What Moved The Markets This Week 📈

10Y Treasury Yield Hits 15-Year High, Nvidia Smashes Earnings, Instacart & Arm To IPO, Threads Launches Web Version, Coinbase Buys Stake In Circle, and Zoom + Snowflake Earnings

Sunday Morning Markets

Trading Week 34, covering Monday, Aug 21 through Friday, August 25. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

10Y treasury yield hits 15-year high

Existing home supply hits 25-year low

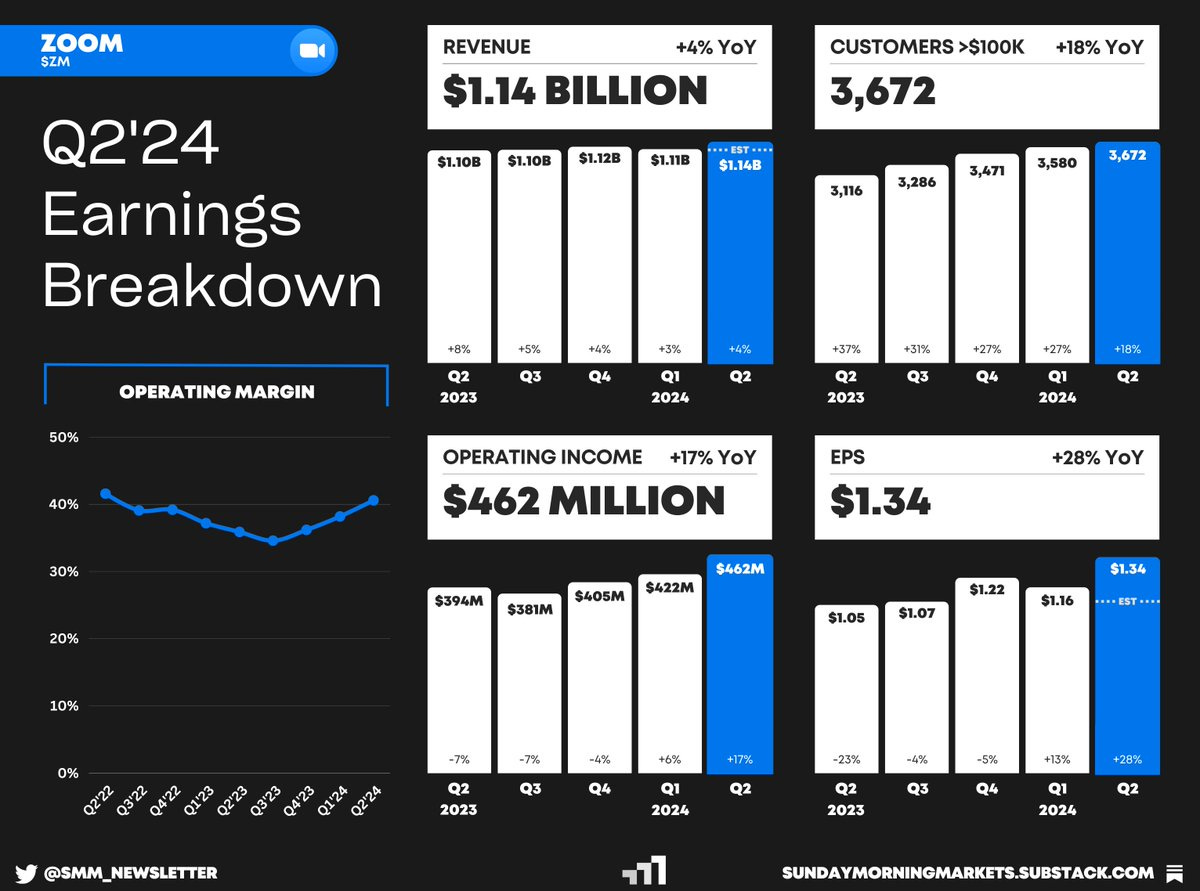

Nvidia crushes their earnings report, raises guidance

T-Mobile US & Charles Schwab announce layoffs

Tesla scales back battery plans and production targets in Germany

Arm & Instacart both file to go public with IPO

Coinbase buys stake in USDC-issuer Circle

Meta Threads launches web version

Alibaba releases two new AI models, Qwen-VL & Qwen-VL-Chat

Earnings from Nvidia, Snowflake, and Zoom — see breakdowns below

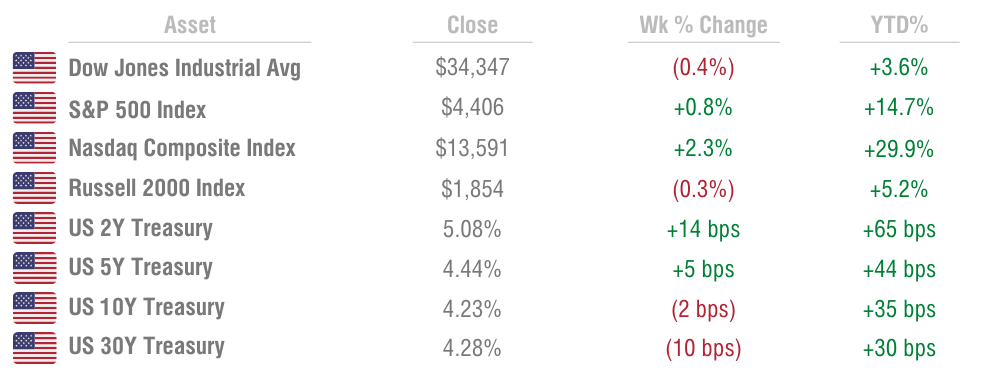

US Markets 🇺🇸

10-year Treasury yield hits highest level since 2007 as investors remain concerned that interest rates could remain higher for longer than expected. The US10Y closed the week trading at a 4.23% yield.

Fed Chair Powell calls inflation ‘too high’ and warns that ‘we are prepared to raise rates further’. A strong economy and decelerating inflation also give the Fed room to “proceed carefully” at upcoming meetings.

Durable good orders rise for third straight month with Boeing’s deliveries set aside, suggesting the struggling industrial side of the U.S. economy may have stabilized. Headline orders sank 5.2% when including Boeing.

Existing home sales fall again in July as supply hits a 25-year low. Sales were 16.6% lower compared with July of last year. There were 1.11M homes available for sale, 14.6% fewer than July 2022 and about half of the pre-Covid supply.

Charles Schwab plans job cuts and office downsizing to achieve at least $500M in annual cost savings. Schwab noted that it’s seeing lower net flows of client money as it integrates TD Ameritrade into its business.

American Airlines pilots approve labor deal that includes an immediate 21% pay bump with compensation increasing more than 46% over the duration of the four-year contract. American has more than 15,000 pilots.

WeWork to complete a 1-for-40 reverse stock split as the company seeks to regain listing compliance, just days after the flexible workspace provider raised "substantial doubt" over its ability to continue operations.

T-Mobile US to cut 7% of workforce or 5,000 jobs as the wireless carrier grapples with rising costs. The carrier has been taking the majority of subscribers looking for cheaper plans in the last three quarters.

Rest of World 🌏

Arm files to go public and IPO on Nasdaq, as SoftBank aims to sell some of its equity in the UK-based chip designer. SoftBank acquired Arm for $32 billion in 2016. The company wants to trade under the ticker symbol “ARM.”

Europe’s economic data goes from bad to worse as the flash composite PMI fell to 47.0 for August, down from 48.6 in July. Excluding the Covid pandemic months, the latest numbers point to the lowest reading since April 2013.

Tesla scales back German battery plans after being won over by US incentives. Tesla has also lowered the production target of its German plant to 4,350/week in July and August after hitting 5,000/week in March.

Major shipping routes are struggling with water shortages as climate-driven events take their toll. In Panama, low water levels have caused a reduction in the number of vessels that pass through the critically important Panama Canal.

India becomes fourth country to land on the moon and the first to land on the moon’s south pole. The pole has emerged as a place of interest thanks to recent discoveries of water molecules on the moon.

Wagner boss Yevgeny Prigozhin presumed dead after plane crash near Moscow, killing all 10 onboard. The plane was flying from Sheremetyevo International Airport in Moscow to St. Petersburg.

Tech ⚡

Instacart files to go public on Nasdaq as they try and unfreeze the tech IPO market. The stock will trade under the ticker “CART.” The company said net income totaled $114M, while revenue in the latest quarter hit $716M.

Meta Threads launches a web version of its application, one of the most requested features. After having one of the most successful app launches of all time, Threads has seen activity plummet over 80% from the peak.

Alibaba launches new image interpretation AI model as well as a model that can carry out more complex conversations called Qwen-VL-Chat. This AI push comes as the cloud division looks to reignite growth as it prepares to go public.

Reddit launches moderator rewards program amid growing discontent among the site’s moderators, many of whom relied on third-party apps that have since been shut down because of Reddit’s API pricing.

Mastercard ends Binance card partnership in Latin America and the Middle East, which let customers user their crypto to purchase goods. Crypto continues to face a broadly tepid response from the financial services industry.

Solana Pay integrates plug-in with Shopify to allow the millions of businesses on the platform to use it for payments. USDC will be the initial payment option for this integration but will consider adding SOL and others in the future.

Coinbase buys stake in stablecoin firm Circle, the issuer of USDC. The two companies will also shut down their joint venture as they get ‘regulatory clarity’. USDC currently accounts for about 21% of the entire stablecoin market.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

Earnings Reports: BYD💰

Tuesday

US - JOLTs Job Openings (JUL)🇺🇸

US - CB Consumer Confidence (AUG)🇺🇸

Earnings Reports: HP Inc, Nio, Best Buy💰

Wednesday

US - GDP (Q2)🇺🇸

US - ADP Employment (AUG)🇺🇸

Germany - CPI Inflation (AUG)🇩🇪

China - Manufacturing PMI (AUG)🇨🇳

Earnings Reports: Salesforce, Crowdstrike, Veeva, Chewy💰

Thursday

US - Jobless Claims 🇺🇸

US - PCE Inflation (JUL)🇺🇸

Europe - CPI Inflation (AUG)🇪🇺

Earnings Reports: Broadcom, Lululemon, MongoDB, Samsara, Okta, SentinelOne, Polestar💰

Friday

US - Nonfarm Payrolls (AUG)🇺🇸

US - Employment Report (AUG)🇺🇸

US - ISM Manufacturing PMI (AUG)🇺🇸

Canada - GDP (JUN)🇨🇦

Europe - HCOB Manufacturing PMI (AUG)🇪🇺

Earnings Reports: Hashicorp, Smartsheet💰

Want to partner with Sunday Morning Markets? Click here to inquire.