What Moved The Markets This Week

Core PCE jumps to 2.8%, CoreWeave IPO, Perplexity crosses $100M ARR, BYD surpasses Tesla, Student Loan defaults soar, Services PMI hits 53.5, and LULU Earnings

Sunday Morning Markets

Trading Week 13, covering Monday, Mar 24 through Friday, Mar 28. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Hot Inflation: Fed’s key gauge jumps to 2.8%, rate cut hopes fade.

Growth Pickup: U.S. services activity surges, Composite PMI hits 53.5.

Recession Risks: Deutsche, Gundlach see 50%+ chance of downturn.

Loan Defaults: 9M student loan borrowers miss payments; $250B overdue.

Trump Tariffs: 25% duty hits autos, targets buyers of Venezuelan oil.

Ukraine Truce: Sea ceasefire marks rare step toward peace.

BYD Overtakes: China’s EV giant tops Tesla with $107B in sales.

CoreWeave IPO: Nvidia-backed AI firm debuts at $39 under ticker CRWV.

Perplexity’s Growth: Crosses $100M ARR with 6.3x YoY growth.

Claude Deal: Anthropic, Databricks sign $100M AI agent deal.

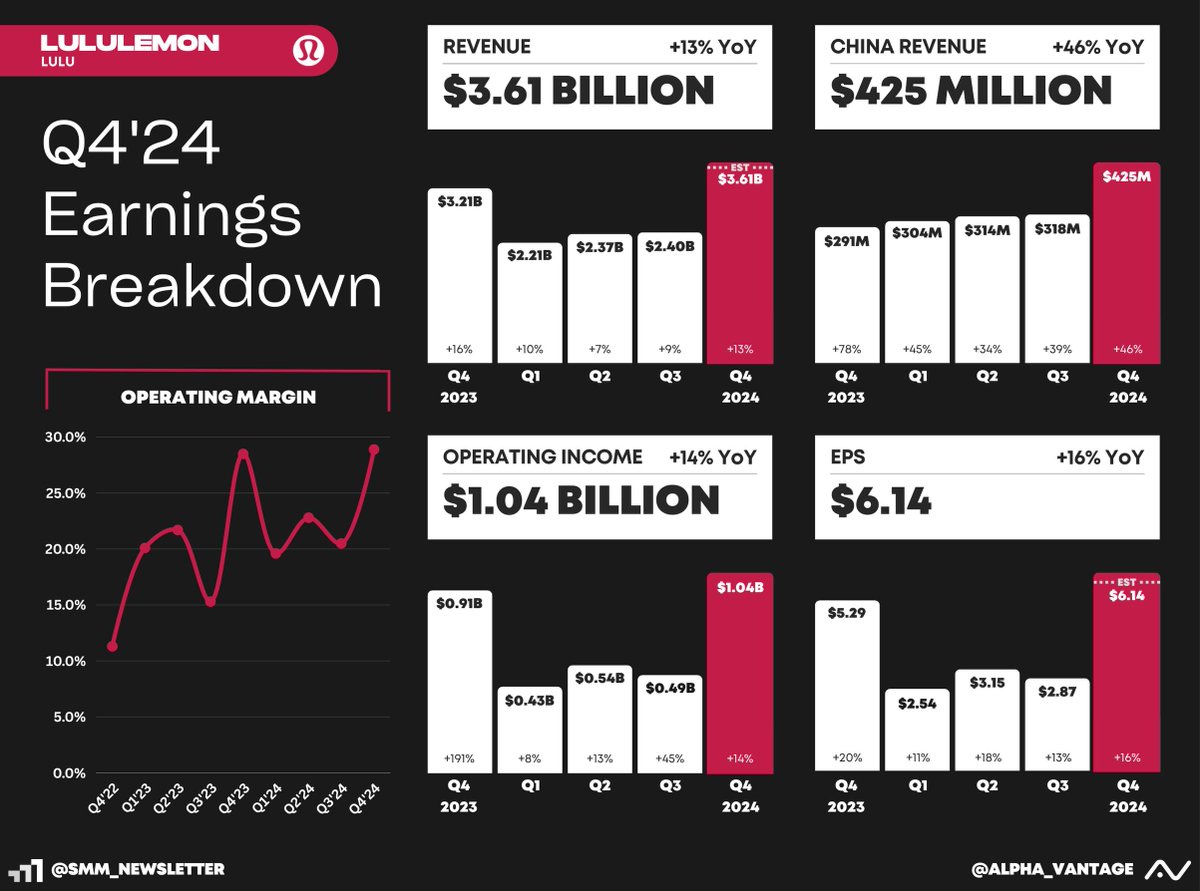

Earnings Reports: Lululemon

US Markets 🇺🇸

Fed's preferred inflation gauge jumps to 2.8%, coming in above estimates and casting doubt on future rate cuts. Personal spending rose 0.4%, while income climbed a stronger-than-expected 0.8%.

Economic activity expanded at its fastest pace in three months, with the S&P Composite PMI rising to 53.5 in March, as services surged but tariffs and labor costs drove inflationary pressures higher.

Over 9M student loan borrowers missed payments after the Covid-era pause ended, the NY Fed estimates. Delinquencies now total $250B, with nearly 16% of loans past due.

Microsoft scraps major AI data center plans, shelving 2GW of new capacity amid potential oversupply. While still on track for $80B in capex this year, investment is expected to slow in 2025 as focus shifts to outfitting existing sites.

Consumer confidence hits a 12-year low as future expectations plunge and recession fears rise. Optimism about income, jobs, and markets sharply declined across all age and income groups.

Recession odds near 50%, Deutsche Bank warns as growth slows and market fears rise. Jeffrey Gundlach puts the risk even higher, at 50-60%, citing volatility, tariffs, and stagflation concerns.

Hyundai unveils $21B U.S. investment to dodge tariffs, including a $5.8B Louisiana steel plant to supply EV production and create 1,400+ jobs amid growing trade tensions.

Global Markets 🌏

Trump slaps 25% tariff on all auto imports, expands duties to nations buying Venezuelan oil—while India cuts tariffs and Trump hints at easing China rates to close a TikTok deal.

BYD surpasses Tesla with $107B in annual sales as China’s EV giant surges ahead on hybrids and game-changing battery tech. Tesla’s sales in Europe plunged 43% last month, as their market share nosedives.

Eurozone economic activity ticked up slightly in March, with the S&P Composite PMI at 50.4, as weak demand and looming U.S. tariffs weighed on growth despite a rebound in German manufacturing.

Russia and Ukraine strike US-brokered truce at sea and agree to halt energy attacks, marking rare progress toward peace as Trump pushes for a swift end to the three-year war.

Canada's GDP stalls after strong growth in January as tariff threats hit confidence. February’s flat output follows January’s 0.4% rise, with weakness in retail, oil, and real estate.

BlackRock launches first Bitcoin ETP in Europe as it expands crypto offerings beyond the US, with listings in Paris, Amsterdam, and Frankfurt. Its U.S. bitcoin ETFs have already attracted $50B in assets.

U.S. blacklists 50+ Chinese tech firms to curb Beijing’s AI and chip ambitions, targeting entities tied to military use and quantum tech amid rising U.S.-China tensions and tariff hikes.

Tech ⚡

Elon Musk’s xAI acquires X in $33B deal in an all-stock merger, combining AI talent, data, and social distribution to create a single Musk-controlled entity aiming to rival tech giants.

Nvidia-backed CoreWeave opens at $39 in landmark IPO, the largest U.S. tech debut since 2021. The stock trades under the ticker “CRWV” and closed Friday's session at $39.97.

Perplexity hits $100M ARR in just 20 months, boasting 6.3x YoY growth and rapid user adoption. OpenAI expects to triple its revenue to $12.7B in 2025, supporting its massive $260B valuation.

OpenAI claims a breakthrough in image creation for ChatGPT after a year of reinforcement learning. CEO Sam Altman tweeted that the viral use of the new image creator tool is "melting” their GPUs.

Google says quantum tech is 5 years away from solving problems classical computers can’t, following a key breakthrough in error correction and rising momentum across the quantum computing race.

Anthropic, Databricks ink $100M AI agent deal to help businesses build custom bots with Claude models. The 5-year pact boosts both firms’ enterprise push amid rising pressure to monetize AI.

Waymo to launch D.C. robotaxi service in 2026 as it races ahead of Tesla and Zoox, but must first secure policy changes to remove human drivers from its fully autonomous fleet.

Earnings Reports 💰

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - Chicago PMI 🇺🇸

DE - CPI Inflation 🇩🇪

CN - Caixin Manufacturing PMI 🇨🇳

AU - RBA Interest Rate Decision 🇦🇺

Tuesday

US - ISM Manufacturing PMI 🇺🇸

US - S&P Manufacturing PMI 🇺🇸

US - JOLTS Job Openings 🇺🇸

EU - CPI Inflation 🇪🇺

EU - HCOB Manufacturing PMI 🇪🇺

Wednesday

US - Crude Oil Inventories 🇺🇸

US - ADP Payrolls 🇺🇸

CN - Caixin Services PMI 🇨🇳

Earnings: Blackberry, RH💰

Thursday

US - ISM Non-Manufacturing PMI 🇺🇸

US - S&P Services PMI 🇺🇸

US - Trade Balance 🇺🇸

CA - Trade Balance 🇨🇦

EU - HCOB Services PMI 🇪🇺

JP - Household Spending 🇯🇵

Friday

US - Nonfarm Payrolls 🇺🇸

US - Unemployment Report 🇺🇸

CA - Unemployment Report 🇨🇦

Want to partner with Sunday Morning Markets? Click here to inquire.