What Moved The Markets This Week 📈

Home Sales Plunge To 14 Year Low, Threads User Activity Collapsing, Fed Launches FedNow Instant Payments, Meta's New Llama2 AI Model, Ford Cuts F150 EV Prices, and Tesla + Netflix + Amex Earnings

Sunday Morning Markets

Trading Week 29, covering Monday, July 17 through Friday, July 21. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Fed launches FedNow instant-payment service

Existing home sales drop to slowest pace in 14 years

Inflation cools in Canada and the United Kingdom

China’s economy struggles to grow and reopen

Ford cuts F-150 Lightning price by $10K

Meta’s Threads user engagement is collapsing

Headlines out of the AI industry:

Meta launches its Llama 2 model

Apple rushing to build its own GPT-like chatbot

Microsoft to charge $30/mo for AI features

Wix launches AI website building tool

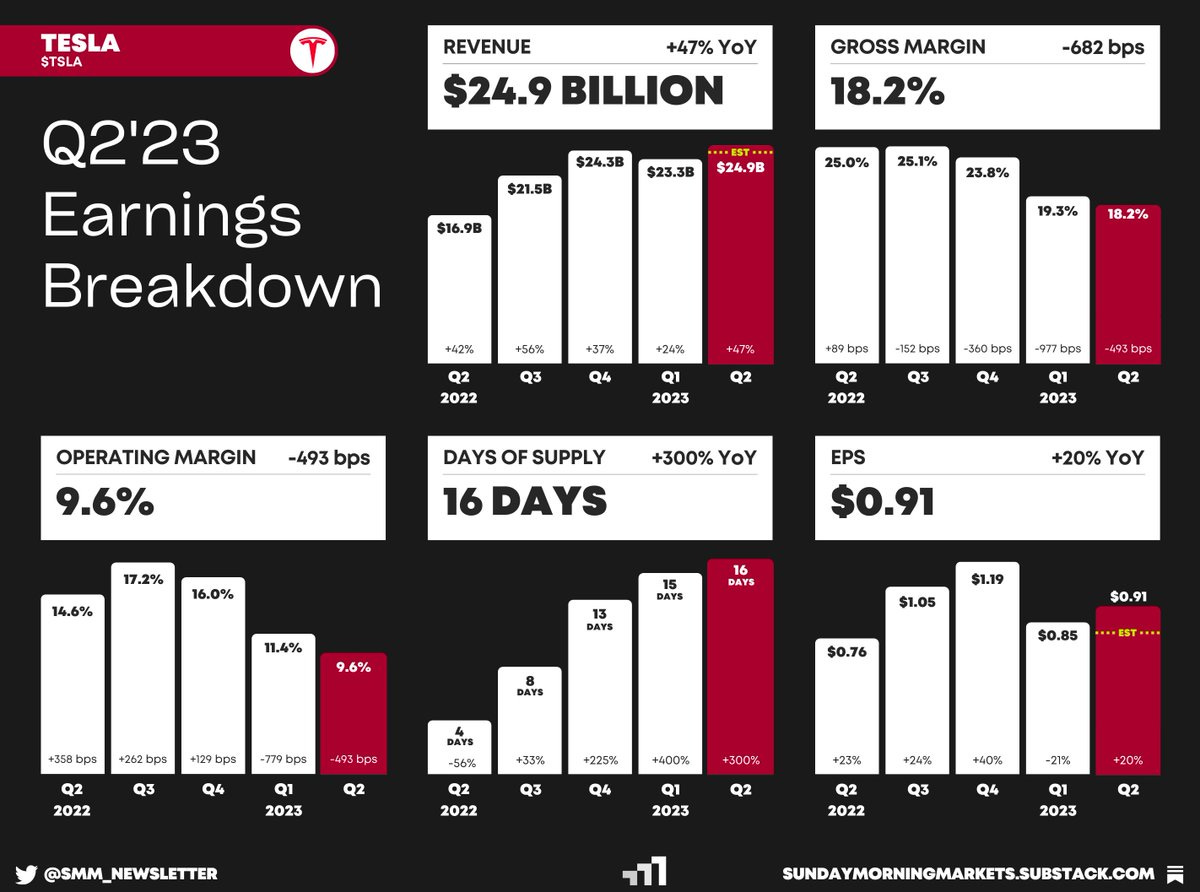

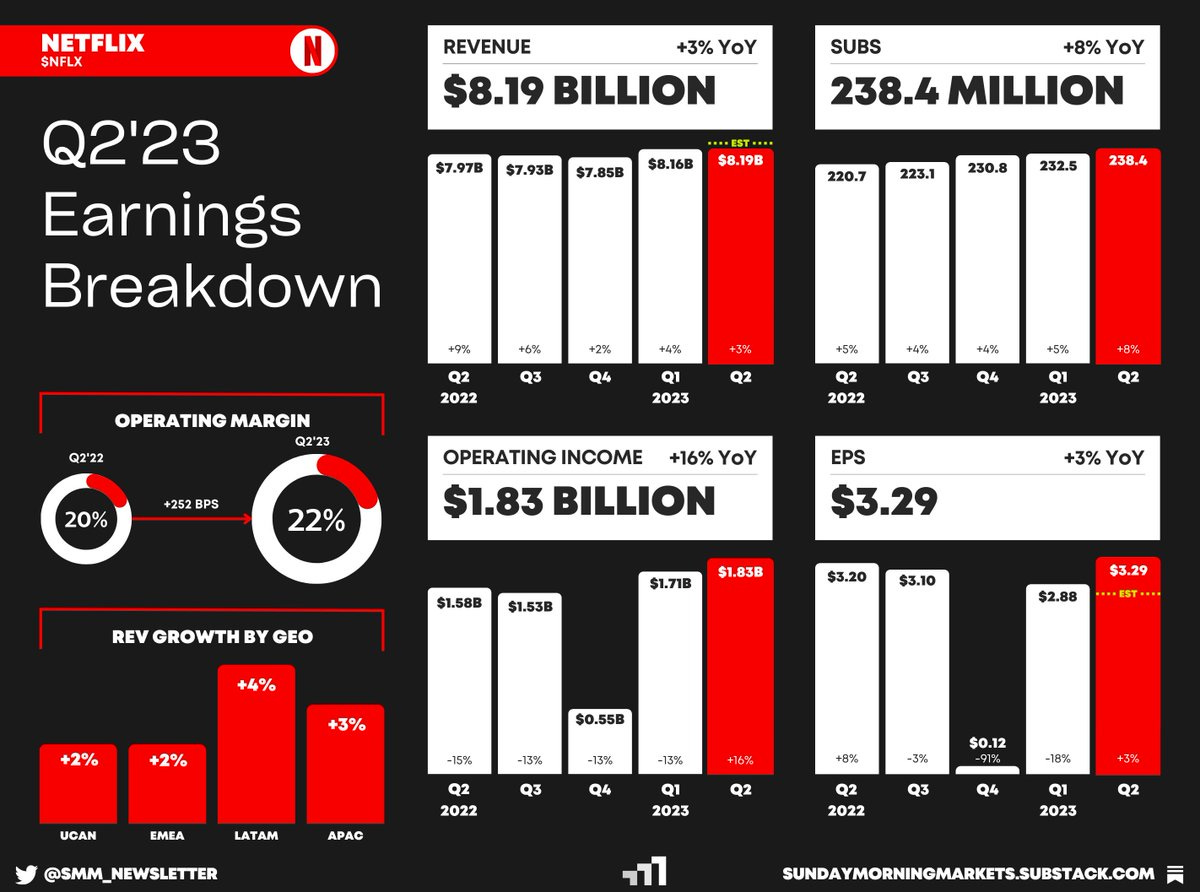

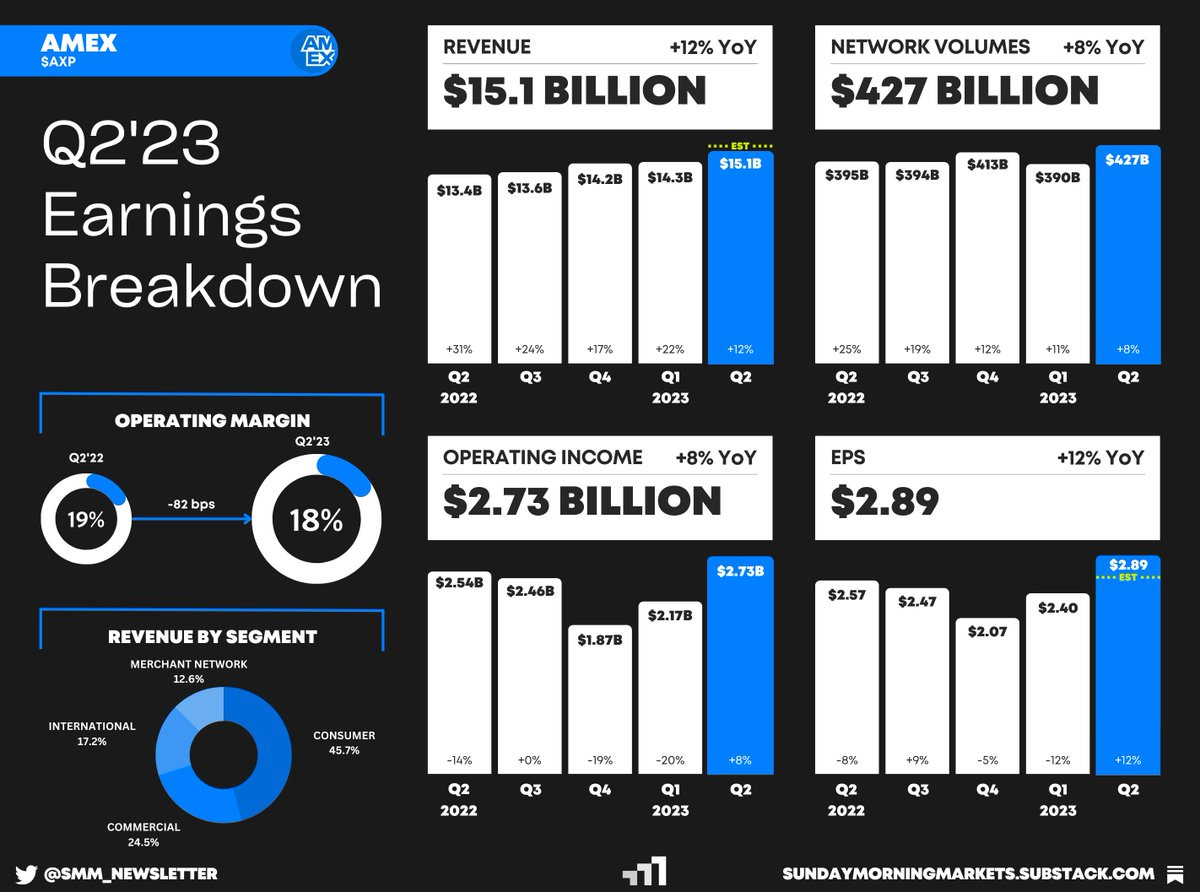

Earnings from Tesla, Netflix, and Amex — see breakdowns below

US Markets 🇺🇸

Existing home sales drop to the slowest pace in 14 years as low supply chokes the market. June home sales were 18.9% lower compared with last year, falling to a seasonally adjusted annualized rate of 4.16 million units.

Federal Reserve launches new FedNow payment service allowing for instant transfers between banks and their consumers. So far, 35 early adopters, including JPMorgan Chase and Wells Fargo have signed up.

U.S. retail sales rise just 0.2% in June reflecting a shift in consumer spending habits and signaling softness in some parts of the U.S. economy. The shortfall stemmed mainly from a decline in spending at gas stations.

U.S. Leading Economic Index (LEI) fell again in June, marking the 15th consecutive month of declines. The index is now down 7.82% versus the year prior, a level consistent with previous recessions.

Goldman Sachs cuts probability of a recession in the next year following a slew of positive economic data. They now only believe there is a 20% to 25% chance the U.S. experiences a recession in the next twelve months.

TSMC delays the start of its Arizona chip factory due to a shortage of skilled labor. The company noted they’re sending trained technicians from Taiwan to train local workers. Apple has plans to use chips built at that plant.

Ford cuts the price of its F-150 Lightning by $10K saying its efforts to boost production and lower costs for battery minerals have paid off. The starting price of the cheapest version of the truck now starts at $50,000.

Rest of World 🌏

Canada’s inflation falls to a 27-month low of 2.8% in June, led lower by energy prices. However, food and shelter inflation persists despite 10 interest rate hikes in less than 18 months. Analysts were expecting inflation to drop to 3%.

China misses their Q2 GDP growth estimates as the economy struggles to reopen as planned. The economy grew 0.8% in the second quarter, slower than the 2.2% QoQ pace recorded in the first three months of the year.

Inflation in the UK cooled off dramatically in June as the CPI fell to 7.9% (vs 8.2% est.), down from May’s reading of 8.7%. CPI seems to have peaked at 11.1% in October. Excluding food & energy, core inflation also fell to 6.9% (vs 7.1% est.)

Russia axes landmark grain deal with Ukraine just hours before the deadline. First signed in July 2022, the U.N.-brokered Black Sea Grain Initiative has been repeatedly extended in short increments.

Netflix starts password crackdown in India and every other global market after its previous limited rollout helped add nearly 6 million new subscribers in Q2. Netflix has struggled to continue its amazing growth seen in ‘20 and ‘21.

Tech ⚡

Meta opens its AI model to commercial use giving startups and businesses a powerful free alternative to pricey models sold by OpenAI and Google. Their model, called Llama 2, will be distributed using Microsoft’s Azure cloud services.

Meta’s Threads user engagement collapses from the peaks seen just a few weeks ago. Data show user engagement has fallen 70% as executives focus on options such as a chronological feed.

Apple is now rushing to build its own LLM to compete with the likes of OpenAI’s ChatGPT, Google’s Bard, and Meta’s Llama 2. Apple’s AI team called Ajax is building a chatbot some call “Apple GPT”.

Microsoft to charge $30/month for an AI subscription that integrates intelligent tooling with its Microsoft365 apps. Including the subscription to Copilot, the monthly cost of enterprise plans could increase as much as 83%.

Amazon to launch “pay-by-palm” technology at all Whole Foods stores by year-end. Amazon One will allow users to enter and pay for items by swiping their hand over a kiosk. The company is marketing the technology to third parties.

Tesla builds its first cyber truck after years of delays. Musk said volume production for the truck will start in 2024. Wall Street expects fewer than 10K deliveries this year, but closer to 100K in 2024.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - S&P Services PMI (JUL)🇺🇸

Europe - S&P Composite PMI (JUL)🇪🇺

Germany - HCOB Manufacturing PMI (JUL)🇩🇪

Earnings Reports: Dominoes, F5 Networks💰

Tuesday

US - CB Consumer Confidence (JUL)🇺🇸

Germany - Ifo Business Climate (JUL)🇩🇪

Earnings Reports: Microsoft, Alphabet, Visa, Louis Vuitton, Texas Instruments, NextEra Energy, Verizon, Raytheon, Unilever, General Electric, General Motors, Spotify, Snap, Teladoc, Jetblue💰

Wednesday

US - FOMC Interest Rate Decision🇺🇸

US - New Home Sales (JUN)🇺🇸

Earnings Reports: Meta, CocaCola, Boeing, ServiceNow, AT&T, Chipotle, Hilton, eBay💰

Thursday

US - GDP (Q2)🇺🇸

US - Durable Goods Orders (JUN)🇺🇸

US - Pending Home Sales (JUN)🇺🇸

Europe - ECB Interest Rate Decision 🇪🇺

Earnings Reports: Mastercard, AbbVie, Mcdonalds, T-Mobile, Intel, Volkswagen, Ford, Roku💰

Friday

US - PCE Inflation (JUN)🇺🇸

Germany - CPI Inflation (JUL)🇩🇪

Earnings Reports: Exxon Mobil, Chevron, Proctor & Gamble, Hermes International, AstraZeneca💰

Want to partner with Sunday Morning Markets? Click here to inquire.