Your Weekly Market Snapshot 📈

Powell Signals Fewer Rate Cuts Ahead, AI Funding Surges 62%, Retail Sales See Sharpest Drop in 2 Years, Trump Meets Putin on Ukraine, OpenAI Rejects Musks $97B Offer, and SHOP + ABNB + COIN Earnings

Sunday Morning Markets

Trading Week 7, covering Monday, Feb 10 through Friday, Jan 14. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Inflation Heats Up: Prices rose 3% in January, delaying Fed rate cuts.

Powell on Rates: Fed chair says no rush to cut rates with inflation above 2%.

Steel Tariffs: Trump announces 25% tariff on steel and aluminum.

Retail Sales Plummet: Sales fall 0.9% in January, the largest drop in 2 years.

Anduril’s Army Deal: Takes over $22B Army headset contract.

Trump Meets Putin: Talks to end Ukraine war as Bessent meets Zelensky.

Apple + Alibaba: Partners to bring AI to iPhones in China.

AI Funding Soars: AI startups raised $110B in 2024, up 62%.

Musk-OpenAI: Board rejects Musk’s $97B acquisition offer.

TikTok Is Back: Google and Apple reinstate TikTok on app stores.

BYD EV Prices: Slashes prices of entry model under $10K.

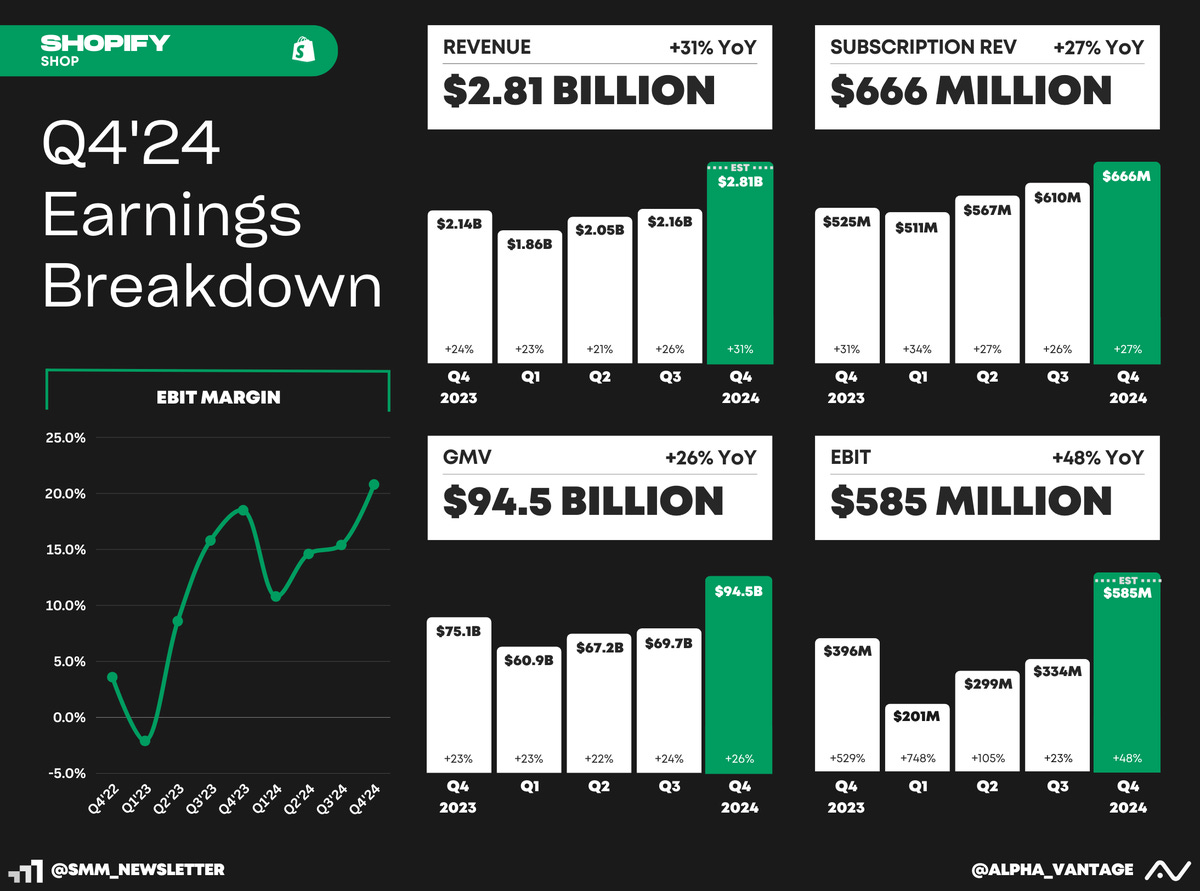

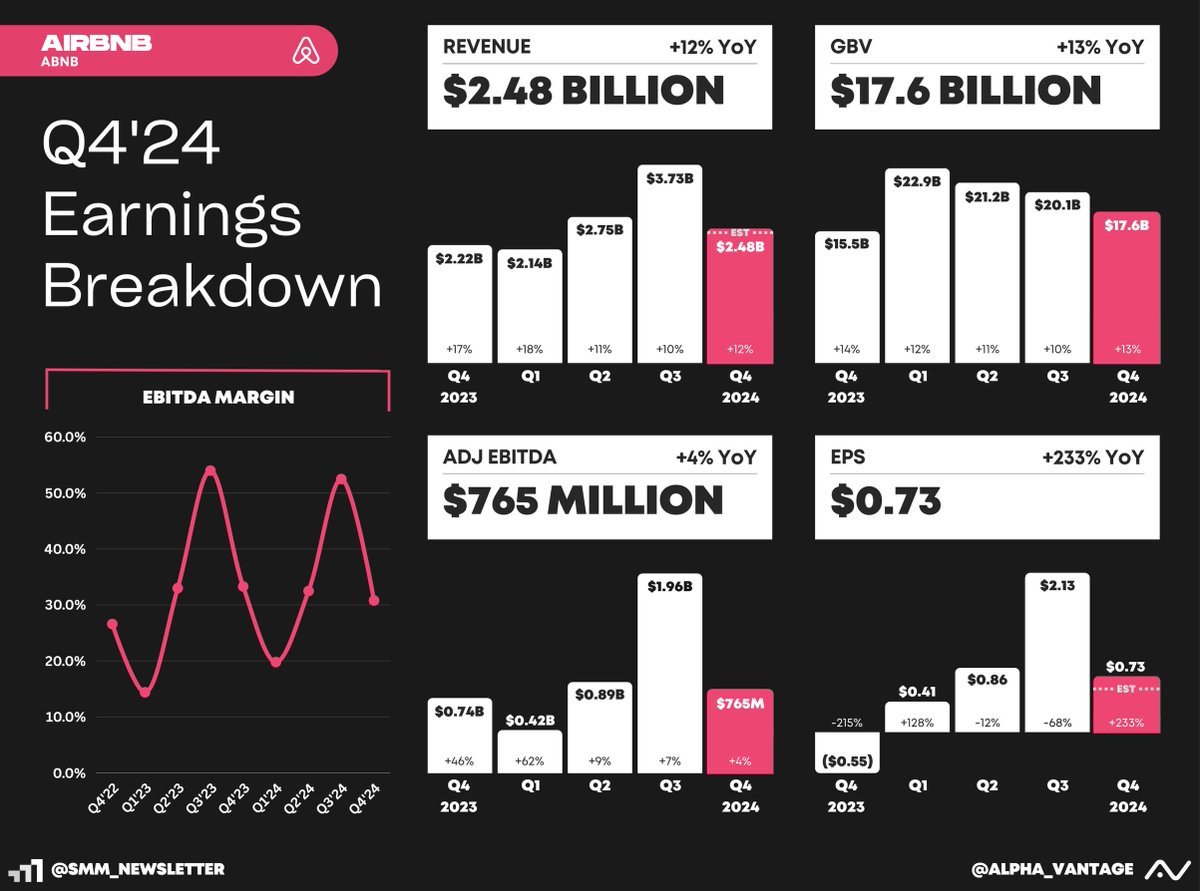

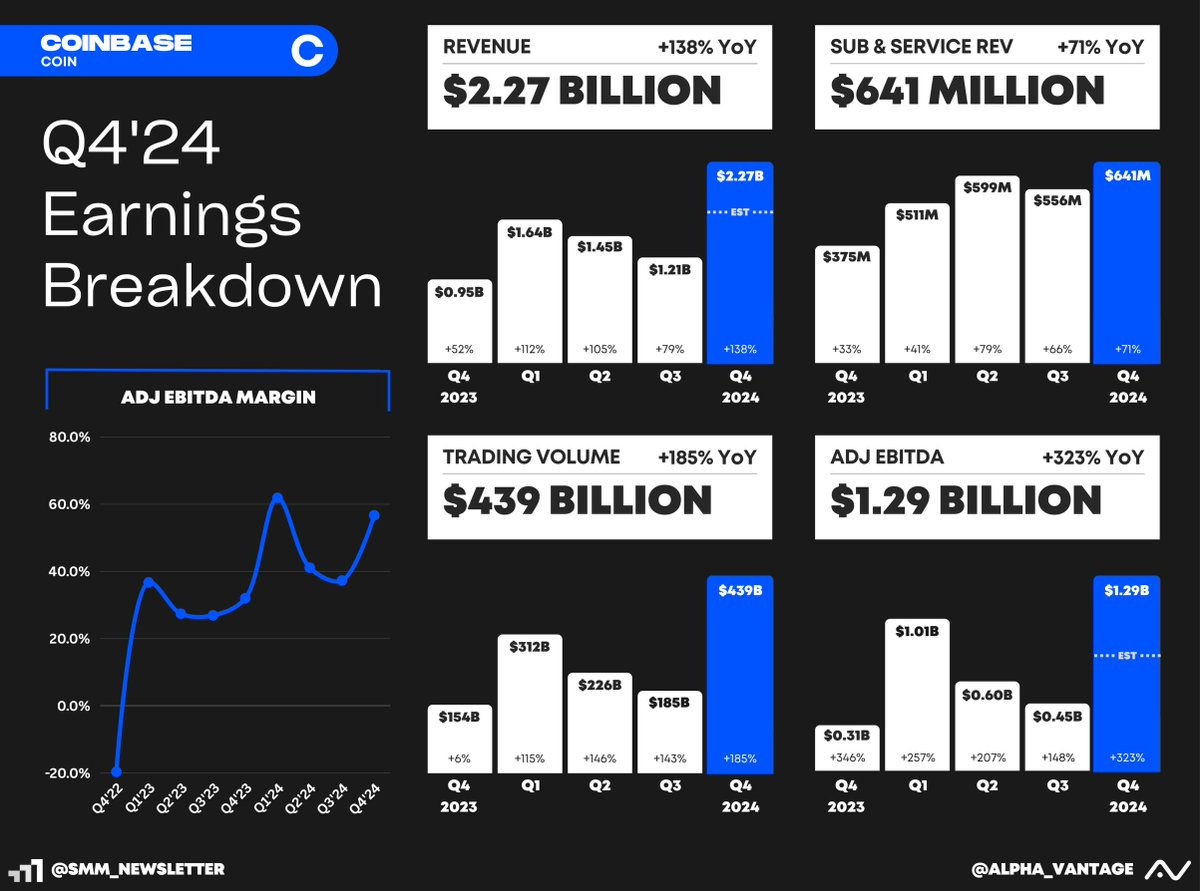

Earnings: Shopify, Airbnb, Coinbase

US Markets 🇺🇸

US inflation heats up to 3% for first time since June as prices jump 0.5% in January, much higher than forecasts. Markets are now pricing in only one rate cut in 2025, according to CME’s FedWatch tool.

Trump imposes 25% tariff on steel and aluminum, hitting key industries from construction to transportation. U.S. producers are likely to benefit, while Canada, Germany, and Asia face losses.

Powell says Fed doesn’t ‘need to be in a hurry’ to cut rates further and called the economy “strong overall” with a “solid” labor market but inflation still hasn’t reached the 2% goal yet.

U.S. retail sales see sharpest drop in two years, falling 0.9% in January, as winter storms and rising prices hit spending. Economists expect a rebound in the coming months.

Chevron plans to slash 20% of its workforce by 2026, aiming to cut $2-3B in annual operating costs. The move follows a Q4 loss in its fuel business and uncertainty over the Hess deal.

Anduril takes over Microsoft’s $22B Army headset deal, overseeing the production and development of the IVAS program. This comes as Anduril eyes a $2.5B funding round at a $28B valuation.

Global Markets 🌏

China's consumer inflation accelerated in January as food and service prices climbed ahead of the Lunar New Year holiday. The CPI rose 0.5% from a year earlier in January, up from 0.1% in December.

Trump to meet with Putin to push for an end to the Ukraine war, while Treasury Secretary Scott Bessent meets Zelensky in Kyiv to discuss security guarantees and a minerals agreement.

Israel and Hamas resolve ceasefire dispute after Trump’s relocation demands and rising tensions. The two countries conducted a hostages-for-prisoners exchange yesterday.

Apple partners with Alibaba to integrate AI into iPhones sold in China. The move aids Apple’s AI strategy and navigates China’s strict tech rules. Shares of BABA 0.00%↑ rose 20% this week.

UK economy ekes out 0.1% growth in Q4, beating estimates. A decline in production (-0.8%) was offset by strong growth in services (+0.2%) and construction (+0.5%), signaling a mixed recovery.

U.S. and India aim to double trade to $500B by 2030, Modi announced with Trump. Talks during their meeting focused on tariffs, defense sales, and AI, amid lingering trade tensions.

Tech ⚡

AI startups raised $110B in 2024, a 62% jump from the year prior. Meanwhile, overall tech funding dropped 12% to $227B, highlighting AI's dominance in venture capital markets.

OpenAI’s board rejects Musk’s $97B takeover offer and says it was ‘not a bid at all.’ Sam Altman responded earlier in the week by saying the OpenAI was not for sale and claimed Musk was just aiming to slow them down.

TikTok reinstated on US app stores after Apple and Google removed it for a month over a national security ban. ByteDance now has until early April to sell its U.S. operations.

MicroStrategy buys up another $742M in Bitcoin, adding 7,633 BTC at $97,255 each. Its total holdings now reach 478,740 BTC, valued at over $46B, continuing its aggressive crypto strategy.

BYD slashes smart EV prices below $10K, undercutting competitors like Tesla. It’s also offering free 'God's Eye' autonomous tech on all models, sparking a new price war in the EV market.

Google invests in Apptronik's $350M round to scale AI humanoid robots. Apptronik's Apollo robot, which rivals Tesla’s Optimus, targets industries with a price tag under that of a car.

Earnings Reports 💰

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - Markets Closed (Presidents Day) 🇺🇸

AU - RBA Interest Rate Decision 🇦🇺

Tuesday

US - Empire State Manf. Index 🇺🇸

CA - CPI Inflation 🇨🇦

EU - ZEW Economic Sentiment 🇪🇺

Earnings: Baidu💰

Wednesday

US - Housing Starts 🇺🇸

UK - CPI Inflation 🇬🇧

CN - PBoC Interest Rate 🇨🇳

Earnings: Etsy, Carvana, Toast, GlobalE, Analog Devices💰

Thursday

US - Jobless Claims 🇺🇸

US - Philly Fed Manf. Index 🇺🇸

US - Leading Economic Index 🇺🇸

Earnings: Alibaba, Rivian, Mercado Libre, Block, Booking, Unity, Walmart, Dropbox, Wayfair 💰

Friday

US - S&P Services PMI 🇺🇸

US - Existing Home Sales 🇺🇸

CA - Retail Sales 🇨🇦

UK - Retail Sales 🇬🇧

UK - S&P Composite PMI 🇬🇧

EU - HCOB Composite PMI 🇪🇺

Want to partner with Sunday Morning Markets? Click here to inquire.