What Moved The Markets This Week 📈

Jetblue & Spirit Merger Blocked, Home Sales Volume Plummets, Reddit Seeks IPO, Uber Shutters Drizly App, Tesla Slashes Prices In Europe, China Misses Q4 Estimates, and TSM + GS + SCHW Earnings

Sunday Morning Markets

Trading Week 3, covering Monday, Jan 15 through Friday, Jan 19. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Jetblue & Spirit merger blocked by judge

Reddit aims to IPO in March

Uber shuts down alcohol delivery app, Drizly

Tesla slashes prices across Europe

Home sales volume worst year since 1995

Layoffs from retailers Macy and Wayfair

Synopsys to acquire Ansys for $35 billion

China misses fourth-quarter growth estimates

UK inflation reaccelerates in December

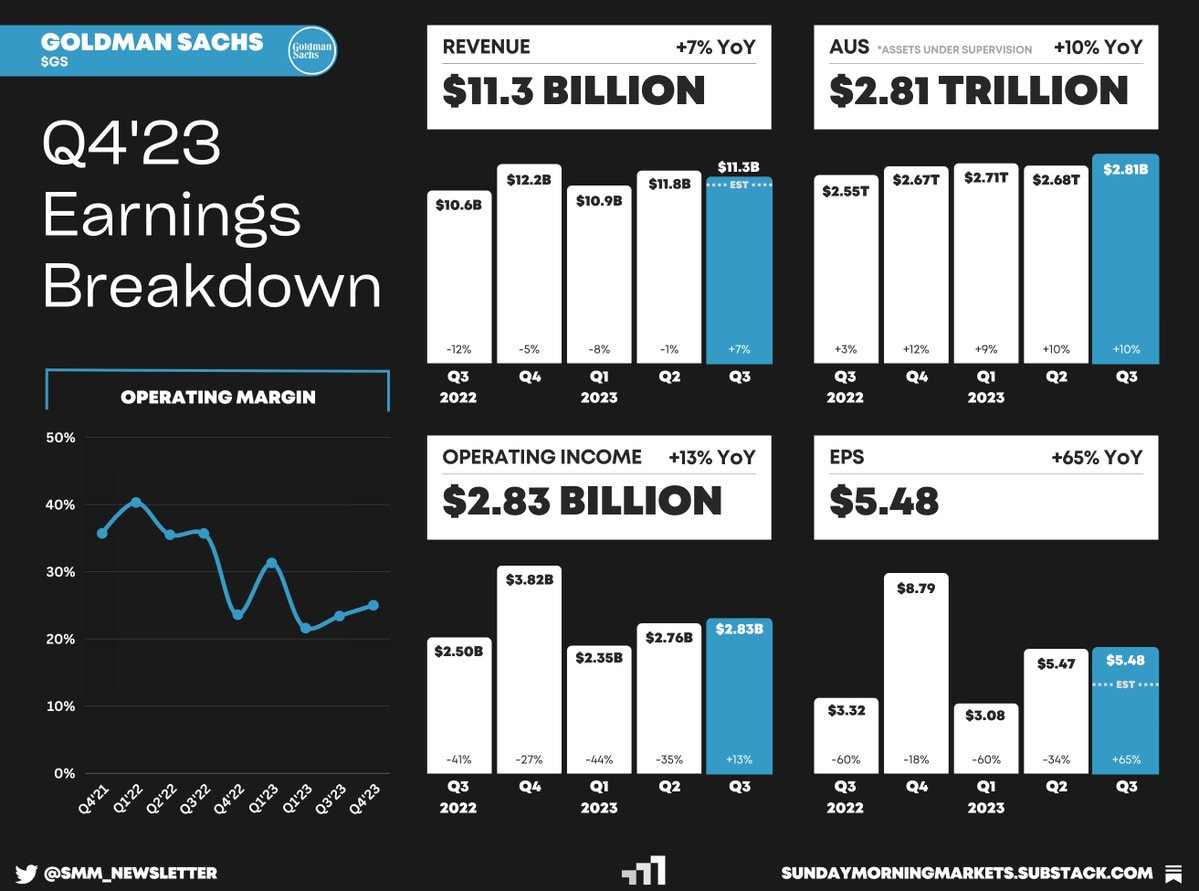

Earnings from TSMC, Goldman Sachs, and Charles Schwab

US Markets 🇺🇸

December home sales have worst year since 1995 as volumes were 6.2% lower than in the same month a year earlier. Available inventory fell 11.5% from November to December.

Consumer sentiment surges to 78.8 for January, its highest level since July 2021 and up 21.4% from a year ago. Sentiment has improved amid a drop in gasoline prices and solid stock market gains.

Retail sales grew another 0.6% in December to cap off a fairly robust holiday season, underscoring the resilience of the U.S. consumer. Economists were expecting a 0.4% increase.

Empire State manufacturing index dives to -43.7, the lowest reading since May 2020. New orders fell from -11.3 to -49.4, shipments fell from -6.4 to -31.3, and prices paid rose from 16.7 to 23.2.

Jobless claims post lowest reading since September 2022, as initial filings fell to 187,000 for the week of January 13. Continuing claims hit 1.81 million, below the consensus estimate of 1.83 million.

Trump gets landslide win in Iowa Caucus with DeSantis edging out Haley for second place. Of the 110,000 votes, Trump received 51.0%, Desantis 21.2%, Haley 19.1%, and Ramaswamy 7.7%.

Retail layoffs accelerate as Wayfair and Macy’s announce cuts of 1,650 and 2,300 workers, respectively. The two retailers join the likes of Hasbro, Etsy, and others who have also announced layoffs in the last month.

Synopsys to acquire Ansys in a $35 billion deal, or about $390 per share. For each share of Ansys, investors would receive 1/3 of a share of Synopsys and $197 in cash. The deal is expected to close in the first half of 2025.

Jetblue-Spirit merger blocked by a federal judge after the Justice Department sued to stop the merger. The two companies have since appealed the decision. SAVE 0.00%↑ shares collapsed 57% this week.

Global Markets 🌏

China misses fourth-quarter growth estimates as GDP rose by 5.2%. Retail sales grew by 7.4% in December from a year ago, also missing expectations for 8% growth. The Hang Seng Index fell 5% following the weak macro data.

Apple offers rare iPhone discounts in China as the company faces rising competition from local players like Xiaomi and Huawei. The prices of its iPhone 15 range will be reduced by 500 Chinese yuan during the sale.

Chinese auto exports surged 64% in 2023 while domestic sales rose 4.2%. An explosion in sales to Russia helped drive the growth, as European and Japanese makers pulled back because of the war in Ukraine.

Tensions in the Middle East spike as Iran strikes Syria, Iraq, and Pakistan. Iraq’s Foreign Ministry called the attacks a “violation of international law” and said it would file a complaint with the U.N. Security Council.

UK inflation unexpectedly rose to 4%, as economists were predicting a modest decline in CPI to 3.8%. Core CPI, which excludes food, energy, alcohol, and tobacco prices, came in at an annual 5.1%, unchanged from November.

Tesla slashes car prices across Europe just one week after cutting prices in China. The price tag on the Model Y in Germany will be cut by 8.1%, 7.7% in the Netherlands, 7.1% in Norway, and 6.7% in France.

Tech ⚡

Reddit aims for an IPO in March, moving forward with the plan it has been eyeing for more than three years. The company was last valued at about $10 billion in 2021 but hasn’t decided on what valuation to seek for IPO.

Uber shutters alcohol delivery service, Drizly, just three years after acquiring the company for $1.1 billion. Uber had planned to integrate Drizly into Uber Eats, but that change never came. The Drizly brand will be discontinued by March.

Sam Altman seeks to raise billions for AI chip factories as part of a new venture. The project would involve working with top chip manufacturers such as Intel, TSMC, or Samsung to build a network of chip fabs.

DOJ expected to file antitrust case against Apple as soon as March, according to Bloomberg. The case would reportedly focus on software and hardware limitations on iPhones and iPads that impede competitive services.

Elon wants 25% of voting control over Tesla before expanding AI & robotics at the company, saying “unless that is the case, I would prefer to build products outside of Tesla.” He currently owns roughly 13% of Tesla.

Meta aims to have 350K H100 graphics cards by the end of the year, or almost 600K H100 equivalents of compute if you include other GPUs. The company is also bringing its two AI teams, FAIR and GenAI, closer together.

Apple redesigns its watch to avoid an import ban from the patent infringement dispute with Masimo. Apple will remove the blood oxygen feature from its Series 9 and Ultra 2 Watches, allowing them to return on sale Thursday.

Apple's $3,499 Vision Pro headset is now available to order. It will launch with 150 3D movies, immersive films, Disney+, Max and more. However, Netflix and YouTube both announced they will not be launching apps.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - CB Leading Index (DEC)🇺🇸

AU - NAB Business Confidence (DEC)🇦🇺

JP - BoJ Interest Rate Decision 🇯🇵

Earnings Reports: United Airlines💰

Tuesday

CA - Housing Price Index (DEC)🇨🇦

JP - Balance of Trade (DEC)🇯🇵

Earnings Reports: Netflix, Verizon, RTX, Lockheed Martin, GE💰

Wednesday

US - S&P Manf. PMI (JAN)🇺🇸

US - S&P Services PMI (JAN)🇺🇸

CA - BoC Interest Rate Decision 🇨🇦

UK - S&P Composite PMI (JAN)🇬🇧

EU - HCOB Composite PMI (JAN)🇪🇺

Earnings Reports: Tesla, ServiceNow, AT&T, ASML, IBM💰

Thursday

US - Jobless Claims 🇺🇸

US - GDP Growth (Q4)🇺🇸

US - Durable Goods Orders (DEC)🇺🇸

US - New Home Sales (DEC)🇺🇸

EU - ECB Interest Rate Decision 🇪🇺

DE - Ifo Business Climate (JAN)🇩🇪

Earnings Reports: Visa, Intel, CapitalOne, American Air💰

Friday

US - PCE Inflation (DEC)🇺🇸

US - Personal Income & Spending (DEC)🇺🇸

US - Pending Home Sales (DEC)🇺🇸

Earnings Reports: American Express💰

Want to partner with Sunday Morning Markets? Click here to inquire.