What Moved The Markets This Week

Black Friday Breaks Records, U.S. Payrolls Surge, US-China Chip War Escalates, Intel CEO Ousted, Waymo Expands To Miami, and CRM + LULU + ZS Earnings

Sunday Morning Markets

Trading Week 49, covering Monday, Dec 2 through Friday, Nov 6. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Payrolls Jump: U.S. adds 227K jobs in November, topping estimates.

Black Friday: Global sales hit record $74.4B, U.S. spending up 10%.

SEC Pick: Trump to nominate Paul Atkins as SEC chair.

Intel Shake-Up: CEO Pat Gelsinger ousted. Stock down 56% this year.

Chip War: U.S. blocks China from advanced chips. Beijing retaliates.

SMCI Cleared: Fraud claims dismissed, shares surge 30%.

TSMC-Nvidia: New Arizona fab to make advanced Nvidia AI chips.

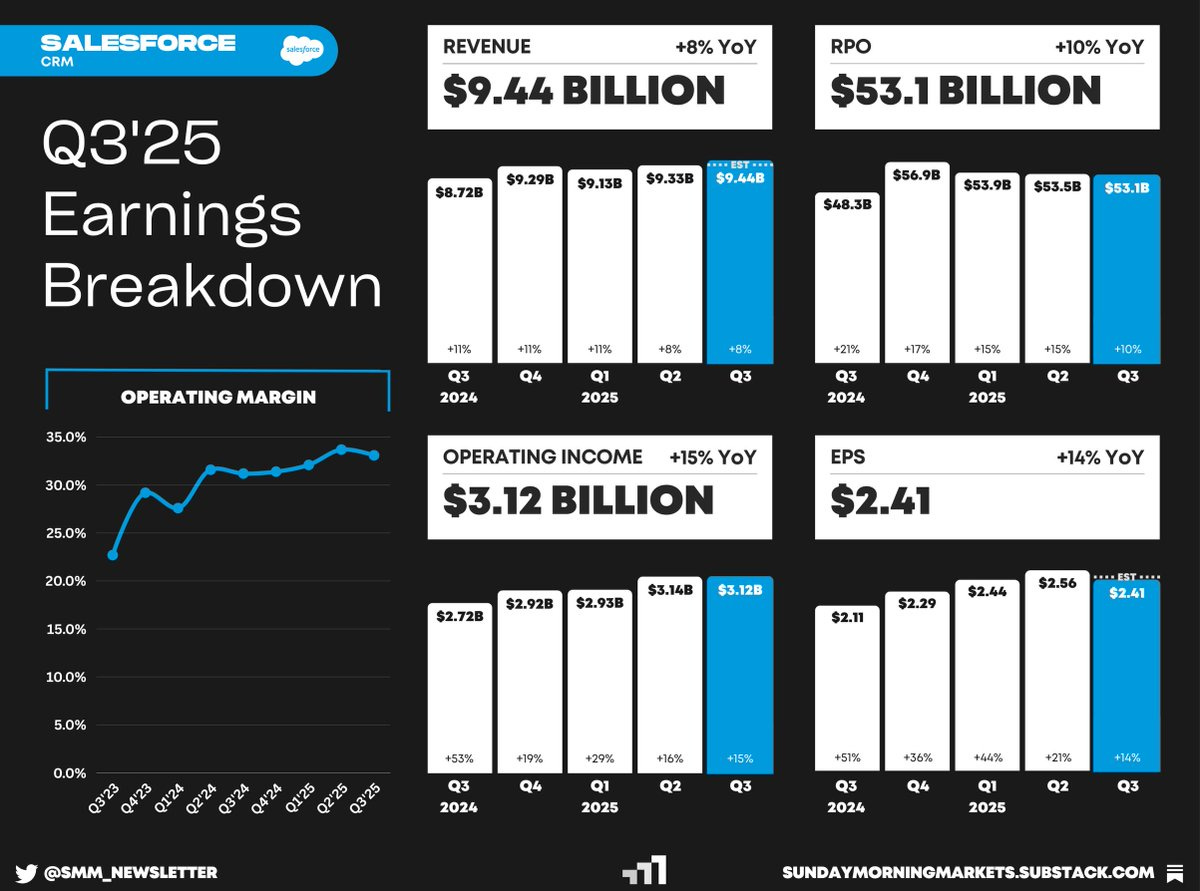

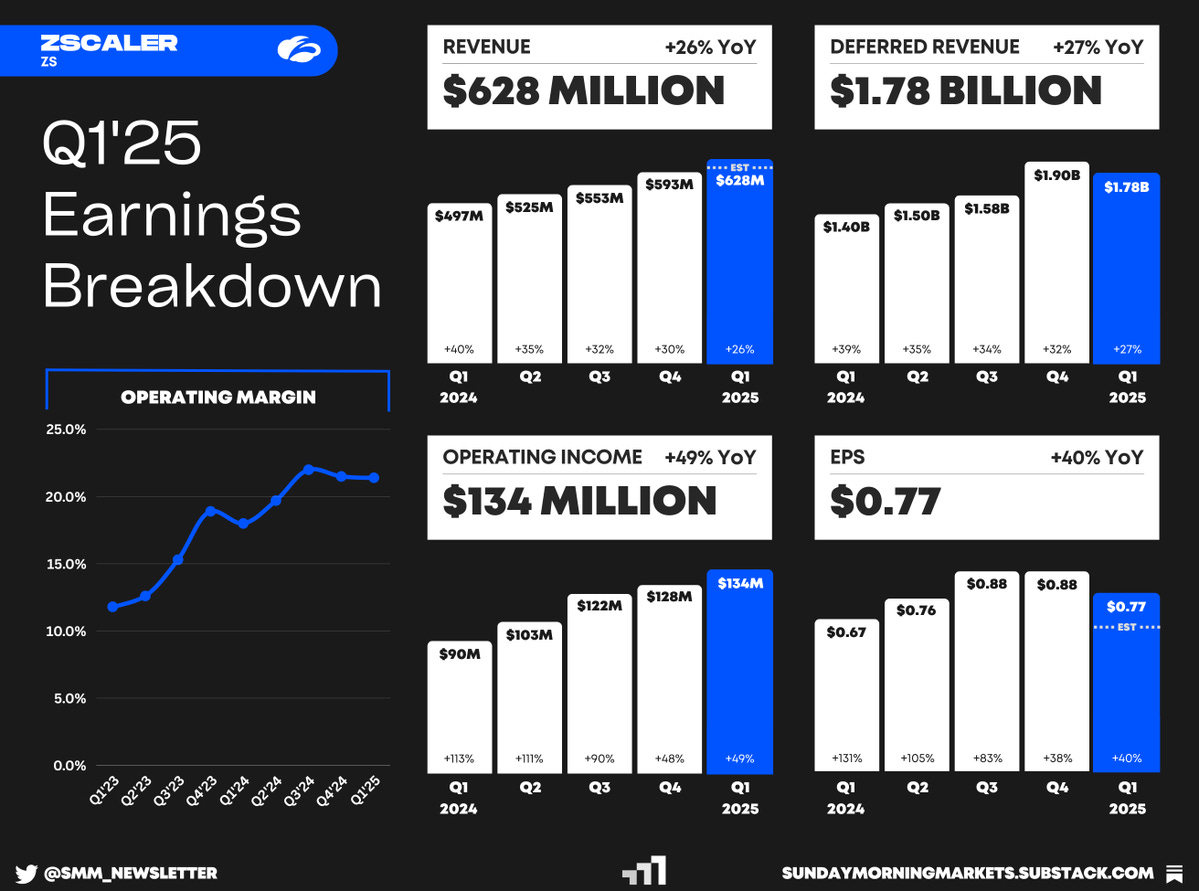

Earnings: Salesforce, Lululemon, and ZScaler

US Markets 🇺🇸

U.S. payrolls grew by 227,000 in November, topping estimates, with job gains in healthcare, hospitality, and government. The unemployment rate edged higher to 4.2%, boosting Fed rate cut odds.

Black Friday sales hit record $74.4B globally with U.S. spending soaring 10.2% to $10.8B. Mobile purchases dominated, and AI chatbot usage for finding deals skyrocketed 1800% YoY.

Trump to nominate Paul Atkins as SEC chair, signaling a deregulatory shift. Atkins, a former SEC commissioner, is set to replace Gary Gensler, easing oversight of financial markets.

U.S. services sector growth slowed in November, with PMI falling to 52.1 as new orders and employment eased. Meanwhile, factory activity contracted for the 8th month, with PMI hitting 48.4.

Intel CEO Pat Gelsinger ousted by board as market share losses and failed AI strategies weigh on the company. Interim co-CEOs named as Intel's stock is down 52% this year.

Musk loses bid to reinstate $56B Tesla pay package after a Delaware judge upheld her ruling, citing flawed approval processes. The plaintiff’s lawyers were awarded $345M in fees. Tesla plans to appeal.

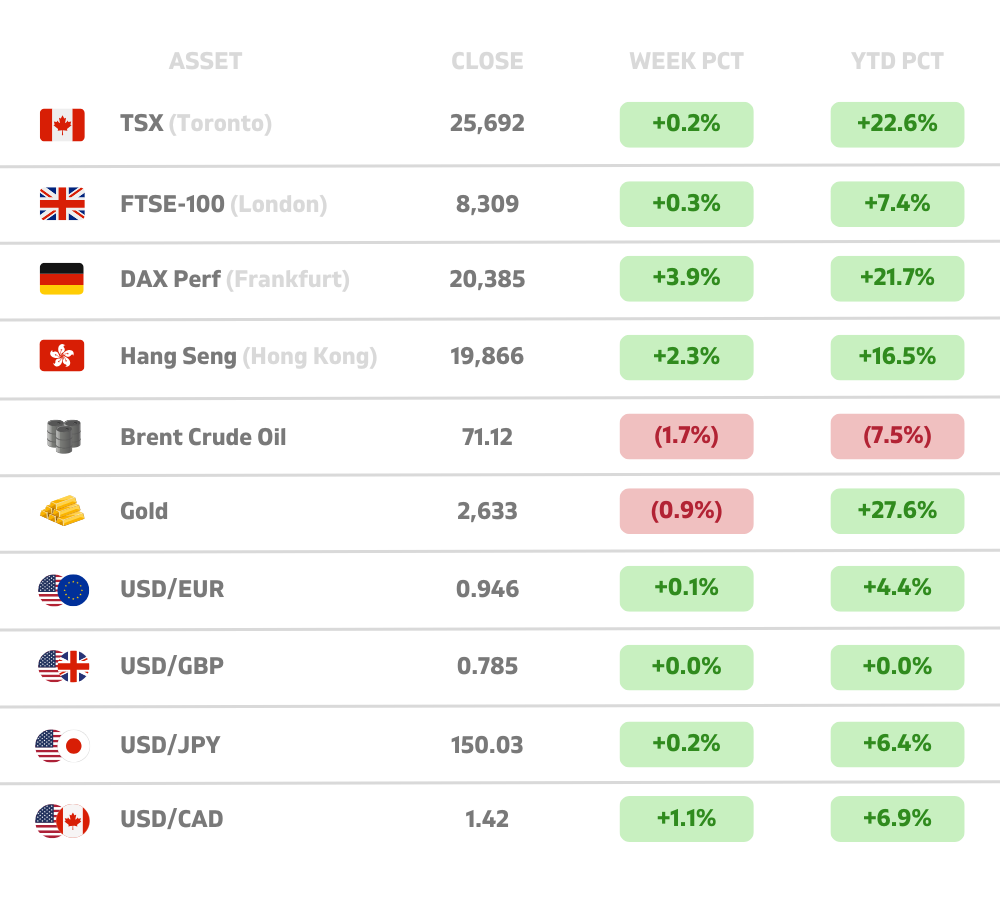

Global Markets 🌏

US-China chip war tensions escalate after the US blocked Chinese access to advanced memory chips, AI tools, and semiconductor equipment. Beijing countered with a critical mineral export ban.

World economy to accelerate in 2025, growing 3.3% as inflation cools, according to the OECD. However, they warn that higher U.S. tariffs and fiscal imbalances could derail the fragile recovery.

China’s central bank pledges bold support by cutting financing costs, boosting liquidity, and reforming policies. The tools will target tech, green finance, and real estate recovery.

OPEC+ postpones production hikes to 2026 amid weak global demand forecasts. Members extended cuts by 3.9M barrels/day, reflecting tepid price recovery and market uncertainty.

South Korea's president retracts martial law after accusing opposition of pro-North Korea rebellion. Swift parliamentary defiance and protests forced the dramatic reversal.

Canada’s services PMI hits a 19-month high at 51.2, buoyed by job growth and lower interest rates. However, weak new business and looming U.S. tariffs on Canadian exports dampen optimism.

Tech ⚡

Super Micro cleared of fraud claims after a special committee found no ‘evidence of misconduct’. Shares of the stock surged 30% on the news, but delayed filings still threaten its Nasdaq listing.

Apple adopts Amazon’s custom AI chips, Trainium2 and Inferentia, for tasks like search and AI model pretraining, gaining up to 50% efficiency. The move signals confidence in non-Nvidia AI solutions.

TSMC in talks with Nvidia to produce AI chips in Arizona, sources say. Blackwell chips will be made in the U.S. but shipped to Taiwan for final packaging due to CoWoS capacity limits.

Waymo to launch Miami robotaxi service by 2026 causing shares of Uber to plunge 10%. The company continues to expand its reach after successes in Phoenix, San Francisco, and Los Angeles.

Elon Musk sues to block OpenAI’s for-profit shift, claiming antitrust violations and improper ties with Microsoft. Musk alleges the move stifles xAI’s access to investments.

Palantir and Anduril team up for AI-driven defense solutions. Together, they’ll streamline data for AI training, aiming to deploy advanced models in national security systems.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

CN - CPI Inflation 🇨🇳

CN - PPI Inflation 🇨🇳

CN - Imports & Exports 🇨🇳

Earnings: Oracle, MongoDB, C3.ai, Braze💰

Tuesday

DE - CPI Inflation 🇩🇪

AU - RBA Interest Rate Decision 🇦🇺

Earnings: GameStop💰

Wednesday

US - CPI Inflation 🇺🇸

US - Fed Interest Rate Decision 🇺🇸

CA - BOC Interest Rate Decision 🇨🇦

Earnings: Adobe, Lennar💰

Thursday

US - Jobless Claims 🇺🇸

US - PPI Inflation 🇺🇸

EU - ECB Interest Rate Decision 🇪🇺

CH - SNB Interest Rate Decision 🇨🇭

Earnings: Broadcom, Costco, RH💰

Friday

UK - Imports and Exports 🇬🇧

CN - New Loans 🇨🇳

Want to partner with Sunday Morning Markets? Click here to inquire.