What Moved The Markets This Week

China and U.S. Agree To 90-Day Truce, DOJ Probes UnitedHealth For Fraud, Saudi Inks $600B Deal With Trump, Moody's Downgrades U.S. Credit Rating, Etoro and Hinge IPO, and SE + NU + MNDY Earnings

Sunday Morning Markets

Trading Week 20, covering Monday, May 12 through Friday, May 16. Your weekly financial markets update, in less than 5 minutes.

Note: Sunday Morning Markets will not be publishing next week but will be back the following week with the latest market news and insights.

The Week In Review ⏪

China Tariff Truce: U.S., China slash tariffs in 90-day deal.

U.S. Inflation Cools: CPI slows to 2.3%, PPI falls 0.5% in April.

Credit Downgrade: Moody’s cuts U.S. rating to Aa1 over rising deficits.

Riyadh Meeting: U.S. secures $600B Saudi deal, removes Syria sanctions.

Japan Slumps: Q1 GDP contracts 0.7%, stoking recession fears.

UnitedHealth Tumbles: DOJ probe triggers stock drop; CEO exits.

Nvidia’s Mega Deal: Sells 18K AI chips to Saudi Arabia in record sale.

IPO Boom: eToro, Hinge Health go public; Chime files for IPO.

Tech M&A: Databricks buys Neon for $1B; Robinhood acquires WonderFi.

Slate Auto: Crosses 100K reservations for $20K electric truck.

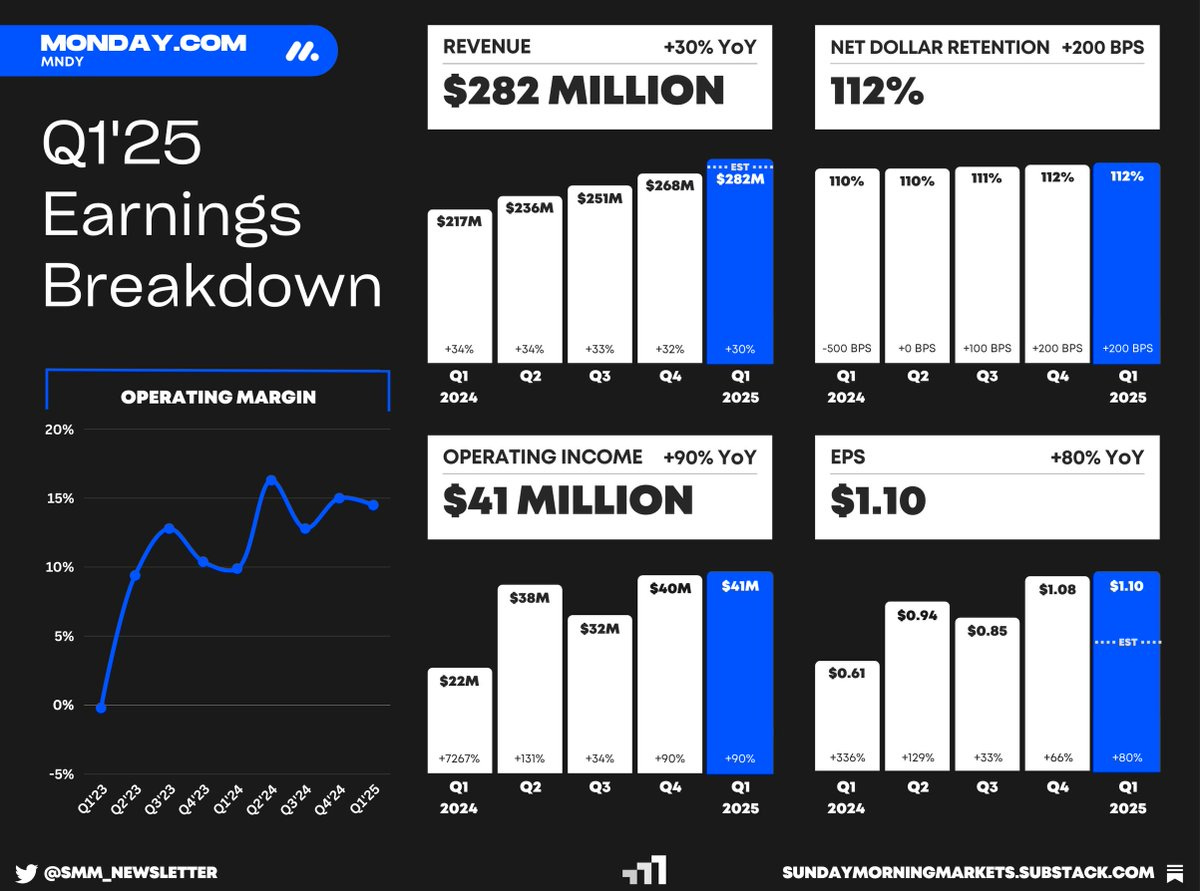

Earnings: Sea Ltd, Nu Holdings, Monday.com

US Markets 🇺🇸

Consumer inflation drops to 2.3% in April, below estimates as CPI hits the lowest level since 2021. Producer prices also unexpectedly fell 0.5% in April, as companies absorbed rising tariff costs, straining profit margins.

Moody’s downgrades U.S. credit rating to Aa1, citing massive deficits and escalating interest costs, leaving the U.S. without a top-tier rating for the first time in history.

House Budget Committee blocks Trump agenda bill, as five GOP conservatives join Democrats to block it over deficit concerns. Republican leaders scramble to revise tax and Medicaid provisions.

UnitedHealth faces DOJ probe over Medicare fraud, triggering a 50% stock plunge in just over a month. CEO Andrew Witty also unexpectedly stepped down amid mounting legal and financial turmoil this week.

Trump pushes to lower drug costs with new EO, tying U.S. prices to those abroad as Americans pay up to 17x more for some medications. The pharmaceutical industry warns the policy could stifle innovation.

U.S. budget surplus hits $258B in April, driven by record tax receipts and a 78% jump in tariff revenue. However, the year-to-date deficit rose 23% to $1.05 trillion, with interest rates up slightly.

Coinbase to join S&P500 as Bitcoin tops $100K, replacing Discover Financial after reporting a 24% increase in revenue and a $2.9 billion acquisition of Deribit to expand its global reach.

Global Markets 🌏

U.S. and China slash tariffs in 90-day truce, easing trade tensions as Washington cuts duties on Chinese goods from 145% to 30% and Beijing lowers U.S. tariffs to 10%, sparking global market rallies.

Japan’s economy contracts 0.7% in Q1 amid trade tensions, with falling exports and flat consumption fueling recession fears and complicating the Bank of Japan’s plans to resume rate hikes.

UK economy grows 0.7% in Q1, outpacing G7 peers, driven by strong services and export gains. Economists warn that looming U.S. tariffs and business tax hikes threaten future growth.

White House announces $600B Saudi investment in U.S., including a $142B defense deal and major tech partnerships. Trump also lifted Syria sanctions during his visit to Riyadh.

Nvidia to sell 18,000 advanced AI chips to Saudi Arabia, its largest deal in the region, as Humain plans to build massive data centers backed by the Saudi Public Investment Fund.

UK labor market cooled in March as wage growth fell to 5.6% and unemployment rose to 4.5%. However, BOE Deputy Gov. Lombardelli warns wage growth still well exceeds the bank’s 2% inflation target.

Tech ⚡

eToro and Hinge Health go public, while Chime files for IPO, signaling renewed investor confidence. eToro now trades under ticker ETOR, Hinge under HNGE, and Chime will soon trade under CHYM.

OpenAI unveils Codex, an AI coding agent, designed to autonomously handle tasks like writing code, debugging, and testing within sandboxed environments, aiming to boost developer productivity.

Apple blocks Fortnite's App Store return, leaving iOS users worldwide without access as Epic Games accuses Apple of defying court orders in their ongoing legal battle.

Slate Auto hits 100,000 reservations for $20K EV truck, just two weeks after unveiling the customizable electric pickup. Production capacity is projected to reach 150,000 vehicles annually by 2027.

Tech M&A activity heats up as Databricks acquires Neon, an open-source database startup, for $1B. Robinhood also snapped up Canadian crypto firm WonderFi for $179 million, expanding its international reach.

ESPN unveils new all-access streaming app starting at $30/month, featuring live games and exclusive content not available on ESPN+. There will also be a $36/month bundle that includes Disney+ and Hulu.

Earnings Reports 💰

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - CB Leading Index 🇺🇸

EU - CPI Inflation 🇪🇺

CN - Interest Rate Decision 🇨🇳

CN - Unemployment Report 🇨🇳

Earnings: Trip.com💰

Tuesday

CA - CPI Inflation 🇨🇦

AU - RBA Interest Rate Decision 🇦🇺

JP - Trade Balance 🇯🇵

Earnings: Palo Alto Networks, Pony AI, Home Depot💰

Wednesday

UK - CPI Inflation 🇬🇧

EU - ECB Non-Policy Meeting 🇪🇺

Earnings: Snowflake, Zoom, Target, Baidu, Xpeng💰

Thursday

US - Jobless Claims 🇺🇸

US - Existing Home Sales 🇺🇸

US - S&P Composite PMI 🇺🇸

UK - S&P Composite PMI 🇬🇧

EU - HCOB Composite PMI 🇪🇺

Earnings: AutoDesk, Intuit💰

Friday

US - New Home Sales 🇺🇸

CA - Retail Sales 🇨🇦

UK - Retail Sales 🇬🇧

DE - GDP Growth 🇩🇪

Want to partner with Sunday Morning Markets? Click here to inquire.