What Moved The Markets This Week 📈

OpenAI Fires CEO Sam Altman, Amazon To Sell Cars Online, Softer Than Expected Inflation Data, Xi Meets With Biden, Nvidia's New H200 AI Chip, and WMT + HD + PANW Earnings

Sunday Morning Markets

Trading Week 46, covering Monday, Nov 13 through Friday, Nov 17. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Inflation Data:

US CPI +3.2% YoY (estimates 3.3%)

US PPI +1.3% YoY (estimates 1.9%)

UK CPI +4.6% YoY (estimates 4.8%)

US retail sales fall for first time in seven months

Amazon to start selling cars on its platform

Alibaba scraps plans to spinoff cloud division

President Xi meets with Biden and other US executives

Sam Altman fired from his role as CEO of OpenAI

Nvidia unveils new H200 AI chip

SpaceX Starship reaches space on second attempt

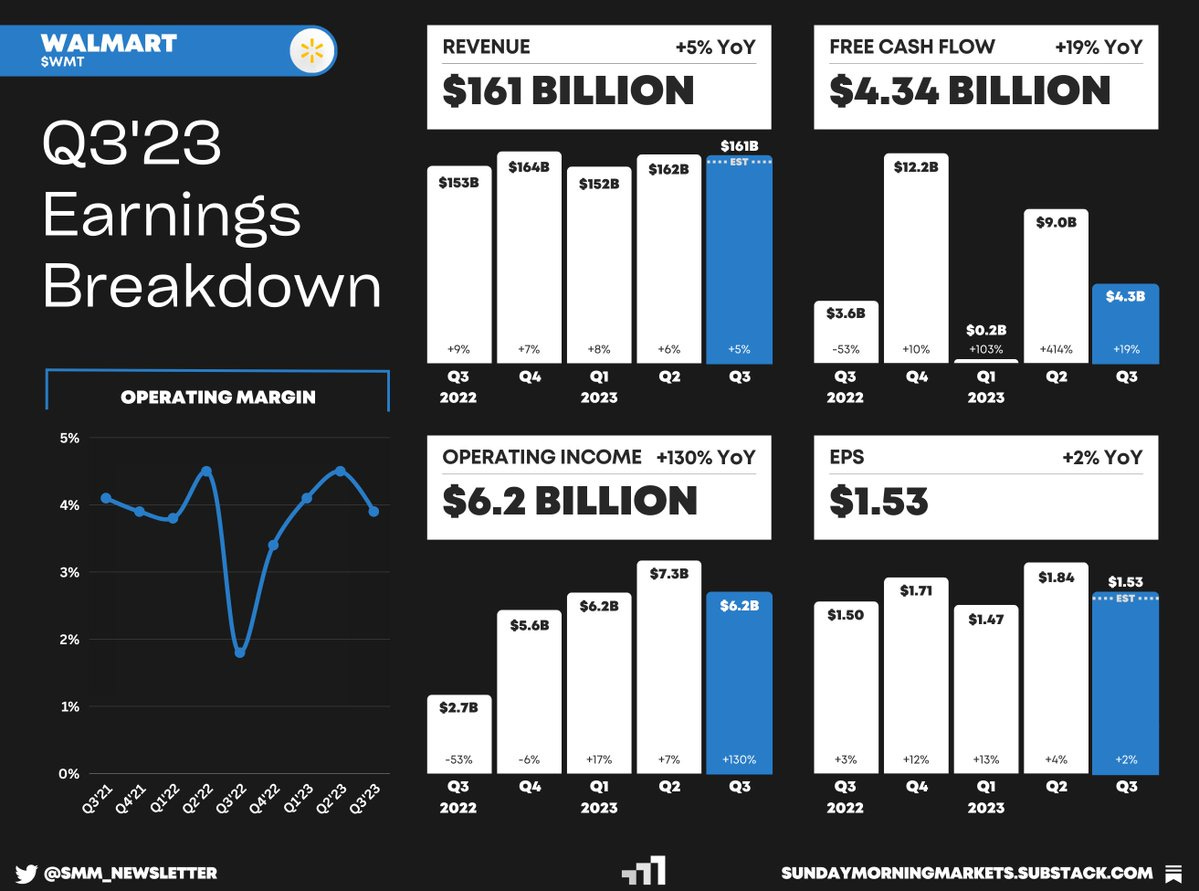

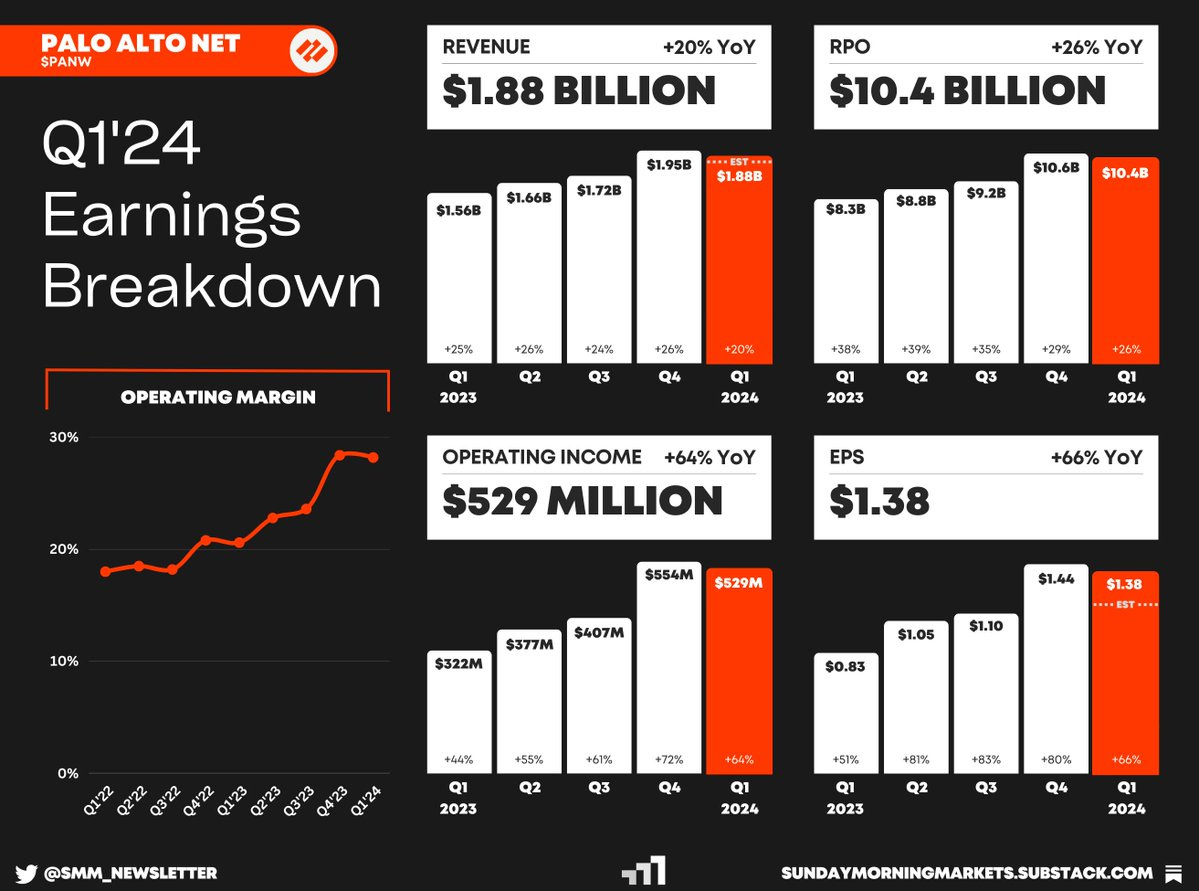

Earnings from WMT, PANW, HD — see breakdown below

US Markets 🇺🇸

Consumer inflation cools off in October, sending yields sinking as markets now see rate cuts in ‘24. Headline CPI increased 3.2% YoY (estimates 3.3% & previous 3.7%) while core CPI rose 4.0% (estimates 4.1% & previous 4.1%).

Wholesale prices plunged 0.5% in October for the biggest monthly drop since April 2020. Headline PPI rose just 1.3% YoY (estimates 1.9% & previous 2.2%) while core PPI increased 2.4% (estimates 2.7% & previous 2.7%).

US retail sales fell for the first time in seven months with interest rates at a 22-year high. Sales volume fell 0.1% in October from the prior month, slightly less than the 0.3% decline economists were expecting.

Homebuilder sentiment drops to lowest point in a year but falling rates spur some optimism. More builders reported cutting prices in November. The average cut was 6%. The US10Y yield fell 21 basis points this week to 4.44%.

Stellantis offers buyouts to half of U.S. salaried workers to reduce headcount and cut costs after the UAW strikes are expected to cost the company around $800 million in profit and roughly $3.2 billion in revenue.

Amazon to allow dealers to sell cars through its site, starting with Hyundai. Customers will be able to search for available vehicles in their area and check out on Amazon using their preferred payment and financing method.

Global Markets 🌏

Japan’s economy shrinks far more than expected in Q3 as GDP contracted 2.1% from a year ago, after growing 4.8% in the second quarter. Rising domestic inflation continues to weigh on consumer demand.

U.K. inflation fell sharply in October to 4.6% from 6.7% the previous month, hitting a two-year low. Core CPI, which excludes volatile food, energy, alcohol, and tobacco prices, fell to 5.7% in October from 6.1%.

China’s retail sales and industrial data grew faster than expected in October as the IMF raised its growth forecast for the year to 5.4%. Retail sales grew by 7.6% year-over-year, above the 7% estimate.

Alibaba scraps plans to spin off its cloud business due to Biden’s new chip export curbs, which have “created uncertainties for the prospects of Cloud Intelligence Group.” BABA 0.00%↑ shares fell 6% this week.

China’s Xi meets with President Biden in SF before meeting with dozens of major U.S. executives. Xi said China is ready to be a partner and friend of the U.S. and to handle relations with mutual respect and peaceful coexistence.

Emirates orders 95 Boeing aircraft worth $52 billion following the 2023 Dubai Airshow. Boeing dominated the show, chalking up 295 orders in comparison to Airbus's 86 orders by day four of the aviation event.

Tech ⚡

Sam Altman fired as CEO of OpenAI as the ‘board no longer has confidence’ in his ability to lead. Altman will be replaced by former Chief Technology Officer Mira Murati.

SpaceX Starship rocket reaches space for first time after successfully separating from its booster. However, an issue arose and the rocket’s onboard system intentionally destroyed the vehicle mid-flight.

Nvidia unveils the H200, its new high-end AI chip that includes 141GB of next-generation “HBM3” memory that will help it generate text, images, or predictions using AI models. NVDA 0.00%↑ shares have risen 17% this month.

Microsoft announces Maia 100 AI chip, to compete with Nvidia in the highly sought-after AI GPUs. They also released a ‘Cobalt 100’ Arm chip, aimed at general computing tasks, and could compete with Intel.

Airbnb acquires Gameplanner.AI for $200M in its first acquisition as a public company. The AI startup was founded by Adam Cheyer, one of the creators of Siri. The deal aims to accelerate some of Airbnb’s AI projects.

WhatsApp is rolling out new Discord-like voice chat feature for large groups, allowing you to start a group channel and talk with whoever joins, while also letting you continue messaging those who aren’t on the call.

Snap users can now buy Amazon products directly in app in a new partnership between the two companies. The Amazon ads will display real-time pricing, delivery estimates, product details, and Prime eligibility.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

DE - PPI Inflation (OCT)🇩🇪

Earnings Reports: Zoom, Compass, Trip.com💰

Tuesday

US - Existing Home Sales (OCT)🇺🇸

CA - CPI Inflation (OCT)🇨🇦

Earnings Reports: Nvidia, Lowes, Medtronic, Analog Devices, Dell, Autodesk, Baidu, Best Buy💰

Wednesday

US - Durable Goods (OCT)🇺🇸

US - UMich Consumer Sentiment (NOV)🇺🇸

Earnings Reports: Deere&Company💰

Thursday

US - Thanksgiving Markets Closed 🇺🇸

EU - HCOB Composite PMI (NOV)🇪🇺

JP - National CPI (OCT)🇯🇵

Friday

US - Markets Early Close 1PM 🇺🇸

US - S&P Composite PMI (OCT)🇺🇸

CA - Retail Sales (OCT)🇨🇦

DE - GDP (Q3)🇩🇪

Want to partner with Sunday Morning Markets? Click here to inquire.