What Moved The Markets This Week

TSMC Arizona Chip Yield Surpasses Taiwan, Home Sales Plummet, Boeing Explores Sale Of Space Business, China and Canada Cut Interest Rates, Capri Merger Blocked, and TSLA + NOW + VRT Earnings

Sunday Morning Markets

Trading Week 43, covering Monday, Oct 21 through Friday, Oct 25. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Home sales plummet, prices still rise to $404,500

TSMC’s Arizona chip yields surpass Taiwan’s

Tapestry merger with Capri blocked, shares collapse

China, Canada cut interest rates

Israel conducts airstrikes in Iran

Boeing explores sale of its space business

Anthropic’s new model can control your PC

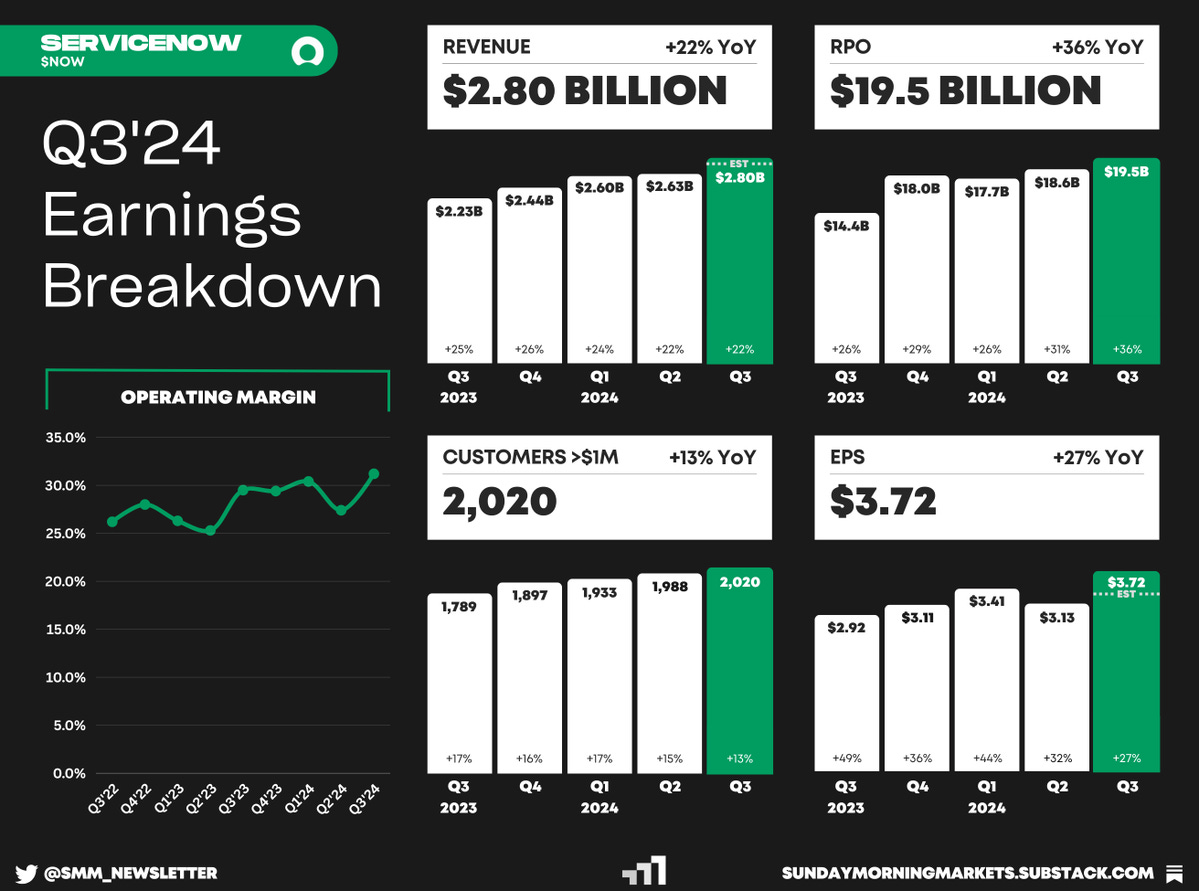

Earnings from Tesla, ServiceNow, and Vertiv

US Markets 🇺🇸

Home sales plummet to the lowest level since 2010 as rising mortgage rates and high prices stall demand. Despite softening sales, median home prices still rose 3% year-over-year to $404,500.

Boeing explores sale of its space business and other NASA projects including Starliner. The new CEO Kelly Ortberg plans to streamline the business amid financial strains and rising competition with SpaceX.

Judge blocks Tapestry’s $8.5B merger with Capri, citing FTC concerns over competition and pricing. Shares of Capri, who owns brands like Michael Kors and Versace, crashed 49% in Friday’s trading session.

McDonald’s hit by an E. coli outbreak causing 22 hospitalizations and one death, the CDC reports. Shares plunged 10% as the company investigates slivered onions as a possible source.

Boeing’s machinist strike deepens financial woes as workers reject a new labor contract, extending the 5-week work stoppage. After losing over $6 billion last quarter, the CEO warned cash burn will persist through 2025.

Peloton partners with Costco to sell its Bike+ at a discount in 300 U.S. stores and online, aiming to attract younger, affluent customers. Shares of Peloton surged on the news, up 10% this week.

Global Markets 🌏

China reduces key lending rates by 25 basis points, lowering the one-year loan prime rate to 3.1% and the five-year to 3.6%, aiming to stimulate its struggling economy. Analysts suggest further fiscal stimulus is needed.

Bank of Canada cuts rates by 50 basis points to 3.75%, the fourth straight cut as inflation hits 1.6%. Governor Tiff Macklem says Canada has reached its inflation target, signaling more possible cuts ahead.

Israel’s airstrikes on Iran mark a new escalation, targeting missile sites to send a warning. Though both sides seem cautious, risks of miscalculation and wider conflict loom.

Eurozone’s economy stagnates on weak German and French output, with October's private-sector activity barely improving. As inflation cools, the ECB may pursue rate cuts to offset declining demand.

Putin touts BRICS as alternative to West at Kazan summit, aiming to strengthen ties with emerging economies. The event focused on BRICS expansion, financial independence, and conflict de-escalation efforts.

Chinese smartphone maker Oppo doubles down on AI, holding weekly talks with Google and Microsoft to enhance its AI capabilities. Oppo aims to boost product innovation and factory automation.

Tech ⚡

TSMC’s Arizona chip yields surpass Taiwan's, marking progress for U.S. semiconductor manufacturing. The Arizona plant, aided by CHIPS Act funding, has a higher output yield despite initial delays and labor issues.

Anthropic unveils model that can control your PC, allowing Claude 3.5 Sonnet to interact with software via a new API. This AI can mimic mouse gestures and keystrokes to automate complex PC tasks.

Amazon’s new warehouse will have 10x more robots, using advanced AI and robotics to boost efficiency and safety. Located in Shreveport, the facility will be roughly the same size as 55 football fields.

Waymo raises $5.6B to expand robotaxi services, partnering with Uber and moving into new U.S. cities beyond LA, Phoenix, and SF. It currently runs over 100,000 trips weekly.

Elon Musk’s xAI launches Grok API, offering access to its generative AI model for $5 per million tokens. The API supports external tool connections, as xAI aims to compete with OpenAI and Anthropic.

Tesla may test autonomous ‘Cybercabs’ in Palo Alto, collaborating with the city to address a rideshare program facing financial issues. The project aims to fill gaps in Palo Alto's Link shuttle service, which is struggling with costs.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

CA - Wholesale Sales 🇨🇦

Earnings: On, Ford💰

Tuesday

US - JOLTs Job Openings 🇺🇸

US - CB Consumer Confidence 🇺🇸

AU - CPI Inflation 🇦🇺

Earnings: Alphabet, AMD, Chipotle, Visa, PayPal, Sofi, Mcdonalds, Pfizer, Jetblue, Reddit, First Solar💰

Wednesday

US - GDP Growth 🇺🇸

US - ADP Job Report 🇺🇸

US - Pending Home Sales 🇺🇸

EU - GDP Growth 🇪🇺

DE - GDP Growth 🇩🇪

CN - Chinese Composite PMI 🇨🇳

JP - BOJ Interest Rate Decision 🇯🇵

Earnings: Microsoft, Meta, Booking, Starbucks, DoorDash, Coinbase, Robinhood, Eli Lilly, Roku, Twilio, Etsy, Riot💰

Thursday

US - Jobless Claims 🇺🇸

US - PCE Inflation 🇺🇸

US - Personal Savings 🇺🇸

US - Chicago PMI 🇺🇸

EU - CPI Inflation 🇪🇺

CN - Caixin Manf. PMI 🇨🇳

Earnings: Apple, Amazon, Uber, Intel, Mastercard, Atlassian, Peloton💰

Friday

US - Nonfarm Payrolls 🇺🇸

US - ISM Manf. PMI 🇺🇸

US - Unemployment Rate 🇺🇸

Earnings: Exxon, Chevron, Fubo, Wayfair💰

Want to partner with Sunday Morning Markets? Click here to inquire.