What Moved The Markets This Week 📈

Unemployment Rate Falls To 3.7%, Tesla Beats Delivery Estimates, BYD Sales Surge, Fidelity Cuts X Valuation By 72%, Maersk Pauses Red Sea Routes Due To Houthi Attacks, and STZ Earnings

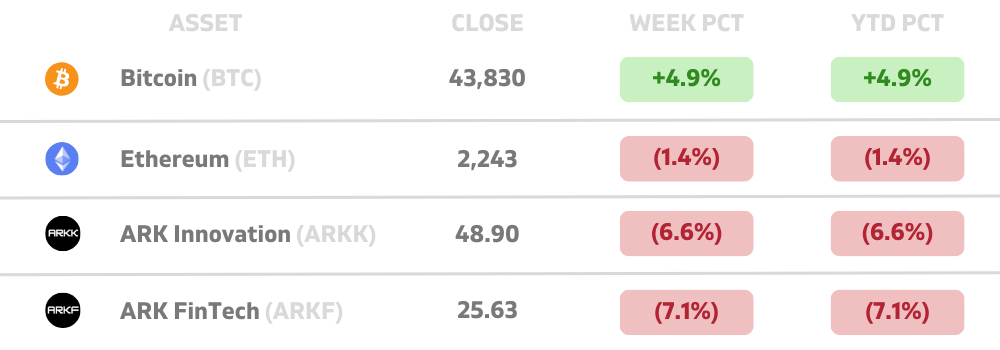

Sunday Morning Markets

Trading Week 1, covering Monday, Jan 1 through Friday, Jan 5. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Labor Market Data

Job openings drop moderately to 8.79M (est. 8.85M)

Nonfarm payrolls grow 216K (est. 170K)

ADP payrolls increase 164K (est. 130K)

Unemployment rate 3.7% (est. 3.8%)

ISM Manf. PMI shows 14th straight month of contraction

Peloton partners with TikTok on content deal

Tesla slightly beats Q4 delivery estimates

Maersk to halt all routes through the Red Sea

BYD EV sales surge 62% in 2023

Fidelity marks down its equity in X by 72%

Earnings from STZ

US Markets 🇺🇸

Job openings fell moderately in November to a two-year low. JOLTs reported 8.79 million available jobs, below estimates and down from October’s reading of 8.85 million. The ratio of job openings to available workers fell to 1.4 to 1.

Nonfarm payrolls increased by 216,000 for the month, much stronger than the estimate of 170K. Under the hood, the metrics were less favorable with full-time jobs plunging by 1.53M, the largest monthly drop since Covid started.

ADP private payrolls grew by 164,000 in December, better than the 130,000 consensus estimate and up from the 101,000 added in November. Pay growth decelerated again to 5.4% annually.

U.S. manufacturing activity contracted for 14th straight month, the longest stretch since 2000. The ISM manufacturing PMI moderately rose to 47.4 in December after being unchanged at 46.7 for the previous two months.

FOMC meeting minutes show rate cuts are likely in 2024 amid concern of an ‘overly restrictive’ policy. The members expect an average of 3 cuts this year but are highly uncertain about how or if that will happen.

Xerox to cut 15% of its workforce as part of a plan to revamp its operating model. The layoffs are expected to affect more than 3,000 employees. XRX 0.00%↑ shares plunged more than 10% following the news.

NCAA and ESPN ink 8-year $920 million media rights deal that will run until 2032 and will provide more exposure and revenue to women’s sports. The deal is roughly triple the value of the current deal.

Global Markets 🌏

Japan hit with a 7.6 magnitude earthquake that destroyed buildings, knocked out power to tens of thousands of homes, and prompted over 100,000 residents in coastal areas to flee to higher ground.

Maersk halts Red Sea shipping until further notice after one of its vessels came under attack from Houthi militants. Vessels will be rerouted around the Cape of Good Hope in Africa.

Chinese EV giant, BYD, posts 62% jump in vehicle sales as the company sold 1.6 million battery EVs and 1.4 million plug-in hybrid EVs during 2023. BYD plans to expand west with a new plant in Hungary.

China’s factory activity accelerated last month as the Caixin Manufacturing PMI rose to 50.8, marking the fastest expansion in seven months and surpassing analysts' forecasts of 50.4.

Canada's Ivey PMI rises to 8-month high of 56.3 in December, up from 54.7 in November. The gauge of employment rose to an adjusted 57.9 from 55.3 in November, while the prices index was at 64.5, up from 62.1.

Senior Hamas leader killed in Lebanon via drone strike, stoking fears that the war in Gaza could spread beyond Palestine. Israeli PM, Netanyahu, described it as a “surgical” hit on Hamas, rather than an attack on Lebanon.

Inflation in Europe accelerates in December as consumer prices rose 2.9%, up from 2.4% in November. However core inflation, which excludes volatile food and energy, slightly slowed from 3.6% to 3.4%.

Tech ⚡

Tesla reports a record 485K vehicle deliveries for Q4, bringing its annual total to 1.8 million. The delivery numbers represent 20% annual growth for the quarter, down from 31% in the year prior. TSLA 0.00%↑ shares fell 7% this week.

Fidelity marks down X (Twitter) valuation by 71.5%, according to a new disclosure. The company spent $19.2 million to acquire a stake in X back in October 2022.

Peloton announces a new partnership with Tiktok to offer short-form fitness classes on the social media app as part of its strategy to attract a broader array of customers. PTON 0.00%↑ shares surged 25% following the news.

Microsoft Copilot is now available on iOS and Android giving access to ChatGPT-4 for free. Since the app’s launch over the holidays, Copilot has been downloaded more than 1.5 million times worldwide.

TikTok aims to grow its U.S. shop business 10x this year to a $17.5 billion run rate and will raise its commission rate from 2% to 8%. The app saw over 5 million new U.S. customers using the TikTok Shop this holiday season.

Mobileye warns sales are expected to drop dramatically during the first quarter of 2024 causing MBLY 0.00%↑ shares to plummet 31% this week. Intel owns a staggering 88% of the auto chip manufacturer.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - Consumer Credit (NOV)🇺🇸

JP - Tokyo Core CPI (DEC)🇯🇵

AU - Retail Sales (NOV)🇦🇺

Earnings Reports: Jefferies💰

Tuesday

US - Atlanta Fed GDPNow (Q4)🇺🇸

DE - Industrial Production (NOV)🇩🇪

EU - Unemployment Rate 🇪🇺

Earnings Reports: Albertsons💰

Wednesday

US - Crude Oil Inventories 🇺🇸

US - 10-Year Note Auction 🇺🇸

Thursday

US - CPI Inflation (DEC)🇺🇸

US - Jobless Claims 🇺🇸

EU - ECB Economic Bulletin 🇪🇺

CN - CPI Inflation (DEC)🇨🇳

CN - PPI Inflation (DEC)🇨🇳

Earnings Reports: Delta Airlines, Infosys💰

Friday

US - PPI Inflation (NOV)🇺🇸

UK - GDP (NOV)🇬🇧

Earnings Reports: JPMorgan, UnitedHealth, Bank of America, Wells Fargo, Blackrock, Citi💰

Want to partner with Sunday Morning Markets? Click here to inquire.