What Moved The Markets This Week 📈

Home Prices Hit Record High, OpenAI Acquires Rockset, Anthropic Unveils Claude 3.5 Sonnet, SpaceX Launches Starlink Mini, Apple Shuts Down BNPL, and ACN + KMX + LEN Earnings

Sunday Morning Markets

Trading Week 25, covering Monday, Jun 17 through Friday, Jun 21. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

US Markets 🇺🇸

Home prices hit record high

Apple shuts down its BNPL product

Fisker files for bankruptcy

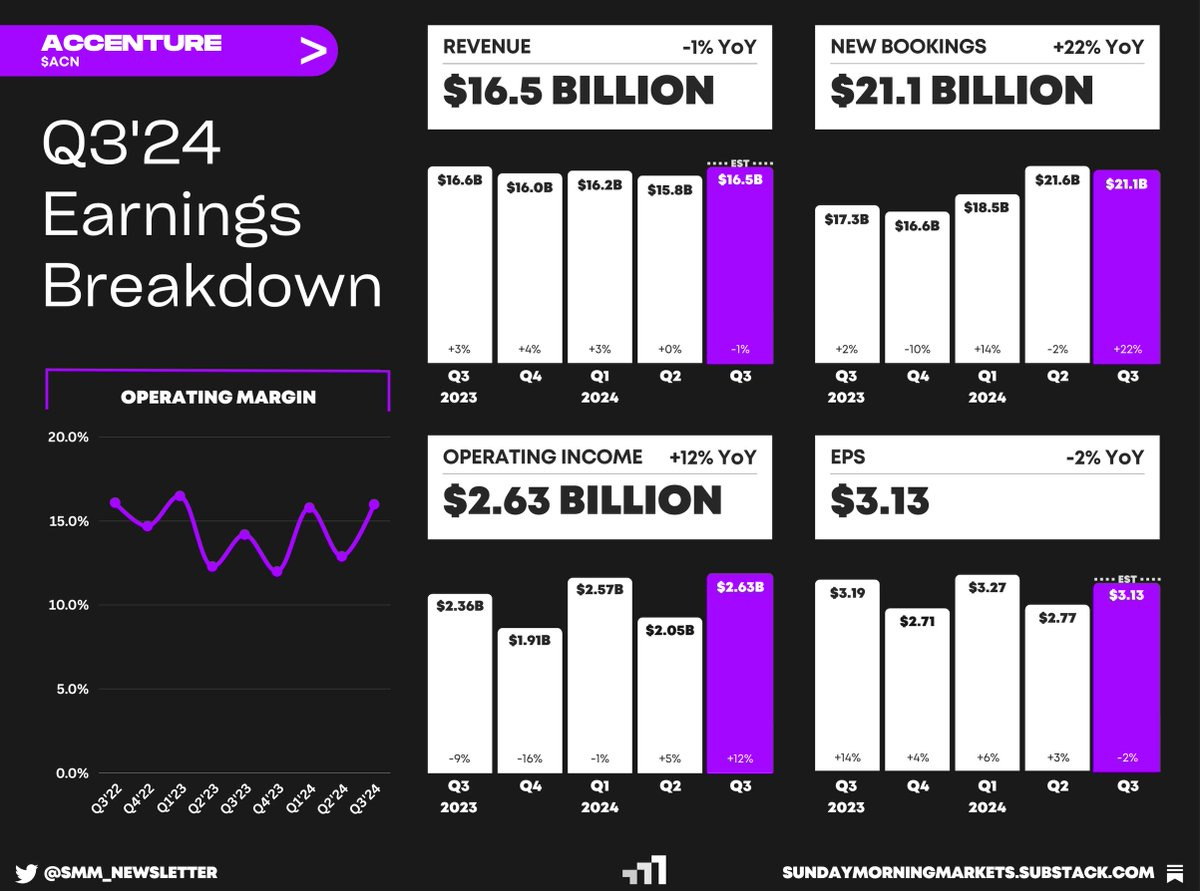

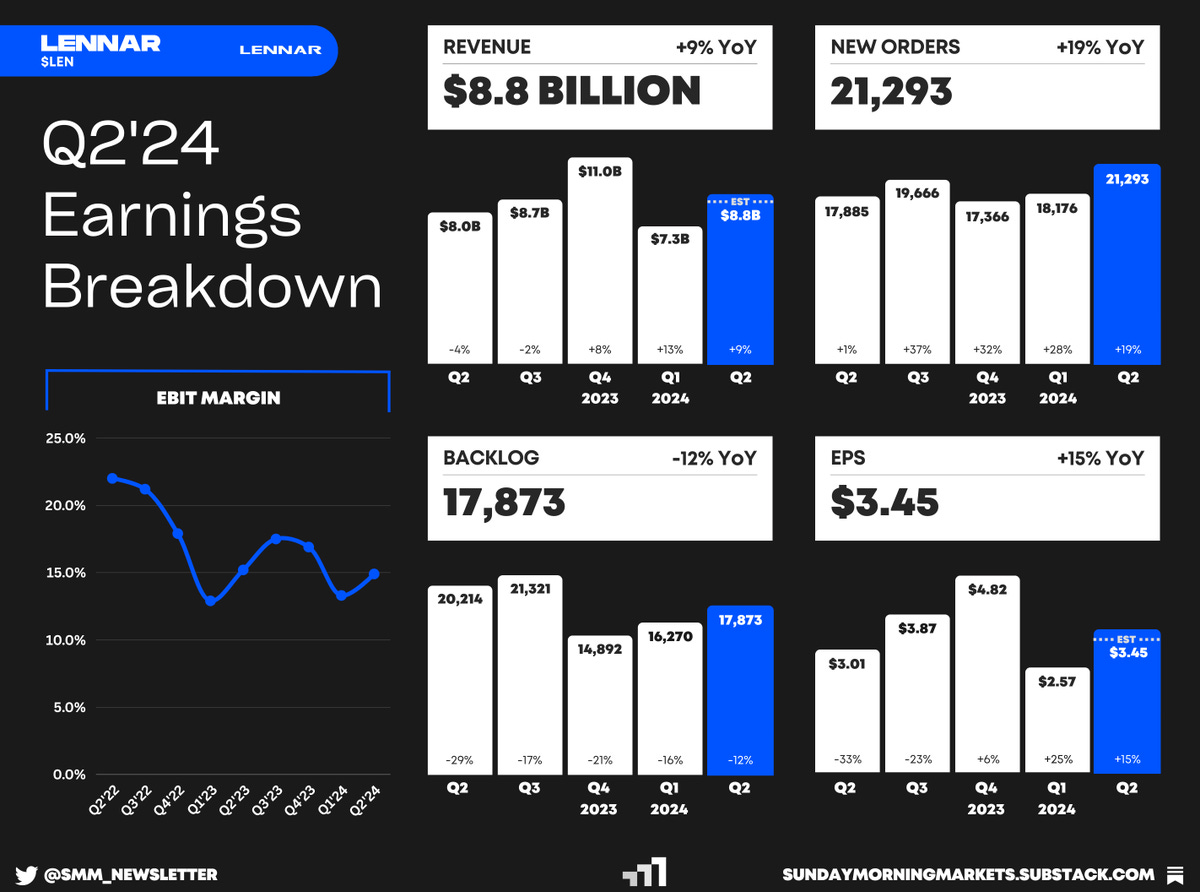

Earnings from Accenture, CarMax, Lennar

Global Markets 🌏

China hints at monetary policy shift

Russia and North Korea agree on partnership

Bank of England leaves interest rates steady

Tech ⚡

Anthropic launches Claude 3.5 Sonnet

OpenAI acquires Rockset

SpaceX unveils ‘Starlink Mini'

US Markets 🇺🇸

Home prices hit a new record high with the median selling price jumping to $419,300 in May, up nearly 6% year-over-year. Inventory levels surged 7% from April and 19% from the previous year.

Housing starts fall to a new four-year low after plunging 5.5% during the month to an annualized rate of 1.27 million homes. Home builders have scaled back on new projects due to high financing costs and softening demand.

U.S. business activity hits a 26-month high, with the S&P Composite PMI rising to 54.6 in June. Businesses reported strong demand and cooling inflationary pressures, signaling robust economic momentum.

Retail spending was weaker than expected in May as consumers grappled with persistent high inflation. Retail sales rose just 0.1% during the month and 2.3% year-over-year.

U.S. sues Adobe over subscription plan disclosures, alleging that the tech giant inadequately disclosed hefty termination fees and made the cancellation process onerous and complicated.

Apple to shut down its ‘buy now, pay later’ service after about a year since its launch. Instead, the tech giant will allow Apple Pay users to obtain BNPL loans through Affirm as part of its new partnership.

EV startup Fisker files for bankruptcy as it looks to salvage its operations by selling assets and restructuring its debt. Some of its largest creditors include Adobe, Alphabet’s Google, and SAP.

Chegg announces deep job cuts in restructuring plan, sending shares surging over 20%. The education technology firm announced plans to cut 23% of its global workforce, totaling about 440 employees.

Global Markets 🌏

Russia and North Korea sign defense pact as part of a ‘comprehensive strategic partnership.’ Officials warn that North Korea may seek support for its nuclear weapons in return for aiding Russia’s war in Ukraine.

China's central bank left its key policy rate unchanged, matching market expectations. The PBOC also proposed restarting Treasury bond trading to help manage liquidity and enhance policy flexibility.

Bank of England holds rates steady but signaled potential cuts soon. The BOE kept rates at 5.25% despite inflation easing to the 2% target. Analysts predict a possible cut by November.

Japan's inflation rose to 2.8% in May, fueling predictions for rate hikes despite lagging wage growth. Higher electricity bills drove the increase, with inflation remaining above the 2% target for over two years.

Europe's recovery slows amid political uncertainty, with the eurozone PMI falling to 50.8 in June. French businesses report declining orders due to surprise elections, impacting overall economic growth

Canada’s housing starts hit a seven-month high of 264,506 units in May, up 9.7% from April. Ontario and Quebec led the surge, offsetting declines in British Columbia. Government incentives aim to address the housing shortage.

Tech ⚡

Anthropic launches Claude 3.5 Sonnet, its most powerful AI model yet. Claude 3.5 Sonnet is ideal for enterprise use, excelling in data processing, code generation, and sales forecasting.

OpenAI acquires database analytics firm Rockset to enhance its enterprise AI capabilities. The move aims to integrate Rockset's real-time analytics, boosting OpenAI's data processing and AI-driven solutions for business clients.

SpaceX unveils backpack-sized ‘Starlink Mini’ satellite internet antenna for $599. The Mini antenna targets remote and mobile users, promising near-global reach and respectable speeds.

xAI names Dell and Super Micro as key suppliers for its supercomputer project. “Dell is assembling half of the racks that are going into the supercomputer that xAI is building,” Musk said in an X post.

Apple suspends work on Vision Pro 2, its next-generation headset, amid slowing sales of the high-end model. The company is still working on a more affordable Vision product with fewer features.

Tether launches gold-backed USD stablecoin named Alloy (aUSDT). The new synthetic dollar will be collateralized by Tether Gold (XAUt), marking the first step in the rollout of real-world asset tokenization platforms.

OpenAI co-founder Ilya Sutskever announces new AI startup called Safe Superintelligence, or SSI. Sutskever was one of several OpenAI board members who clashed with Altman over the company’s handling of AI safety.

Apple supplier TDK claims major battery breakthrough that can deliver significantly higher performance. The Tokyo-based firm says its new batteries could have 100 times greater energy density than its previous batteries.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

DE - Business Expectations 🇩🇪

EU - Eurogroup Meetings 🇪🇺

Tuesday

US - CB Consumer Confidence 🇺🇸

CA - CPI Inflation 🇨🇦

Earnings: FedEx, Carnival💰

Wednesday

US - New Home Sales 🇺🇸

CA - Wholesale Sales 🇨🇦

DE - Consumer Climate 🇩🇪

Earnings: Micron, Paychex, Blackberry💰

Thursday

US - GDP 🇺🇸

US - Jobless Claims 🇺🇸

US - Pending Home Sales 🇺🇸

US - Durable Goods 🇺🇸

UK - Financial Stability Report 🇬🇧

Earnings: Nike, Walgreens💰

Friday

US - PCE Inflation 🇺🇸

US - Personal Spending 🇺🇸

US - UMich Consumer Sentiment 🇺🇸

US - Chicago PMI 🇺🇸

CA - GDP Growth 🇨🇦

UK - GDP Growth 🇬🇧

Want to partner with Sunday Morning Markets? Click here to inquire.