What Moved The Markets This Week 📈

Adobe Scraps $20B Figma Acquisition, Apple's Patent Dispute, PCE Inflation Cools to 2.6%, Walmart Expands Affirm's BNPL To Self Checkout, and NKE + FDX + KMX Earnings

Sunday Morning Markets

Trading Week 51, covering Monday, Dec 18 through Friday, Dec 22. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Adobe abandons $20B acquisition of Figma

PCE inflation cools to 2.6%, core PCE to 3.2%

Apple pauses Watch sales due to patent

ServiceTitan prepares for IPO in 2024

Walmart expands partnership with Affirm

Anthropic looks to raise $750M in new round

Bank of Japan keeps interest rates steady

U.K. GDP contracts in the third quarter

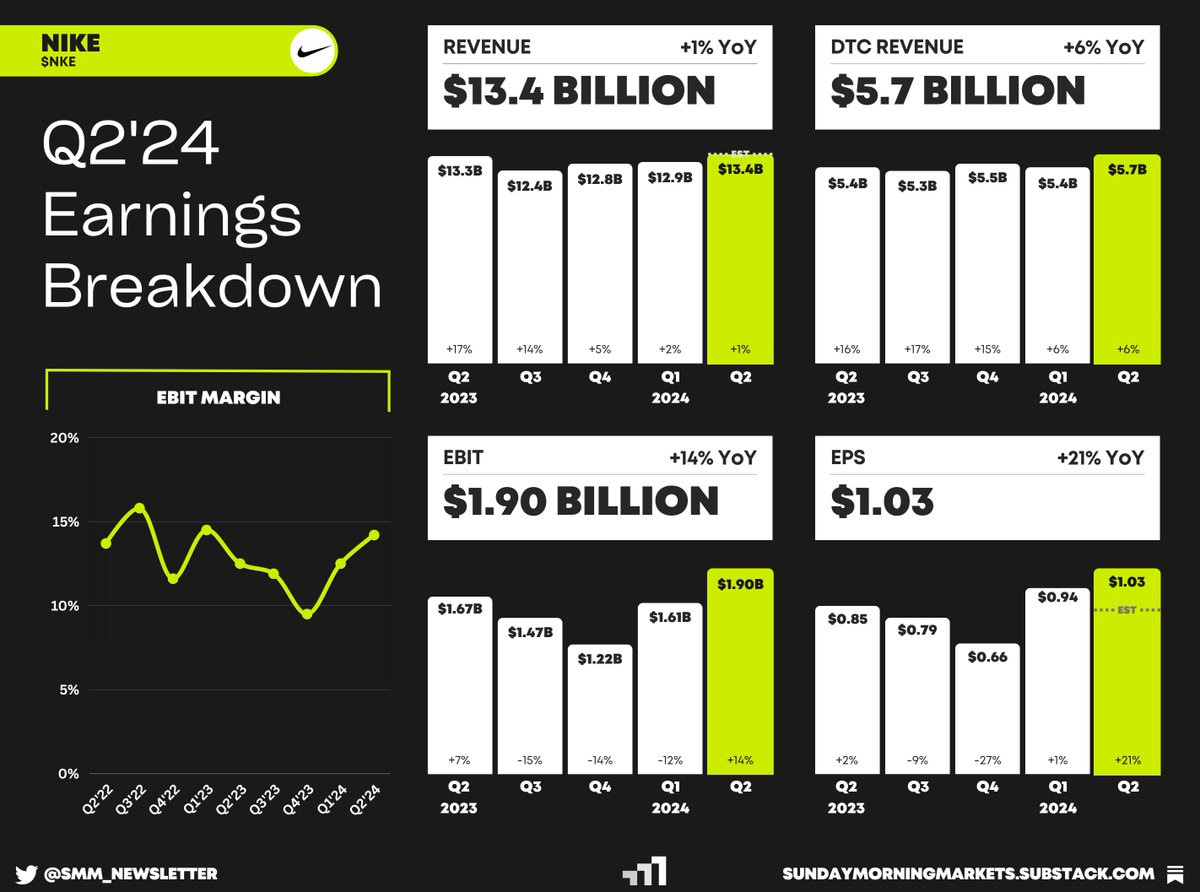

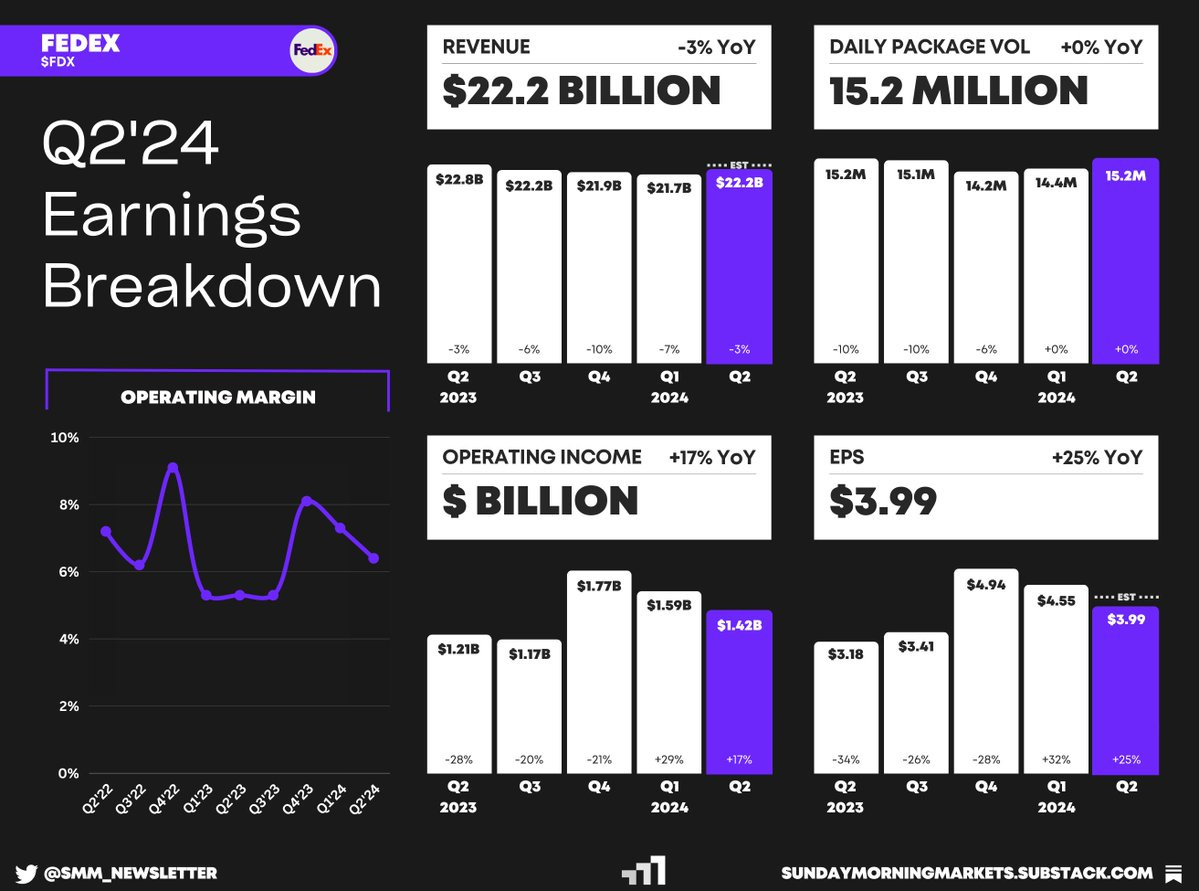

Earnings from NKE, FDX, KMX

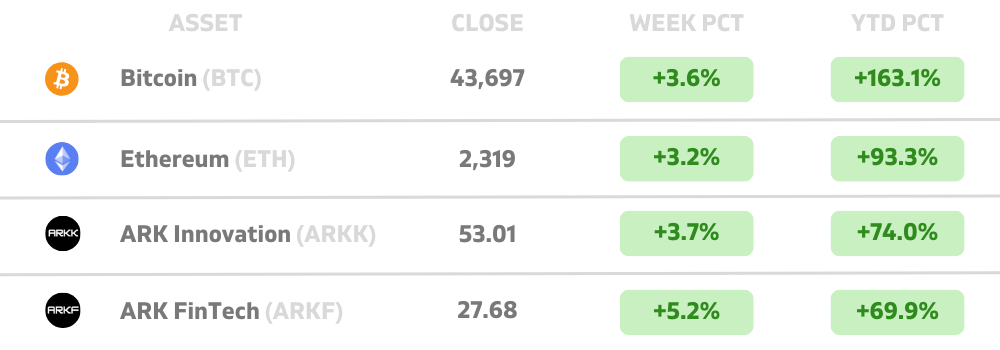

US Markets 🇺🇸

Fed’s key inflation cooled notably in November. Headline PCE rose 2.6% for the year (2.8% expected, 2.9% previous). Excluding food & energy, Core PCE rose 3.2% (3.3% expected, 3.4% previous).

US consumer confidence jumps to five-month high in December, with Americans growing more optimistic about financial conditions. The jump in confidence occurred across all age groups and household income levels.

Single-family housing starts surged 18% last month to a new 18-month high as incentives from builders and declining mortgage rates are likely to draw buyers back into the housing market.

Trump barred by Colorado Supreme Court from the 2024 ballot due to his act of inciting the 2021 U.S. Capitol riot. The Trump campaign said it will ask the U.S. Supreme Court to overturn the ruling.

Google to pay $700 million in an antitrust settlement over its Google Play store rules. As part of the settlement, Google will simplify the users' ability to download apps directly from developers.

Bristol Myers to buy Karuna Therapeutics for $14 billion, gaining a promising schizophrenia drug to power growth as patents on its older therapies expire. The price represents a 53% premium on Karuna’s previous closing price.

Lionsgate Studios to go public via SPAC at a $4.6 billion valuation. The deal is expected to deliver about $350 million in gross proceeds to Lionsgate, the creator of The Hunger Games, John Wick, and The Twilight Saga.

Global Markets 🌏

Shipping firms avoid Red Sea as Houthi attacks increase, with over 15 strikes since the start of the Israel-Hamas war in October. Shippers have already diverted about $105 billion worth of cargo away from the region.

Bank of Japan sticks to ultra-easy monetary policy amid ‘extremely high’ economic uncertainties. The BoJ kept short-term rates at -0.1% and the upper bound for its longer-term 10-year bond at 1%.

U.K. economy shrinks in the third quarter, signaling a potential recession may be underway. GDP contracted 0.1% over the last three months, below estimates. However, retail sales jumped 1.3% in October, much stronger than expected.

U.K. inflation drops to a two-year low of 3.9%, widely missing economists’ expectation of 4.4%, and below October’s reading of 4.6%. The weak inflation data caused markets to raise bets for rate cuts in 2024.

China’s Xi warned Biden that they will reunify with Taiwan during their recent summit in San Fransisco. Xi also said China prefers to take Taiwan peacefully, not by force, and that the timing has not yet been decided.

Alibaba CEO takes control of its domestic ecom businesses in the company’s latest reshuffle. Eddie Wu will now lead Taobao and Tmall, as well as Alibaba’s cloud division and parent organization.

Toyota recalls over 1 million vehicles with airbag defect in Avalons, Camrys, Highlanders, RAV4s, Siennas, and Corollas from model years 2020 to 2022. This comes just one month after the company recalled 1.85 million RAV4s.

Japan’s Nippon Steel to buy U.S. Steel in a $14.9 billion deal, beating out prevailing Cleveland-Cliffs and ArcelorMittal in an auction for the 122-year-old iconic steelmaker. X 0.00%↑ shares jumped 22% this week.

Tech ⚡

Adobe abandons $20 billion acquisition of Figma as the two companies no longer see a path toward regulatory approval. Adobe will pay Figma a $1 billion breakup fee, which is 3x more than Figma has raised in its history.

Apple halts Watch sales over a patent dispute with medical device maker Masimo. The issue surrounds the SpO2 sensor for tracking blood oxygen levels. Masimo says they are “the rightful creator and inventor of this technology.”

Software startup, ServiceTitan, prepares for IPO with plans to go public as early as Q2’24. The company was last valued at $9.5 billion in a 2021 fundraising round but has yet to announce what valuation it will seek at IPO.

Electric scooter company, Bird, files for bankruptcy just months after it was delisted from the NYSE. The company went public in 2021 via a SPAC merger but saw its share price plunge over 95% within the first 12 months.

Walmart expands its partnership with Affirm to allow shoppers to use “buy now, pay later” feature when they are using the self-checkout at more than 4,500 stores in the U.S. AFRM 0.00%↑ shares surged 15% following the news.

OpenAI rival Anthropic in talks to raise $750 million in a new fundraising round led by Menlo Ventures. The deal would value them at $18.4 billion, 550% higher than their previous round raised earlier this year.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

Markets Closed - Christmas 🎄

Tuesday

US - S&P HPI Composite (OCT)🇺🇸

Wednesday

JP - Industrial Production (NOV)🇯🇵

Thursday

US - Pending Home Sales (NOV)🇺🇸

US - Goods Trades Balance (NOV)🇺🇸

Friday

US - Chicago PMI (NOV)🇺🇸

Want to partner with Sunday Morning Markets? Click here to inquire.