What Moved The Markets This Week 📈

Personal Bankruptcies Spike, Amazon To Invest $4B In Anthropic, PCE Inflation Softens, Target Closes Down Stores, ChatGPT Gets New Upgrades, and NKE + ACN + KMX Earnings

Sunday Morning Markets

Trading Week 39, covering Monday, Sep 25 through Friday, Sept 29. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Inflation data:

PCE +3.5% YoY (est. 3.5%)🇺🇸

Core PCE +3.9% YoY (est. 3.9%)🇺🇸

Japan CPI +3.3% YoY (est. 3.2%)🇯🇵

Germany CPI +4.5% YoY (est. 4.6%)🇩🇪

Europe CPI +4.3% YoY (est. 4.5%)🇪🇺

Personal bankruptcies spiked 18% to 39K in August

FTC & 17 states sue Amazon on antitrust charges

Target to close 9 major stores due to theft, safety

Diplomatic relations between India and Canada worsen

Amazon to invest $4B into Anthropic AI

ChatGPT gets updates; browsing, images, audio

Meta launches AI chatbot features, new Quest 3 headset

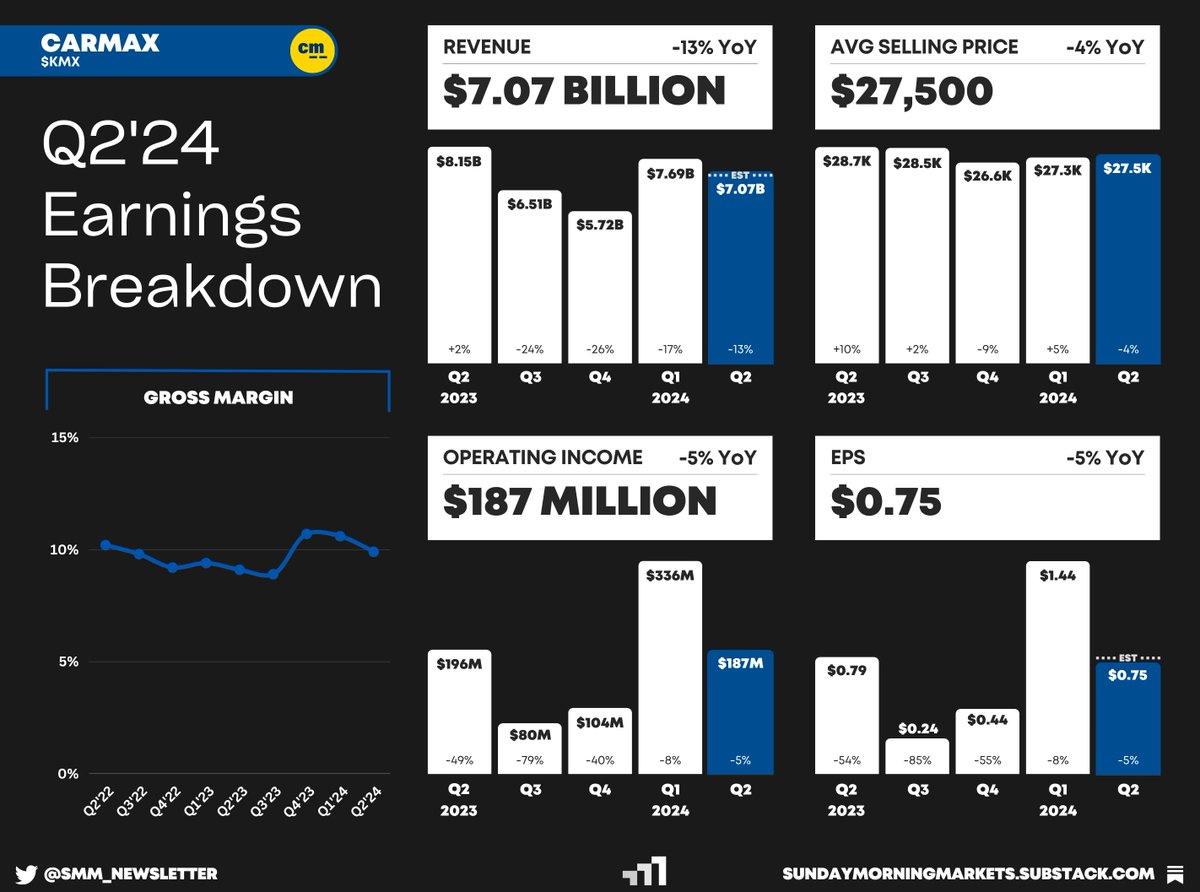

Earnings from Nike, Accenture, Carmax — see breakdowns below

US Markets 🇺🇸

The Fed’s key inflation indicator rose less than expected in August. Excluding food and energy, the core PCE index increased 0.1% for the month, lower than the expected 0.2%. On a 12-month basis, the index was up 3.9%, as expected.

Personal bankruptcies spiked 18% in August as more than 39,000 Americans filed for protection. It’s the 13th consecutive month of annual increases in claims. Inflation and higher interest rates continue to eat into consumers’ pockets.

Pending home sales tumbled 7.1% in August with all four U.S. regions posting monthly losses and year-over-year declines in transactions. The average 30-year fixed-rate mortgage hit 7.31%, according to Freddie Mac.

Biden stands with striking UAW autoworkers on the picket line outside Detroit and urged strikers to continue their fight for new contracts with hefty pay raises. “We saved them, it’s about time they step up for us,” Biden said.

FTC and 17 states sue Amazon on antitrust charges as they “effectively require” sellers to use its “costly” fulfillment services to obtain the Prime badge. AMZN 0.00%↑ shares have fallen 6% this month.

Peloton and Lululemon agree to a strategic partnership for the next five years. Peloton will develop digital fitness content for Lululemon, while Lululemon will become Peloton’s primary athletic apparel provider.

Ozempic, Wegovy drug prescriptions hit 9 million, surging 300% in under three years. Drugmakers have spent nearly $500M on advertisements for these obesity drugs during the first seven months of this year, according to new data.

Target says it will close nine stores in major cities after struggling with crime and safety threats at those locations. Target expects to lose $500M this year due to shrinkage, and will close locations in NYC, Seattle, SF, and Portland.

Global Markets 🌏

Evergrande shares plunge on debt restructuring roadblock after revealing its subsidiary, Hengda Real Estate, was being probed. Later in the week, news broke that the founder, Hui Ka Yan, was being investigated for "illegal crimes”.

Alibaba to file for IPO for its logistics unit Cainiao with shares becoming tradable on the Hong Kong Stock Exchange. Upon completion of the spinoff, Alibaba will continue to hold more than 50% of the shares of Cainiao.

Eurozone inflation rate drops to 4.3%, down from 5.2% in August and the lowest reading since the start of the Ukraine war. Croatia had the highest inflation in the Eurozone at 7.3%, whereas the Netherlands had the lowest at -0.3%.

German inflation fell to lowest level since start of Ukraine war as the economy continued to slow. Prices rose by just 4.3% in September, below estimates of 4.5% and down from the 6.4% reading in August.

India suspends visa services for Canadians as the relationship worsens. It began after Canada announced it was investigating “credible allegations” that the Indian government orchestrated the slaying of a Sikh separatist in Canada.

Tokyo CPI inflation misses expectations in September amid some cooling in consumer spending. The index rose 2.5% for the year, which was below expectations of 2.6%, and down from August’s print of 2.8%.

Tech ⚡

Amazon to invest up to $4 billion in Anthropic, a rival to ChatGPT developer OpenAI. The move underscores Amazon’s aggressive AI push as it looks to keep pace with rivals such as Microsoft and Alphabet’s Google.

ChatGPT can now speak, listen, and process images in a new update that will also integrate browsing and data from after September 2021. The update will be rolling out to paying users in the next two weeks.

Meta announces new Quest 3 VR headset starting at $499. The defining feature of the new headset is the ability to quickly see the outside world, which will make the device less isolating and more comfortable to use for long periods.

Meta rolls out new AI feature sets from chatbots that can create photo-realistic images, as well as Ray-Ban smart glasses that can answer questions, perform language translation, and even live stream from an embedded camera.

Meta’s Threads struggles to grow amid rivalry with Elon Musk’s X. With only 23.7 million U.S. users, Threads ranks near the bottom of the most popular social apps, ahead of only Tumblr.

Mixin Network loses nearly $200M in hack of assets on its mainnet. Mixin is a service similar to a layer-2 protocol, designed to make cross-chain transfers cheaper and more efficient.

Three Arrows Capital co-founder arrested in Singapore while attempting to flee. Su Zhu and his co-founder, Kyle Davies, have both been sentenced to four months in prison.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - ISM Manufacturing PMI (SEP)🇺🇸

US - S&P Manufacturing PMI (SEP)🇺🇸

EU - Eurozone Manufacturing PMI (SEP)🇪🇺

AU - RBA Interest Rate Decision (OCT)🇦🇺

Tuesday

US - JOLTs Job Openings (AUG)🇺🇸

Earnings Reports: McCormick💰

Wednesday

US - ADP Employment (SEP)🇺🇸

US - ISM Non-Manufacturing PMI (SEP) 🇺🇸

US - S&P Services PMI (SEP)🇺🇸

Thursday

CA - Ivey PMI (SEP)🇨🇦

JP - Household Spending (AUG)🇯🇵

Earnings Reports: Constellation Brands, ConAgra💰

Friday

US - Nonfarm Payrolls (SEP)🇺🇸

US - Avg. Hourly Earnings (SEP)🇺🇸

CA - Employment Report (SEP)🇨🇦

DE - Factory Orders (AUG)🇩🇪

Want to partner with Sunday Morning Markets? Click here to inquire.