What Moved The Markets This Week 📈

US10Y Hits Highest Level Since 2007, Fed Keeps Rates Steady, Cisco Acquires Splunk For $28B, UAW Expands Strikes At GM & Stellantis, Dorsey Takes Over As Square CEO, and FDX + FDS Earnings

Sunday Morning Markets

Trading Week 38, covering Monday, Sep 18 through Friday, Sept 22. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Interest rate decisions:

Fed holds at 5.5% 🇺🇸

BoE holds at 5.25% 🇬🇧

SNB holds at 1.75% 🇨🇭

BoJ holds at -0.1% 🇯🇵

US10Y treasury yield hit highest level since 2007

Strikes at GM and Stellantis expand, Ford close to a deal

Instacart & Klayvio go public under tickers CART & KYVO

Jack Dorsey takes over as Square’s CEO

Rocket Lab’s Electron Rocket explodes at takeoff

Cisco acquires Cybersecurity firm Splunk for $28 billion

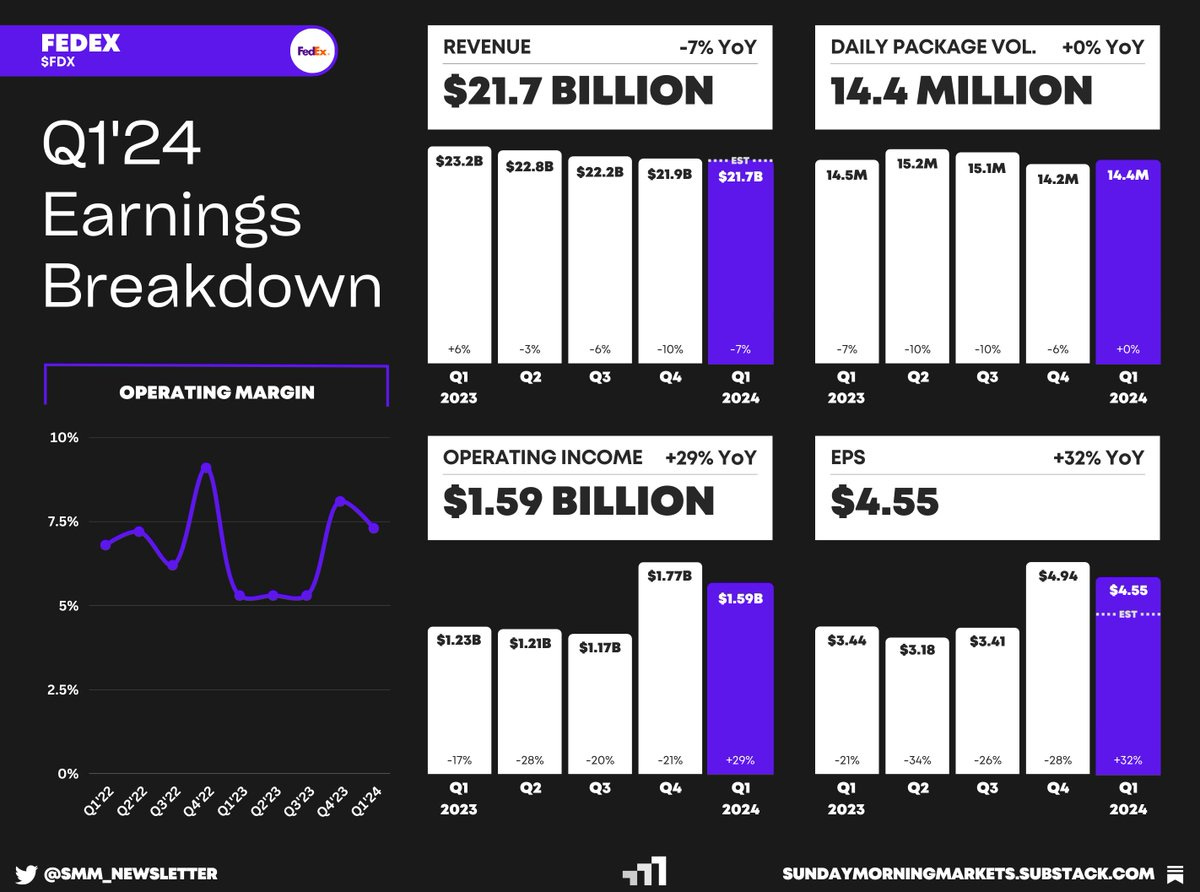

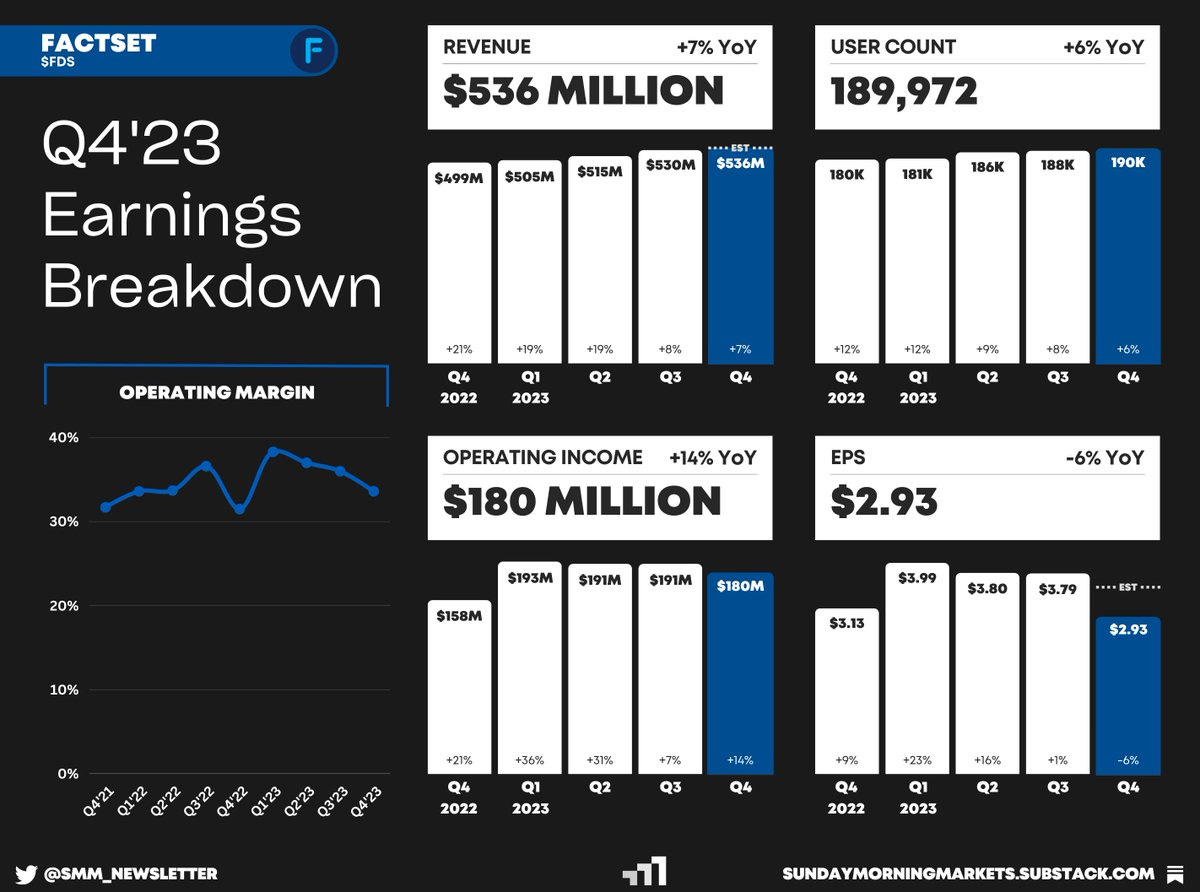

Earnings from FedEx, FactSet — see breakdowns below

US Markets 🇺🇸

Fed keeps rates steady but expects to stay higher for longer as inflation efforts stall. SEP projections imply one more 25 bps hike this year. The median view of the Fed funds rate at the end of 2024 is now 5.1% (prev 4.6%).

US10Y Treasury yield hits highest level since 2007 as investors digested the Fed’s interest rate decision and “higher for longer” projections, alongside unemployment claims hitting the lowest level since January.

LEI falls farther into recessionary territory after dropping 0.4% in August to 105.4, down 7.2% versus the year prior. "With August's decline, the US Leading Economic Index has now fallen for nearly a year and a half straight.”

Amazon plans to add 250,000 workers for the holidays and is bumping its average pay to $20.50 an hour, up from $19 an hour. The company is offering sign-on bonuses worth $1,000 to $3,000 in some locations.

Disney to double its investment in Theme Park business to roughly $60 billion over the course of 10 years. Theme parks have been a relative bright spot while the company struggles to profit from streaming.

Microsoft projects growth in mobile gaming and ads, a leaked presentation shows, with the Activision deal giving them a leg up in those categories. The company has set a target of $500 billion in total revenue by 2030.

UAW expands strikes against GM and Stellantis to 38 parts and distribution locations across 20 states. The union will not initiate additional strikes at Ford Motor, as the company has proven it’s “serious about reaching a deal.”

75,000 Kaiser Permanente workers threaten strike if an agreement is not reached by the end of next week. Kaiser Permanente is the largest nonprofit healthcare organization in the US, serving nearly 13 million patients.

Global Markets 🌏

Bank of England decides to keep rates constant as the Committee voted by a narrow margin of 5-4 to hold the Bank Rate at 5.25%. It was the first time since December 2021 that the BoE did not increase borrowing costs.

UK inflation dips to 6.7%, below expectations as food prices ease. On a monthly basis, the headline CPI rose by 0.3%, well below estimates of a 0.7% increase despite a slight uptick in prices at the pump.

UK PM Rishi Sunak announces shift on climate policies, delaying the ban of new gasoline and diesel cars from 2030 to 2035. The move was criticized for causing uncertainty for the automotive industry.

Inflation in Canada jumped to 4.0% in August, up significantly from 3.3% in July. The Bank of Canada may be forced to raise interest rates yet again after 10 hikes since March of last year as inflation reaccelerates.

India-Canada tensions hit crisis point after allegations that the Indian government was behind the killing of a Sikh community leader in British Columbia. Both countries have expelled diplomats in an escalation.

Bank of Japan leaves rates unchanged on concerns of ‘extremely high uncertainties’, sending the Yen sinking against the dollar. The BOJ kept its short-term interest rates at -0.1% and also capped the 10Y government bond near zero.

Russia to introduce restrictions on diesel exports to stabilize fuel prices on the domestic market. The ban, which came into immediate effect and applies to all countries apart from four former Soviet states, does not have an end date.

Tesla, Saudi Arabia in early talks for EV factory as the kingdom continues to shift its economy away from oil. The proposal reportedly gives Tesla the right to purchase certain metals and minerals the company needs for its batteries.

Tech ⚡

Cisco acquires cybersecurity company Splunk for $157 per share in an all-cash deal worth $28 billion. This marks Cisco’s fifth acquisition in 2023 alone, as they’ve already inked deals with Armorblox, Oort, Valtix, and Lightspin.

Salesforce to acquire Airkit.ai, a low-code platform for building AI customer service agents. Terms of the deal were not disclosed. When the deal closes, Airkit.ai will be merged into its customer service platform, Service Cloud.

Klayvio and Instacart officially go public and now trade under the tickers “KYVO” and “CART”, respectively. Both companies priced their IPO at $30 per share. KYVO closed the week at $33.39, while CART closed at $30.

Jack Dorsey takes over as CEO of Square as Alyssa Henry steps down after spending nine years with the company. Block shares fell 16% this week following the news, as the market doesn’t seem to like the shift in leadership.

Rocket Lab suffered its first launch failure in more than two years, causing the stock to sell off 12% this week. Its uncrewed 41st Electron rocket launch failed about two minutes and 30 seconds after lifting off from New Zealand.

OpenAI unveils DALL-E 3 image model that now uses ChatGPT to assist with prompting. ChatGPT will take text as short as a few words and make it more descriptive, providing more guidance to the DALL-E 3 model.

Amazon unveils next-gen Echo Frames with enhanced speech processing, better noise isolation and a $269.99 price tag. The new Frames are 15% thinner and last for six hours on a charge, an improvement over the previous gen.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

DE - Ifo Business Climate (SEP)🇩🇪

Tuesday

US - New Home Sales (AUG)🇺🇸

US - CB Consumer Confidence (SEP)🇺🇸

Earnings Reports: Costco, Cintas💰

Wednesday

US - Durable Goods Orders🇺🇸

Earnings Reports: Micron, Paychex💰

Thursday

US - GDP (Q2)🇺🇸

US - Pending Home Sales (AUG)🇺🇸

DE - CPI Inflation (SEP)🇩🇪

CN - Caixin Services PMI (SEP)🇨🇳

JP - Industrial Production (AUG)🇯🇵

Earnings Reports: Accenture, Nike, CarMax💰

Friday

US - PCE Inflation (AUG)🇺🇸

UK - GDP (Q2)🇬🇧

EU - CPI Inflation (AUG)🇪🇺

DE - Retail Sales (AUG)🇩🇪

CN - Manufacturing PMI (SEP)🇨🇳

Want to partner with Sunday Morning Markets? Click here to inquire.