What Moved The Markets This Week 📈

Amazon Axes Venmo Partnership, Unemployment Rate Falls To 3.7%, Google Unveils Gemini AI Model, Spotify's Major Layoffs, AMD Challenges Nvidia With New Chip, and LULU + MDB + S Earnings

Sunday Morning Markets

Trading Week 49, covering Monday, Dec 4 through Friday, Dec 8. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Labor Market Data:

Unemployment rate = 3.7% (est 3.9%)

Nonfarm payrolls = +199K (est 180K)

ADP job adds = +103K (est 130K)

Job openings = 8.73M (est 9.3M)

Average hourly earnings = +4.0% (est 4.0%)

Amazon abruptly ends partnership with Venmo

Alaska Air to acquire Hawaiian Air for $1.9B

Google launches its new AI model Gemini

AMD unveils its latest AI chip to compete with Nvidia

Spotify announces layoffs for 17% of staff

Disney to integrate Hulu into Disney+

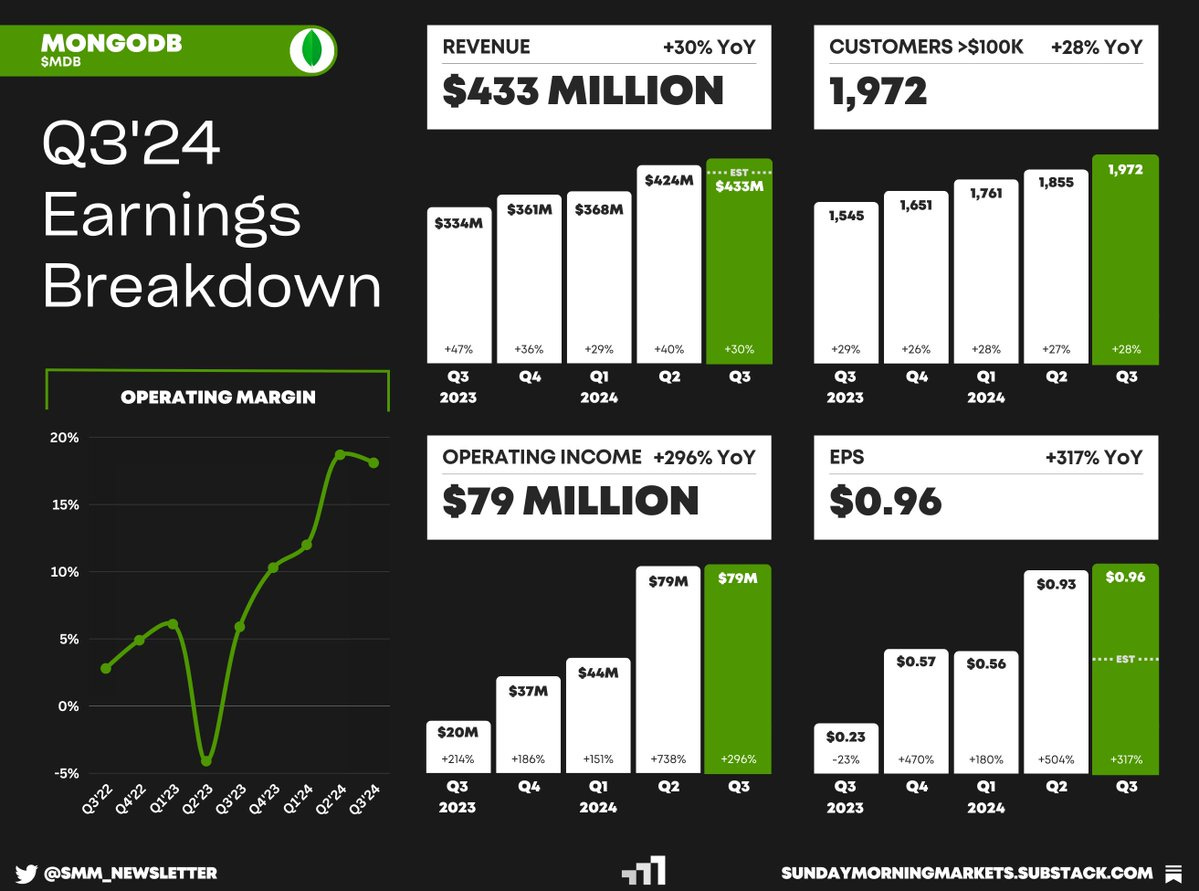

Earnings from LULU, MDB, S — see breakdown below

US Markets 🇺🇸

The unemployment rate unexpectedly slips to 3.7% as U.S. payrolls rose 199,000 in November, above estimates. Average hourly earnings, a key inflation indicator, increased by 0.4% for the month and 4% from a year ago.

Job openings plunged to 8.7 million in October, falling 6.6% from the month prior and widely missing estimates. It is the lowest reading since March 2021 and brought the ratio of openings to available workers down to 1.3 to 1.

Private payrolls increased by 103,000 in November according to ADP, below the estimate of 128,000, as the labor market continues to lose steam. Annual pay increased 5.6%, the smallest gain since September 2021.

Alaska Airlines agrees to buy Hawaiian Airlines in $1.9B deal, setting up another potential regulatory battle. Alaska would pay $18 a share for Hawaiian and would take on $900 million of its debt.

Uber gets selected to join the S&P 500 Index and will replace Sealed Air Corp, as the popular ride-hailing company has generated over $1B in profits over the last twelve months. $UBER shares rose 8% this week following the news.

Amazon to stop accepting Venmo as a payment option, marking an abrupt reversal on the partnership that was announced only about a year ago. $PYPL shares fell 2% following the news.

Abbvie to acquire Cerevel Therapeutics for $8.7 billion in an attempt to expand its drug pipeline. Abbvie is on quite the shopping spree, buying cancer drug developer Immunogen for $10 billion just last week.

McDonald's plots rapid growth of 10,000 new stores by 2027, with 70% coming from its international markets including China, India, Japan, and Brazil. The company also plans to grow its app’s user base to 250 million.

Global Markets 🌏

The Bank of Canada keeps rates unchanged at 5%, saying there is evidence higher rates are working to slow price increases across the economy. “Data suggests the economy is no longer in excess demand”.

Australia’s central bank holds interest rates steady until at least February, buying it more time to assess the state of the economy as the likes of the U.S. and Europe are likely to start easing next year.

China's consumer prices fall fastest in 3 years as the CPI fell 0.5% from the year prior. Deflation is expected to persist as “developers and local governments continue to deleverage and as global growth is expected to slow.”

ByteDance offers to buy back shares at a $268B valuation just weeks after proposing to purchase outstanding RSUs and options from employees. The Chinese tech behemoth is spending up to $5B on the buybacks.

Swiss bank, Banque Pictet, admits to hiding $5.6 billion of Americans’ money from IRS. In an agreement with prosecutors, the bank has agreed to pay about $122.9 million in restitution and penalties.

Tech ⚡

Google launches its ‘most capable’ AI model, Gemini as it continues to chase OpenAI. Google noted that Gemini outperforms OpenAI’s GPT-3.5, but didn’t comment on how it stacks up against GPT-4. Watch the demo here.

Elon Musk’s X.AI files to raise $1 billion in fresh capital after publicly releasing Grok last month. The company has already secured $135 million in funding from four investors and has agreements in place for the remaining shares.

AMD unveils the Instinct MI300X, its latest AI chip, that stacks up directly against Nvidia. Companies such as Meta, OpenAI, and Microsoft all said they plan to use the MI300X to reduce training costs.

Spotify to layoff 17% of its workforce, or about 1,500 jobs, in a dramatic move to reduce costs and adjust for a slowdown. CEO Daniel Ek said the company overhired in 2020 and 2021. $SPOT shares jumped 10% this week.

Disney to integrate Hulu into its Disney+ platform in a bid to bundle subscribers with the launch expected in March 2024. The news comes just one month after Disney bought the remaining 33% stake in Hulu from Comcast.

OpenAI rival Mistral raises €450 million from investors including Nvidia and Salesforce in a funding round that values the company at about $2 billion. The three co-founders agreed to each sell €1 million in equity as part of the deal.

The FDA approves Casgevy, the first gene-editing treatment to be marketed in the country. Casgevy uses Nobel Prize-winning technology CRISPR to treat sickle cell disease, a blood disorder that affects about 100,000 Americans.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

AU - NAB Business Confidence (NOV)🇦🇺

Earnings Reports: Oracle💰

Tuesday

US - CPI Inflation (NOV)🇺🇸

UK - Employment Report (NOV)🇬🇧

Wednesday

US - PPI Inflation (NOV)🇺🇸

US - Fed Interest Rate Projection 🇺🇸

UK - GDP (OCT)🇬🇧

Earnings Reports: Adobe💰

Thursday

US - Retail Sales (NOV)🇺🇸

UK - BOE Interest Rate Decision🇬🇧

EU - ECB Interest Rate Decision🇪🇺

CH - SNB Interest Rate Decision🇨🇭

CN - Industrial Production (NOV)🇨🇳

Earnings Reports: Costco, Lennar💰

Friday

US - S&P Services PMI (NOV)🇺🇸

US - Empire State Manf. Index (NOV)🇺🇸

Earnings Reports: Darden💰

Want to partner with Sunday Morning Markets? Click here to inquire.