Your Weekly Market Snapshot 📈

U.S. Housing Sales Hit 29-Year Low, Netflix Surpasses 300M Subs, OpenAI Launches 'Operator' Tool, SEC Forms Crypto Task Force, Apple iPhone Sales Drop 18% in China, and NFLX + AXP + SCHW Earnings

Sunday Morning Markets

Trading Week 4, covering Monday, Jan 20 through Friday, Jan 24. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Energy Policy Shift: Trump declares emergency, exits Paris Accord.

Housing Market Slump: Sales hit 29-year low due to affordability issues.

Netflix Growth: 300M subscribers, raises prices, adds $15B to buybacks.

Crypto Task Force: SEC forms group to regulate digital assets.

OpenAI Operator: Introduces new tool to automate web tasks.

Stargate Project: $500B AI investment with OpenAI, Oracle, and SoftBank.

Perplexity API: Launches Sonar, an AI search API for enterprises.

Apple Struggles in China: iPhone sales drop 18%, Huawei reclaims top spot.

EU Reforms: Plans to cut red tape, boost competitiveness.

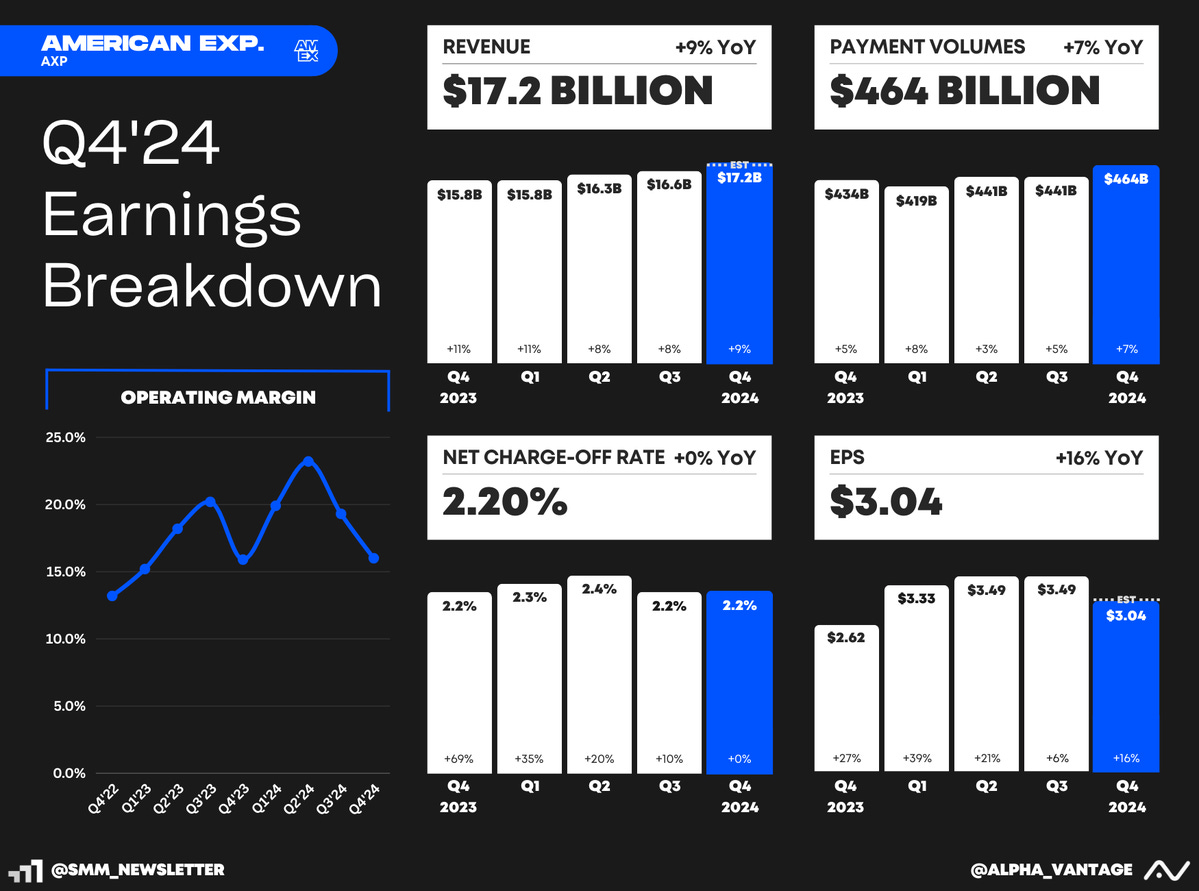

Earnings: Netflix, American Express, and Charles Schwab.

US Markets 🇺🇸

Home sales hit a 29-year low in 2024, driven by high mortgage rates and record home prices. Despite a slight December rebound, affordability and tight inventory remain key hurdles.

Trump declares national energy emergency and exits Paris accord to boost U.S. fossil fuel production. Policies slash EV goals, revoke drilling bans, and prioritize domestic energy independence.

U.S. economic growth slowed in January, as services hit a 9-month low. However, manufacturing rebounded, showing its first expansion in six months with rising orders and employment.

Leading indicators lost momentum in December as the Conference Board's LEI dipped 0.1%. Stock market gains helped offset declines in confidence, orders, and building permits. Real GDP is forecasted at 2.3% for 2025.

Netflix surpasses 300M paying subscribers with 19M signups in Q4 alone. The company announced it’s raising its subscription prices and adding $15B to its share repurchase agreement.

Novo Nordisk’s new obesity drug cuts weight by 22% in early trials. Unlike Wegovy, amycretin targets both GLP-1 and amylin hormones, showing promising 36-week results with mild side effects.

Global Markets 🌏

EU plans sweeping reforms to cut red tape and boost competitiveness against the U.S. and China. The bloc eyes simpler regulations and innovation to revive growth amid global tensions.

Apple loses ground in China as iPhone sales drop 18% in Q4, falling to third place in the smartphone market. Huawei sales surged 16%, reclaiming the top spot with its AI-powered premium phones.

Bank of Japan hikes interest rates to 0.5%, the highest since 2008, as rising wages and inflation signal economic recovery and a "virtuous cycle" of sustained growth.

U.K. jobs market weakens as unemployment rises to 4.4%, its highest level since the pandemic. The report adds pressure on the BOE to cut rates, despite strong wage growth of 5.6%.

Trump considers 25% tariffs on Canada and Mexico starting Feb. 1st, citing border issues and fentanyl trafficking. He also hinted at new tariffs on China if TikTok negotiations falter.

China’s central bank holds key policy rate at 2% while injecting $27.4 billion into a medium-term lending facility. The move signals a steady stance on interest rates moving forward.

Tech ⚡

Trump announces $500B Stargate AI project with OpenAI, Oracle, and Softbank. The venture aims to build out U.S. AI infrastructure, starting with massive Texas data centers.

OpenAI launches “Operator” tool that automate tasks like vacation planning, booking reservations, and placing grocery orders. Available to U.S. Pro users, it directly rivals Anthropic's similar tool.

Perplexity rolls out Sonar, an AI search API allowing enterprises and developers to integrate the startup’s generative AI search tools into their applications with realtime, cited answers.

SEC establishes a crypto task force to craft a clear regulatory framework under Trump’s pro-crypto agenda. Industry leaders welcome the shift as Bitcoin hits a new high of $109K.

Microsoft is no longer OpenAI’s exclusive cloud provider under a new deal that grants Microsoft the “right of first refusal” for AI hosting but allows OpenAI to use rivals if Azure lacks capacity.

Google injects another $1B into AI startup Anthropic, raising its total investment to $3B. Known for its Claude chatbot, Anthropic eyes a $60B valuation in funding talks.

Earnings Reports 💰

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - New Home Sales 🇺🇸

DE - Ifo Business Climate 🇩🇪

Earnings: SoFi, AT&T💰

Tuesday

US - CB Consumer Confidence 🇺🇸

US - Durable Goods 🇺🇸

AU - Inflation Report 🇦🇺

JP - BoJ Inflation Report 🇯🇵

Earnings: Starbucks, Boeing, GM, Lockheed Martin, RTX, Jetblue💰

Wednesday

US - Fed Interest Rate Decision 🇺🇸

CA - BoC Interest Rate Decision 🇨🇦

EU - ECB Monetary Policy Statement 🇪🇺

Earnings: Microsoft, Meta, Tesla, ASML, T-Mobile, ServiceNow, Lam Research, IBM💰

Thursday

US - Pending Home Sales 🇺🇸

US - GDP Growth 🇺🇸

EU - ECB Interest Rate Decision 🇪🇺

EU - GDP Growth 🇪🇺

EU - Unemployment Report 🇪🇺

CN - Caixin Manf. PMI 🇨🇳

Earnings: Apple, Intel, KLA Corp, Visa, Mastercard, UPS, Atlassian💰

Friday

US - PCE Inflation 🇺🇸

US - Chicago PMI 🇺🇸

CA - GDP Growth 🇨🇦

DE - CPI Inflation 🇩🇪

Earnings: Exxon, Chevron, Abbvie💰

Want to partner with Sunday Morning Markets? Click here to inquire.