What Moved The Markets This Week

OpenAI Launches New Search Engine, AI Fuels Cloud Demand, Labor Market Stalls, China’s Economy Shows Growth, and Big Tech Earnings: MSFT, GOOG, AMZN, META, AAPL

Sunday Morning Markets

Trading Week 44, covering Monday, Oct 28 through Friday, Nov 1. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

GDP growth slows to 2.8%, below estimates

Job gains grind to a halt, +12K in October

PCE inflation eases to 2.1%, core PCE hits 2.7%

OpenAI launches new search engine

SMCI auditor resigns, shares plunge 30%

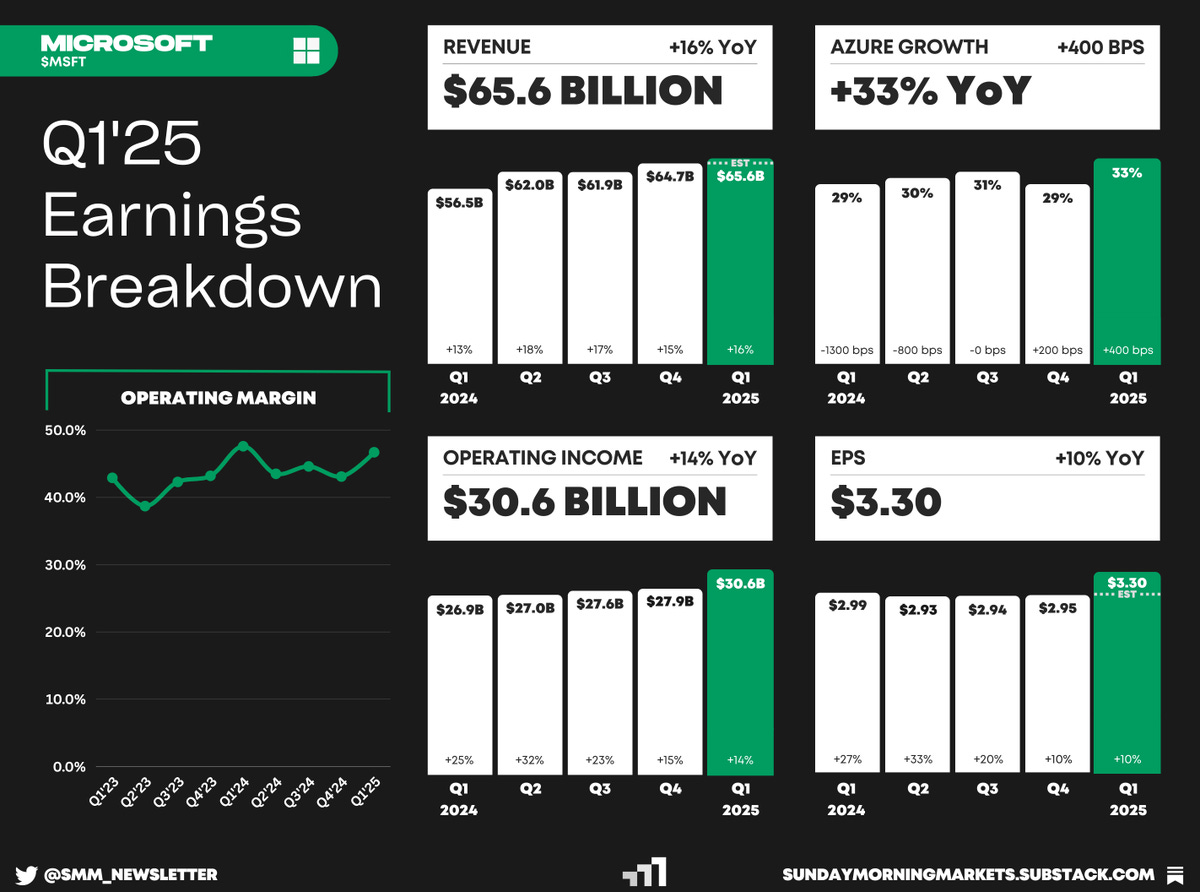

Strong cloud demand, Google Cloud +35%, Azure +33%, AWS +19%

China’s factory activity expands for first time in 6 months

Bank of Japan holds rates steady, hints at more hikes ahead

Earnings from Microsoft, Alphabet, Amazon, Apple, and Meta

US Markets 🇺🇸

U.S. economy added just 12,000 jobs in October, as hurricanes and the Boeing strike stifled growth. Revised data erased 112,000 jobs from prior months, raising concerns about labor market health.

U.S. GDP growth slows to 2.8% in Q3, below the 3.1% forecast. Strong consumer and federal spending boosted growth, but gains were limited by high imports and moderate inflation.

Fed's key inflation gauge hits 2.1% in September, meeting estimates and nearing the 2% target. However, core inflation rose to 2.7%, while consumer spending surpassed forecasts.

Job openings fell to 7.44M in September, the lowest since January 2021 and below the expected 8M. The data suggests a cooling labor market as the Fed’s interest rate decision nears.

Pending home sales jumped 7.4% last month, reaching their highest level since March as buyers took advantage of lower mortgage rates. However, with rates back over 7%, future gains may stall.

Major layoffs hit Dropbox, Visa, and Volkswagen as firms adjust to shifts in the global economy. Dropbox cut 20% of its workforce, Volkswagen 10%, and Visa less than 5%.

Global Markets 🌏

China's economy picks up steam as economic and factory activity show expansion for the first time in six months. The NBS official PMI rose to 50.1%, while the S&P manufacturing PMI rose to 50.3%.

Eurozone economy expands faster than expected, growing 0.4% in Q3. Boosted by consumer spending in France and Germany, the GDP report raises hopes for a soft landing.

Bank of Japan keeps interest rates steady at 0.25% as widely expected. Governor Ueda noted that a December hike could be in order with inflation near 2% and U.S. risks easing.

Eurozone inflation jumps to 2% in October, higher than expected. The report weakens the case for a larger rate cut from the ECB. Core inflation and services inflation were both unchanged from the previous month.

U.K. announces new set of tax hikes as part of Finance Minister Rachel Reeves’ first budget. Following the announcement, yields soared as markets priced in more gilt issuance and higher public spending plans.

China's Xiaomi delivered 20,000 EVs last month, just months after launch. They also opened preorders for the high-end SU7 Ultra, priced at 814,900 yuan ($114,304). Shares of Xiaomi are up 75% year-to-date.

Tech ⚡

OpenAI launches ChatGPT search, bringing real-time web results like sports, stocks, and news to users. This move intensifies competition with Google and Microsoft's Bing, enhancing search interactivity.

Cloud computing demand surges as AI fuels growth. Google Cloud’s revenue growth reaccelerated to 35% year-over-year, with Microsoft Azure growing 33% and Amazon Web Services up 19%.

OpenAI partners with Broadcom and TSMC on its first AI chip, focusing on inference efficiency while shelving its foundry plans. OpenAI will also add AMD chips to its lineup as compute demands soar.

Super Micro shares plunge 30% after auditor Ernst & Young resigned, citing concerns over internal controls, board independence, and accounting practices. The firm remains under federal investigation.

Apple rolls out Apple Intelligence with iOS 18.1, bringing AI features to iPhone 16 and 15 Pro models. Users can access new tools for text rewriting, notification summaries, and advanced Siri options by opting in.

Robinhood adds election trading, letting users buy Harris or Trump contracts amid growing demand for prediction markets. The move follows a key CFTC ruling impacting platforms like Kalshi and Polymarket.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

EU - Eurozone Manf. PMI 🇪🇺

CN - Caixin Services PMI 🇨🇳

AU - RBA Interest Rate 🇦🇺

Earnings: Palantir, Astera Labs, Hims, Constellation Energy, Berkshire, Marriott💰

Tuesday

US - Presidential Election 🇺🇸

US - ISM Services PMI 🇺🇸

US - S&P Services PMI 🇺🇸

US - Imports & Exports 🇺🇸

UK - Composite PMI 🇬🇧

Earnings: SMCI, Coupang, Ferrari, Global Foundries💰

Wednesday

US - Crude Oil Inventories 🇺🇸

CA - Ivey PMI 🇨🇦

EU - Composite PMI 🇪🇺

CN - Imports & Exports 🇨🇳

Earnings: Arm, MercadoLibre, Qualcomm, Hubspot, Zillow, Klayvio, Lyft, Celsius, Novo Nordisk💰

Thursday

US - Fed Interest Rate 🇺🇸

UK - BOE Interest Rate 🇬🇧

Earnings: Airbnb, Draftkings, TradeDesk, Cloudflare, Datadog, Fortinet, Block, Pinterest, Expedia, Toast, Rivian, Affirm, Unity💰

Friday

US - UMich Inflation Expectations 🇺🇸

CN - CPI Inflation 🇨🇳

CN - PPI Inflation 🇨🇳

Want to partner with Sunday Morning Markets? Click here to inquire.