What Moved The Markets This Week

OpenAI CTO Quits, Inflation Hits 2-Year Low Of 2.2%, Vista Acquires Smartsheet For $8.4B, Meta Unveils New Orion AR Glasses, China Stimulus Fuels Stock Surge, and MU + COST Earnings

Sunday Morning Markets

Trading Week 39, covering Monday, Sep 23 through Friday, Sep 27. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

PCE inflation hits 2.2% in August

Visa accused of monopoly on debit payments by DOJ

OpenAI shifts to for-profit company, CTO quits

Meta unveils new Quest headset, Orion AR glasses

Vista acquires Smartsheet for $8.4B

China announces new stimulus, stocks rip higher

Eurozone economic activity contracts in September

Earnings from Micron and Costco

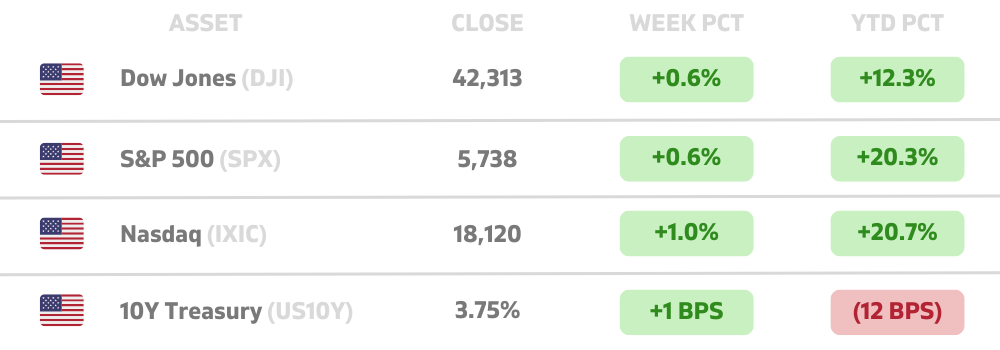

US Markets 🇺🇸

Key Fed inflation gauge drops to 2.2% in August, below estimates. This marks the lowest inflation rate since 2021, raising hopes for future rate cuts. Core PCE inflation rose 2.7% year-over-year.

U.S. business activity held steady in September, but rising prices for goods and services hit a six-month high, signaling renewed inflation pressures. Manufacturing slumped to its lowest level in 15 months.

New home sales drop 4.7% in August, but lower mortgage rates and declining prices could drive demand soon. The median house price fell 4.6% from a year ago to $420,600.

Consumer confidence plummets by most in three years, falling 6.9 points during September. Concerns over jobs and inflation drove the decline, with respondents earning less than $50,000 reporting the most pain.

DOJ accuses Visa of monopoly on debit payments, alleging it inflates prices by suppressing competition. Visa controls over 60% of U.S. debit transactions, driving billions in fees.

Blackstone and Vista to acquire Smartsheet for $8.4 billion, offering $56.50 per share, a 41% premium. The all-cash deal is expected to close by January 2025, pending shareholder approval.

Global Markets 🌏

China ramps up economic support with rate cuts, $70 billion in loans, and plans for a $142 billion capital injection into state banks to counter low growth and a real estate crisis. KWEB surged 26% this week.

Eurozone economy contracts sharply in September, as private-sector activity shrinks and job cuts rise. High borrowing costs and weakening demand suggest further economic challenges ahead, particularly in manufacturing.

HSBC expects the ECB to cut rates at every meeting from October to April, citing weakening economic data. This would bring the key deposit rate to 2.25% by next spring.

Australia's central bank holds rates steady at 4.35%, diverging from global peers despite inflation falling back within target to 2.7%. RBA policymakers still remain cautious about future rate cuts.

Canada's GDP growth stalls in August, missing targets after the 0.2% rise in July. Economic data points to stagnation, raising expectations for deeper interest rate cuts as the central bank aims to spur growth.

Tech ⚡

OpenAI explores shift to for-profit and plans to give CEO Sam Altman 7% of the company. Following the news, CTO Mira Murati and two other top research execs announced their departure from the company.

Meta unveils $299 Quest 3S VR headset and the Orion AR glasses prototype at its latest event. The Quest 3S offers a cheaper alternative to its predecessor, while Orion represents Meta's vision for future AR technology.

Intel launches two new AI chips to boost its data center business. The Xeon 6 CPU and Gaudi 3 AI accelerator aim to deliver improved performance and power efficiency for AI-driven workloads.

PayPal to allow U.S. businesses to trade and hold crypto, expanding its services beyond consumers. However, businesses in New York are excluded at launch due to regulatory restrictions.

Jony Ive and Sam Altman team up on a top-secret AI project, reportedly raising $1B. The device aims to be less socially disruptive than smartphones, potentially reshaping AI-powered tech.

OpenAI sees $5B loss on $3.7B of revenue this year. Despite the loss, revenue is expected to jump to $11.6B next year, with a new funding round valuing the company at $150B.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - Chicago PMI 🇺🇸

UK - GDP Growth 🇬🇧

DE - CPI Inflation 🇩🇪

CN - Caixin Manufacturing PMI 🇨🇳

Earnings: Carnival💰

Tuesday

US - JOLTs Job Openings 🇺🇸

US - ISM Manufacturing PMI 🇺🇸

US - S&P Manufacturing PMI 🇺🇸

EU - CPI Inflation 🇪🇺

CN - Markets Closed 🇨🇳

Earnings: Nike, Paychex💰

Wednesday

US - ADP Employment Report 🇺🇸

CN - Markets Closed 🇨🇳

Thursday

US - ISM Services PMI 🇺🇸

US - S&P Services PMI 🇺🇸

US - Jobless Claims 🇺🇸

CN - Markets Closed 🇨🇳

Earnings: Constellation💰

Friday

US - Nonfarm Payrolls 🇺🇸

CA - Ivey PMI 🇨🇦

CN - Markets Closed 🇨🇳

Want to partner with Sunday Morning Markets? Click here to inquire.