What Moved The Markets This Week

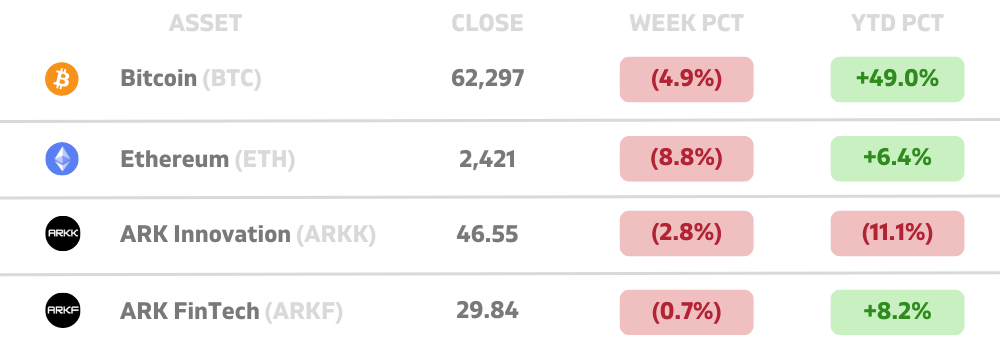

Job Growth Soars With Payrolls Up +254K, Tesla Misses Delivery Estimates, Port Workers End Strike, AI Chipmaker Cerebras Files for IPO, Meta Unveils New Video AI Model, and NKE Earnings

Sunday Morning Markets

Trading Week 40, covering Monday, Sep 30 through Friday, Oct 4. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Job growth soars, payrolls up +254K (est +150K)

Service sector remains strong, ISM index climbs to 54.9

Port workers end strike with new wage deal

Tesla misses delivery estimates

Iran launches missile attack on Israel

China's manufacturing activity contracts significantly

Meta unveils new video generation AI model

Cerebras, an AI chipmaker, files for IPO

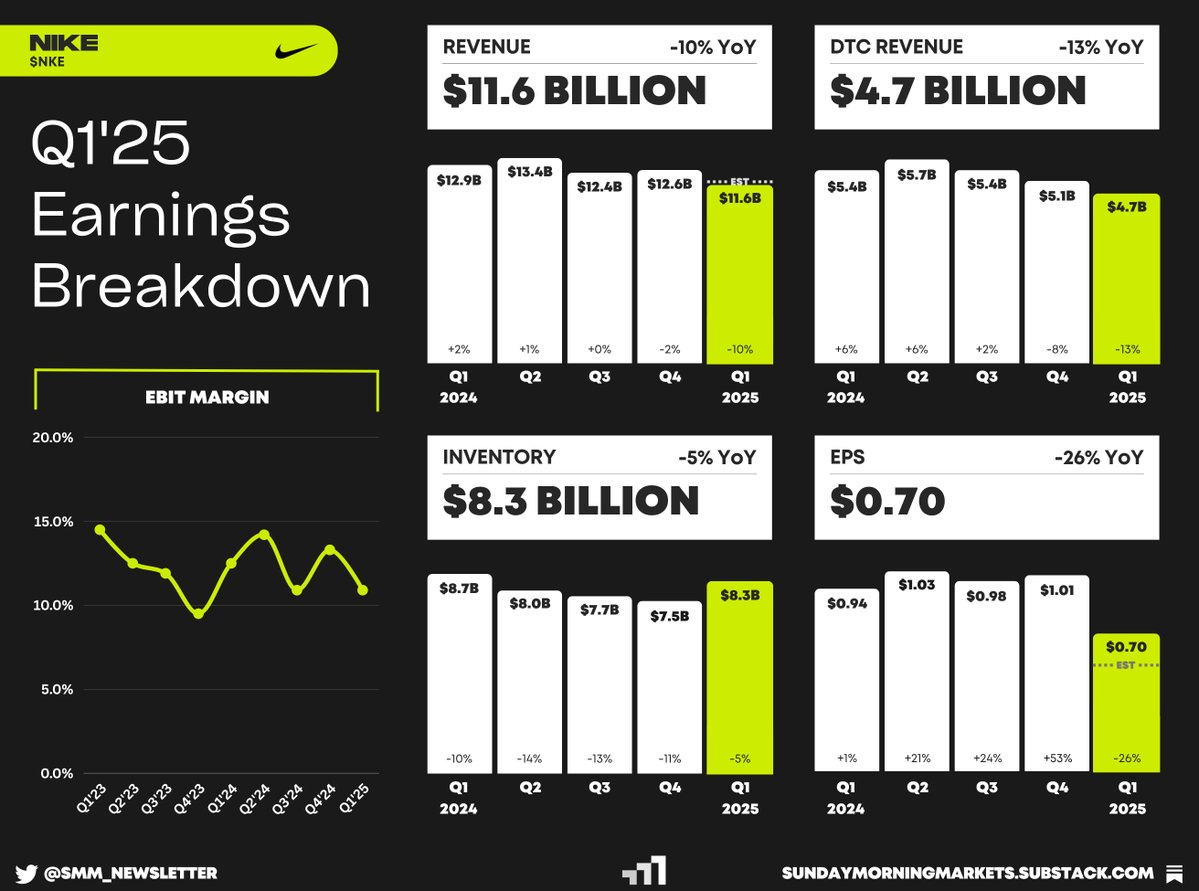

Earnings from Nike

US Markets 🇺🇸

U.S. job growth surged past expectations as payrolls jumped by 254,000, beating forecasts of 150,000. The unemployment rate fell to 4.1%, while wages rose 4% year-over-year.

Job openings rebound to 8.04 million in August, signaling no major deterioration in the labor market. However, slower hiring and fewer resignations suggest cooling demand overall.

Service sector activity surged with the ISM index climbing to 54.9, signaling strong demand. Meanwhile, manufacturing remained in contraction at 47.2, but lower input prices hint at a potential recovery.

U.S. port workers end strike with tentative wage deal, easing concerns over supply chain disruptions. The agreement includes a 61.5% wage hike over six years, with full negotiations extended to January.

Tesla misses delivery estimates for Q3, delivering 463K vehicles, up just 6% from the year prior. Increasing competition, especially in China, adds pressure to its growth. Tesla shares fell 3.5% this week.

Nike withdraws full-year guidance and postpones investor day amid CEO transition. Revenue fell 10% to $11.6B as sales slumped across key franchises. Nike shares are down 23% so far this year.

Global Markets 🌏

Iran launched a missile attack on Israel in retaliation for the killing of Hezbollah leader Nasrallah and an Iranian general. Most missiles were intercepted, but tensions have swelled. Crude oil prices surged nearly 10% this week.

China manufacturing contracts at fastest rate in 14 months, Caixin PMI shows. Despite recent stimulus measures, weak domestic and foreign demand dampened factory confidence to near-record lows.

Eurozone inflation drops to 1.8% in September, below the ECB’s 2% target. The decline strengthens the case for more rate cuts in October as core inflation also eased to 2.7%.

Samsung to cut thousands of jobs globally as it struggles in the AI market. Layoffs could affect up to 10% of its overseas workforce, driven by competition in memory chips and operational challenges.

ByteDance is developing a new AI model using Huawei's Ascend 910B chips as U.S. export restrictions push the company toward local suppliers. ByteDance's chatbot Doubao has more than 10 million MAUs.

Tech ⚡

AI chipmaker Cerebras files for IPO, aiming to take on Nvidia. The company has seen significant revenue growth in 2024, driven by its WSE-3 chip and cloud-based AI services.

Meta unveils its AI model, Movie Gen, which can generate realistic video with sound from text prompts, rivaling tools like OpenAI's Sora. The model generates 16-second clips at 24 FPS.

California Governor vetoes AI safety bill, citing concerns it could stifle innovation and drive AI companies away. While the bill aimed to regulate powerful AI models, critics argued it was too restrictive.

OpenAI raises $6.6B in new funding at a $157B valuation. With backing from Thrive Capital and Microsoft, the company aims to expand computing capacity as competition in the AI market intensifies.

Serve partners with Google's Wing for drone deliveries, extending their delivery range. Serve's robots will transport food to Wing's drone stations, offering faster, more efficient delivery options for restaurants.

Nvidia CEO calls demand for the new Blackwell AI chip "insane" with units priced at $30,000 to $40,000. Major firms like OpenAI and Microsoft are lining up, boosting Nvidia's stock 150% year-to-date.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - Consumer Credit 🇺🇸

UK - Retail Sales 🇬🇧

UK - House Price Index 🇬🇧

DE - Factory Orders 🇩🇪

Tuesday

US - Imports & Exports 🇺🇸

Earnings: Pepsi💰

Wednesday

US - FOMC Meeting Minutes 🇺🇸

US - Crude Oil Inventories 🇺🇸

Thursday

US - CPI Inflation 🇺🇸

US - Jobless Claims 🇺🇸

UK - BOE Credit Conditions 🇬🇧

Earnings: Delta Airlines, Dominoes💰

Friday

US - PPI Inflation 🇺🇸

US - UMich Inflation Expectations 🇺🇸

UK - GDP Growth 🇬🇧

DE - CPI Inflation 🇩🇪

Earnings: JPMorgan Chase, Wells Fargo, Blackrock💰

Want to partner with Sunday Morning Markets? Click here to inquire.