What Moved The Markets This Week 📈

Ford & UAW Reach Deal To End Strikes, Microsoft's Azure Grows Staggering 28%, US Economy Expands 4.9%, Chevron To Buy Hess For $53B, Google Invests In Anthropic, and MSFT + GOOG + AMZN Earnings

Sunday Morning Markets

Trading Week 43, covering Monday, Oct 23 through Friday, Oct 27. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Cloud sector growth:

Amazon AWS: $92B run rate, 12% growth YoY

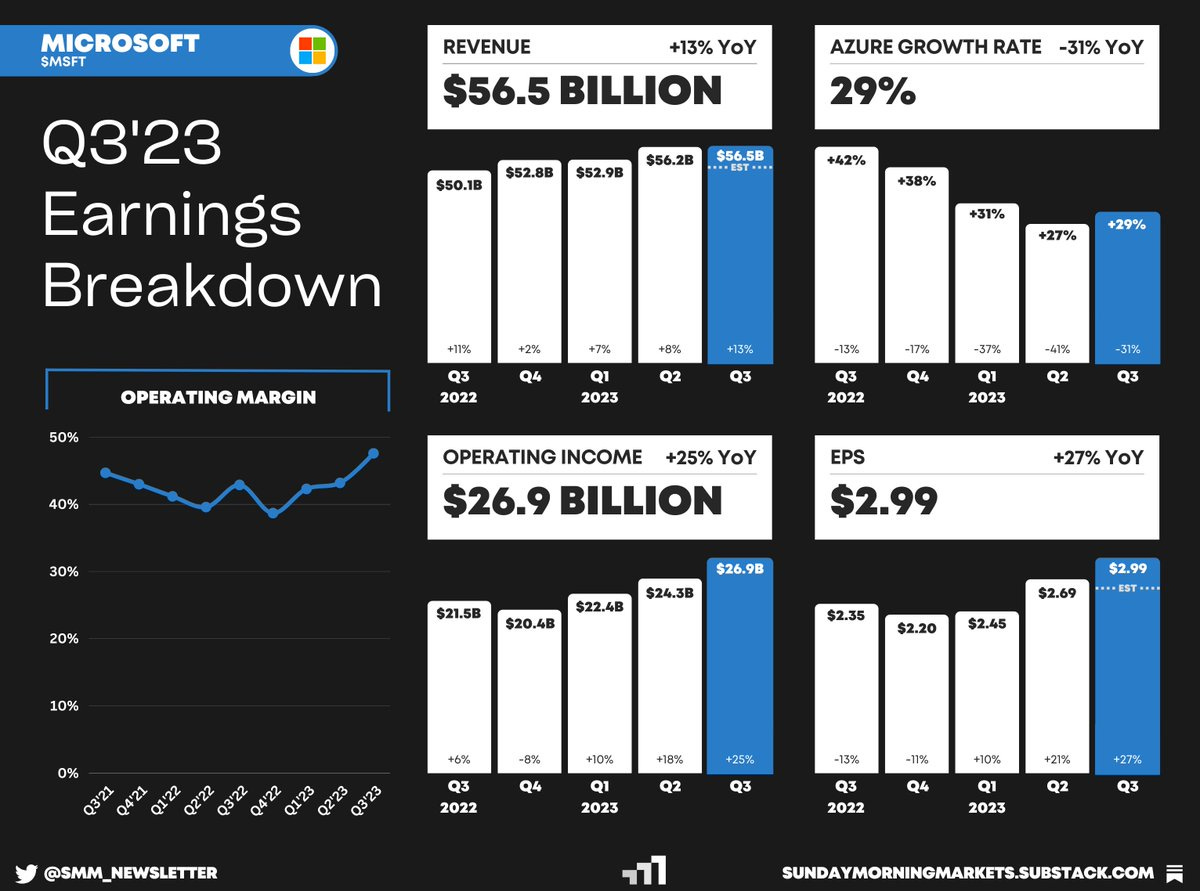

Microsoft Azure: ~$66B run rate (estimate), 28% growth YoY

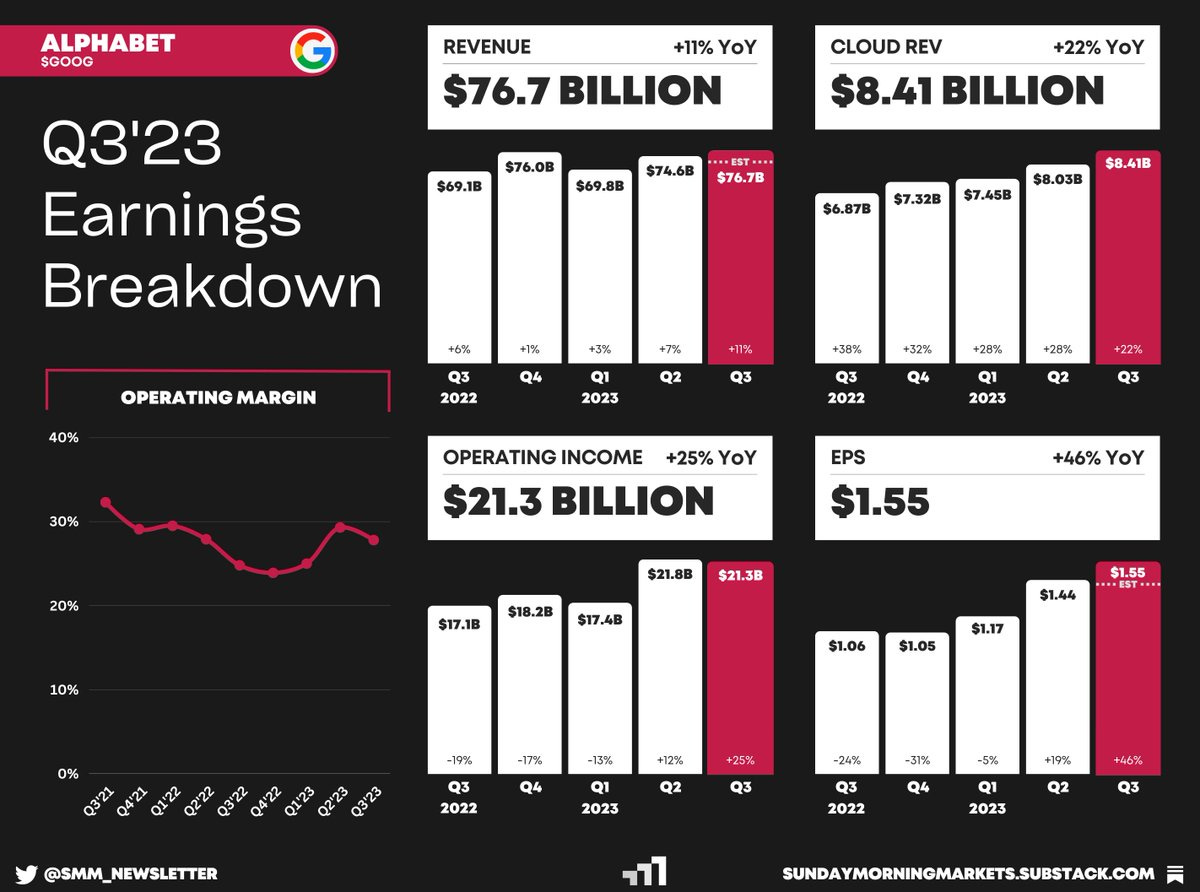

Google Cloud: $34B run rate, 22% growth YoY

US economy grows 4.9% in Q3

Ford & UAW reach tentative deal to end strikes

Chevron to buy Hess for $53 billion

US carries out airstrikes on Iranian targets in Syria

Google to invest $2B into Anthropic AI

Cruises to cease operations to rebuild public trust

Bank of Canada holds rates at 5%, ECB holds at 4%

Earnings from MSFT, GOOG, AMZN — see breakdown below

US Markets 🇺🇸

US economic growth accelerated to 4.9% in third quarter as GDP data came in stronger than the 4.7% estimates. The strength was led higher by consumer spending, exports, residential investment, and government spending.

Key Fed inflation gauge rose 0.3% as expected in September. On an annual basis, core PCE increased 3.7%, one-tenth lower than August, while headline PCE was up 3.4%, the same as the prior month. Personal spending surged 0.7%.

New home sales jump to 19-month high as builders offered price discounts to woo buyers, but rates approaching 8% could curb demand. Sales increased 12.3% in September as the median selling price fell 12.3% to $419K.

Mike Johnson elected as the new House speaker with full support from all 220 Republicans who casted a ballot. Johnson said the first bill he would bring to the House floor is a resolution expressing solidarity with Israel.

Ford and UAW reach tentative deal to end labor strikes after nearly six weeks of negotiations. The deal includes 25% pay increases over the terms of the agreement and will raise the top wage to more than $40 per hour.

Chevron to buy Hess for $53 billion in an all-stock deal which would give a 4.9% premium on Hess’ last closing price. The acquisition is announced just weeks after Exxon Mobil bid $60 billion for Pioneer Natural Resources.

Jamie Dimon to sell 1 million shares of JPMorgan, or about 9% of his total holding, according to a company filing. The plan sparked concern that Dimon, who is 67 years old, could be contemplating retirement.

Global Markets 🌏

Bank of Canada keeps interest rates at 5%, saying steeper borrowing costs are dampening consumption, and bringing supply and demand closer to balance. It warned that progress toward its 2% target remains slow.

ECB to hold interest rates steady at 4% after 10 consecutive hikes. The ECB repeated its message that rates at current levels would help bring inflation to target if “maintained for a sufficiently long duration.”

Eurozone PMI hits lowest level in nearly 3 years, suggesting the bloc may slip into recession. The HCOB Composite PMI fell to 46.5 in October from September's 47.2, its lowest since November 2020.

US carries out strikes against Iranian targets in Syria in response to a spate of attacks against American forces in both Iraq and Syria, the Pentagon said. The strikes were ordered by President Joe Biden.

Biden expected to meet with China’s Xi Jinping next month in San Fransisco. The two leaders haven’t spoken since last November. Since then, tensions have heightened between Washington and Beijing.

Xpeng to roll out driver-assist tech in Europe next year as the company looks to gain a foothold in the region. They also said it remains on track with plans to expand the tech to 50 cities in China by the end of this year.

Tech ⚡

Google invests up to $2B into Anthropic as the AI proxy war heats up. The funding deal reportedly involves $500 million now and up to $1.5 billion later, and comes just one month after Amazon’s $4B investment in the AI company.

Cruise pauses all driverless robotaxi operations to ‘rebuild public trust’, a decision that comes just two days after the California DMV suspended Cruise’s deployment and driverless testing permits.

Apple raises price of Apple TV+ to $9.99 a month and plans to announce similar hikes with Apple One, Arcade, and News. The move mirrors similar actions made by other major media players, including Disney and Netflix.

Databricks acquires data startup Arcion for $100 million, marking their first acquisition since MosaicML. The acquisition comes after Databricks announced a $500 million funding round in September at a valuation of $43 billion.

Nvidia is working on an Arm-based PC chip, competing directly with Intel. Sales of PC chips make up over half of Intel’s total revenue. AMD’s Arm chip is also in development, according to the report.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

DE - CPI Inflation (OCT)🇩🇪

CN - Manufacturing PMI (OCT)🇨🇳

JP - BoJ Interest Rate Decision🇯🇵

Earnings Reports: McDonald’s, Arista Networks💰

Tuesday

US - CB Consumer Confidence (OCT)🇺🇸

DE - GDP (Q3)🇩🇪

EU - GDP (Q3)🇪🇺

EU - CPI Inflation (OCT)🇪🇺

Earnings Reports: Pfizer, AMD, Amgen, Caterpillar, Paycom, Jetblue💰

Wednesday

US - Fed Interest Rate Decision🇺🇸

US - ADP Payrolls (OCT)🇺🇸

US - JOLTS Job Openings (OCT)🇺🇸

US - ISM Manufacturing PMI (OCT)🇺🇸

Earnings Reports: Qualcomm, Airbnb, PayPal, Electronic Arts, CVS, Etsy💰

Thursday

US - Jobless Claims 🇺🇸

UK - BoE Interest Rate Decision🇬🇧

CN - Services PMI (OCT)🇨🇳

Earnings Reports: Apple, Starbucks, Eli Lilly, Booking, MercadoLibre, Atlassian, Fortinet, Expedia💰

Friday

US - Nonfarm Payrolls (OCT)🇺🇸

US - Average Hourly Earnings (OCT)🇺🇸

US - ISM Services PMI (OCT)🇺🇸

Want to partner with Sunday Morning Markets? Click here to inquire.