Your Weekly Market Snapshot 📈

Fed Holds Rates Steady, DeepSeek's AI Model Shakes Markets, OpenAI Unveils o3-mini, Starlink Partners With Apple, ECB Cuts Rates, and AAPL + MSFT + META + TSLA Earnings

Sunday Morning Markets

Trading Week 5, covering Monday, Jan 27 through Friday, Jan 31. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Fed Holds Rates: Keeps rates at 4.25%-4.5%, remains cautious on inflation.

Economy Slows: GDP grew just 2.3% in Q4, missing 2.5% forecasts.

Federal Buyouts: Trump admin offers 9-month pay for federal resignations.

ECB Cuts Rates: Drops to 2.75%, warns of weak eurozone growth.

AI Disruption: DeepSeek’s AI model sparks market turmoil, challenging U.S. tech.

OpenAI Responds: Unveils o3-mini, eyes $40B raise at $340B valuation.

Apple + Starlink: iPhones to support satellite texting via T-Mobile.

Elon’s X Money: X partners with Visa for instant payments.

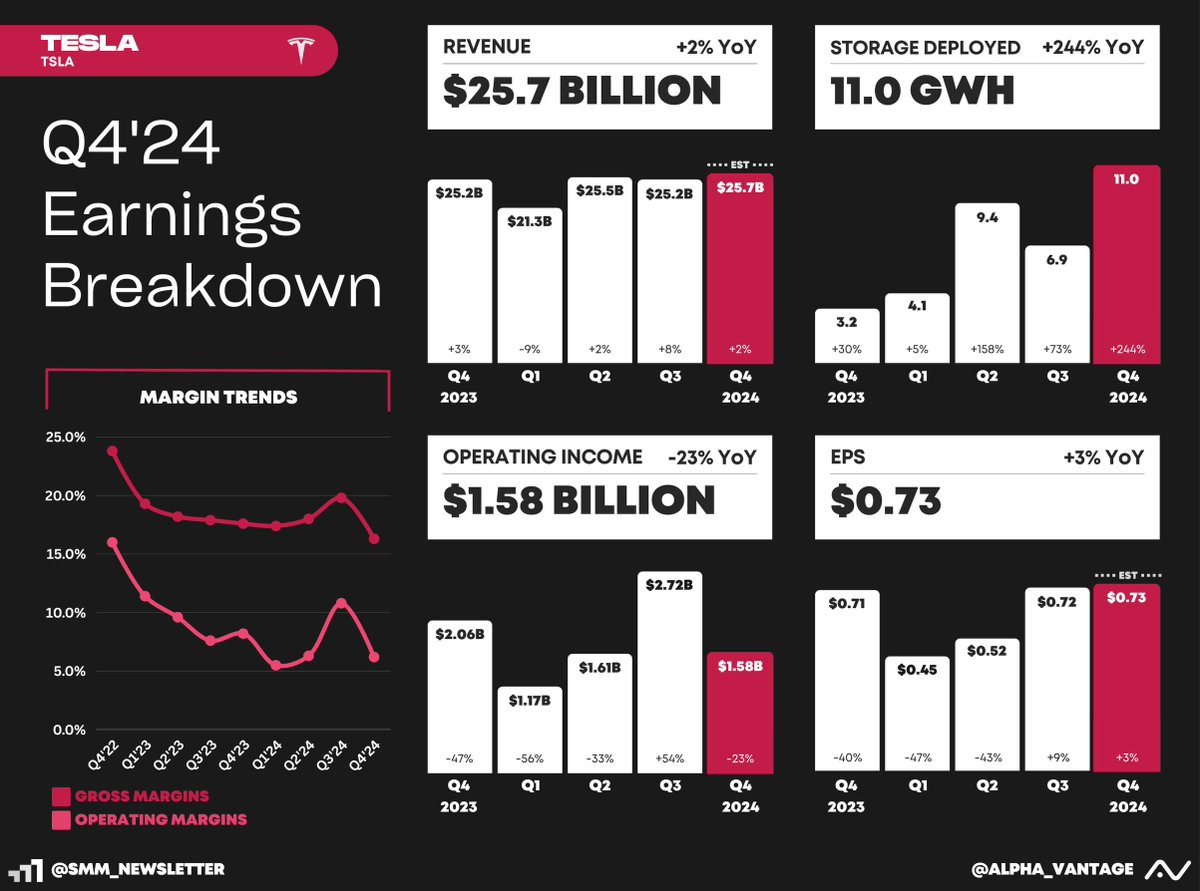

Earnings: Apple, Microsoft, Tesla, and Meta.

US Markets 🇺🇸

Federal Reserve keeps interest rates unchanged at 4.25%-4.5%, dropping key language about progress on inflation. Markets fell as traders pushed rate cut expectations to June.

Core inflation holds steady at 2.8%, aligning with forecasts and keeping pressure on the Fed to maintain current rates. Headline PCE inflation rose to 2.6%, also in line with estimates.

GDP growth slowed to 2.3% in Q4, missing forecasts of 2.5% and down from 3.1% in Q3. Consumer spending surged 4.2%, but declines in trade and investment weighed on growth.

Trump admin offers buyouts to nearly all federal workers, allowing them to resign and collect nine months of pay. The White House expects up to 10% of federal employees to take the deal.

Sales of newly constructed homes exceed expectations, rising 3.6% in December. A total of 683,000 units were sold in 2024, with the median price increasing 2.1% to $427,000.

Elon Musk’s X unveils the “X Money Account” through a partnership with Visa, launching in Q1 2025 to enable instant peer-to-peer payments and bank account integration.

Global Markets 🌏

Trump’s new tariffs on Canada, Mexico, and China take effect. The 25% and 10% duties, aimed at the fentanyl trade, spark market losses and raise concerns over inflation and trade retaliation.

The ECB cuts rates by a quarter point to 2.75% and warns of weak growth ahead. The eurozone economy flatlined in Q4, missing forecasts, as inflation picked up steam. More cuts may come as the ECB diverges from the Fed.

Bank of Canada cuts rates to 3% as economy contracts, with GDP shrinking 0.2% in November. A rebound is expected in December, but tariff risks keep markets eyeing another cut in March.

China's factory activity slid into contraction in January as the PMI fell to 49.1 from 50.1, ending a 3-month expansion. The Lunar New Year and weak domestic demand drove the decline.

Australia’s inflation hits lowest since 2020 as the CPI rises 2.4% year-over-year. The soft report clears the path for the RBA to ease policy, with markets forecasting a 90% chance of a February rate cut.

Norway is on track to fully electrify its car market by 2025, with EVs making up 96% of new sales this year. By contrast, EVs made up only 8.1% of U.S. car sales in 2024.

Tech ⚡

DeepSeek's AI breakthrough shakes markets, wiping $590B off Nvidia’s market cap in one trading day. The Chinese AI model threatens U.S. tech dominance and overall GPU demand.

OpenAI launches new o3-mini reasoning model with a free ChatGPT version. The model is optimized for STEM, offers better accuracy than o1-mini, and is 63% cheaper—aiming to rival DeepSeek’s R1.

Microsoft and Meta defend massive AI investments, shrugging off DeepSeek’s breakthrough. Investors, however, worry about soaring costs and uncertain return profiles.

Alibaba releases AI model in response to DeepSeek news and claims their latest model, Qwen 2.5-Max, outperforms DeepSeek-V3, ChatGPT 4o, and Llama-3.1-405B across the board.

Apple's iPhones to support Starlink direct-to-cell starting in the United States. Users can test satellite texting via T-Mobile, with voice and data features that are expected to launch soon.

Perplexity AI revises its TikTok merger proposal, offering the U.S. government up to a 50% stake in a new entity post-IPO. The deal would exclude TikTok’s core algorithm.

OpenAI in talks to raise $40B at a $340B valuation, with SoftBank investing up to $25B. The AI giant lost $5B in 2024 despite generating $3.7B in revenue, fueling funding needs.

Earnings Reports 💰

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - ISM Manufacturing PMI 🇺🇸

EU - Inflation Report 🇪🇺

Earnings: Palantir💰

Tuesday

US - JOLTs Job Openings 🇺🇸

Earnings: Google, AMD, Chipotle, Snap, Spotify, PayPal💰

Wednesday

US - ISM Services PMI 🇺🇸

US - ADP Job Report 🇺🇸

US - Balance of Trade 🇺🇸

CA - Balance of Trade 🇨🇦

Earnings: Disney, Uber, Qualcomm, Arm, Symbotic💰

Thursday

CA - Ivey PMI 🇨🇦

UK - BOE Interest Rate Decision 🇬🇧

Earnings: Amazon, Fortinet, Cloudflare, Pinterest, Affirm, Bill, Eli Lilly, Roblox, Peloton💰

Friday

US - Nonfarm Payrolls 🇺🇸

CA - Unemployment Report 🇨🇦

Want to partner with Sunday Morning Markets? Click here to inquire.