Your Weekly Market Snapshot 📈

Trump Orders Major Pentagon Cuts, OpenAI Hits 400M Users, Musk Snubs Uber on Robotaxis, Apple Unveils $599 iPhone 16e, Microsoft's Quantum Chip, and BABA + RIVN + XYZ Earnings

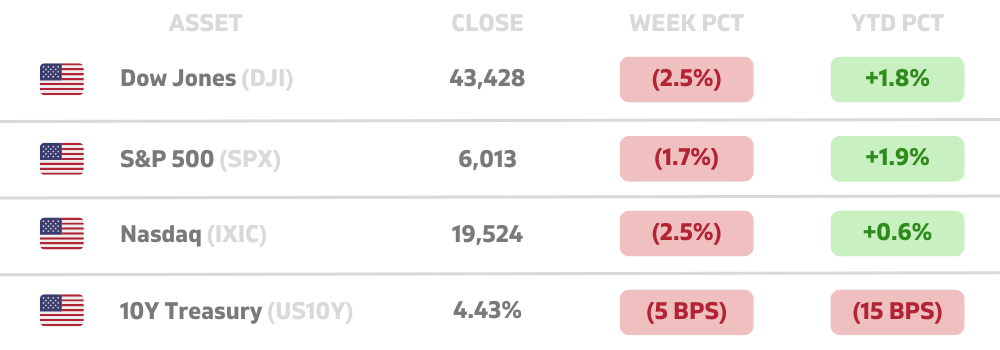

Sunday Morning Markets

Trading Week 8, covering Monday, Feb 17 through Friday, Jan 21. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Fed Pause: Officials delay rate cuts, citing tariff risks.

Pentagon Cuts: Trump orders 8% annual defense budget cuts.

iPhone 16e: Apple unveils $599 AI-powered budget model.

Eurozone Stagnates: Germany recovers, France declines.

Microsoft Quantum: Unveils "Majorana 1" qubit chip.

OpenAI Growth: 400M users, DeepSeek competition heats up.

Grok 3 Launch: Musk’s AI beats rivals in key benchmarks.

Musk Snubs Uber: Tesla robotaxis to launch solo in Austin.

Bybit Hack: Record $1.4B crypto theft from cold wallet.

Earnings: Alibaba, Rivian, and Block

US Markets 🇺🇸

Fed officials signal a pause on rate cuts amid tariff fears. Meeting minutes reveal growing concern that Trump’s trade policies could drive inflation higher. Markets are currently pricing in 2 cuts this year.

Trump orders Pentagon to plan deep budget cuts, aiming to slash 8% annually over five years. Exemptions include border security and missile defense, but critics warn of risks to military readiness.

Home sales plunge 4.9% as prices hit record high, with January’s median sales price up 5% year-over-year to $396,900. High mortgage rates and tight supply continue to squeeze affordability.

TSMC and Broadcom consider splitting Intel in two as Broadcom eyes its chip design unit, while TSMC targets its factories. Shares of Intel surged 16% following the news, despite talks being just ‘preliminary’.

Apple reveals iPhone 16e, a cheaper AI-powered model starting at $599. It features the A18 chip, FaceID-only, and Apple’s first in-house modem, bringing advanced AI to a budget-friendly device.

FDA declares Wegovy and Ozempic shortages over, ending a two-year supply crunch. Compounding pharmacies must halt unbranded versions, causing shares of HIMS to plunge 25%.

Nikola files for Chapter 11 bankruptcy protection after failing to secure new funding or a buyer. Once valued at $30B, the EV startup fell from grace amid scandals, recalls, and dwindling cash reserves.

Global Markets 🌏

Eurozone stagnates as Germany improves but France slumps, with the PMI stuck at 50.2. Trade tensions and high costs add pressure ahead of the ECB’s next meeting.

Australia’s central bank cuts rates for first time in 4 years, lowering its benchmark to 4.10% as inflation eases. The RBA remains cautious, signaling a gradual approach amid economic uncertainties.

Trump calls Zelensky a ‘dictator’ as Ukraine feud escalates, accusing him of misusing U.S. aid. Zelensky hits back, calling Trump’s claims Russian disinformation. Tensions rise over peace talks.

Japan’s GDP beats forecasts on strong exports, growing 0.7% in Q4. However, weak domestic demand remains a concern, with full-year growth slowing sharply to 0.1% from 1.5% in 2023.

China’s Xi urges private businesses to “show their talents” as Beijing signals stronger support for entrepreneurs. The move aims to boost confidence amid economic slowdown and global trade tensions.

UK inflation surges to 3% in January, surpassing forecasts as food, transport, and school fees drive prices higher. Despite this, the Bank of England still signals future rate cuts.

Canada’s inflation ticks up to 1.9% in January, driven by rising gas and vehicle prices despite a sales tax holiday. Core inflation remains elevated, dimming hopes for a March rate cut.

Tech ⚡

Microsoft reveals its first quantum computing chip, Majorana 1, featuring eight topological qubits. Microsoft says the quantum technology is 'years, not decades' away.

OpenAI hits 400M weekly active users, up 33% in three months, despite rising competition from DeepSeek. Enterprise users doubled to 2M, while competition and legal battles, including Musk’s lawsuit, heat up.

Musk’s xAI launches Grok 3 model, claiming it beats rivals in math, science, and coding tests. The AI model will roll out to premium X users, with a powerful new “Deep Search” feature.

Musk rejects Uber partnership for Tesla robotaxis, opting to go solo in Austin. Uber and Waymo will compete with Tesla, as autonomous rides reshape the industry.

Bybit hacked in record $1.4B crypto theft, as attackers drained 401,346 ETH from a cold wallet. The exchange says it remains solvent, but the breach marks the largest crypto heist ever.

Dell nears $5B AI server deal with Musk’s xAI, supplying Nvidia-powered hardware for AI workloads. The move cements Dell’s position as a leading AI server provider amid booming demand.

HP buys Humane AI's assets for $116M and will shut down the AI Pin this month after struggling to gain traction despite raising $230M. Humane engineers will join HP’s new AI lab.

Earnings Reports 💰

Weekly Poll 🗳️

Week Ahead 📅

Monday

EU - CPI Inflation 🇪🇺

DE - Ifo Business Climate 🇩🇪

Earnings: Zoom, Hims, Tempus, Riot💰

Tuesday

US - CB Consumer Confidence 🇺🇸

DE - GDP Growth 🇩🇪

Earnings: Home Depot, Cava, Coupang, Workday, Intuit, Lucid, Instacart💰

Wednesday

US - New Home Sales 🇺🇸

Earnings: Nvidia, Salesforce, Snowflake, Lowes, Stellantis💰

Thursday

US - GDP Growth 🇺🇸

US - Durable Goods 🇺🇸

US - Pending Home Sales🇺🇸

Earnings: Dell, Autodesk, Duolingo, RocketLab💰

Friday

US - PCE Inflation 🇺🇸

US - Personal Income & Spending 🇺🇸

CA - GDP Growth 🇨🇦

DE - Inflation Rate 🇩🇪

CN - NBS Manufacturing PMI 🇨🇳

Want to partner with Sunday Morning Markets? Click here to inquire.