What Moved The Markets This Week 📈

Capital One Acquires Discover For $35B, PMIs Show Strong Economic Growth In US, Ford Cuts Mach-E Pricing, China Cuts Interest Rates, and NVDA + SQ + PANW Earnings

Sunday Morning Markets

Trading Week 8, covering Monday, Feb 19 through Friday, Feb 23. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

S&P PMIs show strong economic growth in U.S.

Capital One to acquire Discover for $35B

Walmart to buy Vizio for $2.3B

Biden cancels another $1.2B in student loans

Amazon to replace Walgreens in the Dow Industrial Avg

China cuts prime rate to 3.95%

Ford cuts Mach-E pricing by up to $8,100

Intel signs Microsoft as Foundry customer

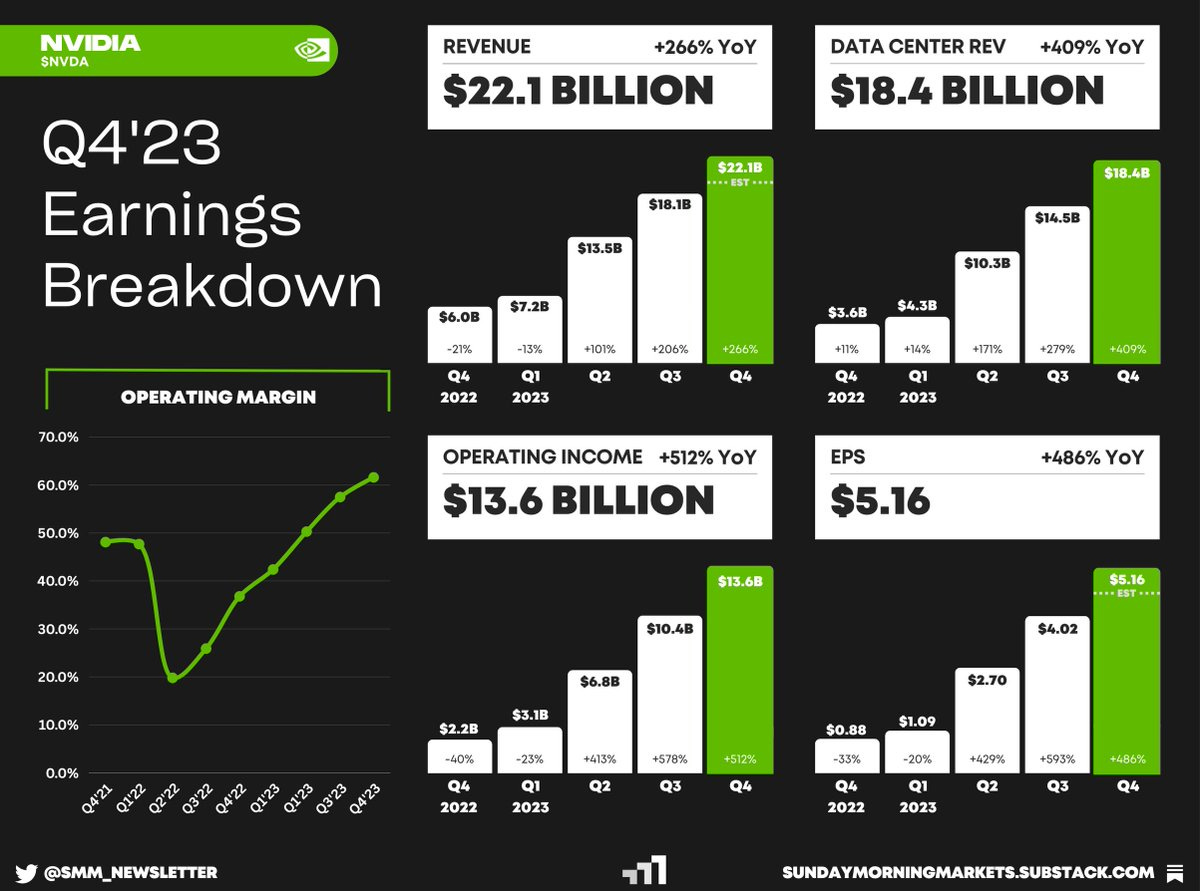

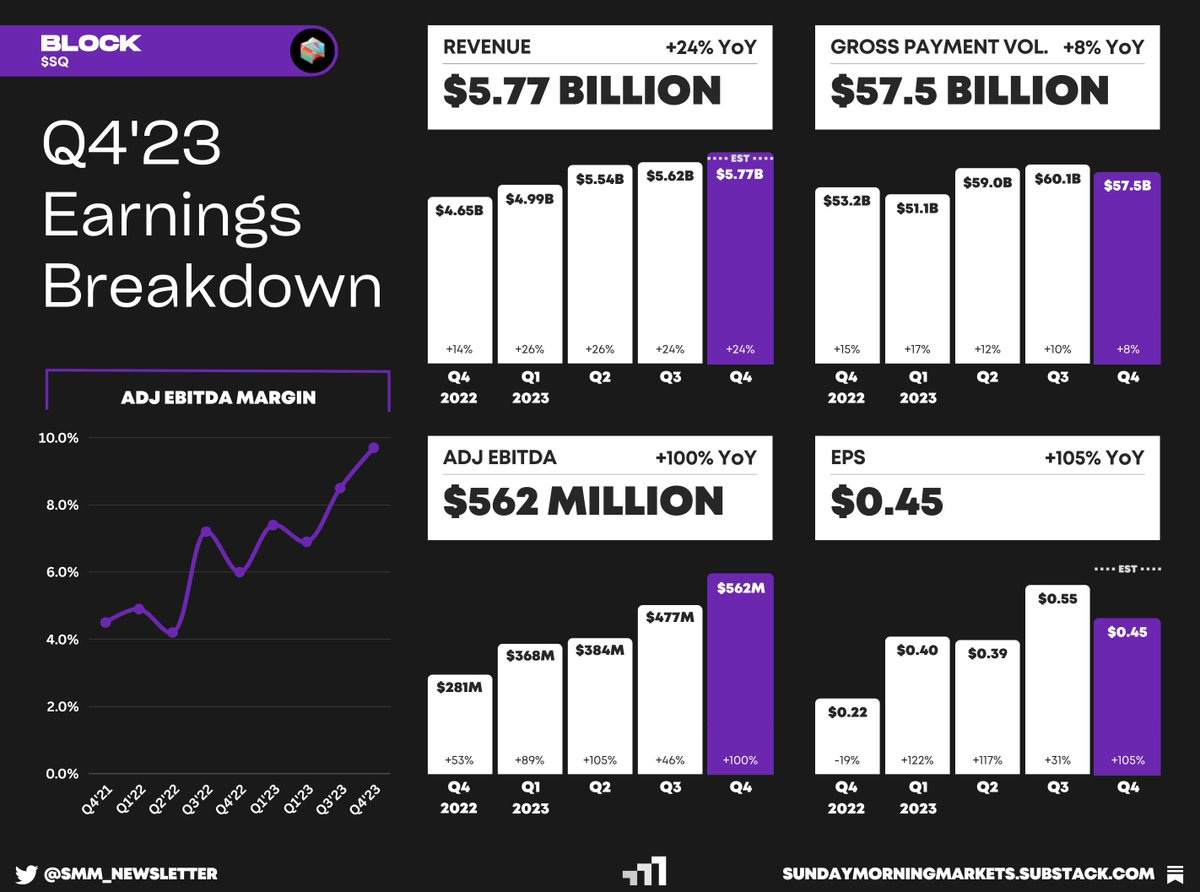

Earnings from Nvidia, Block, and Palo Alto Networks

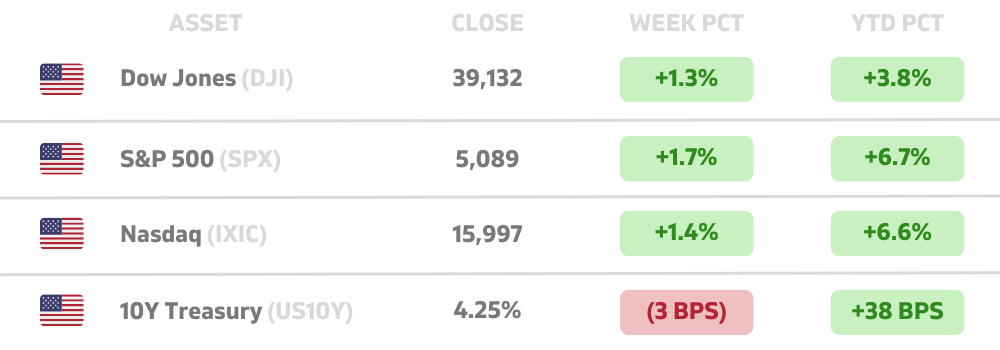

US Markets 🇺🇸

Fed officials expressed caution about lowering rates too quickly at the last meeting, meeting minutes show. According to CME’s FedWatch tool, the market is only pricing in a 2.5% chance of a rate cut at the next meeting.

U.S. economy grew steadily in February according to a pair of S&P surveys. The flash manufacutring PMI rose to a 17-month high of 51.5, while the flash services PMI dipped to a three-month low of 51.3.

The Leading Economic Index no longer forecasts recession as six of its ten components were positive over six months. However, it was still the 23rd straight monthly decline, just one short of the record-long slump in 2008.

Capital One to acquire Discover Financial for $35 billion in an all-stock deal. Discover shareholders would receive 1.0192 shares of Capital One for each share owned, representing a 27% premium on the previous closing price.

Walmart to buy TV maker Vizio for $2.3 billion in cash. Walmart touted the deal’s potential to boost its ad business through Vizio’s SmartCast operating system which has 18 million active accounts.

Biden cancels another $1.2 billion in student debt for over 150,000 borrowers enrolled in its new repayment plan. The relief will go to borrowers who have been in repayment for over a decade and originally took out $12,000 or less.

Amazon to replace Walgreens in Dow Industrial Average next week, sending WBA 0.00%↑ shares down 3%. As a result of the adjustment, investors will gain more exposure to consumer retail, advertising, and cloud computing.

Boeing replaces head of troubled 737 Max program less than two months after a panel blew out during an Alaska Airlines flight. Katie Ringgold will become the new president and general manager of the Max program.

Global Markets 🌏

Chinese banks cut five-year prime rate to 3.95% from 4.2% previously. The move is part of a larger campaign to prop up its housing market and support an economy battling deflation, slowing exports, and weak consumer confidence.

China’s real-estate downturn is getting worse as existing home prices slid 4.4% in January compared with a year earlier. It was the steepest such decline in almost nine years. New home prices fell 1.2% from a year earlier.

Japan’s Nikkei index hits new high after 35-year slump as robust corporate earnings and strong investor sentiment fuel a steep rally. Fourth quarter earnings have surged 45% and widely beaten estimates, according to Goldman Sachs.

Inflation in Canada cools to 2.9% in January coming in well below economists’ forecast of 3.3%. It is the last inflation reading before the central bank’s policy meeting in March where they are expected to hold rates steady again.

Canadian retail sales rose 0.9% in December to a seasonally adjusted 67.3 billion CAD. However, advance estimates for January’s numbers indicate a 0.4% decline, which would be the largest drop in nine months.

U.S. to invest billions to replace Chinese-made cranes as part of a series of actions to strengthen the cybersecurity of America’s ports. Roughly 80% of ship-to-shore cranes moving trade at U.S. ports are manufactured in China.

Xpeng plans to invest $500 million in AI and hire as many as 4,000 new employees as the CEO warns that China’s EV market may end in a “bloodbath”. They also intend to launch 30 new or upgraded cars over the next three years.

Tech ⚡

Reddit to go public under ticker “RDDT” marking the first major tech IPO of the year. Reddit said it had $804 million in annual sales for 2023, up 20% from the $667 million it brought in the previous year.

Intuitive Machines lands on the moon and becomes the first U.S. spacecraft to touch down on the lunar surface since 1972. LUNR 0.00%↑ shares have rallied a whopping 263% in the last month.

Google unveils new family of open-source AI models named ‘Gemma’. The new models will only handle text and have been built from the same research and technology used to create the company’s flagship AI model, Gemini.

Intel signs Microsoft as a Foundry customer to build its custom chips. Intel also said it plans to retake the mantle of making the world's fastest chips from TSMC later this year with Intel 18A manufacturing technology.

Ford cuts the price of its Mach-E by up to $8,100 as sales of the EV have plunged 51% from a year ago after losing its eligibility for the federal tax credit. Ford is also offering 0% financing and major leasing incentives.

Google pauses Gemini AI image generator after receiving backlash on social media over “inaccuracies” in historical pictures. Google defended itself by saying it’s a global and diverse product but will re-release an improved version soon.

Apple releases free new sports app for iPhone in its latest effort to become a sports content provider. The app is designed to be fast and simple for multiple quick score checks every day with nothing else in the way.

FuboTV sues Disney, Fox, and Warner Bros over its new streaming joint venture. FuboTV cited what it calls “extreme suppression of competition in the U.S. sports-focused streaming market.”

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

SMM Product Hunt 🧠

🧑💻 Alpha Vantage provides enterprise-grade financial market data through a set of powerful and developer-friendly APIs. From traditional asset classes (e.g., stocks and ETFs) to economic metrics, from foreign exchange rates to cryptocurrencies, from fundamental data to technical indicators; Alpha Vantage is your one-stop shop for real-time and historical global market data delivered through RESTful stock APIs, Excel, and Google Sheets. Read more about Alpha Vantage in their Best Financial APIs Review or Top Stock Market APIs of 2024.

Week Ahead 📅

Monday

US - New Home Sales (JAN)🇺🇸

CA - Wholesale Sales (JAN)🇨🇦

Earnings: Workday, Zoom, Unity, Hims💰

Tuesday

US - Durable Goods (JAN)🇺🇸

US - CB Consumer Confidence (FEB)🇺🇸

Earnings: Lowes, Cava, Beyond Meat, Splunk💰

Wednesday

US - GDP (Q4)🇺🇸

US - Crude Oil Inventories🇺🇸

JP - Industrial Production (JAN)🇯🇵

AU - Retail Sales (JAN)🇦🇺

Earnings: Salesforce, Snowflake, Okta, C3, Baidu💰

Thursday

US - Jobless Claims 🇺🇸

US - PCE Inflation (JAN)🇺🇸

US - Chicago PMI (FEB)🇺🇸

US - Pending Home Sales (JAN)🇺🇸

CA - GDP (Q4)🇨🇦

DE - CPI Inflation (FEB)🇩🇪

CN - Manufacturing PMI (FEB)🇨🇳

Earnings: Zscaler, Dell, Autodesk, Polestar, Veeva, Celsius, Best Buy💰

Friday

US - S&P Manufacturing PMI (FEB)🇺🇸

US - ISM Manufacturing PMI (FEB)🇺🇸

EU - CPI Inflation (FEB)🇪🇺

DE - HCOB Manufacturing PMI (FEB)🇩🇪

Earnings: Plug, Fubo💰

Want to partner with Sunday Morning Markets? Click here to inquire.