What Moved The Markets This Week 📈

Biden Quadruples Tariffs On Chinese EVs, U.S. Consumers Spend All Excess Savings, Instacart and Uber Team Up, Neuralink's First Implant Malfunctions, and UBER + SHOP + DDOG Earnings

Sunday Morning Markets

Trading Week 19, covering Monday, May 6 through Friday, May 10. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

US Markets 🇺🇸

Excess savings have been fully depleted

Rivian loses $38,000 per vehicle sold in Q1

TikTok sues to block the new ban

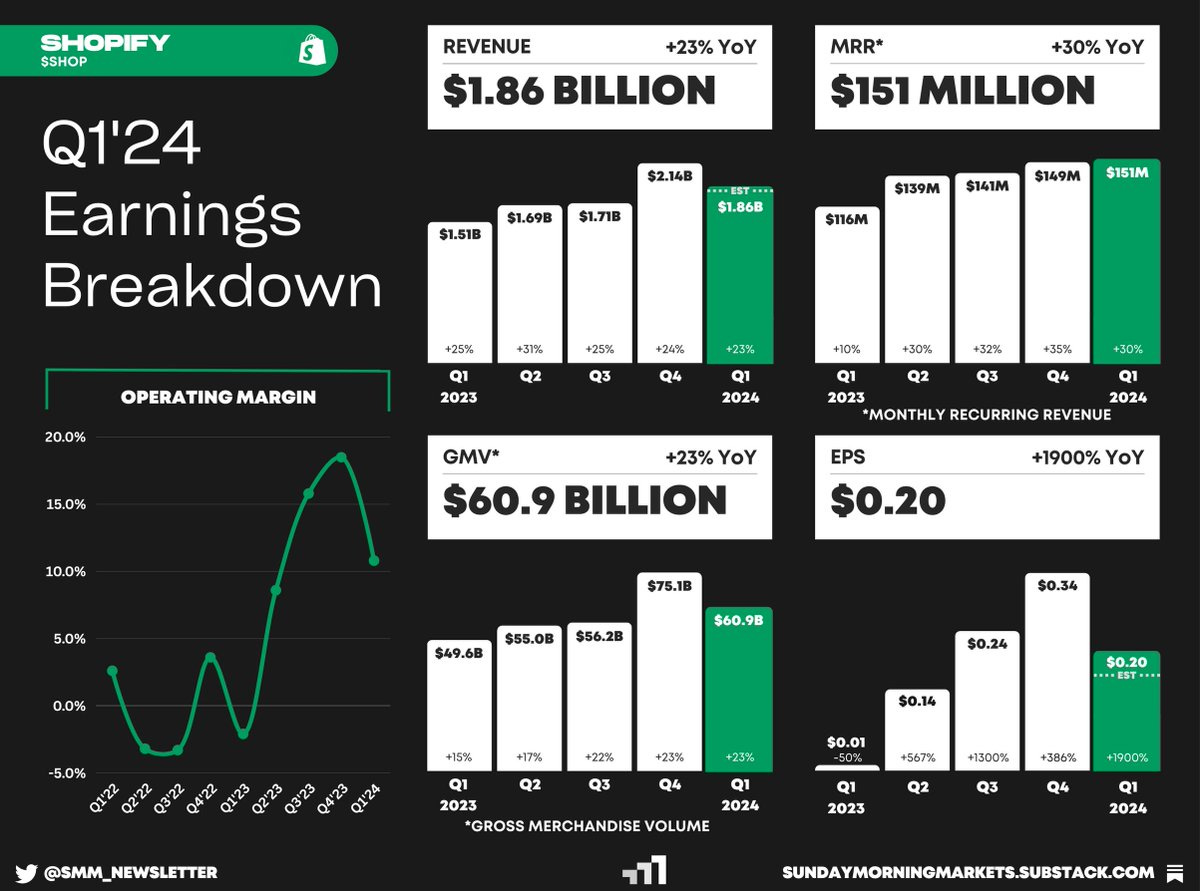

Earnings from Uber, Shopify, and DataDog

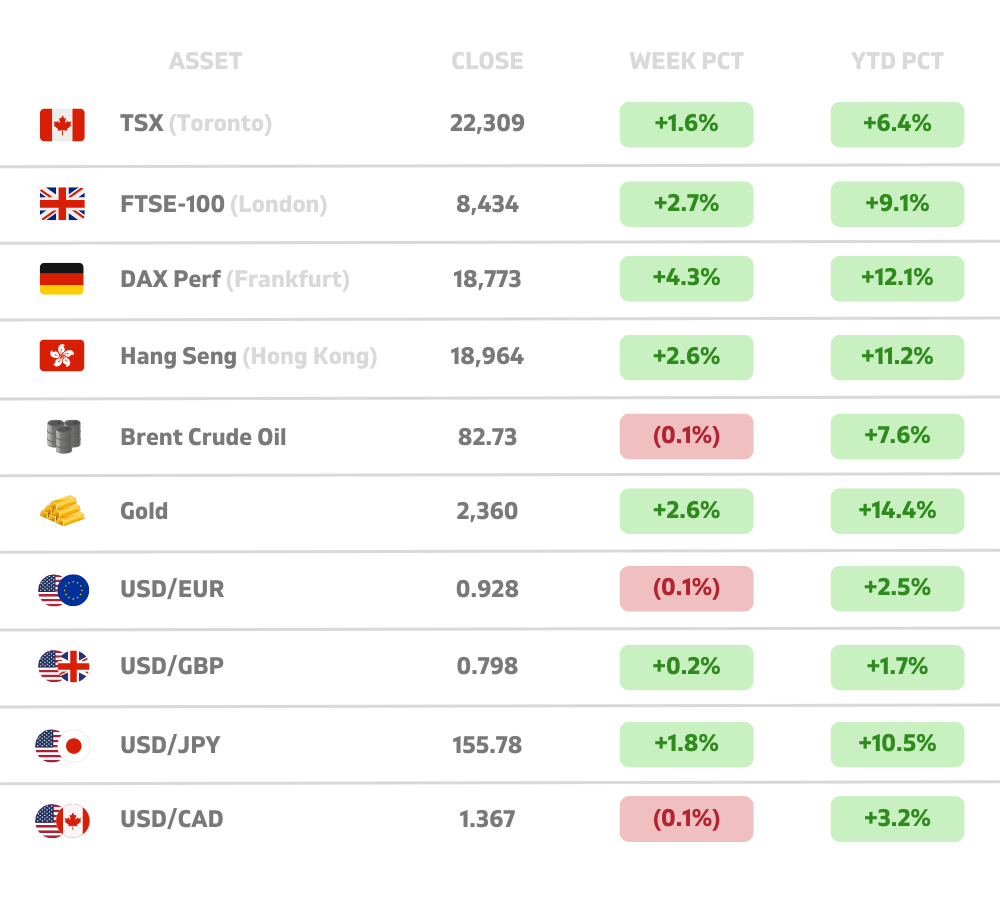

Global Markets 🌏

Bank of England holds interest rate, signal cuts ahead

Biden quadruples tariffs on Chinese EVs

iPhone shipments in China soar 12%

Tech ⚡

Instacart and Uber partner for food deliveries

Neuralink’s first brain implant malfunctions

Robinhood receives Wells Notice from SEC

Apple unveils new line of iPads

US Markets 🇺🇸

Pandemic savings have finally been spent according to a Fed report. Excess savings swelled to $2.1 trillion by August 2021 but have now turned negative as households drew over $70 billion per month over the last 28 months.

U.S. consumers pulled back sharply on credit card use in March as total new credit increased by $6.3 billion, well below estimates. However, delinquency rates on both credit cards and auto loans continue to rise.

Social Security is expected to run out of money in 2035, says the U.S. Treasury, one year later than the previous forecast. The commissioner urges Congress to extend the fund’s solvency as soon as possible.

Consumer sentiment tumbles as inflation fears surge. The University of Michigan surveys showed the one-year inflation outlook jumping to 3.5% and the five-year outlook rising to 3.1%.

TikTok sues to block the pending U.S. ban and argues it violates the First Amendment free speech protections. The new law gives ByteDance until January 19th to sell TikTok or face a complete ban.

Rivian lost $38,000 per vehicle delivered in Q1 as the company’s cash pile has plunged from over $18 billion at the end of 2021 to just $6 billion today. Shares of RIVN 0.00%↑ are down over 50% so far this year.

Pinnacle Bank buys Fort Worth's tallest tower for $12.3M or just $12.30 per square foot at a foreclosure auction. The 1 million-square-foot office plaza was last bought by Opal Holdings in 2021 for $137.5 million.

Global Markets 🌏

Bank of England leaves interest rates unchanged for the sixth straight meeting but indicated that it’s on course to join its European peers in cutting rates over the coming months.

UK exits recession with fastest growth in three years as GDP grew 0.6% in the first quarter. Prime Minister Rishi Sunak took a victory lap and claimed that the economy has "turned a corner".

China's consumer prices rose for a third straight month in April while producer prices extended declines. The report signals an improvement in domestic demand as the country aims to revive growth.

Biden to quadruple tariffs on Chinese EVs from 25% to roughly 100% and will also target solar goods and batteries. This comes one month after the administration increased tariffs on Chinese steel and aluminum.

Tesla’s China sales fell again in April despite a rebound in overall EV demand. The U.S. automaker sold just 62,167 China-made cars in April, down 18% compared with a year earlier.

Zeekr goes public on NYSE under ticker ‘ZK’ at $21/share, at the top end of the expected range. Shares of the Chinese EV maker opened trading Friday at $28/share, up almost 35% on the day. Click to see Zeekr’s F1.

Chinese iPhone shipments soared 12% in March after Apple slashed prices. The company has struggled to turn its Chinese business around since 2023 as domestic competitors such as Huawei have taken market share.

Tech ⚡

Instacart and Uber team up in new partnership to allow users to order takeout directly from Instacart’s app. The orders will still be processed and delivered by Uber, but Instacart will presumably get a revenue share of each order.

Neuralink’s first human brain implant malfunctioned as the threads retracted from the brain, reducing its speed and accuracy. In response, the company modified its algorithms to rebalance metrics.

Apple unveils new versions of its iPad Air and iPad Pro tablets as CEO Tim Cook calls it “the biggest day for iPad since its introduction.” The new iPads will be thinner than the last generation and include Apple’s M4 chip

OpenAI and Apple close in on deal to put ChatGPT on iPhones as part of a broader push to bring AI features to its devices. The new features are expected to be included in Apple’s upcoming software update, iOS 18.

Robinhood receives a Wells Notice from the SEC and says the regulator could soon pursue enforcement action over its crypto operations. Robinhood reported Wednesday that its crypto-based revenue grew 232% in the first quarter.

FTX says most customers will get all their money back according to a new court filing. Customers whose claims amount to $50,000 or less will receive approximately 118% of the amount of their allowed claim.

Disney and WarnerBros to launch new streaming bundle that will include Disney+, Hulu, and Max. The subscription price hasn’t been disclosed but there will be both ad-supported and ad-free options.

Self-driving startup Wayve raises $1 billion from Softbank, Nvidia and Microsoft. Similarly to the Tesla V12 model, the company uses self-learning rather than a rule-based system.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - NY Fed Inflation Expectations 🇺🇸

EU - Economic Forecasts🇪🇺

Tuesday

US - PPI Inflation (APR)🇺🇸

UK - Unemployment Report (APR)🇬🇧

EU - ZEW Economic Sentiment (MAY)🇪🇺

DE - CPI Inflation (APR)🇩🇪

Earnings: Home Depot, Alibaba, Nu Holdings, Sea Ltd, Flutter, Dlocal💰

Wednesday

US - CPI Inflation (APR)🇺🇸

US - Retail Sales (APR)🇺🇸

US - Empire State Manf. Index (MAY)🇺🇸

CA - Housing Starts (APR)🇨🇦

JP - GDP (Q1)🇯🇵

Earnings: Cisco, JD.com, Grab, Monday, Dynatrace💰

Thursday

US - Jobless Claims 🇺🇸

US - Housing Starts (APR)🇺🇸

US - Phili Fed Manf. Index (MAY)🇺🇸

CN - Industrial Production (APR)🇨🇳

CN - Unemployment (APR)🇨🇳

Earnings: Walmart, Applied Materials, Take-Two💰

Friday

US - CB Leading Index (APR)🇺🇸

EU - CPI Inflation (APR)🇪🇺

Want to partner with Sunday Morning Markets? Click here to inquire.