What Moved The Markets This Week 📈

W20 - Consumer Debt Hits New High At $17 Trillion, Montana Bans TikTok, US To Refill Oil Reserve, LEI Signals Recession, Tether Buys Bitcoin With Profits, and Walmart + Target + Home Depot Earnings

Sunday Morning Markets

Trading Week 20, covering Monday, May 15 through Friday, May 19. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

LEI falls deeper into recession territory

US to buy 3m bbls of oil, begin refilling SPR

Retail sales rebound as consumer debt hits $17T

Montana first state to ban TikTok

Meta to release Twitter competitor this summer

Data out of China shows the economy slow to reopen

Tether (USDT) to buy Bitcoin for reserve with profits

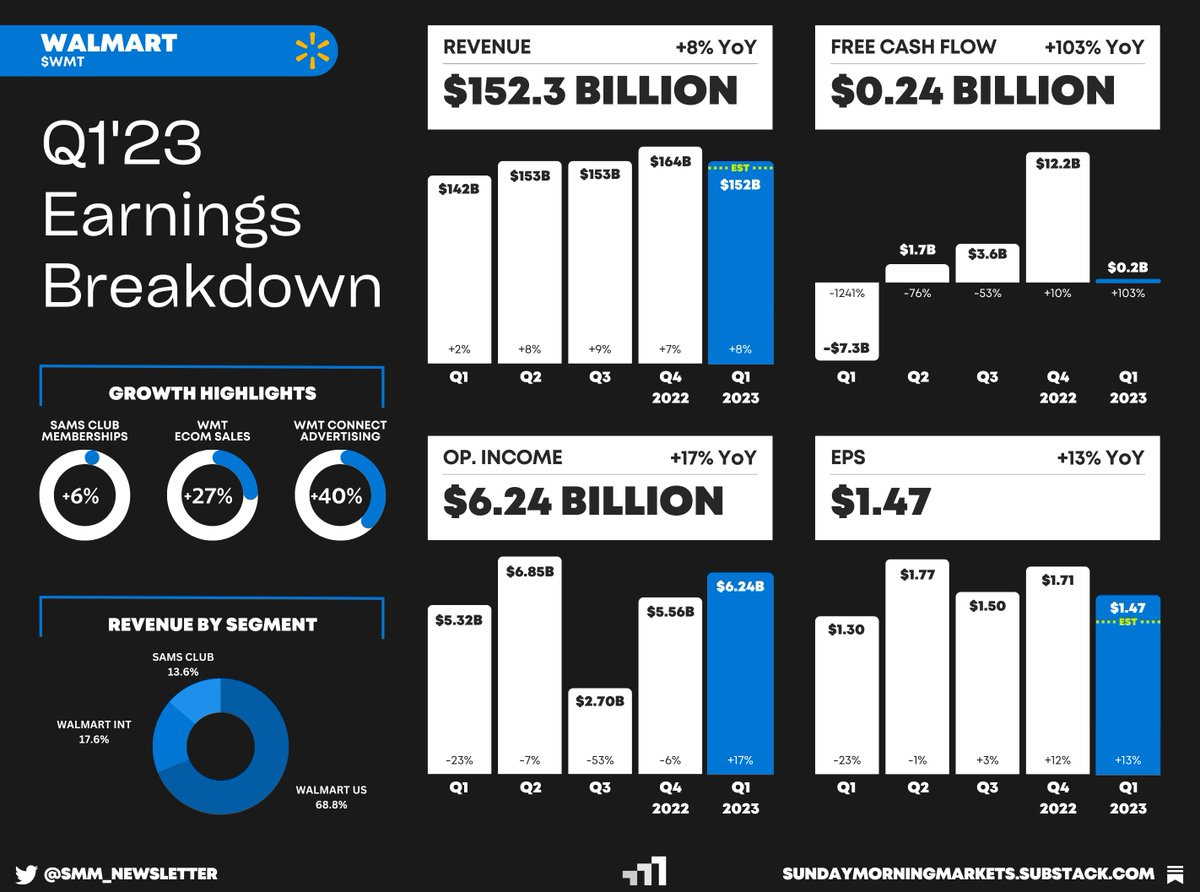

Earnings from Walmart, Target, Home Depot — see breakdowns below

US Markets 🇺🇸

The LEI shows US economy heading into recession as the index fell another 0.6% in April. The indicator is currently down 8.04% versus the year prior, a level only seen during the five previous recessions dating back to 1980.

US to buy 3 million barrels of oil to refill reserve as the emergency stockpile hits the lowest level since the 1980s. The Biden administration conducted the largest sale ever from the SPR of 180 million barrels last year.

Retail sales rebound in April but miss expectations by a fair margin. Sales jumped 0.4% during the month, largely because of strong demand for new autos and higher consumer spending online, but missed estimates of a 0.8% increase.

Consumer debt passes $17 trillion for first time despite new mortgage originations totaling just $324B, the lowest level since the second quarter of 2014. Total delinquency rates moved up 0.2 percentage points to 3%.

Pfizer to raise $31B in a debt offering to fund its acquisition of Seagen. The offering comes as corporations like Apple, T-Mobile, and Merck rush to tap the U.S. bond market ahead of a potential spike in borrowing costs.

Montana to become first US state to ban TikTok after Governor Greg Gianforte signed legislation to protect residents from alleged intelligence gathering by China. The ban is to take effect Jan. 1, 2024.

Vice Media files for bankruptcy to enable the sale to lenders including Soros and Fortress, as the media industry comes under pressure due to lower advertising income. Buzzfeed News shuttered operations just last month.

Meta to launch Twitter competitor next month according to leaked marketing slide that labels the product “Instagram’s new text-based app for conversations”. It will feature text-based posts with up to 500 characters, photos, and videos.

Rest of World 🌏

China’s economic data misses expectations as the economy rebounds slower than expected. Retail sales jumped 18.4% YoY (exp. 21%), industrial production rose 5.6% (exp. 10.9%), and fixed asset investment rose 4.7% (exp. 5.5%).

DoJ charges ex-Apple engineer for selling tech to China. Weibao Wang was charged with six counts after he stole troves of source code on Apple’s autonomous driving technology for an unnamed Chinese company.

EU approves Microsoft’s $69B acquisition of Activision subject to remedies offered by the US tech giant. The news is a huge win for Microsoft, after the UK’s top competition authority last month blocked the deal.

Crypto ⚡

1 million individual wallets now own a whole Bitcoin, representing a 20% increase since February of last year. The number grew by 79K between November ‘22 and January ‘23, amid the collapse of FTX.

Tether buys Bitcoin with a portion of its net profit to back its USDT stablecoin. They will invest up to 15% of net profits into Bitcoin to “diversify” the reserves. USDT is the largest stablecoin in the market, with a supply of over $80B.

Earnings Reports 💰

See more breakdowns for Nu, Monday, Sea, Cisco, and Applied Material on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

Earnings Reports: Advanced Auto, GlobalE💰

Tuesday

US - New Home Sales (APR)🇺🇸

US - S&P Manufacturing PMI (MAY)🇺🇸

Germany - S&P Manufacturing PMI (MAY)🇩🇪

Earnings Reports: Lowe’s, Intuit, Palo Alto Networks, Zoom, Agilent, Dicks💰

Wednesday

US - FOMC Meeting Minutes 🇺🇸

UK - CPI Inflation (APR)🇬🇧

Germany - Ifo Business Climate (MAY)🇩🇪

Earnings Reports: Nvidia, Splunk, Analog Devices, Trip.com💰

Thursday

US - Pending Home Sales (APR)🇺🇸

US - GDP (Q1)🇺🇸

Germany - GDP (Q1)🇩🇪

Australia - Retail Sales (APR)🇦🇺

Earnings Reports: Snowflake, NetEase, Medtronic, Workday, Autodesk, Dollar Tree, Ulta, Best Buy💰

Friday

US - Durable Goods (APR)🇺🇸

US - PCE Inflation (APR)🇺🇸

US - Personal Spending (APR)🇺🇸

UK - Retail Sales (APR)🇬🇧

Earnings Reports: Dell, Marvell💰

Want to partner with Sunday Morning Markets? Click here to inquire.