What Moved The Markets This Week

GDP Contracts in Q1, US-Ukraine Ink Minerals Deal, Taiwan Restricts TSMC Exports, China Factory Output Slumps, Waymo-Toyota Partner on AV Tech, and MSFT + AAPL + AMZN + META Earnings

Sunday Morning Markets

Trading Week 18, covering Monday, April 28 through Friday, May 2. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Q1 GDP: U.S. economy contracts 0.3% as imports surge pre-tariff.

Tariff Talks: China ties trade progress to full U.S. tariff rollback.

Minerals Deal: U.S. and Ukraine sign deal for critical resource access.

Labor Market Mixed: NFP gains 177K, ADP lags, UPS to cut 20K workers.

TSMC Limits: Taiwan bans export of top chip tech under new law.

Carney Wins: Mark Carney elected Canadian PM, leads minority gov't.

China Slump: Factory PMI hits 2-year low as tariffs bite output.

AI Race: Nvidia CEO says China is 'not behind' the U.S. in AI

Waymo-Toyota: Firms team up on self-driving car integration.

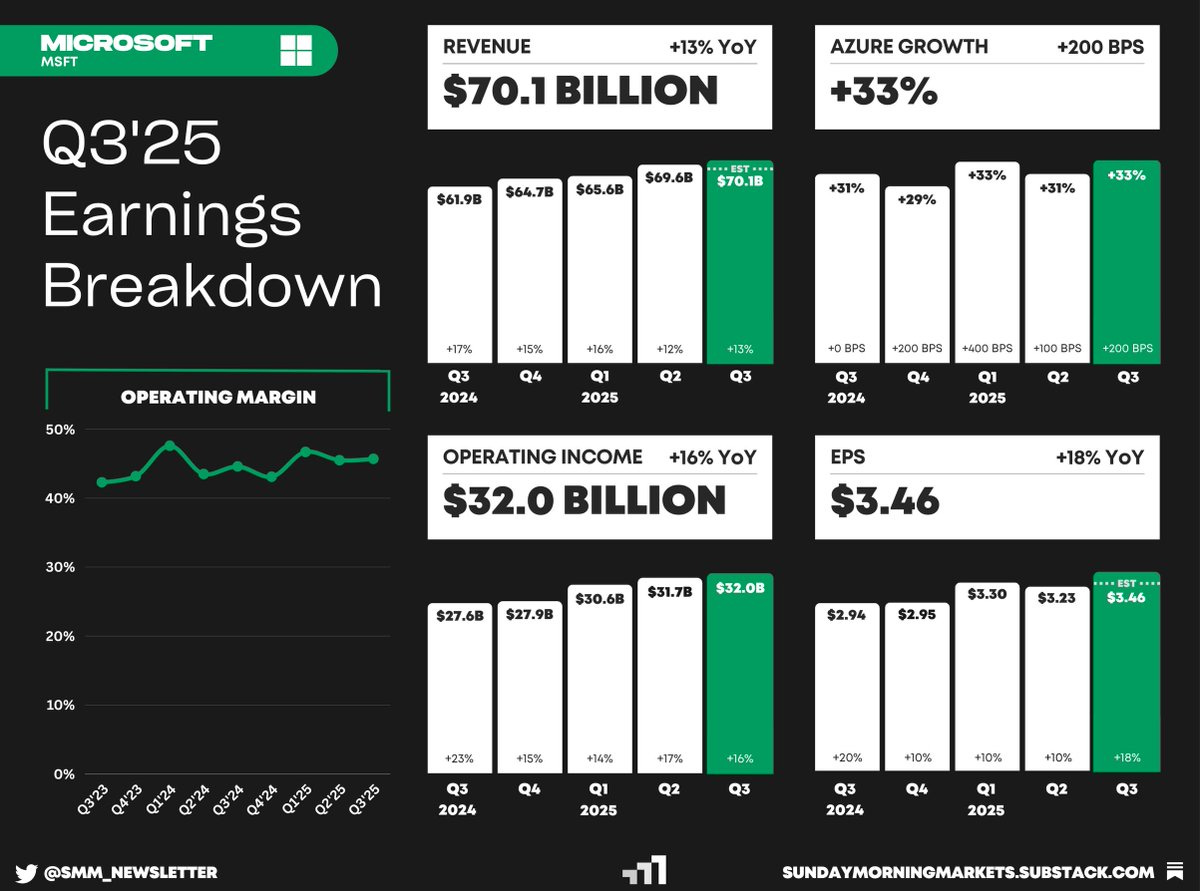

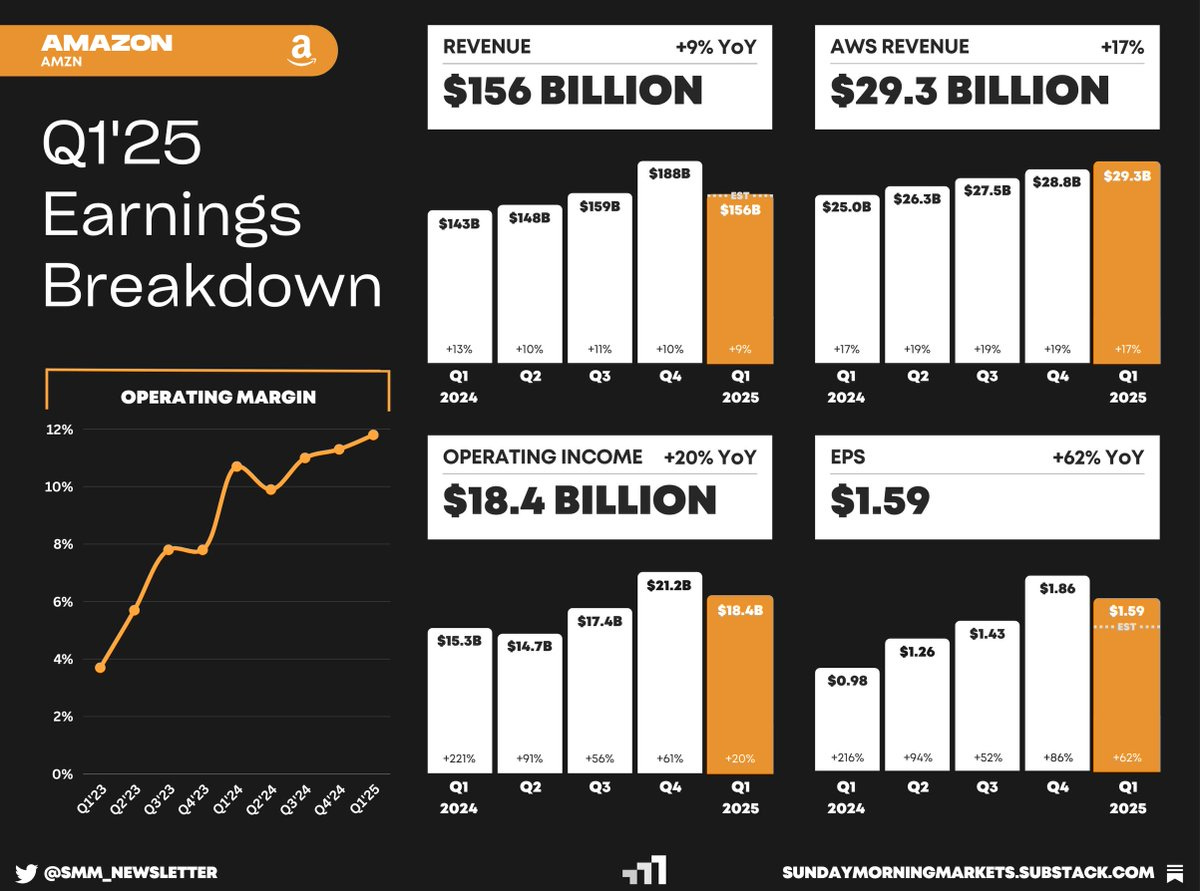

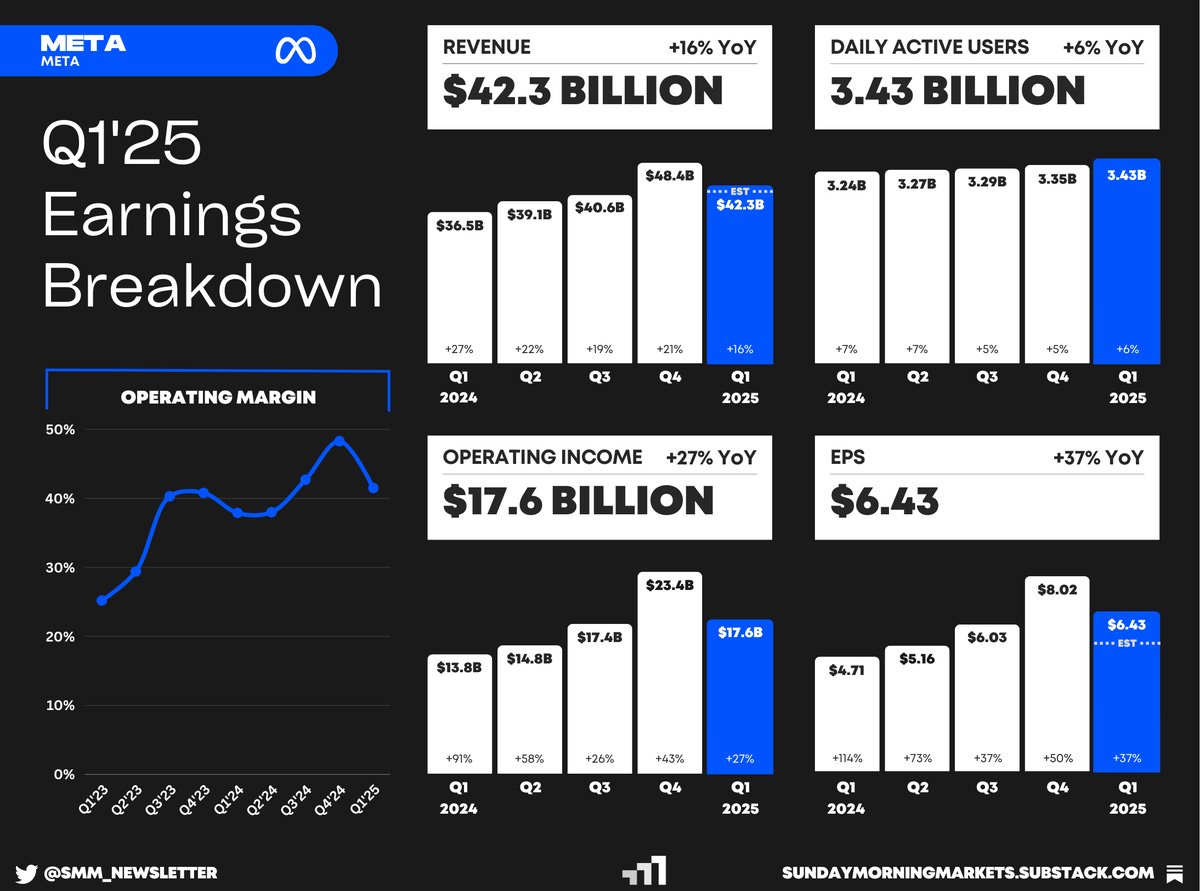

Earnings: Microsoft, Apple, Amazon, Meta

US Markets 🇺🇸

China says it's evaluating trade talks with the U.S., but warns progress depends on full tariff rollback and clear U.S. commitment. The Trump administration says it's very close to a trade deal with India.

U.S. economy shrank 0.3% in the first quarter, worse than expected and driven by a 41% surge in imports as businesses raced to beat Trump’s new tariffs. The contraction adds pressure on the Fed.

U.S. and Ukraine sign landmark minerals deal, granting Washington access to critical resources in return for a joint reconstruction fund. Experts warn the agreement could face legal and investor hurdles.

Fed’s preferred inflation gauge moderated in March with core PCE up 2.6%, matching estimates and easing pressure on the Fed. Consumer spending surged 0.7%, the strongest since early 2023.

Consumer confidence plunges to lowest since 2011, driven by rising tariff fears and deteriorating views on jobs, income, and business conditions. Expectations for the next six months signal looming recession risks.

Nonfarm payrolls rose 177,000 in April, beating expectations and signaling resilience in the labor market. However, ADP’s private payroll data showed job growth slowing sharply to 62,000.

UPS to slash 20,000 jobs amid Amazon slowdown, aiming to cut costs by $3.5B in 2025 through layoffs and facility closures. Despite weak volumes, Q1 profit beat estimates.

Novo Nordisk partners with Hims & Hers on Wegovy deal, expanding telehealth access as compounded versions face crackdowns. Patients can get Wegovy online for $599/month through Hims.

Global Markets 🌏

Taiwan restricts TSMC from exporting cutting-edge chip tech, enforcing an 'N-1' rule to keep its most advanced nodes domestic. New laws also tighten overseas investments to safeguard national security.

Mark Carney wins Canadian election for Prime Minister, as the former BoE chief led the Liberal party to another term amid backlash to U.S. policies. The party fell just short of a majority and will govern as a minority.

China’s factory activity sinks to a near 2-year low, with April’s PMI at 49.0 as U.S. tariffs hit demand and disrupt trade flows. Analysts warn stimulus may not fully offset mounting pressure.

Microsoft warns U.S. may fall behind China in quantum race, calling for urgent federal investment to protect national security. IBM announced plans this week to invest $150B to expand quantum infrastructure.

Eurozone economy picked up steam in Q1, growing 0.4% and outpacing the U.S. for the first time in nearly three years. However, the global trade war threatens to derail export growth and sentiment.

BoJ holds rates steady for second straight meeting as Trump tariffs threaten exports. Japan now expects just 0.5% growth in 2025, sharply lower than January’s 1.1% forecast.

Eurozone inflation held steady at 2.2% in April, coming in softer than expected and keeping the door open for further ECB rate cuts. Core and services inflation ticked up, but growth risks remain.

Tesla's European sales plunged 37% in Q1, even as fully-electric vehicle sales grew 28% across the region. Its EU market share dropped from 20% to 9% as buyers turned to cheaper Chinese EVs.

Tech ⚡

Nvidia CEO Jensen Huang warns China is ‘not behind’ in AI, arguing Huawei is a formidable competitor and the U.S. must act fast to maintain its edge. He urged policymakers to support innovation over chip restrictions.

Meta unveils its first standalone AI app powered by the Llama models to take on ChatGPT. The move marks a major push in the AI race alongside rivals like Google’s Gemini and xAI’s Grok.

Satya Nadella says 30% of Microsoft’s code is written by AI, revealing a sharp rise in machine-generated development at LlamaCon. Meta’s Zuckerberg predicts AI will soon build half of its own models.

Waymo and Toyota team up on self-driving tech, aiming to bring autonomous features to personal vehicles and possibly integrate Toyotas into Waymo’s expanding ride-hailing fleet.

Amazon launches Kuiper satellites to rival Starlink, marking its first step in a $10B plan to build a global internet network, with 27 units now in orbit and service expected to begin later this year.

Aurora launches first driverless truck service in U.S., debuting autonomous freight hauls between Dallas and Houston as it eyes expansion despite regulatory hurdles and a slowing freight market

Hugging Face releases $100 robotic arm kit, expanding into hardware with the SO-101, a camera-equipped, AI-trainable device designed for basic tasks and rapid assembly with 3D-printable parts.

Earnings Reports 💰

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - ISM Services PMI 🇺🇸

US - S&P Services PMI 🇺🇸

CN - Caixin Services PMI 🇨🇳

Earnings: Palantir, Hims, Berkshire, On, Ford💰

Tuesday

US - Imports & Exports 🇺🇸

US - 10Y Auction 🇺🇸

CA - Ivey PMI 🇨🇦

EU - HCOB Composite PMI 🇪🇺

Earnings: AMD, Rivian, SMCI, Astera, Datadog, Celsius, Ferrari, Lucid💰

Wednesday

US - Fed Interest Rate Decision 🇺🇸

US - Consumer Credit 🇺🇸

DE - Factory Orders 🇩🇪

Earnings: Uber, Disney, NovoNordisk, Unity, Applovin, Carvana, Arm, DoorDash💰

Thursday

US - Jobless Claims 🇺🇸

UK - BoE Interest Rate Decision 🇬🇧

DE - Trade Balance 🇩🇪

Earnings: Shopify, TradeDesk, Coinbase, MercadoLibre, Cloudflare, DraftKings, Afirm, Peloton💰

Friday

CA - Unemployment Report 🇨🇦

CN - Trade Balance 🇨🇳

CN - CPI Inflation 🇨🇳

Want to partner with Sunday Morning Markets? Click here to inquire.