Your Weekly Market Snapshot 📈

Amazon & Alphabet Boost AI Spending, Tesla Struggles in China, USAID Shutdown Blocked, Job Growth Slows, China Tariffs Escalate, U.S. Explores Bitcoin Reserve, and AMZN + GOOG + PLTR Earnings

Sunday Morning Markets

Trading Week 6, covering Monday, Feb 3 through Friday, Jan 7. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Job Growth Slows: U.S. adds 143,000 jobs in January; wages surge 0.5%.

USAID Battle: Trump moves to shut down USAID; judge blocks suspensions.

Federal Buyouts: Court halts deadline; 60,000 workers accept offer.

Amazon & Google AI Spend: Amazon plans $100B CapEx, Alphabet $75B.

Tesla Struggles in China: Sales drop 11.5% as local rivals like BYD surge.

China Tariffs Escalate: Beijing slaps 15% duties on U.S. goods.

Bitcoin Reserve: Trump’s crypto czar explores a U.S. Bitcoin reserve.

OpenAI Expands: New ChatGPT Pro tool launches for citation-backed research.

Workday Layoffs: 1,750 jobs cut in AI pivot, with $270M in related costs.

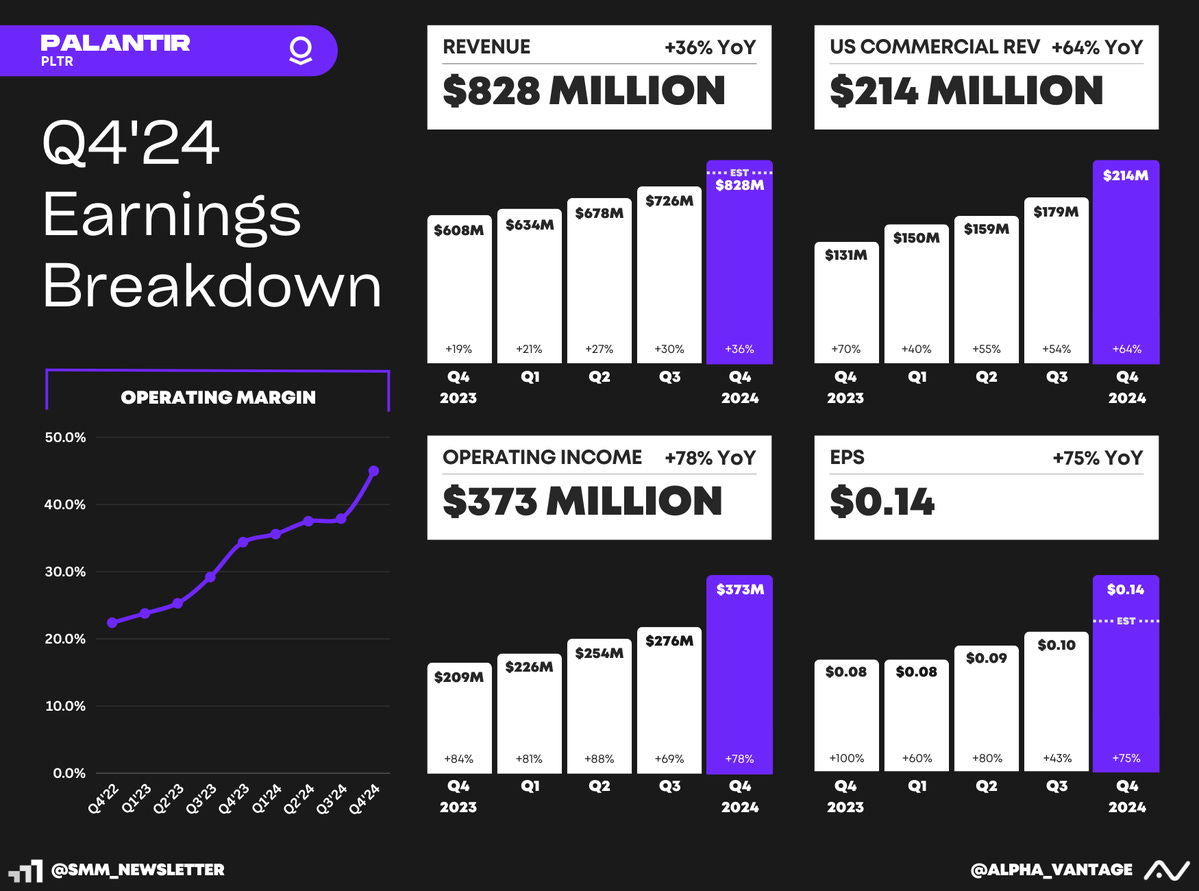

Earnings: Amazon, Alphabet, and Palantir.

US Markets 🇺🇸

US job growth slowed to 143,000 in January, missing forecasts of 170,000, while unemployment dipped to 4%. Wages surged 0.5% during the month, likely delaying any rate cuts from the Fed.

Elon Musk says he and Trump are shutting down USAID, calling it “beyond repair.” On Friday, a Federal Judge blocked Trump from putting thousands of USAID workers on administrative leave.

Amazon plans $100B in CapEx for AI expansion in 2025 as the company aims to seize a "once-in-a-lifetime" opportunity, while Alphabet also reaffirmed its $75B CapEx guidance for the year.

Judge halts Trump’s federal worker buyout deadline pending a Monday court hearing on its legality. Over 60,000 employees have accepted the offer, which unions argue lacks legal and financial clarity.

Trump signs order to create a U.S. sovereign wealth fund, aiming to boost economic development and potentially buy TikTok. Treasury has 90 days to develop an operational strategy.

Inflation fears surge as tariffs rattle consumer confidence. The survey shows inflation expectations for next year jumped to 4.3%, the highest since 2023, as Trump's tariffs heighten economic anxiety.

Global Markets 🌏

China retaliates with tariffs up to 15% on U.S. imports, targeting energy, agriculture, and autos starting Feb. 10th. The move escalates trade tensions as a new U.S.-China tariff battle looms.

Trump says U.S. will ‘take over’ Gaza to develop it and suggests Palestinians relocate to Egypt and Jordan. The proposal faces fierce backlash from Arab nations and human rights groups.

US delays tariffs on Canada and Mexico for 30 days after agreements to boost border security and curb fentanyl trafficking. Negotiations with both countries on a final deal are ongoing.

Bank of England cuts rates and signals more easing ahead as it slashes the UK’s 2025 growth forecast from 1.5% to 0.75%. Policymakers warn of both economic uncertainty and inflation risks.

Eurozone inflation rises to 2.5% in January, exceeding forecasts as energy prices surge. The hot inflation report adds pressure on the ECB amid ongoing economic uncertainty.

Temu parent PDD’s stock tumbles after key trade loophole is closed which allowed duty-free imports under $800. The move threatens Temu and Shein’s low-price strategy in the U.S.

Tesla’s China sales drop 11.5% as local competition rises. Rivals like BYD saw strong growth, forcing Tesla to rely on price cuts and incentives to stay competitive. A new affordable model is expected in 2025 to boost demand.

Tech ⚡

Trump’s crypto czar eyes US Bitcoin reserve, with officials studying its feasibility as part of a broader digital asset strategy. A regulatory framework report is expected in six months.

Workday to cut 1,750 jobs in AI shift, aiming to streamline operations and boost global expansion. The company expects up to $270M in related costs, with layoffs completed by mid-2026.

European AI startups raised $8B in 2024 as funding surged, with 70% of investments going to early-stage rounds. The U.K., France, and Germany led the way, while AI applications in health and climate gained momentum.

Uber to launch Waymo robotaxis in Austin, inviting users to join an interest list ahead of the rollout. The autonomous vehicles will be available exclusively through Uber’s app.

OpenAI unveils "deep research" agent for ChatGPT Pro, designed for in-depth, citation-backed research in finance, science, and more. It's launching on web-only for now, with app support coming soon.

Mistral launches AI assistant on iOS & Android, expanding its competition with ChatGPT and Gemini. The update includes a Pro tier, faster responses, and enterprise deployment options.

Earnings Reports 💰

Weekly Poll 🗳️

Week Ahead 📅

Monday

UK - Retail Sales 🇬🇧

AU - Westpac Consumer Confidence 🇦🇺

Earnings: McDonalds, On Semi, Astera Labs, Monday💰

Tuesday

US - Fed Powell Testifies 🇺🇸

Earnings: Shopify, DoorDash, SMCI, Confluent, Lyft, Zillow, Upstart💰

Wednesday

US - CPI Inflation 🇺🇸

Earnings: Cisco, TradeDesk, Robinhood, Reddit, Applovin, Hubspot💰

Thursday

US - PPI Inflation 🇺🇸

UK - GDP Growth 🇬🇧

EU - Industrial Production 🇪🇺

Earnings: Airbnb, Coinbase, Palo Alto Networks, DraftKings, Roku, DataDog, CyberArk💰

Friday

US - Retail Sales 🇺🇸

EU - GDP Growth 🇪🇺

EU - Unemployment Report 🇪🇺

Want to partner with Sunday Morning Markets? Click here to inquire.