What Moved The Markets This Week 📈

Recession Fears Reignite, Weak U.S. Manufacturing and Jobs Data, OpenAI Cofounder Raises $1B For New AI Startup, Tesla To Launch FSD In Europe & China, and AVGO + ZS + PATH Earnings

Sunday Morning Markets

Trading Week 36, covering Monday, Sep 2 through Friday, Sep 6. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Recession fears ignite on weak economic data

Payrolls grow 142K in August, missing expectations

Tesla to launch FSD in Europe and China

Anthropic unveils Claude Enterprise

Salesforce acquires Own and Tenyx

Ilya Sutskever raises $1B in seed round for SSI

Bank of Canada cuts rates for third time

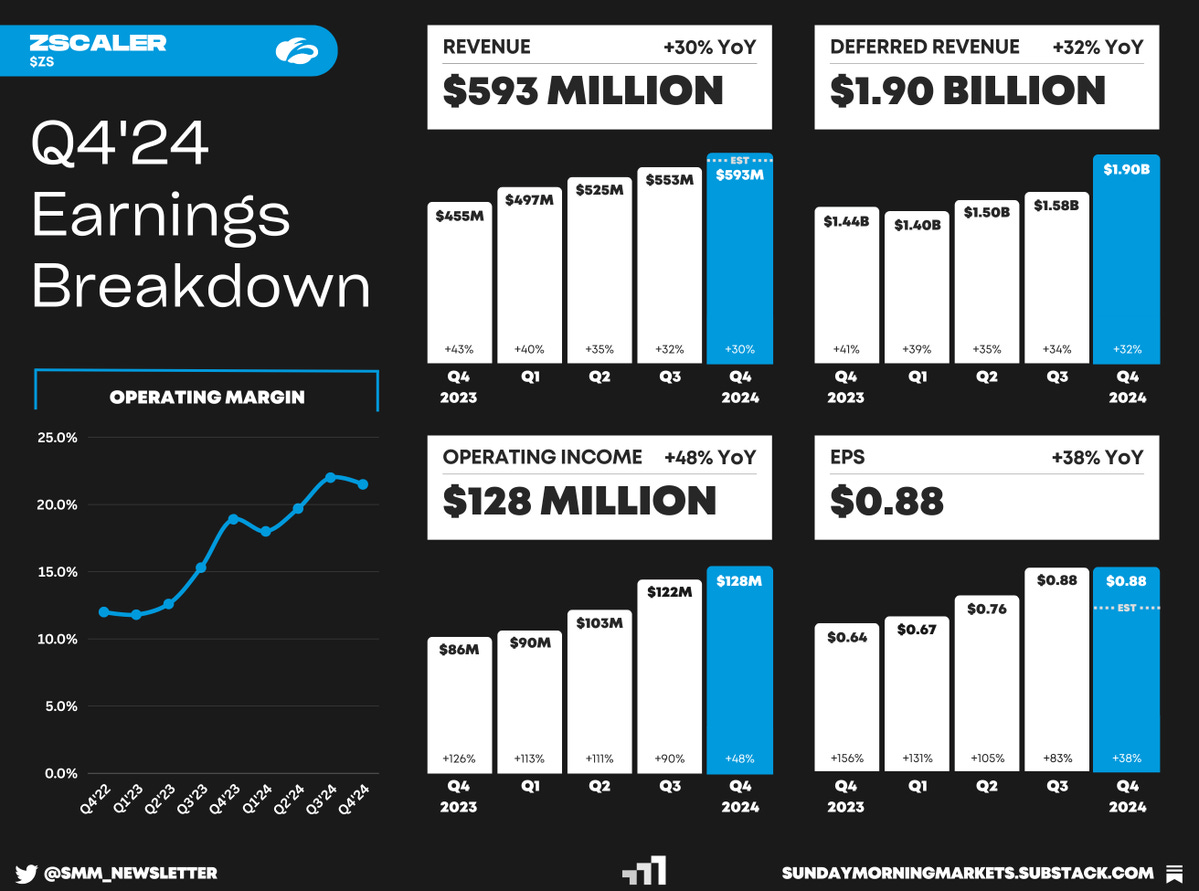

Earnings from Broadcom, Zscaler, UiPath

US Markets 🇺🇸

Weak U.S. manufacturing activity fuels recession fears, with August’s ISM reading at 47.2% still in contraction territory. The market is now pricing over 1% of rate cuts by the end of 2024.

August job growth misses expectations at 142,000, while the unemployment rate dipped to 4.2%. Downward revisions to June and July figures show a weakening labor market with a surge of part-time jobs.

Job openings plummet to 3.5-year low of 7.67 million in July. Layoffs rose significantly during the month while hiring only saw a minor increase, adding pressure on the Fed ahead of its policy meeting.

Verizon to acquire Frontier in $20B deal, boosting its fiber network coverage by 3%. The acquisition adds 2.2M Frontier fiber subscribers, enhancing Verizon’s competitive edge against AT&T and T-Mobile.

Trump taps Musk to lead a government efficiency commission to audit federal agencies and cut wasteful spending. This plan sharpens Trump's economic vision ahead of his debate with Kamala Harris.

Global Markets 🌏

The Bank of Canada cuts rates for the third time, lowering its key rate to 4.25% amid concerns over a weakening economy. Canada's unemployment rate hit a new 3-year high of 6.6% this week.

China’s central bank hints at easing reserve requirements but signals no aggressive monetary moves. With the reserve ratio at 7%, officials see room for smaller cuts to revive weak demand.

German recession fears rise as manufacturing slumps, with July's output down 2.4%. Weak global demand, high energy costs, and competition from China continue to stifle its recovery.

Australia’s economy posts its weakest growth since 1992, with annual growth at just 1.0%. Weak household spending dragged down GDP, while government spending helped offset further contraction.

Bank of Japan should raise interest rates says board member Hajime Takata. He emphasizes the need to shift gears in monetary policy as inflation stabilizes and corporate health indicators improve.

Alibaba to offer Tencent's WeChat Pay on its platforms, signaling a shift in China's tech landscape. The move follows years of rivalry and Beijing’s antitrust scrutiny, easing barriers for consumers.

Tech ⚡

OpenAI co-founder Ilya Sutskever secures $1 billion for his new AI venture, Safe Superintelligence. Backed by top investors, SSI aims to focus solely on developing safe AI, free from short-term commercial pressures.

Anthropic launches Claude Enterprise, a powerful AI tool for businesses, offering a larger context window for tasks like analyzing code and financial reports. Early clients include GitLab and Midjourney.

Tesla to launch Full Self-Driving in Europe and China in Q1 2025, pending regulatory approval. This comes ahead of its "Cybercab" robotaxi debut, though investors remain cautious about regulatory challenges.

Salesforce acquires Own for $1.9 billion just days after buying AI-voice agent firm Tenyx, marking a return to M&A deals. Own specializes in data backups for cloud apps.

Lyft announces layoffs and cuts its bikes and scooters divisions to focus on its core ride-hailing business. The layoffs will cost $34M to $46M but are expected to boost earnings by $20M by 2025.

Mastercard launches crypto card enabling users to spend directly from self-custodial wallets at over 100M European merchants. This move, in partnership with Mercuryo, boosts everyday crypto adoption.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - Consumer Credit 🇺🇸

US - GDPNow 🇺🇸

CN - Inflation Report 🇨🇳

JP - GDP Growth 🇯🇵

Earnings - Oracle, Rubrik💰

Tuesday

UK - Employment Report 🇬🇧

DE - Inflation 🇩🇪

EU - Economic Forecasts 🇪🇺

Earnings: Gamestop💰

Wednesday

US - CPI Inflation 🇺🇸

UK - GDP Growth 🇬🇧

Thursday

US - Jobless Claims 🇺🇸

US - PPI Inflation 🇺🇸

EU - ECB Interest Rate 🇪🇺

Earnings: Adobe, Kroger, RH💰

Friday

US - UMich Inflation Expectations 🇺🇸

CN - Industrial Production 🇨🇳

Want to partner with Sunday Morning Markets? Click here to inquire.