What Moved The Markets This Week 📈

WeWork Bankruptcy, Fed Holds Rates Steady, SBF Faces Up To 115 Years In Jail, Disney Buys Remaining 33% Of Hulu, Splunk Layoffs, and AAPL + ABNB + SHOP Earnings

Sunday Morning Markets

Trading Week 44, covering Monday, Oct 30 through Friday, Nov 3. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Labor Market Data:

Nonfarm Payrolls +150K (vs. estimates 170K)

Job Openings 9.55M (vs. estimates 9.25M)

ADP Payrolls +113K (vs. estimates 150K)

Fed holds interest rates steady. England and Japan follow suit

Disney buys remaining 33% stake in Hulu from Comcast

Nio, Splunk, Maersk announce major layoffs

WeWork plans to file for bankruptcy protection

SBF found guilty for all 7 criminal charges

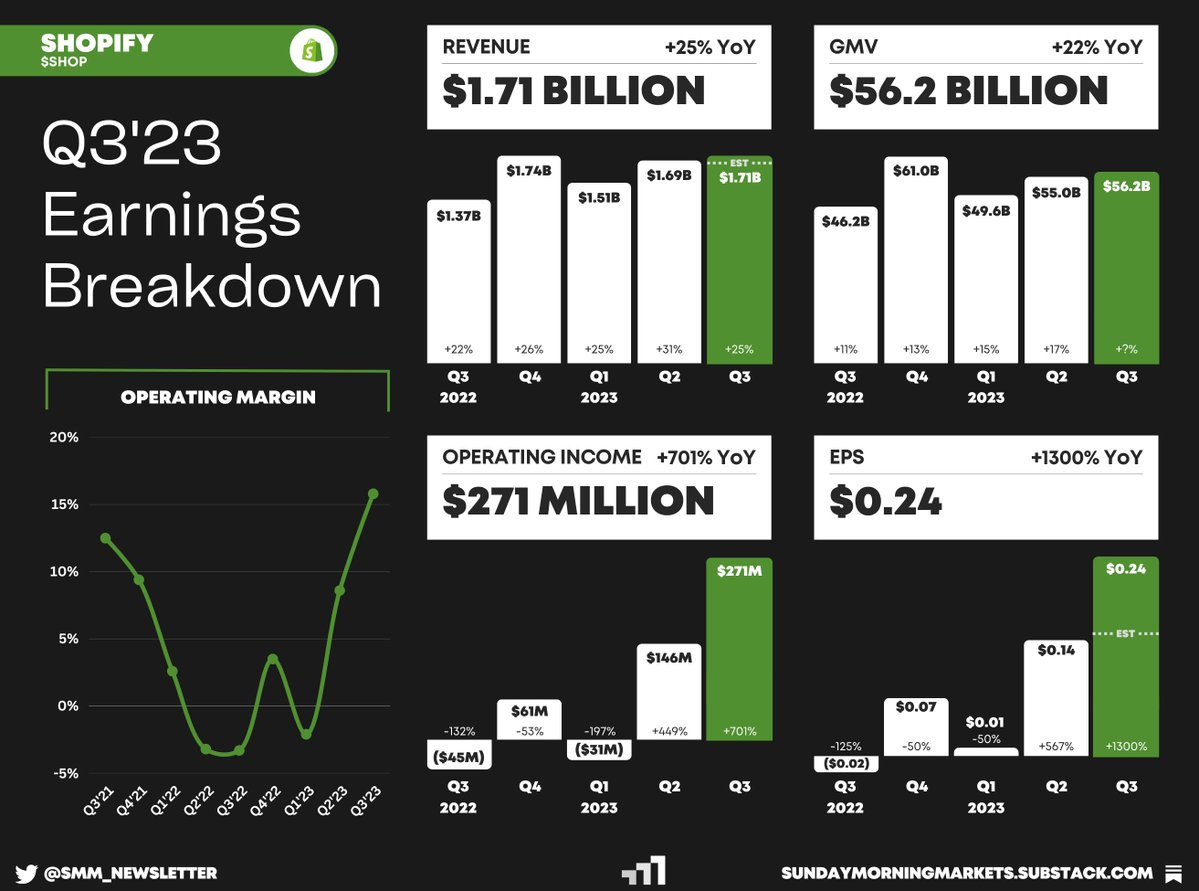

Earnings from AAPL, ABNB, SHOP — see breakdown below

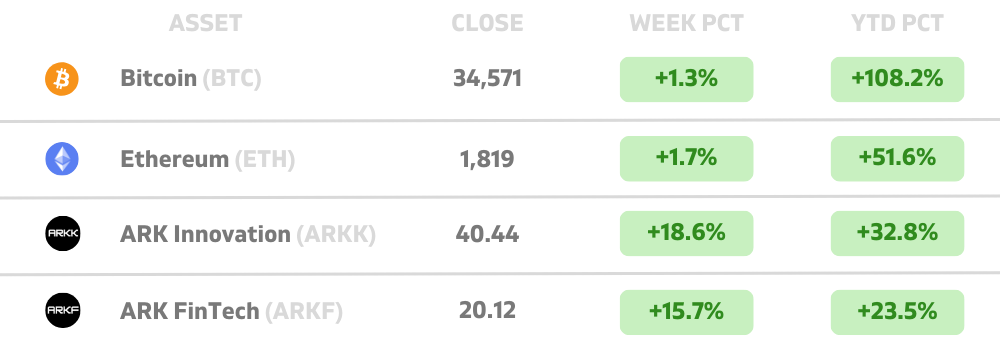

US Markets 🇺🇸

Fed holds rates steady at 5.25% - 5.5%, marking the second consecutive ‘pause’ following a string of 11 straight rate hikes. The decision included an upgrade to the committee’s general assessment of the economy.

Nonfarm payrolls rise just 150,000 in October below the consensus forecast of 170,000 and a sharp decline from the gain of 297,000 in the month prior. The unemployment rate rose to 3.9%, the highest level since January 2022.

Job openings stay elevated, layoffs at nine-month low, the latest JOLTS report shows. The number of available positions increased 56,000 to 9.55 million in September, well above the consensus estimates of 9.25 million.

U.S. manufacturing sector contracted sharply in October after showing signs of improvement in prior months. The ISM Manufacturing PMI fell to 46.7, down significantly from the prior month’s reading of 49.

GM reached a tentative deal with the UAW to end strike after six weeks. GM added that the strike had cost the company about $800 million, while Ford projected they had lost closer to $1.3 billion in profits.

Jury finds realtors liable for inflating commissions in a massive blow to the National Association of Realtors (NAR). The NAR conspired to artificially inflate commissions and is now liable to pay $1.78 billion in damages.

Disney to buy remaining 33% stake in Hulu from Comcast making it the sole owner of the popular streaming platform. Disney will pay $8.61B for the equity and could end up paying more based on an appraisal process.

Global Markets 🌏

Bank of Japan increases flexibility on yield curve control by raising the upper bound of its 10Y bond yield to 1% while keeping its short-term rates unchanged. The Japanese Yen plunged 2% against the dollar following the news.

Eurozone inflation dropped to two-year low in October as headline CPI inflation fell to 2.9%, down from 4.3% in the previous month. Meanwhile, the eurozone economy contracted by 0.1% during the third quarter.

Bank of England leaves interest rates at 15-year high of 5.25% and said they are “watching closely to see if further increases in rates are needed, but even if they are not, it is much too early to be thinking about rate cuts.”

Chinese Tesla rival, Nio, cuts 10% of workforce as CEO predicts ‘intense competition’ ahead. The company will focus on investing in tech, and will cut projects that won’t contribute to the financial performance in three years.

Danish shipping giant Maersk to cut 10K jobs and expects profit to be at the low end of prior guidance. The CEO said the company faces subdued demand and inflationary pressures. Shares plummeted 15% following the news.

China's services activity picked up slightly in October as the Caixin Services PMI rose to 50.4, from the prior reading of 50.2. However, the pace of expansion remained much slower than in the first half of the year.

Tech ⚡

SBF found guilty on all seven criminal fraud counts and the ex-FTX CEO will now face a maximum sentence of 115 years in prison. The prosecution’s key witnesses were former members of Bankman-Fried’s inner circle.

WeWork plans to file for bankruptcy as early as next week as the company struggles with a massive debt pile and hefty losses. WE 0.00%↑ shares have plunged a staggering 99.8% from the peak in 2021.

Biden issues Executive Order for AI safety that sets requirements for companies developing foundation AI models to notify the federal government and share results of all safety tests before they’re deployed to the public.

Apple announces three new M3 computer chips with faster CPU and GPU processing times and extended battery life. There is an entry-level M3, a 40% faster M3 Pro, and a 250% faster M3 Max chip for AI developers.

Tesla’s key battery cell provider warns of sluggish demand, causing Tesla shares to fall 5%. Panasonic, a longtime partner and supplier of Tesla, reduced their battery cell production during the quarter.

Splunk to cut 7% of its workforce, or about 500 employees, just months ahead of the close of its acquisition by Cisco. However, Splunk’s CEO Gary Steele emphasized that the layoffs were not the result of the $28B Cisco deal.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

CA - Ivey PMI (OCT)🇨🇦

CN - Imports & Exports (OCT)🇨🇳

AU - RBA Interest Rate Decision🇦🇺

Tuesday

Earnings Reports: DataDog, Lucid💰

Wednesday

DE - CPI Inflation (OCT)🇩🇪

CN - CPI Inflation (OCT)🇨🇳

CN - PPI Inflation (OCT)🇨🇳

Earnings Reports: Disney, Warner Bros💰

Thursday

US - Jobless Claims 🇺🇸

US - WASDE Report 🇺🇸

Earnings Reports: AstraZeneca, TradeDesk💰

Friday

US - UMich Consumer Sentiment (NOV)🇺🇸

UK - GDP (Q3)🇬🇧

Want to partner with Sunday Morning Markets? Click here to inquire.