What Moved The Markets This Week 📈

Microsoft Hit With $29B IRS Tax Bill, Inflation Hotter Than Expected, UAW Escalates Strikes At Ford, Israel-Hamas Conflict Wages On, Deflation In China, and DAL Earnings

Sunday Morning Markets

Trading Week 41, covering Monday, Oct 9 through Friday, Oct 13. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Inflation Data

CPI 0.4% MoM and 3.7% YoY (vs. estimates 0.3%, 3.6%)

PPI 0.5% MoM and 2.2% YoY (vs. estimates 0.3%, 2.0%)

IRS claims Microsoft owns $29B in back taxes

UAW escalates strikes at Ford factories

Fighting between Israel and Hamas wages on

YouTube passes Netflix as top choice for teens

Chinese factories see deflation again in September

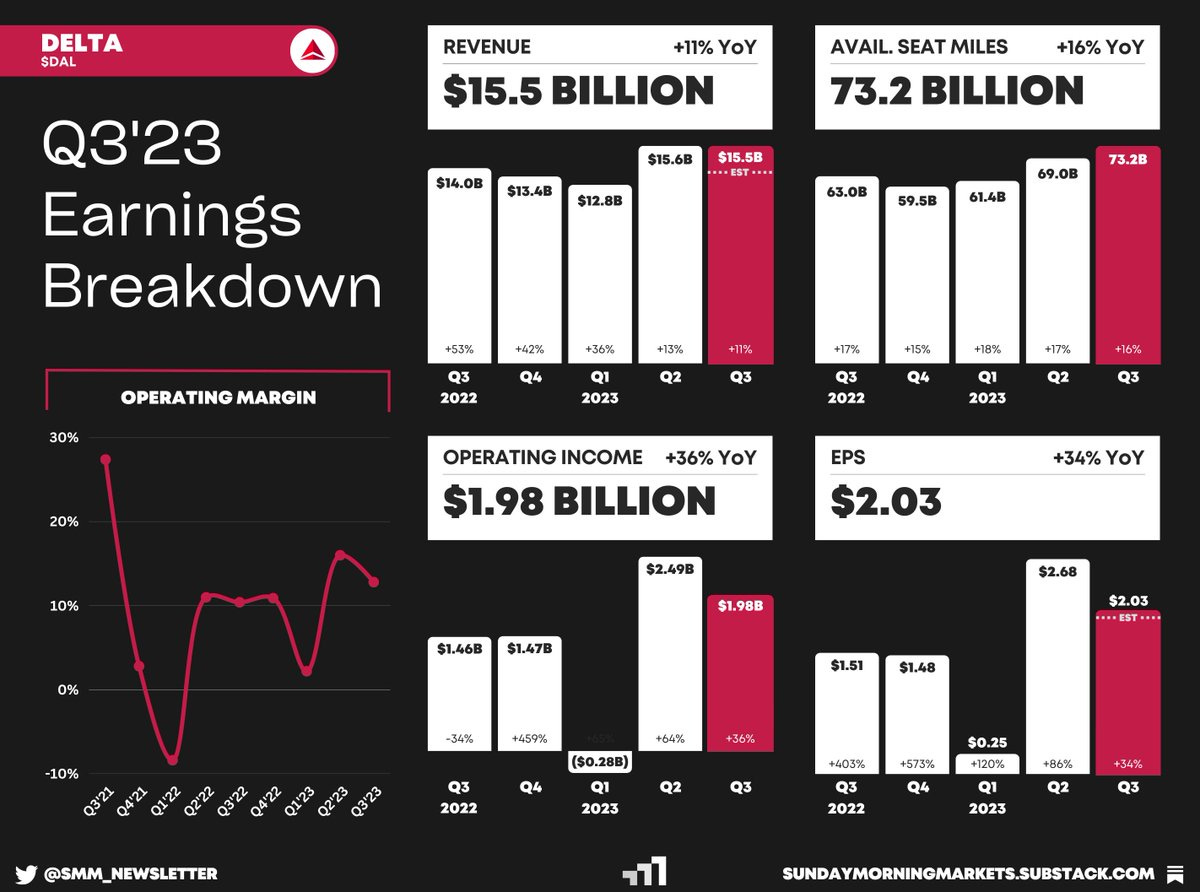

Earnings from Delta — see breakdown below

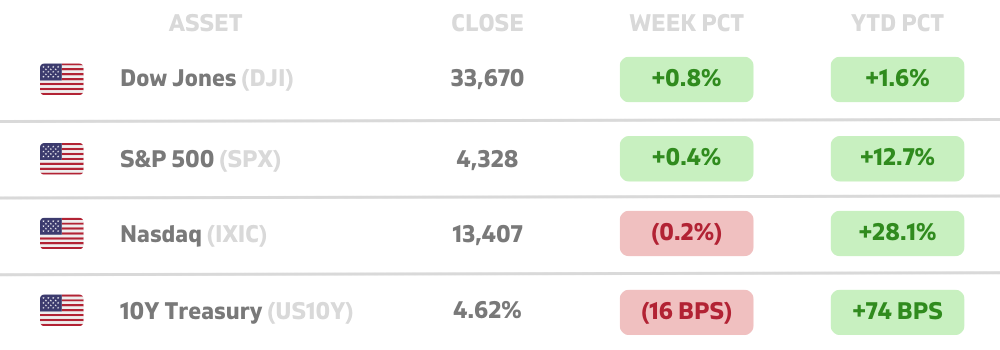

US Markets 🇺🇸

Consumer prices rose 0.4% in September and 3.7% from a year ago, above respective forecasts of 0.3% and 3.6%. Real average hourly earnings fell 0.2% on the month but were up 0.5% from a year ago.

Wholesale inflation comes in hotter than expected as the producer price index (PPI) increased 0.5% for September (vs 0.3% estimate). Excluding food and energy, core PPI was up 0.3% (vs 0.2% estimate).

Fed officials see ‘restrictive’ policy staying in place until inflation eases, minutes show. “A majority of participants judged that one more increase in the target federal funds rate at a future meeting would likely be appropriate”.

IRS says Microsoft owes an additional $29B in back taxes due to allocated profits between countries and jurisdictions from 2004 to 2013. Microsoft will go through the IRS’ administrative appeal, which could take years.

Apple Macbook sales plunged over 23% in Q3 according to new IDC, Gartner, and Canalys data. Shipments declined between 7% and 9% for the rest of the PC industry, however, it saw a marginal improvement from the prior quarter.

UAW launches new strikes at Ford’s truck plant in Kentucky, a major escalation. The new strike includes 8,700 UAW members at a factory that produces Ford pickups and Expeditions, as well as Lincoln Navigators.

Global Markets 🌏

Israel evacuates 1.1M people from northern Gaza, about half of the territory’s population, the UN says. Israeli military pulverized the Gaza Strip with airstrikes following the attacks inside Israel last weekend. The conflict is ongoing.

UK economy grew 0.2% in August as services output led the growth higher, adding 0.4% on the month to offset a fall in production output of 0.7% and a decline in construction output by 0.5%.

Retail sales in Britain continue to slow as consumers avoid big-ticket purchases, the BRC says. Food sales rose 7.4% over the three months to September, while non-food sales further decreased 1.2%.

Chinese consumer price inflation remained flat in September, coming in below estimates of a 0.2% increase as economic recovery remains fragile. Produce prices fell 2.5% from a year earlier.

China’s exports and imports drop again in September amid lackluster global demand for Chinese goods and muted domestic demand. Exports fell by 6.2% from a year ago (vs 7.6% estimate) while imports fell by 6.2% (vs 6% estimate).

Microsoft’s $69B Activision takeover approved by UK, removing the last major hurdle for the deal to close. “The new deal will stop Microsoft from locking up competition in cloud gaming as this market takes off”.

North Korea delivered 1,000 containers of equipment and munitions to Russia for the Ukraine war, according to the White House. Kim Jong Un traveled to Russia to meet President Vladimir Putin and visit key military sites last month.

Tech ⚡

Amazon launches first internet satellite prototypes for Project Kuiper. Project Kuiper is Amazon’s plan to build a network of 3,236 satellites in low Earth orbit, to provide high-speed internet access anywhere in the world.

YouTube passes Netflix as the top video source for teens according to Piper Sandler. Teens polled by the bank said they spent 29.1% of their daily video consumption time on YouTube, beating out Netflix (28.7%) for the first time.

Cruise opens robotaxi service in Houston despite increasing criticism of the company’s operations in San Francisco. GM’s self-driving car subsidiary, Cruise, has about 400 vehicles spread across Austin, Houston, Phoenix, and SF.

Google Search can now generate images and write drafts inside SGE. In the past few months alone, SGE has released capabilities such as AI summarizations, coding improvements, travel and product search features, among other things.

Trezor launches two new crypto devices at the Bitcoin Amsterdam conference. The Trezor Safe 3 is their latest hardware crypto wallet, and the Trezor Keep Metal is their new “mistake-proof” backup solution for wallet passwords.

FTC sues ex-CEO of bankrupt crypto exchange, Voyager, for falsely claiming that users’ accounts were FDIC insured. The FDIC does not insure crypto assets. Voyager’s customers lost more than $1B during the meltdown.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - NY Empire Manufacturing Index (OCT)🇺🇸

CA - Wholesale Sales (AUG)🇨🇦

Earnings Reports: Charles Schwab💰

Tuesday

US - Retail Sales (SEP)🇺🇸

US - Industrial Production (SEP)🇺🇸

CA - CPI Inflation (SEP)🇨🇦

EU - ZEW Economic Sentiment (OCT)🇪🇺

CN - GDP Growth(Q3)🇨🇳

Earnings Reports: J&J, Bank of America, Lockheed Martin, Goldman Sachs💰

Wednesday

US - Building Permits (SEP)🇺🇸

US - Housing Starts (SEP)🇺🇸

UK - CPI Inflation (SEP)🇬🇧

EU - CPI Inflation (SEP)🇪🇺

Earnings Reports: Tesla, ASML, Netflix, Morgan Stanley💰

Thursday

US - Philly Fed Manufacturing Index (OCT)🇺🇸

US - Existing Home Sales (SEP)🇺🇸

Earnings Reports: Philip Morris, AT&T, American Airlines💰

Friday

CA - Retail Sales (SEP)🇨🇦

UK - Retail Sales (SEP)🇬🇧

Earnings Reports: American Express💰

Want to partner with Sunday Morning Markets? Click here to inquire.