What Moved The Markets This Week 📈

Fed Holds Rates Steady, Signals Future Rate Cuts, Major Layoffs From Etsy & Cruise, Epic Games Wins Antitrust Case With Google, Ford Cuts F-150 Lightning Production 50%, and ADBE + ORCL + LEN Earnings

Sunday Morning Markets

Trading Week 50, covering Monday, Dec 11 through Friday, Dec 15. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Inflation data:

CPI: +3.1% YoY (est 3.1%, prev 3.2%)

Core CPI: +4.0% YoY (est 4.0%, prev 4.0%)

PPI: +0.9% YoY (est 1.0%, prev 1.2%)

Core PPI: +2.0% YoY (est 2.2%, prev 2.3%)

The Fed, ECB, and BoE all keep rates steady

SEP outlines 3 rate cuts in 2024, market pricing 6 to 7

Major layoffs from Etsy, Hasbro, Cruise, and Bolt

Epic Games wins major antitrust fight with Google

Ford cuts F-150 Lightning production in half

Intel unveils its new Gaudi3 AI chip

China’s economic data improves, sends markets flying

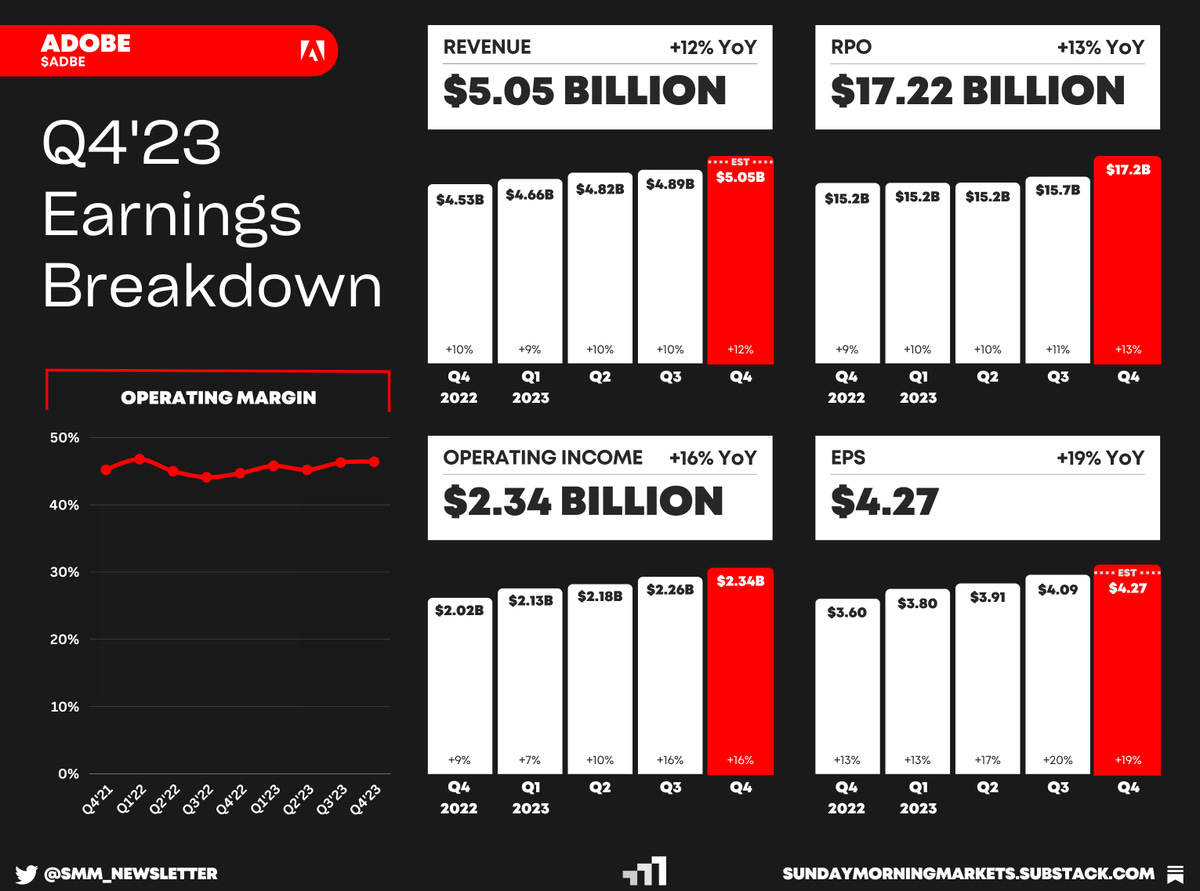

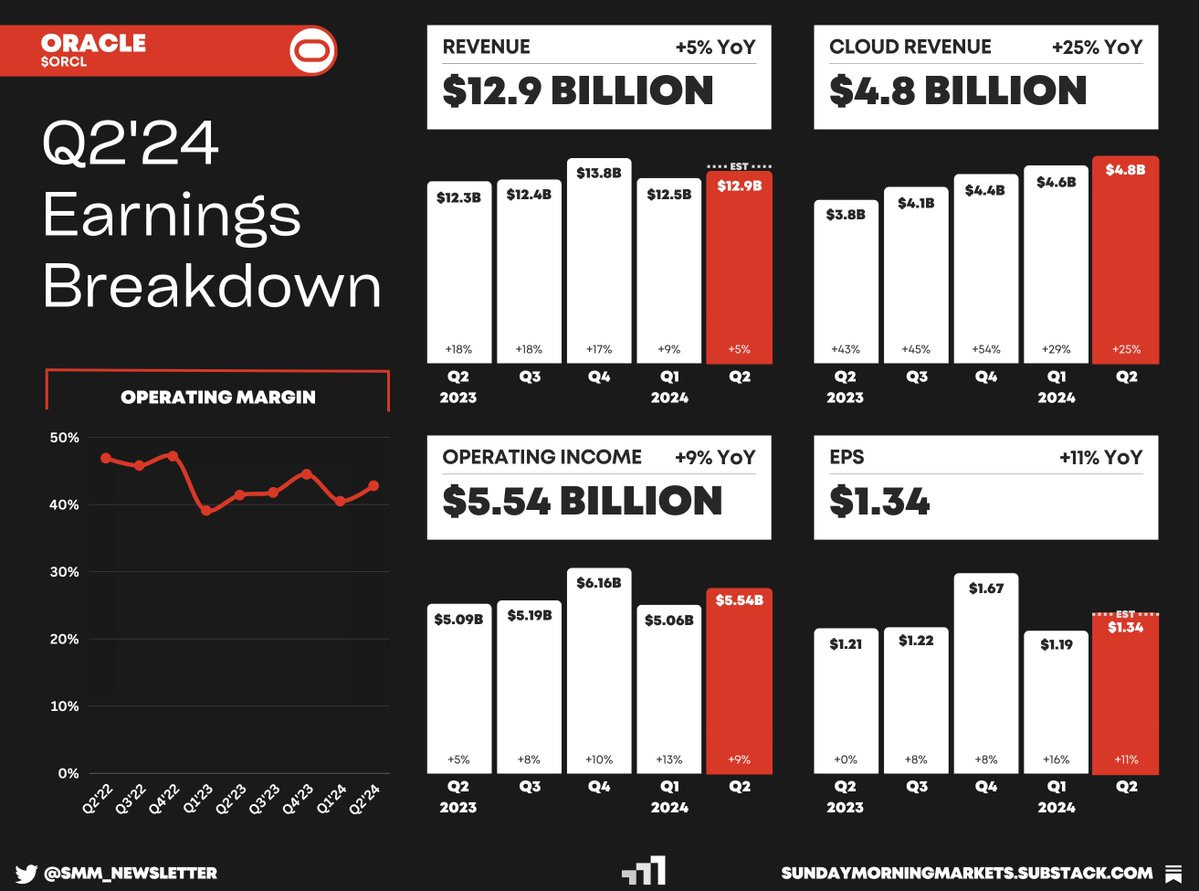

Earnings from ADBE, ORCL, LEN — see breakdown below

US Markets 🇺🇸

Federal Reserve keeps interest rates steady and projects three cuts coming next year as inflation cools off. Yields fell across the board as the market now prices in 6 cuts during 2024, according to CME’s FedWatch tool.

Consumer price inflation slowed to 3.1% last month, led lower by plunging gas prices. Excluding volatile food and energy prices, Core CPI increased 0.3% on the month and 4% from a year ago, in line with estimates.

Wholesale prices flatlined in November as headline PPI was unchanged for the month and up only 0.9% for the year, lower than estimates. PPI peaked above 11.5% last March. Core PPI rose 2% for the year versus estimates of 2.2%.

Retail sales were much stronger than expected in November as volume rose 0.3%, above estimates for a 0.1% decline. Stripping out auto sales and gas stations, sales rose a staggering 0.6% during the month.

Ford cuts expected F-150 Lightning production in half, marking a major reversal after significantly increasing capacity for the EV truck in 2023. The new plans call for an average volume of around 1,600 Lightnings per week.

Hasbro to cut 1,100 jobs, or 20% of its entire workforce, as sluggish demand for its toys persists into the holidays. The company expects sales to drop double digits this year, causing HAS 0.00%↑ shares to decline 19% YTD.

Etsy lays off 225 employees, or 11% of its workforce, as the e-commerce giant looks to restructure due to a “very challenging” macro environment. Despite this, the company also raised its EBITDA margin guidance.

Global Markets 🌏

The European Central Bank holds its key rate at 4% for the second meeting in a row. The ECB also cut its growth forecasts for both 2023 and 2024 and announced plans to shrink its balance sheet.

The Bank of England warns it has a ‘way to go’ on inflation after keeping its key policy rate at 5.25% for the third consecutive meeting. The BOE was more hawkish than the ECB and the Fed when discussing future rate cuts.

EU leaders agree to open membership talks with Ukraine despite Hungary pledging to block the decision. A handful of other EU member states, such as Italy, have also raised issues over enlarging the EU.

Britain’s GDP unexpectedly shrank 0.3% in October, partially offsetting growth of 0.2% in September. Analysts expected GDP to remain flat in the month. The report caused the pound to slip 0.3% against the US dollar.

China reports fastest industrial expansion in nearly 2 years as output grew 6.6% from a year earlier, outpacing expectations for 5.6% in a Reuters poll. The Hang Seng Index rose 2.4% on Friday following the data release.

Lucid’s CFO, Sherry House, is leaving the company to “pursue other opportunities.” The news comes less than a month after Lucid debuted its luxury Gravity SUV, and just days after Lucid’s stock was removed from the Nasdaq 100.

Tech ⚡

Epic Games wins major antitrust fight with Google by a unanimous jury verdict, wrapping up a three-year-long legal battle between the companies. The case could reshape how app marketplaces are allowed to operate.

Intel unveils Gaudi3 AI chip to compete with Nvidia and AMD, which will start shipping in 2024. Intel also announced Core Ultra chips, designed for Windows laptops and PCs, and new fifth-generation Xeon server chips.

Sam Altman’s Worldcoin adds multiple new integrations with Minecraft, Reddit, Telegram, Shopify, and Mercado Libre. Their new protocol, World ID 2.0, makes it easier to distinguish between bots and “verified humans” online.

Tesla recalls 2 million cars with potential Autopilot defect surrounding its feature called ‘Autosteer’ according to regulatory filings. Tesla is rolling out an “over-the-air software remedy” to fix the problem.

GM’s Cruise dismisses 9 key leaders and cuts 24% of staff in response to the fallout from the Oct. 2 incident in which a pedestrian was dragged 20 feet by a Cruise self-driving car after being hit by another vehicle.

TikTok becomes first non-game app to reach $10B in spending across the Apple App Store and Google Play combined, according to data.ai. The spending comes from TikTok’s in-app purchases of ‘coins’ used to gift creators.

Blue Origin aims to launch its first rocket in over a year after the last one had a mid-launch failure in September 2022. The New Shepard launch, titled NS-24, will be a cargo mission, carrying research and scientific payloads.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

DE - Ifo Business Climate (DEC)🇩🇪

Tuesday

US - Building Permits (NOV)🇺🇸

US - Housing Starts (NOV)🇺🇸

CA - CPI Inflation (NOV)🇨🇦

EU - CPI Inflation (NOV)🇪🇺

JP - BoJ Interest Rate Decision🇯🇵

Earnings Reports: FedEx, Accenture, FactSet💰

Wednesday

US - Existing Home Sales (NOV)🇺🇸

US - CB Consumer Confidence (DEC) 🇺🇸

UK - CPI Inflation (NOV)🇬🇧

DE - PPI Inflation (NOV)🇩🇪

Earnings Reports: Micron, General Mills💰

Thursday

US - CB Leading Economic Index (NOV)🇺🇸

CA - Retail Sales (OCT)🇨🇦

Earnings Reports: Nike, PayChex, CarMax, Carnival💰

Friday

US - PCE Inflation (NOV)🇺🇸

US - Durable Good Orders (NOV)🇺🇸

US - New Home Sales (NOV)🇺🇸

UK - GDP (Q3)🇬🇧

Want to partner with Sunday Morning Markets? Click here to inquire.