What Moved The Markets This Week 📈

Amazon's New 'Q' AI Chatbot, AbbVie To Acquire ImmunoGen For $10B, Inflation Hits 2-Year Low, Shein Gears Up To Go Public, and CRM + CRWD + SNOW Earnings

Sunday Morning Markets

Trading Week 48, covering Monday, Nov 27 through Friday, Dec 1. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

US Economic Data:

PCE Inflation: 3.0% (est. 3.0%) ⚫

Core PCE Inflation: 3.5% (est. 3.5%) ⚫

Q3 GDP: 5.2% (est. 4.9%) 🟢

New Home Sales: -5.5% (est. -4.5%) 🔴

ISM Manufacturing PMI: 46.7 (est. 47.6) 🔴

Continuing Jobless Claims: 1.93M (est. 1.87M) 🔴

AbbVie to buy ImmunoGen for $10.1B in cash

Shein files to go public in the US

Key Apple supplier, Foxconn, to invest $1.5B in India

Fighting resumes in Gaza after one-week truce

Amazon unveils new AI chips and Q-chatbot

GM slashes its spending on Cruise by hundreds of millions

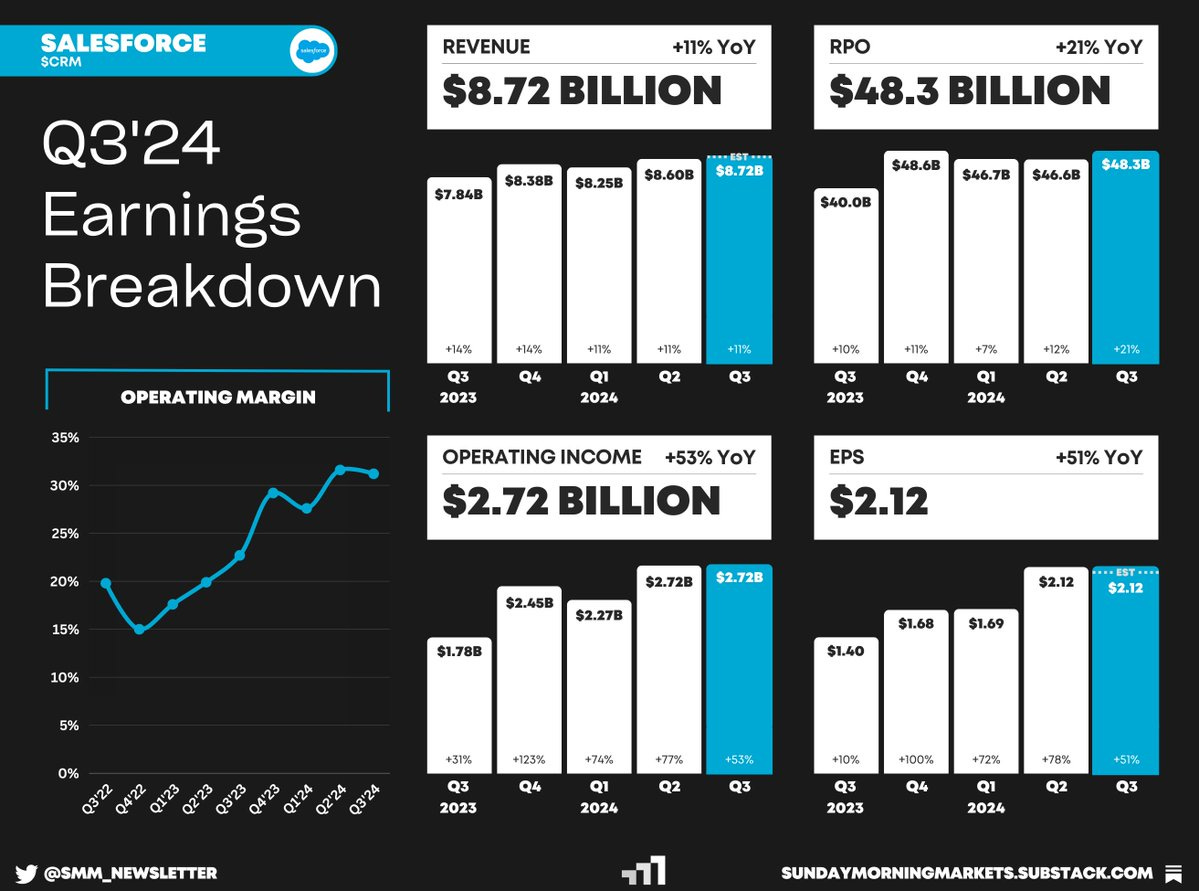

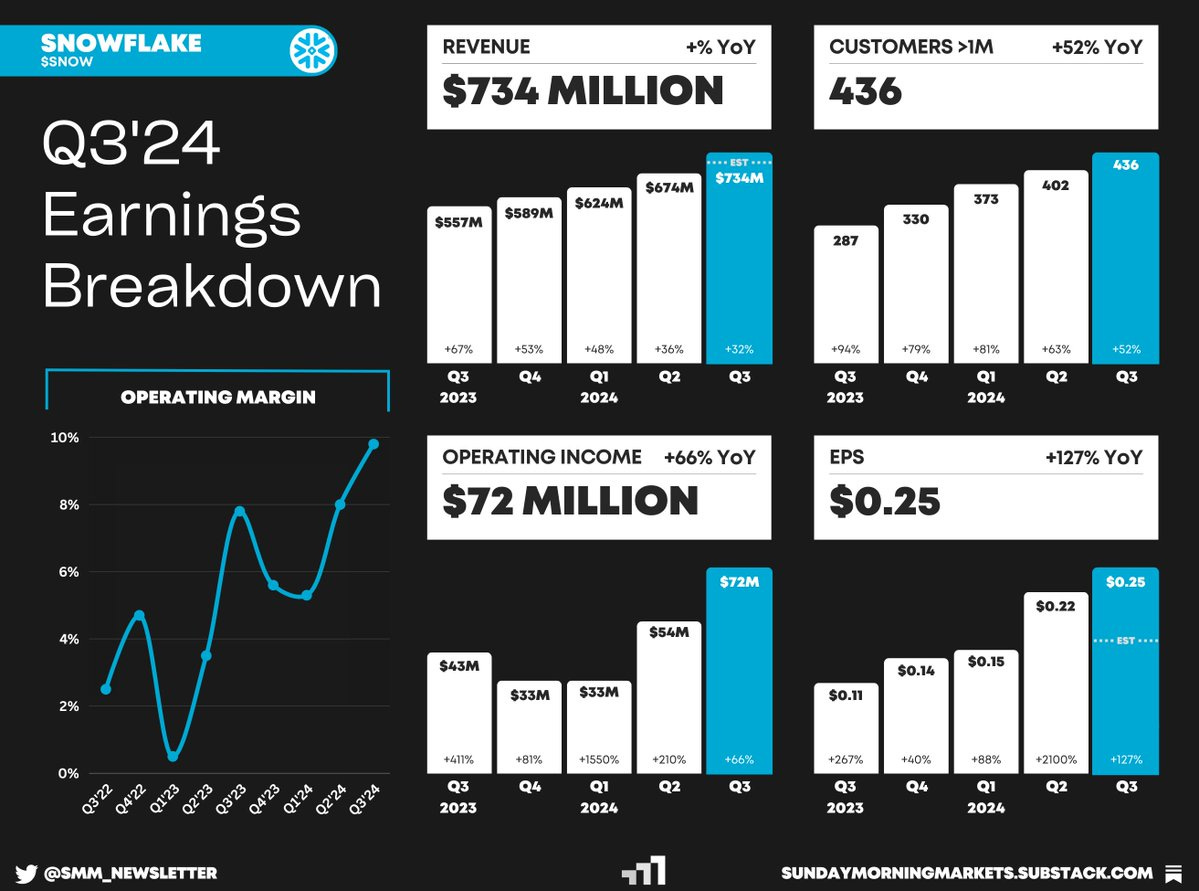

Earnings from CRM, CRWD, SNOW — see breakdown below

US Markets 🇺🇸

Fed’s key inflation gauge hits a 2-year low of 3.5%, in line with expectations. Headline PCE was flat on the month and rose 3% for the year. Continuing unemployment claims surged to 1.93m, the highest level since 2021.

US manufacturing activity continues to weaken as the ISM manufacturing PMI remained in contractionary territory at 46.7, the 13th consecutive reading below 50. Factory employment also declined as hiring slowed.

GDP grew at a 5.2% rate during the third quarter, topping the initial reading of 4.9%. The economy’s growth was boosted by government spending which rose 5.5% during the quarter, offsetting weaker consumer spending.

New home sales fell 5.6% from the prior month as higher mortgage rates reduced affordability further. The median sales price of new houses sold in October was $409K, down a staggering 17.9% from the previous year.

GM initiates $10 billion buyback, boosts dividend by 33%, and reinstates its guidance after UAW strikes. CEO Mary Barra said they are finalizing a budget that will “fully offset the incremental costs of our new labor agreements.”

Federal judge rules against Meta in privacy fight with FTC, allowing the regulator to reduce the amount of money Meta can make from users under 18. The FTC would also limit Meta’s usage of facial recognition technology.

Disney CEO says the company is ready to start building, including plans to invest $60 billion into its theme parks over the next decade, as well as developing a full ESPN streaming service and improving its studio business.

AbbVie will buy ImmunoGen for $10.1 billion in cash or a roughly 95% premium on Wednesday’s closing price. ImmunoGen develops cancer drugs called antibody-drug conjugates, or ADCs.

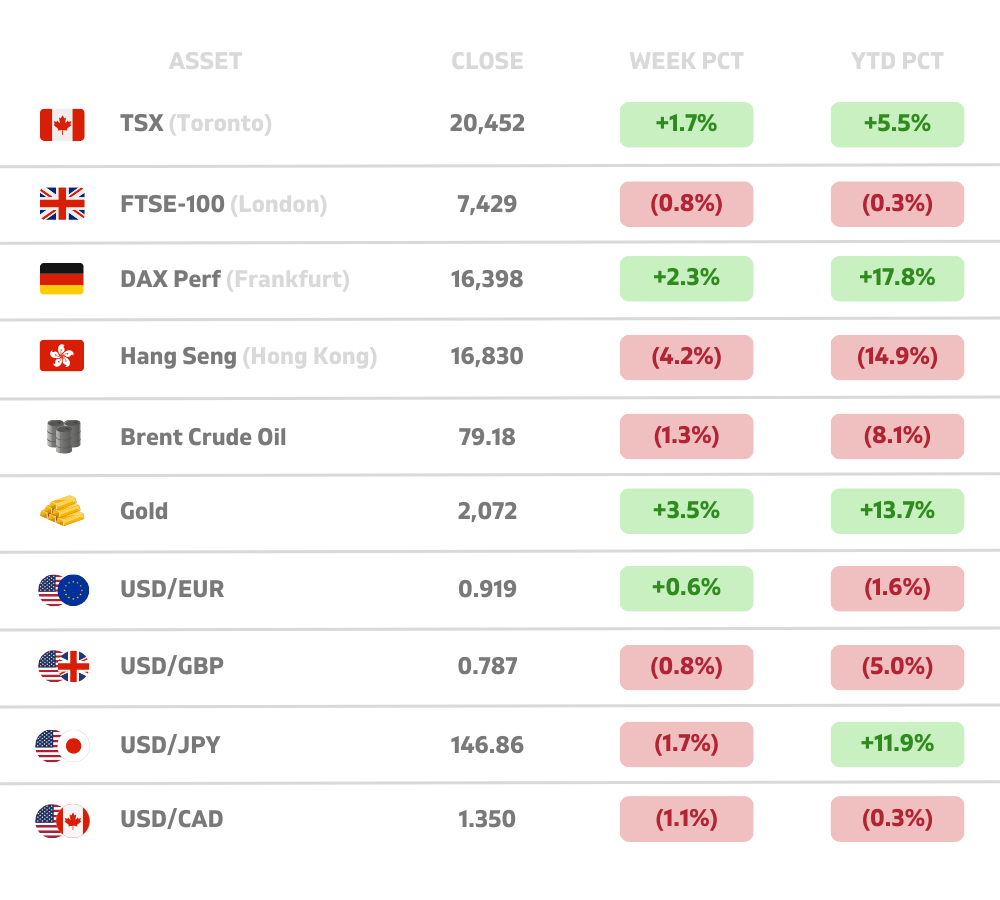

Global Markets 🌏

Apple’s key supplier, Foxconn, to invest $1.5B in India as part of its expansion plan. Foxconn invested heavily in China between 2001 and 2017 but has since slowed down due to the U.S.-China trade tension.

Shein confidentially files to go public in the U.S. as the Chinese fast-fashion juggernaut looks to expand its global reach with an IPO in 2024. The retailer was last valued at $66 billion.

China’s factory activity shrinks for the second month as the official manufacturing PMI fell to 49.4 from 49.5 in October, below the median forecast of 49.7. China’s non-manufacturing PMI also weakened to 50.2.

Eurozone inflation sank to 2.4% in November, from 2.9% in October, well below forecasts. Core inflation fell to 3.6%, from 4.2%, providing fuel for expectations of European Central Bank rate cuts.

Canada's economy unexpectedly contracts 1.1% in Q3 as growth continues to sputter with high interest rates. The GDP reading came in below the Bank of Canada's 0.8% projected gain.

Fighting resumes in Gaza after week long truce expires and Israel claims Hamas breached the agreement. During the ceasefire, 110 hostages held by Hamas were freed, while 240 Palestinian detainees were released.

ByteDance axes hundreds of jobs in its gaming unit, marking a significant retreat from a segment that the Chinese tech giant has invested billions of dollars in to challenge market leader, Tencent.

Tech ⚡

Amazon unveils new chips for training AI models as Nvidia’s top chips are likely sold out until 2024. The AWS Trainium2 can deliver up to 4x the performance and 2x the energy efficiency versus the previous generation.

Amazon announces Q, an AI chatbot for businesses that can be connected to various software tools. The tool will start at $20 per person per month, but many of its capabilities are available now through a preview.

GM to slash spending at Cruise by ‘hundreds of millions of dollars’ and will likely result in widespread layoffs. Cruise recently paused all of its driverless operations across its fleet and saw two of its co-founders resign.

Uber to offer black cab journies in London in a major win for the ride-hailing company. An Uber spokesman said a “small number” of drivers have already signed up and it hopes to recruit “several hundred” by January.

Meta could launch Threads in the EU next month but may have to offer a view-only mode of the app to comply with EU regulations. Thread’s user activity has been waning since launch, with under 100 million MAUs currently.

European startup funding halved to $45B in 2023 with late-stage startups feeling the biggest pinch; only 7 unicorns are set to emerge this year in Europe, compared to 48 in 2022 and 108 in 2021, according to Atomico.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - Factory Orders (OCT)🇺🇸

AU - RBA Interest Rate Decision 🇦🇺

CN - Services PMI (NOV)🇨🇳

Earnings Reports: GitLab💰

Tuesday

US - JOLTS Job Openings (OCT)🇺🇸

US - S&P Services PMI (NOV)🇺🇸

US - ISM Non-Manufacturing PMI (NOV)🇺🇸

EU - HCOB Composite PMI (NOV)🇪🇺

Earnings Reports: AutoZone, MongoDB, SentinelOne, Asana💰

Wednesday

US - ADP Employment (NOV)🇺🇸

CA - BoC Interest Rate Decision 🇨🇦

CA - Ivey PMI (NOV)🇨🇦

CN - Imports & Exports (OCT)🇨🇳

Earnings Reports: Veeva, Chewy, C3, Chargepoint💰

Thursday

DE - Industrial Production (OCT)🇩🇪

JP - GDP (Q3)🇯🇵

Earnings Reports: Broadcom, Lululemon, Docusign, Smartsheet💰

Friday

US - Nonfarm Payrolls (NOV)🇺🇸

US - Unemployment Rate (NOV)🇺🇸

DE - CPI Inflation (NOV)🇩🇪

CN - CPI Inflation (NOV)🇨🇳

CN - PPI Inflation (NOV)🇨🇳

Want to partner with Sunday Morning Markets? Click here to inquire.