What Moved The Markets This Week

U.S. Deficit Hits $1.8T, ECB Accelerates Rate Cuts, Boeing To Raise $25B Amid Strikes, Google Replaces Search Boss, China's Growth Misses Target, Amazon Bets Big On Nuclear, and NFLX + TSM + ASML

Sunday Morning Markets

Trading Week 42, covering Monday, Oct 14 through Friday, Oct 18. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

U.S. deficit hits $1.8T in 2024, interest exceeds $1T

Retail sales rise 0.4%, above estimates

Google replaces its Search & Ads boss

ECB cuts rates to 3.25%, inflation drops to 1.7%

China’s GDP growth misses estimates, up 4.6% in Q3

Hamas leader Yahya Sinwar killed

TSMC reports strong earnings, 3nm revenue up 350%

Amazon to build small nuclear reactors near data centers

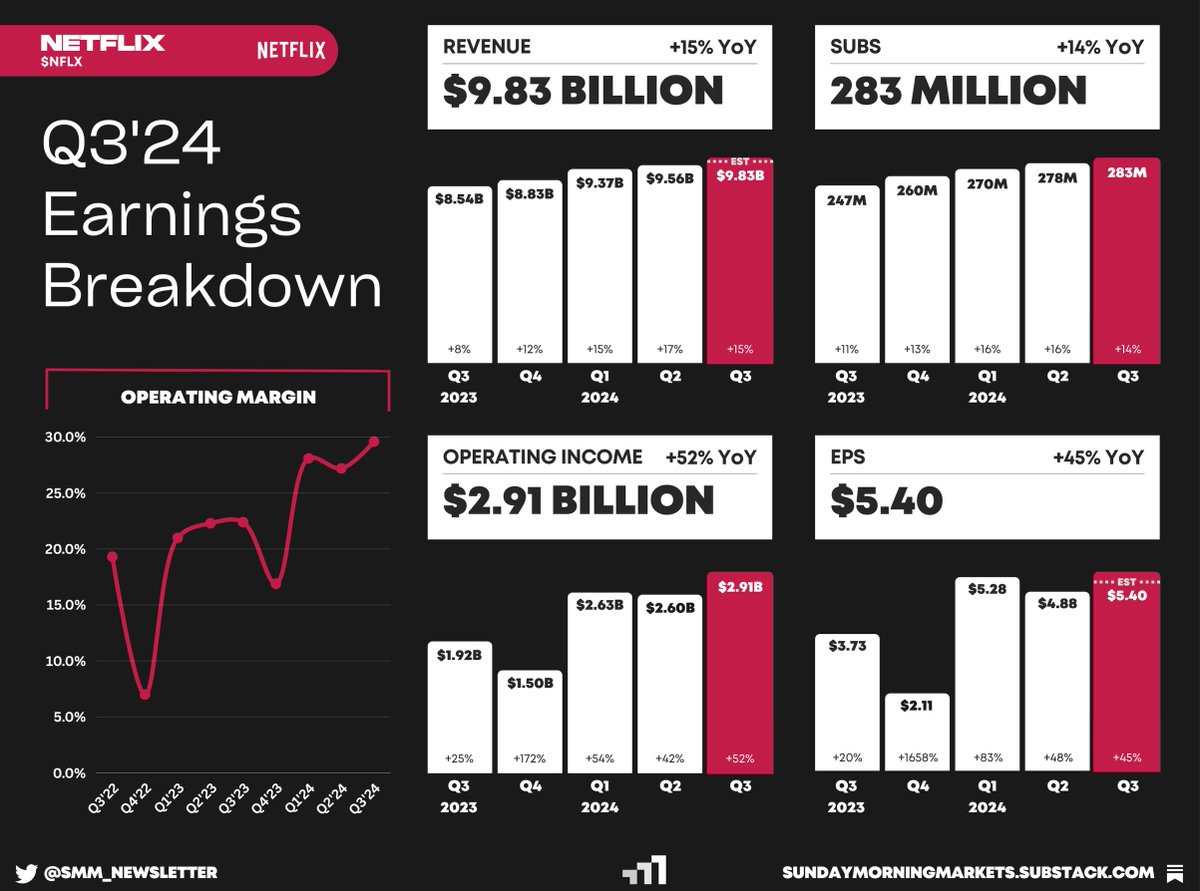

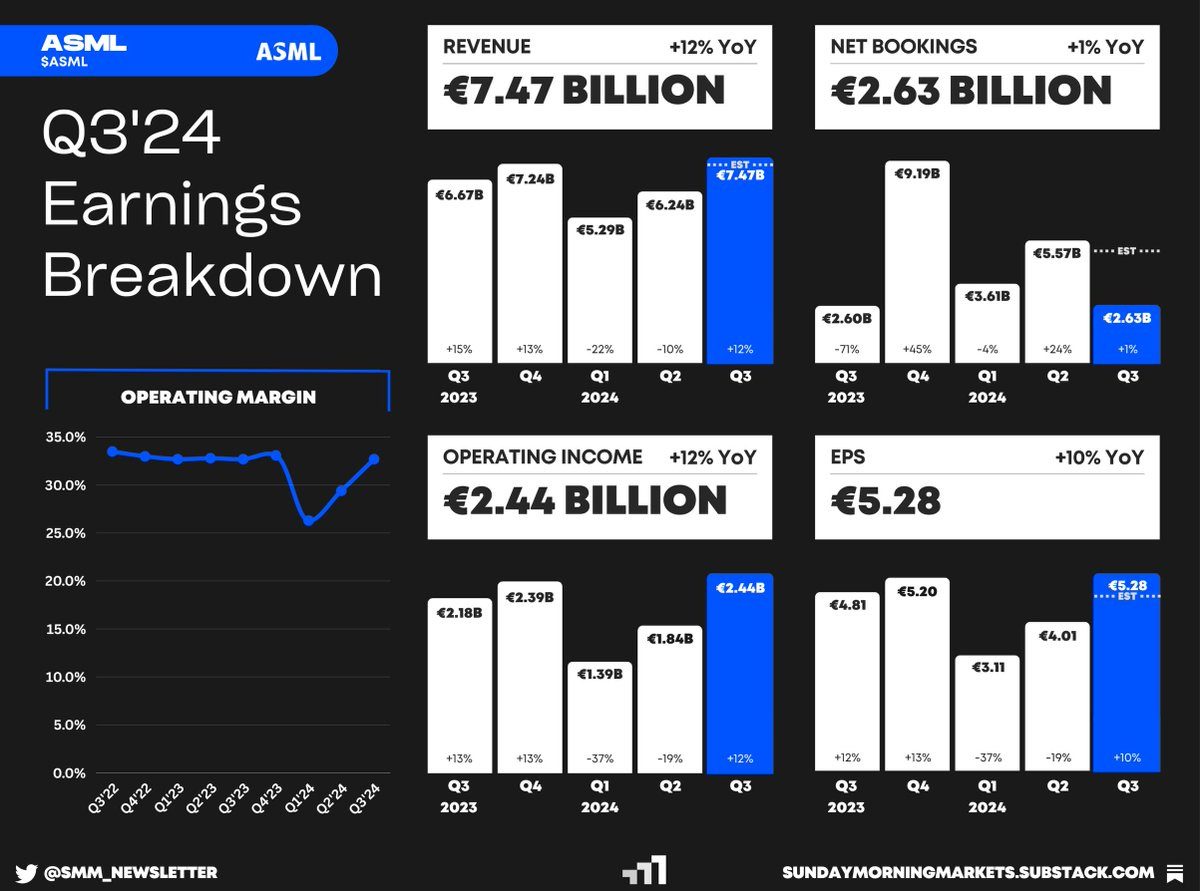

Earnings from Netflix, TSMC, ASML

US Markets 🇺🇸

The U.S. deficit hits $1.8T as interest costs surge past $1 trillion in 2024, marking a new high. Despite record revenues of $4.9T, government spending hit $6.75T, pushing debt to $35.7T.

Retail sales rose 0.4% in September, exceeding expectations. The gains were driven by clothing store sales (1.5%) and bars and restaurants (1%). Declines at gas stations (-1.6%) and electronics stores (-3.3%) offset growth.

Housing starts dipped 0.5% last month, driven by a 9.4% drop in multifamily construction. Permits for future construction also fell 2.9%. However, single-family home starts rose 2.7%, reaching a five-month high.

Google replaces Search and Ads boss with longtime executive Nick Fox. Prabhakar Raghavan will transition to chief technologist, focusing on AI efforts as competition intensifies.

Boeing aims to raise up to $25 billion to boost liquidity amid ongoing strikes and production challenges. It also secured a $10 billion credit line, facing pressure from credit agencies over a potential downgrade.

Walgreens to close 1,200 stores by 2027, citing that a quarter of its U.S. locations are unprofitable. The move aims to slash costs amid pharmacy reimbursement pressure and softer consumer spending.

Global Markets 🌏

ECB accelerates rate cuts as growth falters, lowering rates to 3.25% amid weakening economic signals. Eurozone inflation fell to 1.7% last month, down from 2.2% in August.

China’s Q3 growth slowed to 4.6%, falling short of expectations as stimulus measures struggled to boost the economy. Investors are skeptical about further support, while challenges like local debt and property issues persist.

Hamas leader Yahya Sinwar killed by Israel, a major blow to the group’s leadership. Sinwar, accused of planning the Oct. 7 attacks, leaves uncertainty over Hamas' future command and the fate of hostages.

UK inflation plummets to 1.7%, falling below the Bank of England’s target. Core inflation fell to 3.2%, down from 3.6% in August. Markets now anticipate a rate cut in November to support the slowing economy.

Canada's inflation rate eases to 1.6% in September, lower than expected due to cheaper gas prices. Analysts anticipate a more aggressive 50-basis-point rate cut from the Bank of Canada next week.

Airbus to cut up to 2,500 jobs in its Defense and Space division amid a challenging market, especially in satellite operations. The cuts will impact 7% of the workforce and are planned for mid-2026.

Tech ⚡

TSMC's quarterly profit surges 54% on strong demand for AI and smartphone chips, with revenue hitting $23.5 billion. Shares jumped 11% following the report as TSMC forecasts strong growth to continue into Q4.

Amazon bets big on nuclear power, investing over $500 million in small modular reactors to meet growing energy needs for its data centers and advance its net-zero carbon ambitions.

Adobe rolls out AI video tools, aiming to rival OpenAI and Meta. Its Firefly Video Model generates video from text prompts, with a focus on professional editing features like camera control and seamless footage blending.

Lucid announced a $1.67B stock offering, which caused shares to plunge 15% as investors questioned the need for more capital after securing $1.5B in August. Lucid continues to face demand and cost challenges.

Tesla's Optimus robots were more human-assisted than autonomous at the Cybercab event. Humans teleoperated most of their movements, leaving questions about the robots' true progress.

SpaceX lands $733M Space Force contract for eight Falcon 9 launches by 2026. The deal is part of the National Security Space Launch program, pushing competition in military space missions.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - CB Leading Index 🇺🇸

CN - PBOC Interest Rate 🇨🇳

Earnings: SAP💰

Tuesday

JP - BOJ Core CPI 🇯🇵

Earnings: General Motors, GE Aerospace, Texas Instruments, Verizon, RTX, Lockheed Martin💰

Wednesday

US - Existing Home Sales 🇺🇸

US - Crude Oil Inventories 🇺🇸

CA - BoC Interest Rate Decision 🇨🇦

Earnings: Tesla, T-Mobile, Thermo Fisher, IBM, ServiceNow, AT&T, Boeing, Lam Research💰

Thursday

US - Jobless Claims 🇺🇸

US - New Home Sales 🇺🇸

US - S&P Composite PMI 🇺🇸

UK - S&P Composite PMI 🇬🇧

EU - HCOB Composite PMI 🇪🇺

Earnings: UPS, American Airlines, Appfolio💰

Friday

US - Durable Goods Orders 🇺🇸

US - UMich Inflation Exp 🇺🇸

CA - Retail Sales 🇨🇦

DE - Ifo Business Climate 🇩🇪

Want to partner with Sunday Morning Markets? Click here to inquire.