What Moved The Markets This Week

Powell Pumps Brakes on Rate Cuts, Trump’s Bold Cabinet Picks, Inflation Climbs to 2.6%, SpaceX's Valuation Soars to $250B, and Earnings from Shopify, Disney, and Alibaba

Sunday Morning Markets

Trading Week 46, covering Monday, Nov 11 through Friday, Nov 15. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Inflation rises modestly. CPI +2.6%, Core CPI +3.3%

Powell says Fed isn’t in a rush to cut interest rates

Trump considers killing $7500 EV tax credit

SpaceX prepares tender offer at $250B valuation

AMD to lay off 1,000 employees

China retail sales rebound higher

Eurozone and U.K. economic growth lag estimates

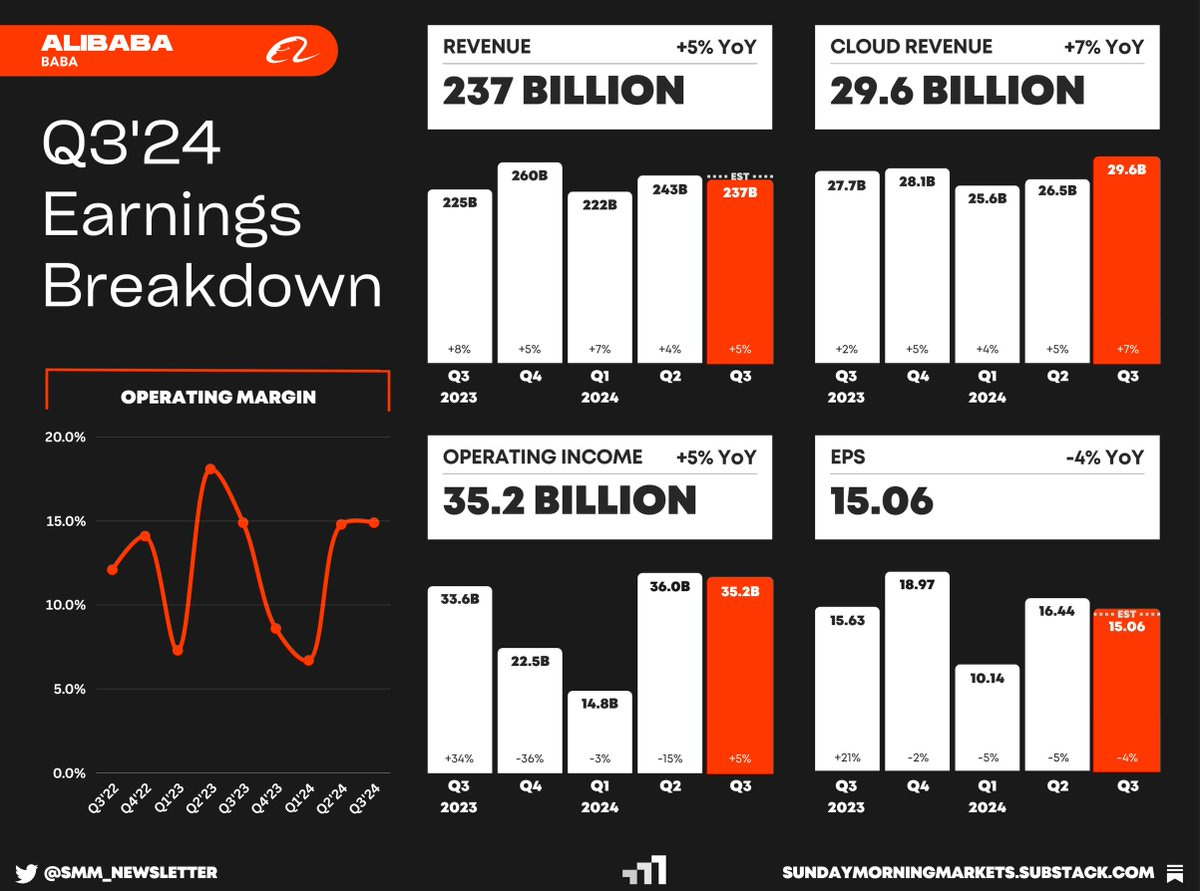

Earnings from Shopify, Disney, and Alibaba

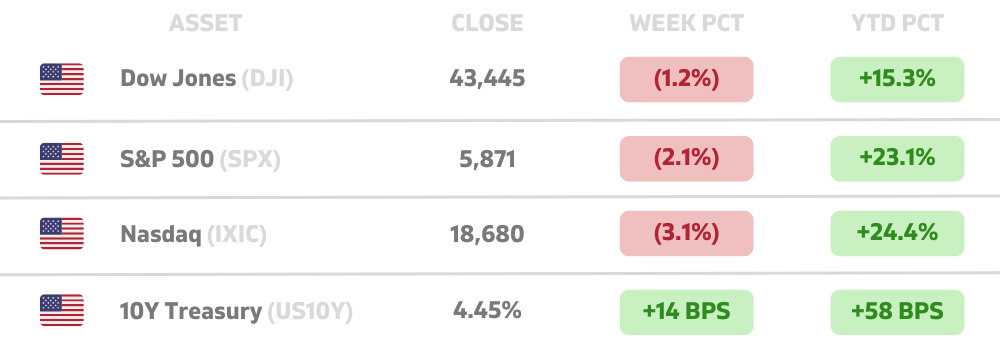

US Markets 🇺🇸

Powell says the Fed isn't rushing to cut rates, citing strong U.S. growth and steady labor markets. Markets see a 62% chance of a December quarter-point rate cut, according to CME’s FedWatch Tool.

Consumer inflation rose to 2.6% in October, led by higher shelter costs, while core CPI hit 3.3%. Wholesale prices also rose modestly. Both inflation reports matched market expectations.

Trump unveils his key Cabinet picks, naming RFK Jr. for HHS, Gaetz for Attorney General, Rubio for State, Gabbard as DNI, and Doug Burgum for Interior Secretary. His picks emphasize loyalty and bold policy shifts.

Tapestry and Capri Holdings abandon $8.5B merger amid legal hurdles. FTC antitrust concerns led to a judge blocking the deal, prompting both companies to terminate the agreement.

Trump's team plans to end $7,500 EV tax credit, potentially impacting EV adoption. Tesla supports the move, as it may give them an advantage over its domestic competitors like Ford, GM, and Stellantis.

F1 owner Liberty Media to spin off entertainment assets into a standalone firm as CEO Greg Maffei steps down. Charter will acquire Liberty Broadband in an all-stock transaction.

Global Markets 🌏

China retail sales rebound and beat forecasts in October, as fiscal stimulus boosts spending. However, the real estate sector continues to be a drag on the economy with new investments down 10.3%.

Eurozone industry falters again as output drops 2%, with weak demand and looming U.S. tariffs adding pressure. Capital goods and auto sectors face significant struggles.

U.K. economy lags expectations as trade tariffs loom, growing just 0.1% in Q3, down from 0.5% in the prior quarter. U.S. tariff threats and weak investment cloud prospects despite budget boosts.

Japan's economy expands in Q3 after two quarters of contraction, growing 0.3% year-on-year. Despite the rebound, sluggish consumption and weaker capital spending temper optimism.

SoftBank-backed Swiggy shares soar 15% in market debut. The Indian food delivery giant raised $1.34B in its IPO, India’s second-largest this year, as it expands into quick commerce via Instamart.

Tech ⚡

SpaceX prepares tender offer at $250B valuation, pricing shares at $135 each. The company also plans to launch Starship's sixth flight test this Tuesday, November 19.

AMD to lay off 1000 employees or about 4% of its workforce as it focuses on AI chip growth amid fierce competition with Nvidia. The layoffs come despite projecting $5B of AI chip sales in 2024.

Amazon launches fixed pricing for telehealth options, offering Prime members affordable hair loss and ED treatments. Shares of Hims & Hers plunged 24% as analysts cite Amazon's competitive pricing edge.

FTX sues Binance and ex-CEO Zhao for $1.8B, alleging a fraudulent 2021 share repurchase funded by insolvent Alameda Research. Binance denies the claims, pledging vigorous defense.

OpenAI co-founder Greg Brockman returns after a three-month sabbatical, resuming his role as president. His return follows a $157B funding round amid executive departures and for-profit transition controversies.

FBI raids Polymarket CEO's NYC apartment, seizing his phone amid scrutiny of the site's $3.6B election betting markets. The company defends itself, calling the raid politically motivated.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

CA - Housing Starts 🇨🇦

EU - Trade Balance 🇪🇺

Earnings: Symbotic, Trip💰

Tuesday

US - Housing Starts 🇺🇸

CA - CPI Inflation 🇨🇦

EU - CPI Inflation 🇪🇺

CN - PBoC Interest Rate Decision 🇨🇳

Earnings: Walmart, Lowes, Xpeng, Medtronic💰

Wednesday

US - Crude Oil Inventories 🇺🇸

UK - PPI Inflation 🇬🇧

Earnings: Nvidia, Snowflake, Palo Alto Networks, Nio, Target, GlobalE💰

Thursday

US - Jobless Claims 🇺🇸

US - Existing Home Sales 🇺🇸

US - CB Leading Economic Index 🇺🇸

Earnings: PinDuoDuo, Intuit, Elastic💰

Friday

US - S&P Manf. PMI 🇺🇸

US - S&P Services PMI 🇺🇸

CA - Retail Sales 🇨🇦

UK - Retail Sales 🇬🇧

Want to partner with Sunday Morning Markets? Click here to inquire.