What Moved The Markets This Week 📈

China Bans iPhones For Government Employees, 20K New Superchargers Coming To Hiltons, Apple & Arm Agree On Chip Deal Through 2040, Credit Card Balances Rise, and ZS + DOCU + GTLB Earnings

Sunday Morning Markets

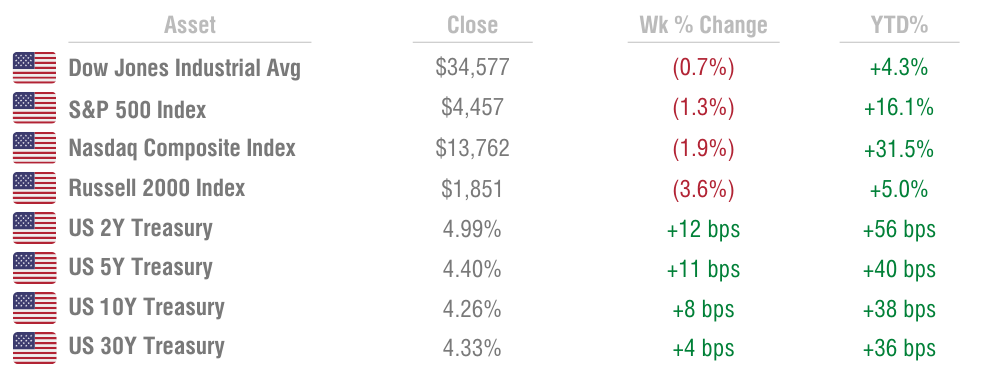

Trading Week 36, covering Monday, Sep 4 through Friday, Sept 8. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

US jobless claims hit lowest level since February

ISM Services PMI reaccelerates to 54.5% (exp. 52.5%)

Consumer credit in US rises $10.4B in July

China bans iPhone usage for government employees

Saudi Arabia extends its oil output cut until EoY

Intel & Tower agree on $300M investment deal

Apple & Arm sign long-term partnership through 2040

Tesla to add 20K charging stations at Hiltons in North America

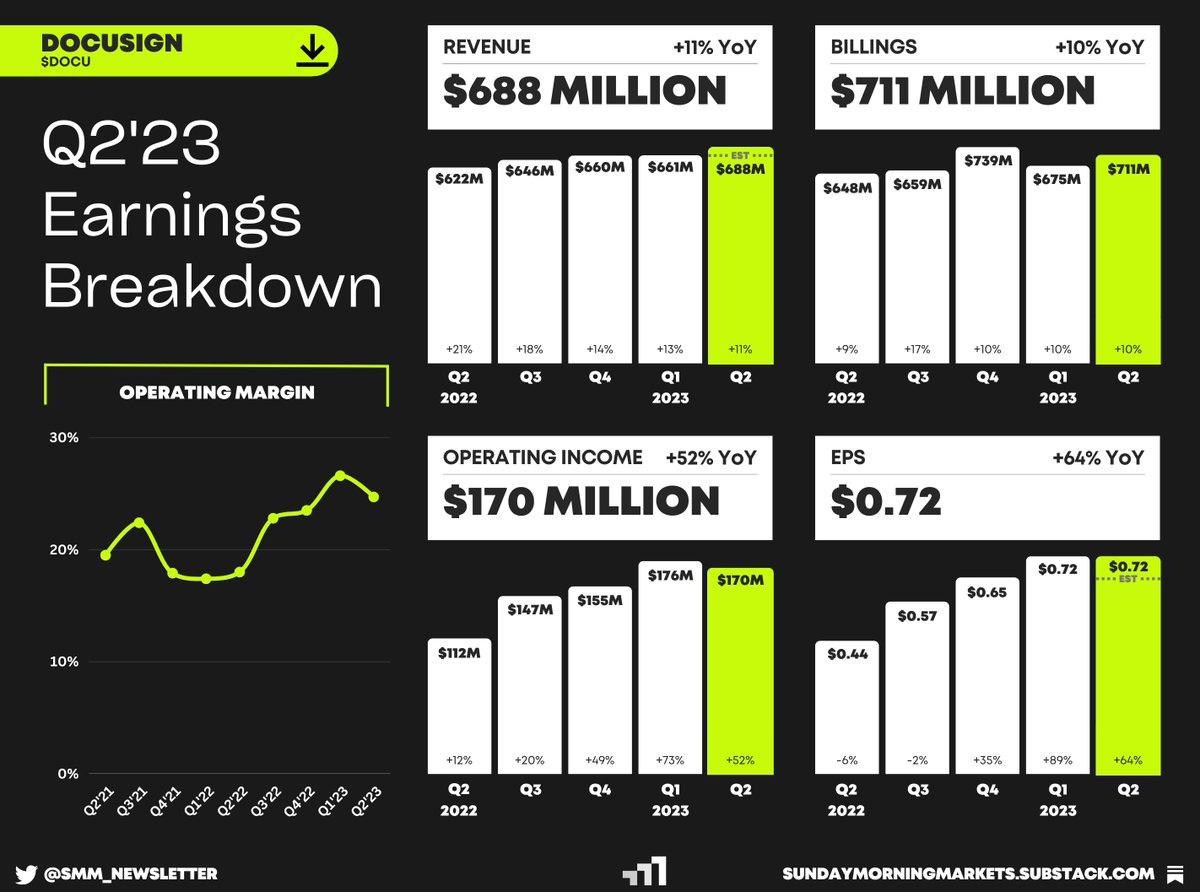

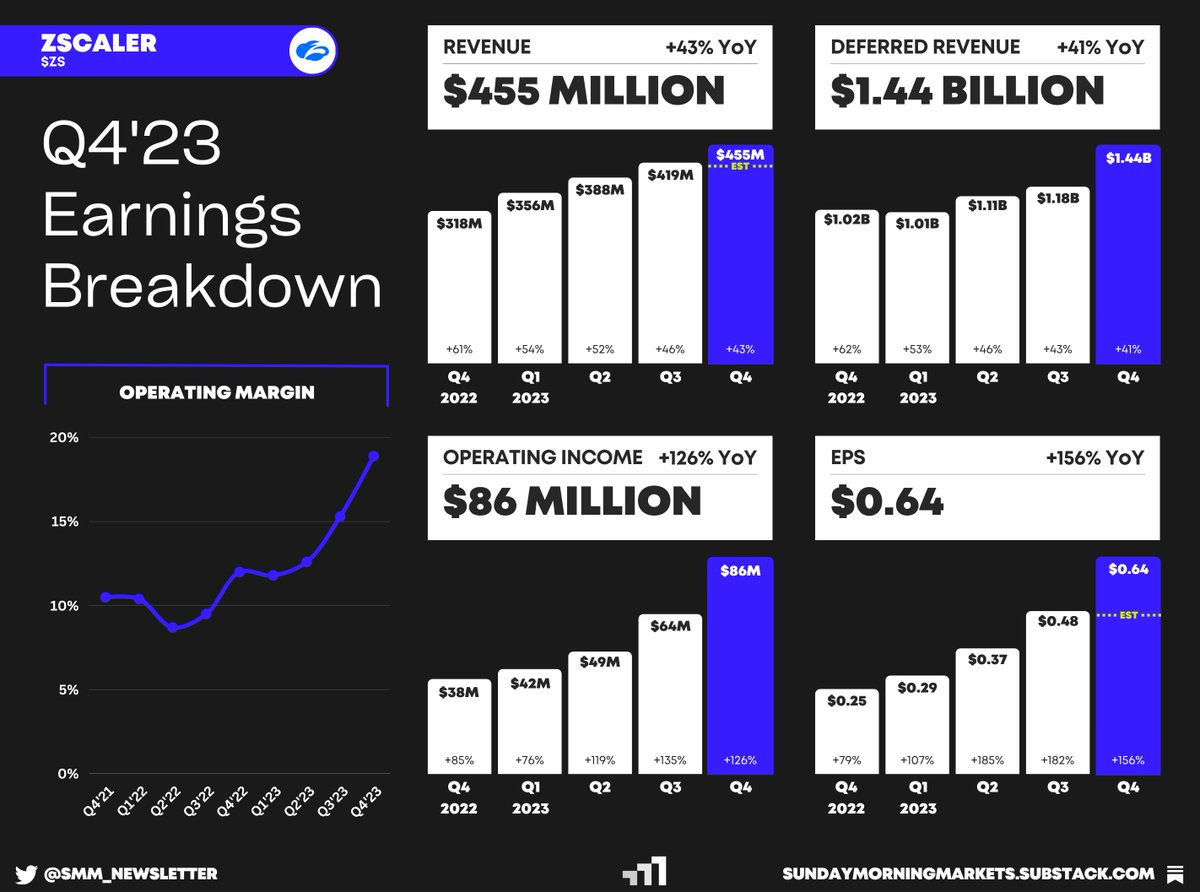

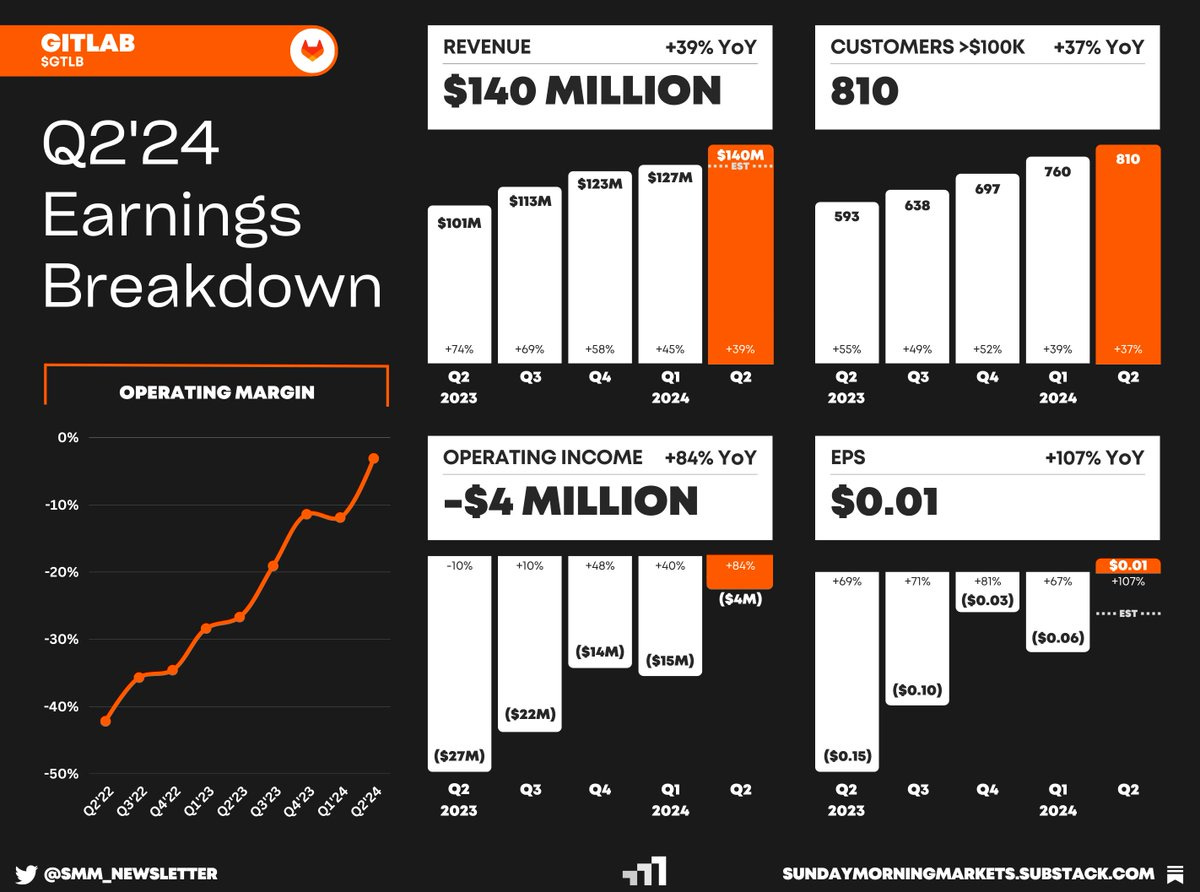

Earnings from Zscaler, GitLab, DocuSign — see breakdowns below

US Markets 🇺🇸

Growth in U.S. service sector accelerated in August as the ISM non-manufacturing PMI jumped to 54.5% from 52.7% in the prior month. Economists polled by the WSJ had expected the index to slip to 52.5%.

US jobless claims hit lowest level since February as the number of Americans seeking to start unemployment benefits unexpectedly fell to 216,000. Meanwhile, the number of continuing claims fell by 40,000 to 1.679 million.

US consumer credit levels rose $10.4B in July, reflecting a rebound in credit card balances. The gain, which isn’t adjusted for inflation, was less than the $16 billion median forecast in a Bloomberg survey of economists.

Walmart cuts starting pay for new hires who prepare online orders and stock shelves, raising questions of whether companies face a cooling labor market or are adjusting to a return to pre-pandemic shopping habits.

Warner Bros Discovery expects earnings hit of $500M this year as the writers’ and actors’ strikes keep production halted. The media company is now expecting its adjusted EBITDA to be in the range of $10.5 billion to $11 billion for 2023.

Disney says Hulu + Live TV subscriptions up 60% relative to internal expectations due to the ongoing dispute with Charter. Disney pulled its channels including ESPN and ABC off Charter Spectrum cable systems late last week.

Roku lays off 10% of its workforce or roughly 360 people, after cutting 200 employees in March and then another 200 in November. The company raised its guidance for its third-quarter revenue and EBITDA.

UPS to raise shipping rates by 5.9% on all air, ground, and international services, effective Dec. 26. The move matches rival FedEx which announced a 5.9% increase late last month.

Rest of World 🌏

Saudi Arabia to extend its voluntary oil output cut of 1 million barrels per day until the end of the year. The reduction, which was first applied in July, will put Saudi crude output near 9 million barrels per day

China bans iPhone usage by government employees and many worry the ban could spread to other state companies and government-backed agencies. China is Apple’s third-largest market, accounting for 18% of total revenue last year.

EU lists six tech giants as “gatekeepers” under a new law as they hope to rein in the market power of Alphabet, Amazon, Apple, ByteDance, Meta, and Microsoft by applying new pro-competition rules.

Bank of Canada holds interest rates steady but says further hikes are possible. The decision to keep their key rate at 5% revolved around recent GDP data that showed the Canadian economy has entered a period of weaker growth.

Canada’s Ivey PMI shows economic activity rebounded in August after contracting in July. The seasonally adjusted PMI rose to 53.5 from 48.6 in July, as the employment gauge rose to an adjusted 54.8.

China’s deflationary pressures ease in August as the CPI rose 0.1% from a year earlier, after falling 0.3% in July. The producer price index (PPI) fell 3.0% from a year earlier, in line with expectations, after a drop of 4.4% in July.

Tech ⚡

Tesla to install charging stations at 2,000 Hiltons in North America, adding over 20,000 charging stations to its network. The move will help Tesla remove a barrier to adoption and help Hilton reattract business customers.

Intel and Tower ink major foundry deal just weeks after they voided the $5.4B acquisition amidst pushback from regulators. In the new deal, Tower would use space in Intel’s plant and invest up to $300M in equipment and tooling.

Apple and Arm sign long-term chip deal that goes beyond 2040. Arm’s architecture is used in nearly every smartphone chip, including Apple’s iPhones. Arm is set to IPO at a valuation that could be as high as $52B.

Robot software firm, Mujin, raises $85M in its Series C, bringing its total funding up to $150M. Mujin’s product allows users to deploy and automate applications for their various industrial robots at a fraction of the cost.

Vodafone teams up with Amazon's Project Kuiper to extend its 5G reach. Kuiper is a constellation of low-Earth orbit satellites that can help connect mobile base stations in remote locations, eliminating the need for fiber-based links.

Square POS has a day-long system outage that left small business owners unable to process payments. Square confirmed Friday morning that systems were back online after the outage started Thursday afternoon.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

Earnings Reports: Oracle💰

Tuesday

US - OPEC Report 🇺🇸

UK - Employment Report (JUL)🇬🇧

Europe - EU Economic Sentiment (SEP)🇪🇺

Wednesday

US - CPI Inflation (AUG)🇺🇸

UK - GDP Growth (JUL)🇬🇧

Europe - Industrial Production (JUL)🇪🇺

Thursday

US - PPI Inflation (AUG)🇺🇸

US - Retail Sales (AUG)🇺🇸

US - Jobless Claims 🇺🇸

Europe - ECB Interest Rate Decision 🇪🇺

China - Industrial Production (AUG)🇨🇳

Earnings Reports: Adobe💰

Friday

US - UMich Consumer Sentiment (SEP)🇺🇸

Want to partner with Sunday Morning Markets? Click here to inquire.