What Moved The Markets This Week 📈

Venture Capital Funding Surges To Two-Year High, Payrolls Grow 206K, Tesla Reports Better-Than-Expected Delivery Numbers, Eurozone Inflation Eases To 2.5%, and STZ Earnings

Sunday Morning Markets

Trading Week 27, covering Monday, Jul 1 through Friday, Jul 5. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

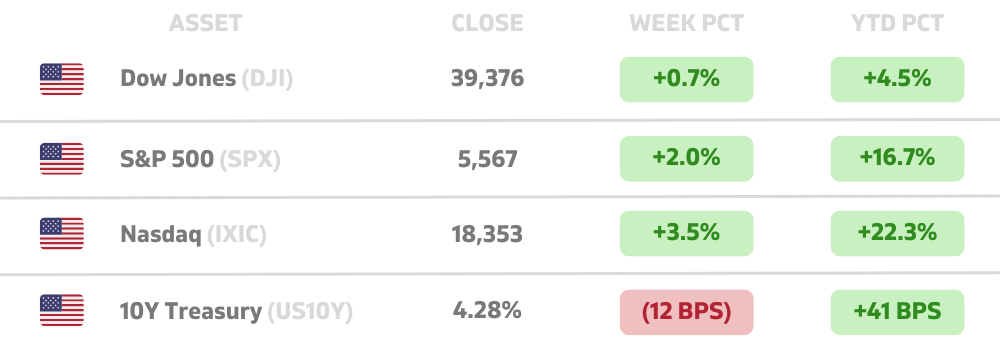

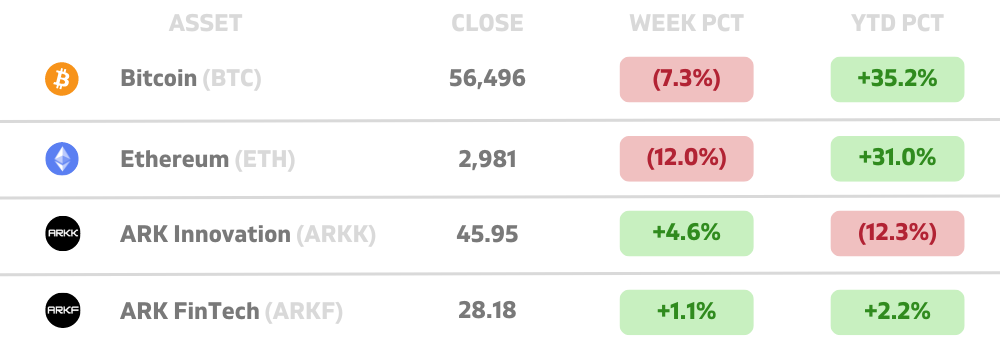

US Markets 🇺🇸

Payrolls grow 206K, unemployment hits 4.1%

Job openings jump to 8.14 million

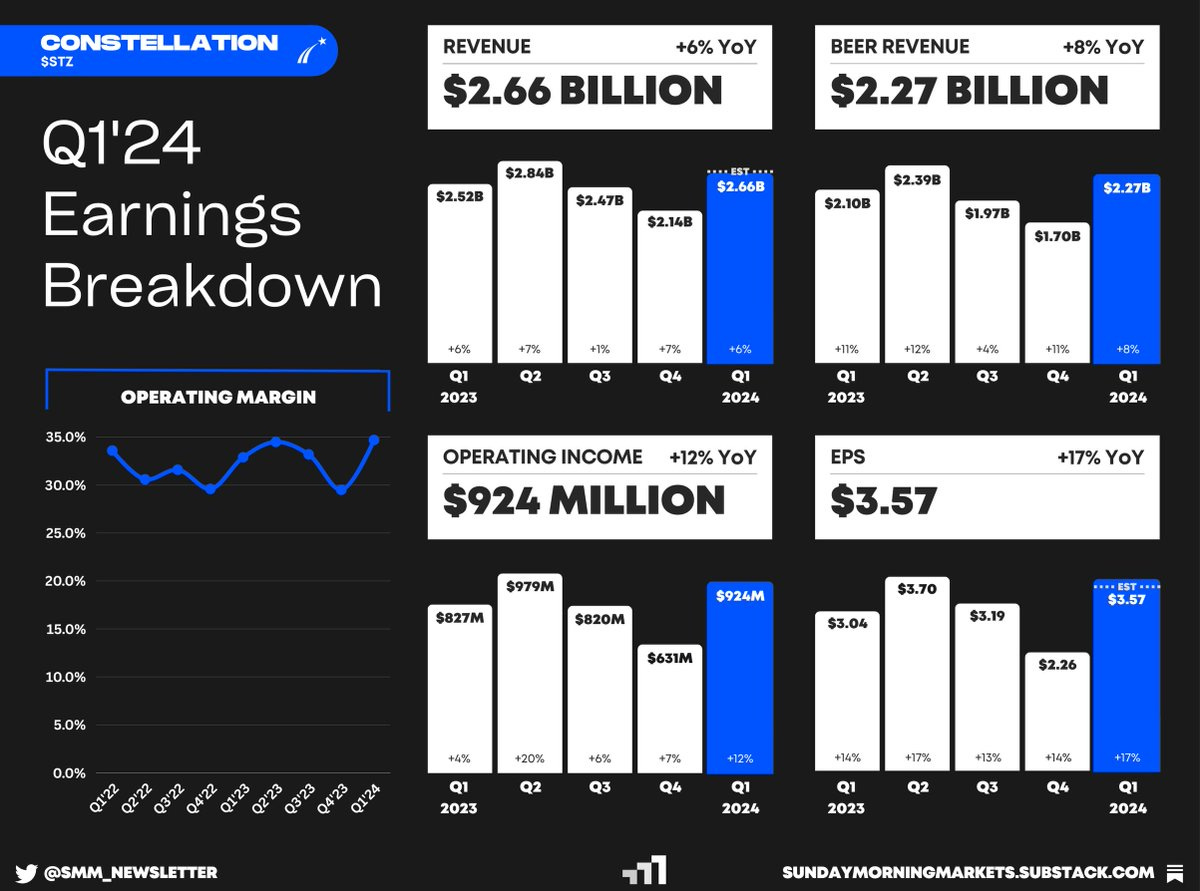

Earnings from Constellation Brands

Global Markets 🌏

Labour Party wins UK election by landslide

Eurozone inflation eases to 2.5%

Tech ⚡

VC funding surges to a two-year high

Tesla beats delivery expectations

Robinhood acquires Pluto Capital

US Markets 🇺🇸

The U.S. economy added 206,000 jobs in June as the unemployment rate unexpectedly climbed to 4.1%. Wages increased 0.3% for the month and 3.9% from a year ago, both in line with estimates.

Job openings unexpectedly jump to 8.14 million after posting outsized declines in the prior two months. However, layoffs also rose by 112,000 during the month, amid slowing economic activity.

U.S. service activity declined in June as the ISM Non-Manufacturing PMI plunged to 48.8%, well short of the consensus estimate of 52.7%. The reading of ‘new orders’ also thoroughly declined to 47.3%.

Supreme Court rules Trump has immunity for ‘official acts,’ limiting the evidence and scope of special counsel Jack Smith’s case. The 6-3 ruling was opposed by the court’s three liberal justices.

FDA approves Eli Lilly Alzheimer’s drug donanemab, expanding the limited treatment options in the U.S. The FDA rejected the drug’s approval last year due to insufficient data.

Boeing to acquire Spirit AeroSystems for $4.7 billion in an all-stock deal. Boeing says that acquiring its major fuselage supplier will improve the safety and quality control of its planes.

Jeff Bezos to sell $5 billion of Amazon shares as the company hits a new all-time high. Earlier this year Bezos sold $8.5 billion — the first time he disposed of company stock since 2021.

Global Markets 🌏

Chinese EV companies see record deliveries in June with a majority of the growth being attributed to hybrids. Meanwhile, Tesla suffered a 24% decline in shipments from its factory in Shanghai.

Eurozone inflation eases to 2.5%, in line with analyst expectations. Core inflation, which excludes the volatile effects of energy, food, alcohol, and tobacco, remained at 2.9% from the prior month.

Labour Party wins UK election in a landslide, unseating the incumbent Conservatives after 14 years. The Labour Party now controls 412 of the 650 seats in the House of Commons.

The Canadian labor market unexpectedly lost jobs for the second time in four months, leaving the door open to more rate cuts this year. The country shed 1,400 jobs in June while the unemployment rate jumped to 6.4%.

Canada's services activity fell to three-month low amid faltering demand. The S&P Services PMI plunged to 47.1 in June from 51.1 in May — a reading under 50 signals a contraction in overall business activity.

China’s factory activity expanded in June with the Caixin PMI rising to 51.8%. However, its services sector signaled the slowest pace of activity growth in eight months with services PMI dropping to 51.2%.

BlackRock to buy UK data group Preqin for $3.2 billion in an all-cash deal as part of BlackRock’s expansion into the private markets data segment. Preqin is expected to generate $240 million of recurring revenue in 2024.

Tech ⚡

AI deals lift VC funding to highest level in two years according to PitchBook. U.S. venture capital funding surged to $56 billion in the second quarter, up nearly 47% quarter-over-quarter.

Tesla reports better-than-expected delivery numbers for Q2. The company delivered 444K vehicles globally, a 5% decline from the same quarter a year ago. TSLA 0.00%↑ shares surged 26% this week.

Robinhood acquires Pluto Capital to add new AI tools into its investing app. The company says that Pluto’s technology will help guide users with investment strategies and offer real-time portfolio optimization.

Nvidia set to face French antitrust charges for specific anti-competitive practices such as its CUDA software being the only system that is 100% compatible with its GPUs.

Figma pulls its new AI tool off the market after criticism that it ripped off Apple’s design. The ‘Make Designs’ feature allows users to quickly mock up apps using generative AI.

OpenAI's internal AI details were stolen in 2023 breach where hackers accessed information about the design of the company’s models. OpenAI believes the hacker was an individual with no ties to a foreign government.

Coinbase wins contract from the US Marshals Service to safeguard and trade its large-cap digital assets portfolio. As of Q1’24, Coinbase had $330 billion of AUS and managed $256 billion in institutional trading volume.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - Consumer Credit 🇺🇸

UK - Retail Sales 🇬🇧

AU - Business Confidence 🇦🇺

Tuesday

CN - CPI Inflation 🇨🇳

CN - PPI Inflation 🇨🇳

NZ - Interest Rate 🇦🇺

Wednesday

US - Crude Oil Inventories 🇺🇸

Earnings: Manchester United💰

Thursday

US - CPI Inflation 🇺🇸

US - Jobless Claims 🇺🇸

UK - GDP Growth 🇬🇧

DE - CPI Inflation 🇩🇪

Earnings: Pepsi, Delta💰

Friday

US - PPI Inflation 🇺🇸

US - UMich Inflation Expectations 🇺🇸

JP - Industrial Production 🇯🇵

Earnings: JPMorgan, Wells Fargo, Citi💰

Want to partner with Sunday Morning Markets? Click here to inquire.