What Moved The Markets This Week 📈

Home Sales Plunge To Four-Year Low, Perplexity Ranked Best LLM Overall, Inflation Cools Off In April, China's iPhone Sales Surge 50%, and CRM + ZS + CAVA Earnings

Sunday Morning Markets

Trading Week 22, covering Monday, May 27 through Friday, May 31. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

US Markets 🇺🇸

PCE shows inflation cooling in April

Home sales plunge to four-year low

Trump found guilty in hush money trial

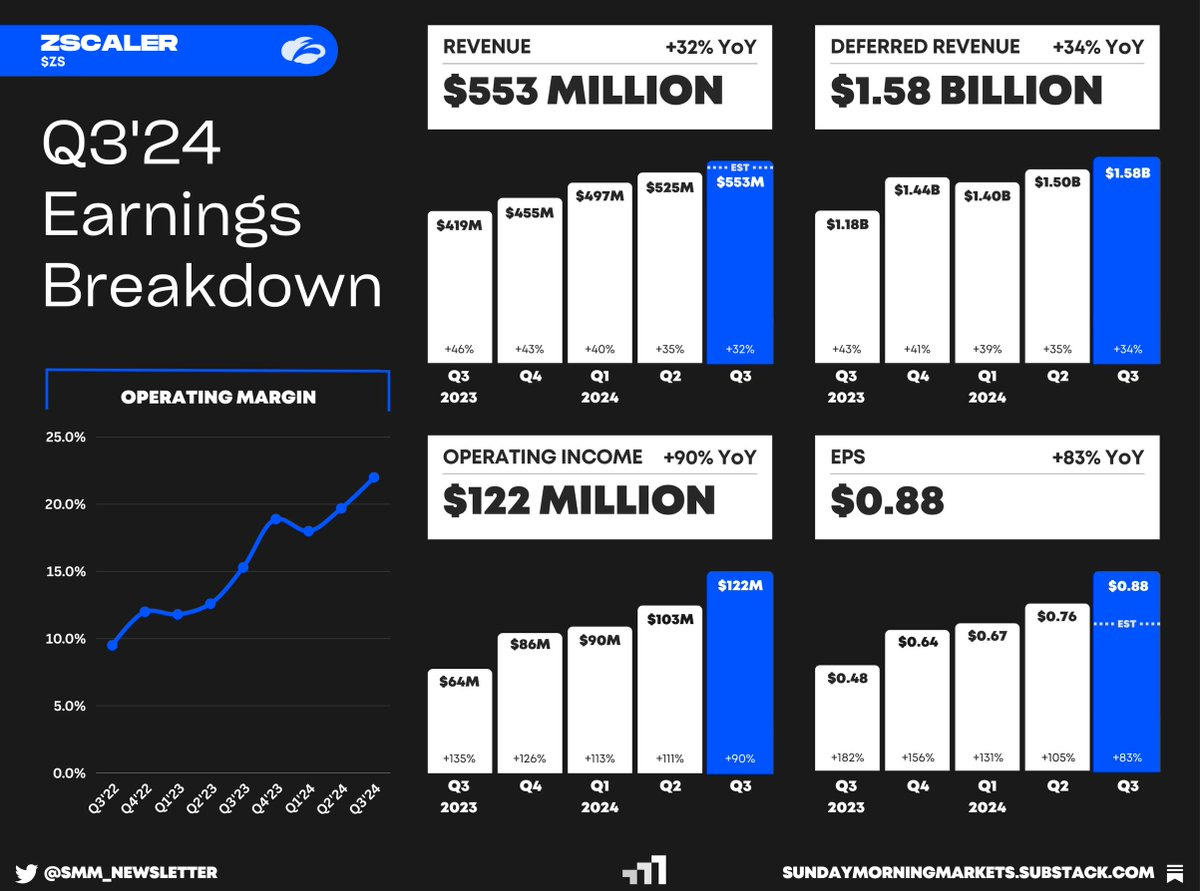

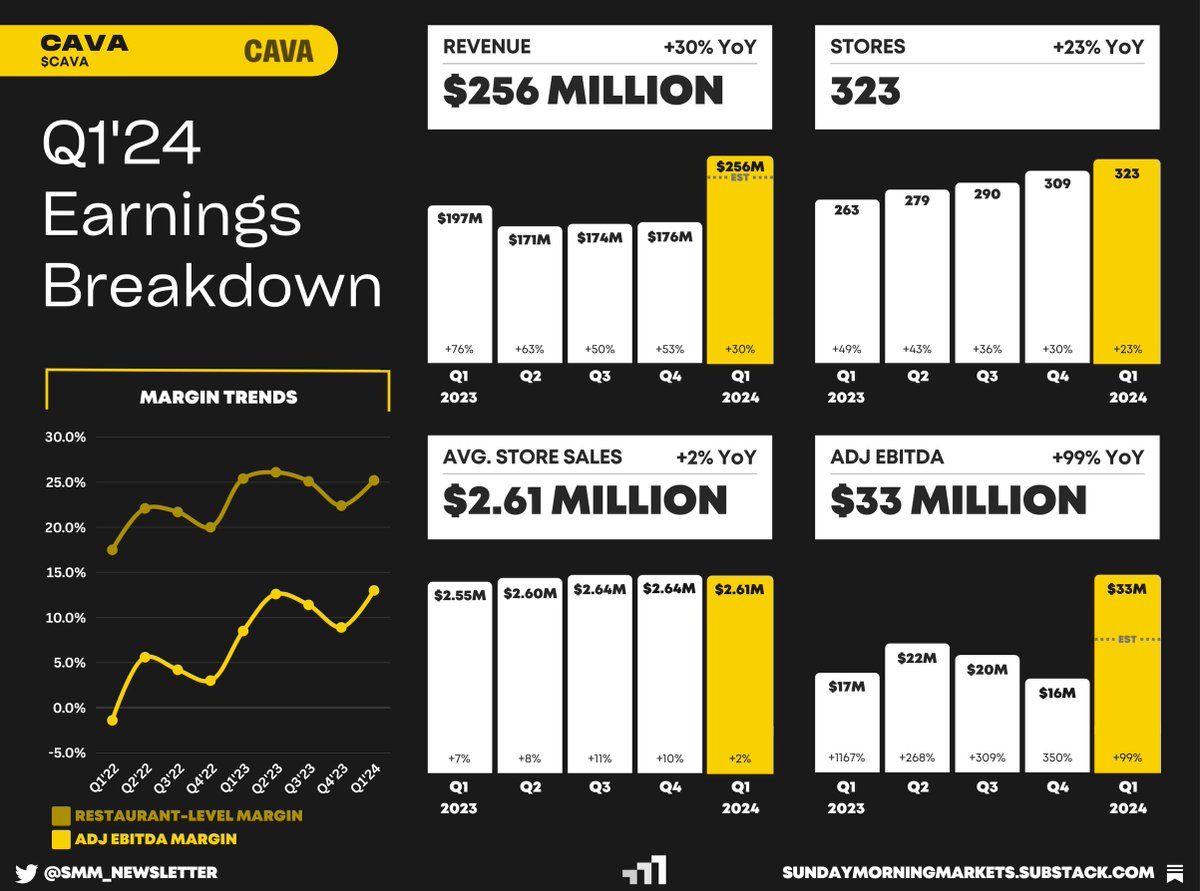

Earnings from Salesforce, ZScaler, and Cava

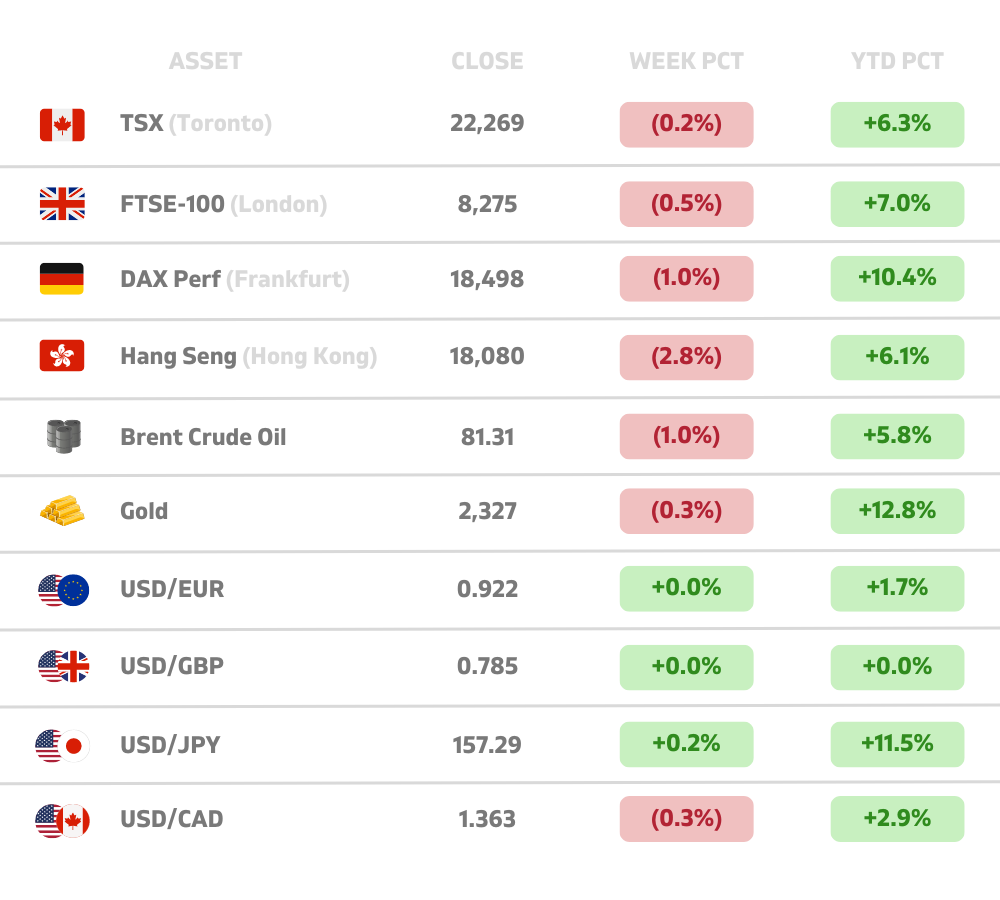

Global Markets 🌏

China places export restrictions on aviation tech

iPhone sales in China surge over 50% in April

BYD unveils ultra-long range EV powertrain

Tech ⚡

Perplexity ranked as the best overall LLM by WSJ

PayPal to launch new ad business

Amazon to expand its drone delivery business

US Markets 🇺🇸

Fed’s preferred inflation gauge cools in April, in line with expectations, as the core PCE index rose 0.2% for the month and 2.8% from a year ago. Meanwhile, disposable income and consumer spending both slowed.

Pending home sales plunge to a four-year low after declining nearly 8% in April. The average rate on the 30-year fixed mortgage ended March at 6.9% and then surged to 7.5% by the end of April.

Trump found guilty on all 34 counts in hush money trial and will become the first U.S. president ever to be convicted of felonies. In the hours following the verdict, Trump’s campaign raised a record $34.8 million in donations.

T-Mobile to acquire most of US Cellular in $4.4 billion deal as they aim to improve coverage in rural areas. US Cellular will retail 70% of its wireless spectrum and towers, and lease space on 2,100 towers to T-Mobile.

Hess shareholders approve $53 billion Chevron deal despite an ongoing dispute with Exxon Mobil. Exxon claims a right of first refusal over Hess’ assets in Guyana under a joint operating agreement.

American Airlines cuts its guidance for 2024 causing its shares to plummet 17% this week. The company reduced its profit outlook by almost 20% and now expects TRASM, a measure of efficiency, to decline 5.5% this year.

Amazon Prime now includes a free Grubhub subscription in its latest effort to attract and retain members amid growing competition from Walmart and Target’s loyalty programs.

Illinois to significantly raise the tax rate on sports betting from a flat 15% to a tiered structure that goes as high as 40% of gross gambling revenues. Shares of DraftKings and Fanduel fell 14% and 5% this week, respectively.

Global Markets 🌏

China to impose export controls on aviation equipment and other technology and software in a move aimed at enhancing national security. The restrictions will begin on July 1st.

Apple's iPhone sales in China jump 52% in April amid intensifying competition in the high-end smartphone category from local rivals like Huawei. Sales may see another boost in May as the company launches more discounts.

Japan confirms first currency intervention since 2022 after the yen plunged to a 34-year-low in April. The Ministry of Finance confirmed Japan spent $62.25 billion buying its own currency between April 26 and May 29.

Eurozone inflation accelerated in May as prices rose 2.6% on the year. The report is unlikely to deter the European Central Bank from proceeding with a heavily signaled interest-rate cut next week.

Saudi Aramco to sell nearly $11.5 billion in stock as it seeks to raise funds for an array of projects aimed at diversifying its fossil fuel-based economy. The country of Saudi Arabia currently owns over 82% of the firm.

BYD unveils new hybrid with ultra-long range of 2000 km, or roughly 1250 miles, allowing drivers to go from New York to Miami on one single charge. The new powertrain will launch in two sedans that cost under $14,000.

Tech ⚡

WSJ ranks Perplexity as the best overall LLM with ChatGPT coming in 2nd and Gemini in 3rd. The tests included everyday tasks such as writing, summarization, coding, speed, and more.

Amazon to expand drone delivery service after clearing a key regulatory hurdle from FAA. Now, Amazon will be able to fly its delivery drones longer distances without the need for ground spotters.

PayPal to launch an ad business using data on its roughly 400 million customers as they aim to rekindle growth. The company recently hired Mark Grether, who formerly led Uber’s advertising business.

Sam Altman was fired because the Board ‘couldn’t trust him’ according to Ex-OpenAI board member, Helen Toner. She claimed Altman repeatedly withheld information and lied to the board about ongoing events at the company.

US Army awards $480 million contract to Palantir for work on a project called the Maven Smart System. The project uses AI computer vision to help militaries assess their battlefield resources and make faster decisions.

Musk’s xAI raises $6 billion at a $24 billion valuation as the company looks to invest more in research and development. Investors include Sequoia Capital and Andreessen Horowitz, among many others.

Jeep to sell new $25,000 electric vehicle ‘very soon’ to better attract mainstream consumers amid slower-than-expected EV adoption, Stellantis CEO Carlos Tavares said.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - ISM Manufacturing PMI 🇺🇸

US - S&P Manufacturing PMI 🇺🇸

UK - Retail Sales 🇬🇧

EU - HCOB Manufacturing PMI 🇪🇺

Earnings: GitLab💰

Tuesday

US - JOLTs Job Openings 🇺🇸

DE - Unemployment Report 🇩🇪

CN - Caixin Services PMI 🇨🇳

Earnings: Crowdstrike, Guidewire 💰

Wednesday

US - S&P Services PMI 🇺🇸

US - ISM Services PMI 🇺🇸

US - ADP Job Report 🇺🇸

CA - BOC Interest Rate 🇨🇦

EU - HCOB Services PMI 🇪🇺

Earnings: Lululemon, Chargepoint, Smartsheet, Sprinklr💰

Thursday

US - Jobless Claims 🇺🇸

US - Imports & Exports 🇺🇸

CA - Ivey PMI 🇨🇦

EU - ECB Interest Rate 🇪🇺

CN - Imports & Exports 🇨🇳

Earnings: Samsara, DocuSign, Nio, Braze💰

Friday

US - Nonfarm Payrolls 🇺🇸

US - Average Hourly Earnings 🇺🇸

US - Unemployment 🇺🇸

EU - GDP 🇪🇺

Want to partner with Sunday Morning Markets? Click here to inquire.