S. as Apple and Google removed it from app stores. However, Trump will ‘most likely’ grant a 90-day extension for ByteDance to divest its U.S. operations.

Meta plans to cut 5% of its workforce, about 3,600 employees, as Mark Zuckerberg aims to “raise the bar on performance.” The cuts focus on “low performers” in an aim to streamline teams.

Blue Origin's New Glenn rocket reaches orbit on debut as the 320-foot rocket successfully launched satellites despite a booster landing failure. Eight launches are planned for 2025.

Klarna partners with Stripe in major payments deal, expanding its ‘buy-now pay-later’ services to 26 countries. The move gives Klarna a major boost ahead of its hotly anticipated IPO.

Microsoft introduces usage-based pricing for 365 Copilot Chat, enabling companies to pay per use rather than a flat fee. The tool offers AI-powered task automation and data-driven insights.

Surging AI chip demand fuels record growth as TSMC's profit jumped 57%, driven by a 140% rise in 3nm chip sales. The company projects another strong quarter ahead with 35%+ growth.

Earnings Reports 💰

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - Markets Closed (MLK Jr. Day) 🇺🇸

US - Inauguration Day 🇺🇸

Tuesday

CA - Inflation Report 🇨🇦

UK - Unemployment 🇬🇧

DE - Economic Sentiment 🇩🇪

Earnings: Netflix, Charles Schwab, CapitalOne, United Airlines💰

Wednesday

US - CB Leading Economic Index 🇺🇸

Earnings: Discover Financial, Johnson&Johnson, Abbott💰

Thursday

CA - Retail Sales 🇨🇦

JP - BoJ Interest Rate 🇯🇵

JP - Inflation Report 🇯🇵

Earnings: Texas Instruments, GE, American Airlines💰

Friday

US - Existing Home Sales 🇺🇸

US - S&P Composite PMI 🇺🇸

UK - S&P Composite PMI 🇬🇧

DE - HCOB Composite PMI 🇩🇪

Earnings: American Express, Verizon💰

Want to partner with Sunday Morning Markets? Click here to inquire.