What Moved The Markets This Week 📈

Credit Card Debt Hits Record High, Google Loses Major Antitrust Case, Dell and Cisco Announce Layoffs, Bank of Japan Walks Back Rate Hike Talks, and UBER + ABNB + SHOP Earnings

Sunday Morning Markets

Trading Week 32, covering Monday, Aug 5 through Friday, Aug 9. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Credit card debt hits new record high

U.S. service sector activity remains strong

Google loses major antitrust case

OpenAI executives to leave the company

Dell and Cisco announce major layoffs

Disney hikes prices on all streaming platforms

China launches satellites to compete with Starlink

Bank of Japan walks back rate hike talks

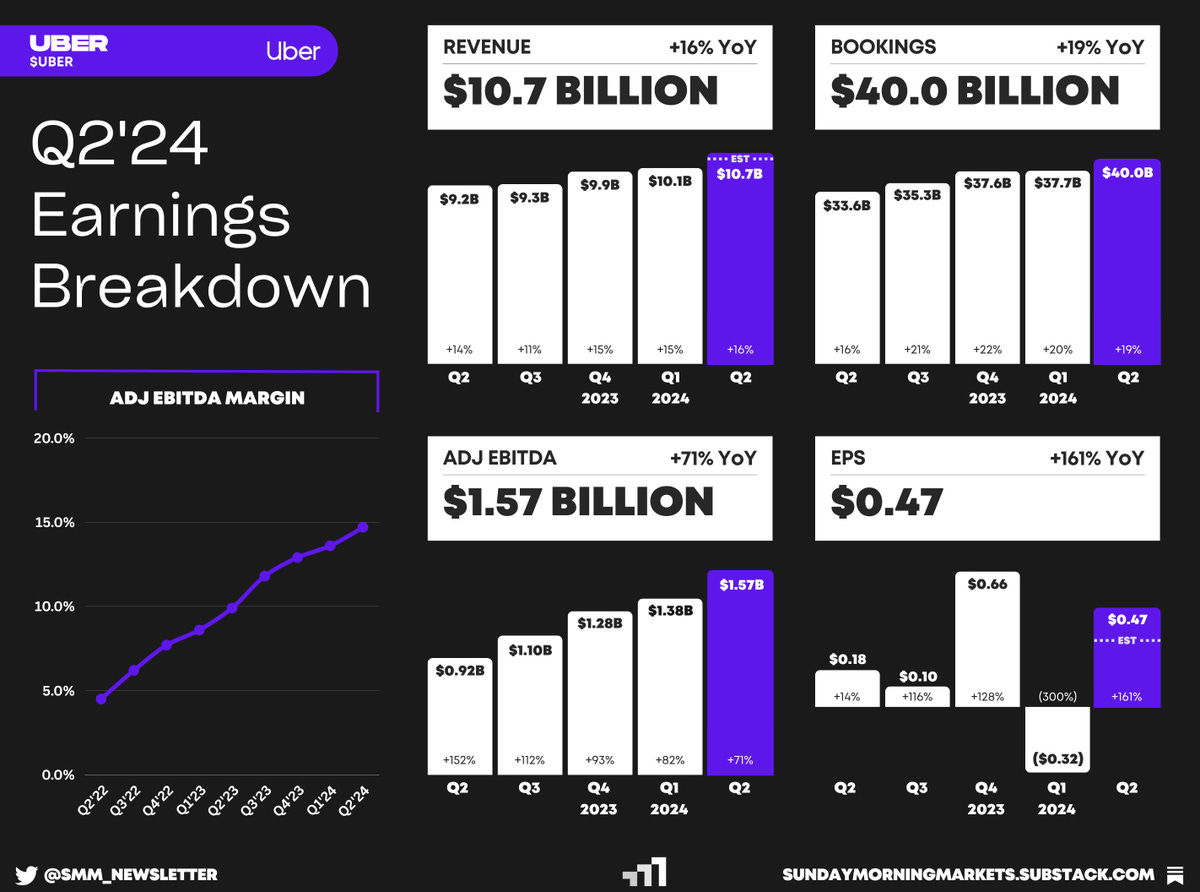

Earnings from Uber, Airbnb, Shopify

US Markets 🇺🇸

Credit card debt hits record $1.14 trillion in the second quarter of 2024, a 5.8% jump from a year ago. According to the report, roughly 9.1% of credit card balances transitioned into delinquency.

US service sector rebounds in July, recovering from a four-year low. The ISM nonmanufacturing PMI surged to 51.4 from June's 48.8, surpassing estimates due to a bounce back in new orders and employment.

Delta turned down aid from both CrowdStrike and Microsoft during the major IT outage. Delta estimates the outage cost the company $500 million, but CrowdStrike’s lawyer says its liability is capped at $10 million.

Jamie Dimon says he still sees a recession on the horizon and estimates the odds of a “soft landing” are 35% to 40%. The CEO of JPMorgan noted geopolitics, deficits, and tightening as main causes for uncertainty.

Dell to cut its workforce by 12,500 to streamline operations and refocus on its major AI initiatives. Cisco also announced a new round of layoffs, expecting to effect 4,000 workers, it’s second major cut this year.

Disney raises streaming prices for Hulu, Disney+ and ESPN+ plans by about $1 to $2 per month. The company’s streaming division posted its first profit ever during its Q2 earnings report this week.

Global Markets 🌏

Bank of Japan retreats from rate hike plans due to market instability. The unwinding of the ‘Yen Carry Trade’ led to financial turmoil, causing the Nikkei Index to plummet 12% on Monday.

Inflation in China picks up steam with consumer prices rising 0.5% in July, well ahead of estimates. Meanwhile, imports jumped 7.2% during the month. Both readings signal a trend of stronger domestic demand.

The Reserve Bank of Australia left interest rates on hold and remained quite hawkish. The central bank’s board said that “inflation is proving persistent” and killed most hopes of rate cuts later this year.

Canada’s service sector contracted further last month as new business declined while elevated wage costs contributed to inflation pressures. The S&P Composite PMI fell to 47.0 last month from 47.5 in June.

China launches its first satellites to rival Starlink in a project named “Thousand Sails.” They plan to build a constellation of 15,000 low-orbit satellites to create global internet coverage.

Tech ⚡

Google loses major antitrust case over search and text advertising. The ruling also poses a threat to Apple as Google pays over $20 billion per year to be the default search engine for Safari.

OpenAI cofounder John Schulman departs to go work for rival AI startup, Anthropic. In addition, OpenAI president and co-founder Greg Brockman is taking an extended leave through the end of the year.

AI chip startup Groq lands $640M in new funding, bringing its valuation to $2.8 billion. The company is creating an ‘LPU’ inference engine to deliver faster model speeds at a fraction of the energy cost.

Rivian lost $105K per vehicle delivered in Q2, or roughly $1.46 billion in total. Rivian’s losses have crept up as it pushed out the last of its first-gen R1 trucks and SUVs in favor of newer, more cost-efficient versions.

Lyft offers new plan to combat surge pricing called “Price Lock”. The new feature will let riders pay a monthly subscription “that caps the price for a specific route at a specific time.”

Elon Musk revives lawsuit against OpenAI and Sam Altman in federal court. Musk claims he was “courted and deceived” by Altman and OpenAI into co-founding the AI firm on the basis that it was a nonprofit.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - NY Fed Inflation Expectations 🇺🇸

CA - Building Permits 🇨🇦

CN - New Loans 🇨🇳

Earnings: Monday💰

Tuesday

US - PPI Inflation 🇺🇸

UK - Employment Report 🇬🇧

EU - ZEW Economic Sentiment 🇪🇺

Earnings: Home Depot, On Running, Flutter, Nu Holdings, Sea Ltd💰

Wednesday

US - CPI Inflation 🇺🇸

US - Crude Oil Inventories 🇺🇸

UK - CPI Inflation 🇬🇧

EU - GDP Growth 🇪🇺

CN - Industrial Production 🇨🇳

JP - GDP Growth 🇯🇵

Earnings: Cisco, D-Local💰

Thursday

US - Jobless Claims 🇺🇸

US - Retail Sales 🇺🇸

US - Philly Fed Manf. Index 🇺🇸

CA - Wholesale Sales 🇨🇦

UK - GDP Growth 🇬🇧

Earnings: Walmart, Alibaba, JD, Applied Materials, Grab💰

Friday

US - Housing Starts 🇺🇸

US - Building Permits 🇺🇸

US - UMich Inflation Expectations 🇺🇸

UK - Retail Sales 🇬🇧

Want to partner with Sunday Morning Markets? Click here to inquire.