What Moved The Markets This Week

U.S.-China Strike Trade Deal, Trump Halts Talks With Canada, Core Inflation Climbs, OpenAI Shifts Away From Nvidia, AI Powers 50% of Salesforce Work, BYD Slashes Output, and NKE + MU + FDX Earnings

Sunday Morning Markets

Trading Week 26, covering Monday, Jun 23 through Friday, Jun 27. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Hot Inflation: Core PCE hits 2.7%, complicating Fed path.

Trade Standoff: Trump freezes Canada trade talks over tech tax.

China Trade Deal: U.S. cuts tariffs, seals rare-earths pact.

Amazon Rural Push: Fast delivery expands to 4,000 rural towns.

Global Growth: Business activity up despite conflict, tariffs.

NATO Pledge: Allies to boost defense spending to 5% of GDP by 2030.

BYD Pivot: EV maker cuts output, halts China plant expansion.

OpenAI-Google: Google TPU chips tapped for ChatGPT deployment.

Salesforce AI: Automation now powers 50% of firm’s work.

Earnings Reports: Nike, Micron, FedEx.

US Markets 🇺🇸

Core inflation hit 2.7% in May, topping forecasts and marking a fresh challenge for the Fed’s rate strategy. Consumer spending and personal income both declined, signaling weakening demand.

Powell stresses Fed’s obligation to prevent ‘ongoing inflation’ in his testimony to the Senate Banking Committee. He expects policymakers to stay on hold until they better understand tariff impacts.

U.S. business activity cools, inflation heats up as composite PMI dips to 52.8 and services fall to 53.1 in June. Input costs surge, with manufacturers' price index hitting 70.0—its highest level since July 2022.

Homeowners now owe more than homes are worth in once-hot markets like Cape Coral and Austin. Homes now sit 12% longer on the market as buyer demand cools, with the average listing taking 27 days to sell.

Novo Nordisk cut ties with Hims over knockoff Wegovy sales, citing illegal compounding and deceptive marketing practices. Shares of Hims & Hers plummeted 34% following the announcement.

Amazon expands fast delivery to 4,000 rural towns, bringing Same-Day and Next-Day shipping to more Prime members by year’s end. A $4B investment will triple its delivery network by 2026.

Global Markets 🌏

China and the U.S. strike breakthrough trade deal, easing tariffs and boosting rare-earth exports under a new framework. The U.S. will cut its China tariffs to around 30%, while China reduces its to about 10%.

Trump halts all U.S.-Canada trade talks over Canada's digital services tax on U.S. tech firms, calling it a "blatant attack." He vows to announce new tariffs within seven days.

Global business activity stays strong despite tariffs and war as U.S., Europe, and Asia see continued growth in June. U.S. price pressures rise sharply, while Middle East tensions cloud the forward outlook.

NATO allies agree to boost defense spending to 5% of GDP by 2030, in a landmark move to counter rising global threats and strengthen collective security. Members must file yearly plans to hit the target.

Canada’s GDP shrinks as manufacturing slumps with April output down 0.1% and another dip likely in May. Inflation remained steady at 1.7% in May, as gas prices fell and rent hikes cooled, but core measures remained firm.

BYD slashes output, halts expansion at China plants amid rising inventory and sluggish sales despite steep price cuts. The EV giant is shifting focus as growth momentum cools.

Tesla sales in Europe plummeted 28% last month as customers flock to cheaper Chinese EVs despite new EU tariffs. Musk’s political antics and rising rivals fuel the ongoing decline.

Tech ⚡

OpenAI taps Google's AI chips for ChatGPT in a surprising shift from Nvidia and Microsoft. The move could lower inference costs and marks OpenAI’s first major use of non-Nvidia chips.

AI now handles up to 50% of Salesforce’s workload, CEO Marc Benioff revealed, calling it a “digital labor revolution.” He says their AI tech is operating at around 93% accuracy.

Tesla robotaxis caught driving erratically in Austin have drawn federal scrutiny after viral videos showed wrong-way driving and abrupt stops. NHTSA is investigating the incidents.

Rubrik snaps up AI startup Predibase in a deal valued at over $100 million to boost secure, cost-efficient AI model deployment. Predibase will continue operating as a standalone unit.

Amazon’s Ring now sends AI alerts of suspicious activity spotted by its doorbells and cameras, aiming to help users quickly assess potential threats. The beta is live for U.S. and Canada premium subscribers.

Uber and Waymo launch driverless rides in Atlanta with over 65 square miles of coverage using electric Jaguar I-PACEs. Waymo now logs 250K weekly rides and is rapidly expanding.

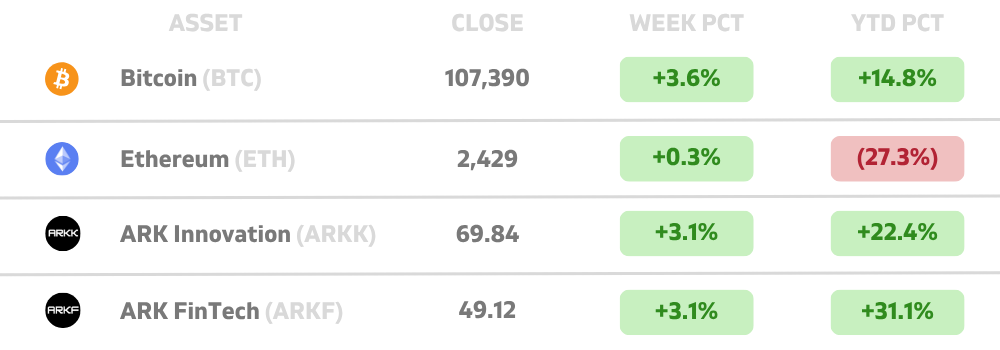

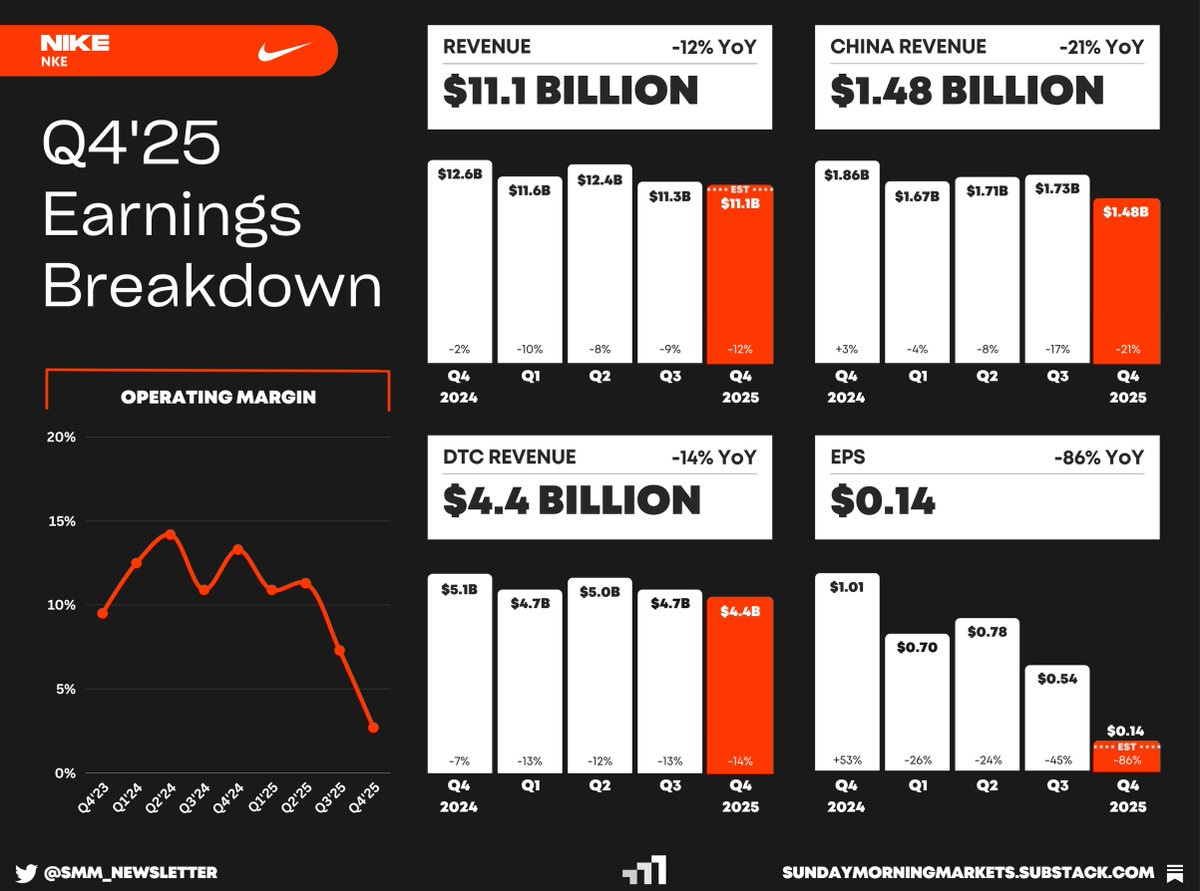

Earnings Reports 💰

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - Chicago PMI 🇺🇸

UK - GDP Growth 🇬🇧

DE - CPI Inflation 🇩🇪

CN - Caixin Manf. PMI 🇨🇳

Tuesday

US - ISM Manf. PMI 🇺🇸

US - S&P Manf. PMI 🇺🇸

US - JOLTS Job Openings 🇺🇸

US - Fed GDPNow 🇺🇸

UK - S&P Manf. PMI 🇬🇧

EU - HCOB Manf. PMI 🇪🇺

EU - CPI Inflation 🇪🇺

Earnings: Constellation Brands💰

Wednesday

US - ADP Payrolls 🇺🇸

EU - Unemployment Report 🇪🇺

CN - Caixin Services PMI 🇨🇳

Thursday

US - Markets Close Early 🇺🇸

US - Nonfarm Payrolls 🇺🇸

US - Trade Balance 🇺🇸

US - ISM Services PMI 🇺🇸

US - S&P Services PMI 🇺🇸

EU - HCOB Services PMI 🇪🇺

Friday

US - Markets Closed (July 4th) 🇺🇸

Want to partner with Sunday Morning Markets? Click here to inquire.