What Moved The Markets This Week

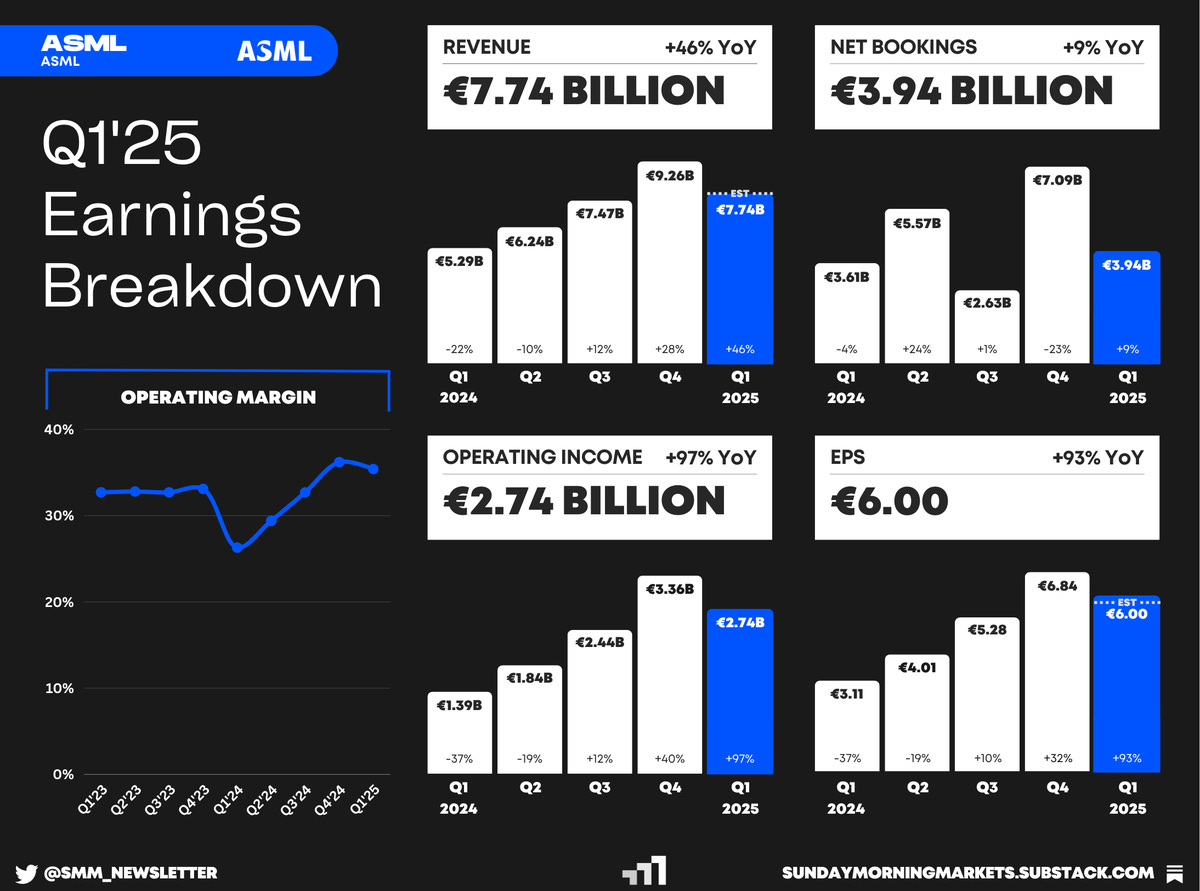

Tariff war simmers as U.S. eyes trade deals, Google loses antitrust ruling, Nvidia slammed with $5.5B charge, IMF sees no global recession, ECB slashes rates, Figma IPO, and NFLX + TSM + ASML earnings

Sunday Morning Markets

Trading Week 16, covering Monday, April 14 through Friday, Apr 18. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Tariff Update: U.S. sees solid trade offers, China tensions continue.

Fed Dilemma: Powell flags tariffs as barrier to rate cuts, growth.

Google Antitrust: Judge rules monopoly, DOJ eyes ad business split.

Retail Rebound: Sales jump 1.4% as buyers race tariff deadlines.

Chip Fallout: Nvidia, AMD hit with billions in China export fees.

IMF Outlook: Global growth hit by tariffs, but no recession.

ECB Cut: ECB lowers rates, warns of shaky demand amid trade hits.

China GDP: Q1 tops at 5.4% as firms rush exports pre-tariffs.

Nvidia Build: $500B AI supercomputer push starts in Texas.

Figma IPO: Files confidentially despite volatile tech markets.

Earnings: Netflix, TSMC, and ASML.

US Markets 🇺🇸

Tariff war has a relatively quiet week, as U.S. adviser Hassett says strong trade offers are rolling in, even as China cancels Boeing orders and the U.S. adds new fees on Chinese shipping.

Powell says Fed is in a dilemma between inflation and growth, citing Trump-era tariffs as a key driver of rising prices that could both delay rate cuts and stall economic momentum.

Retail sales jumped 1.4% last month, beating expectations as consumers accelerated spending, especially on autos, amid concerns over looming tariffs and future price hikes.

Nvidia hit with $5.5B charge over China chip exports, as U.S. curbs on H20 processors bite. AMD also braces for an $800M hit, signaling broader fallout across the AI chip industry.

Intel to sell 51% of Altera for $4.46B, marking CEO Lip-Bu Tan’s first big move to streamline operations and raise cash. The deal values Altera at just half its 2015 acquisition price.

Eli Lilly’s weight loss pill shows strong results, helping diabetes patients lose weight and lower blood sugar in a major late-stage trial. Shares jumped 14% as it edges closer to FDA approval.

Tesla registrations plunged 15% in California, as backlash against Elon Musk’s politics and aging models drove buyers to rivals. Tesla’s market share in the state slid to 43.9%, down from 55.5% a year ago.

Global Markets 🌏

IMF sees global growth hurt by trade tensions but no recession, as tariff hikes fuel forecast downgrades. A Reuters poll of economists puts U.S. recession odds at 45% over the next year.

ECB cuts rates amid deteriorating growth outlook, citing trade tensions and exceptional uncertainty. More cuts could follow as they warned of weakened business confidence and global demand shocks.

China’s Q1 GDP beat forecasts at 5.4%, fueled by stimulus and strong retail sales. March exports surged 12.4%, but economists warn the recovery may fade as firms rushed shipments ahead of looming U.S. tariffs.

Bank of Canada holds rates at 2.75%, pausing after seven cuts and signaling readiness to act as U.S. tariffs cloud the outlook. Inflation fell to 2.3% in March, giving the BoC room for future easing.

Japan’s inflation jumped to 3.6% in March, marking three straight years above the BOJ’s 2% target. The closely watched “core-core” rate rose to 2.9%, adding pressure for policy tightening.

Turkey shocks markets with 350-point rate hike, lifting its key rate to 46% as inflation nears 40% and political turmoil fuels economic instability. Analysts say rate cuts are now off the table for 2025.

Apple's China phone sales slump 9% in Q1, its seventh straight quarterly decline, while rival Xiaomi's shipments soared 40% as it capitalized on new government subsidies.

Tech ⚡

Judge rules Google holds monopoly in ad tech, clearing the path for the DOJ to seek a breakup of its ad business. Meta faces similar antitrust heat as regulators target tech giants.

Nvidia to mass-produce AI supercomputers in Texas, launching a $500B U.S. manufacturing push amid tariff pressures and shifting supply chains, with production set to begin within 15 months.

Figma files confidential IPO paperwork despite market jitters, pressing ahead even as peers like Klarna and StubHub pause plans amid tariff-driven market volatility. The $12.5B design startup is backed by top VCs.

OpenAI eyes social network to rival X and Instagram, driven by viral demand for its AI image tools. The move adds fuel to its escalating rivalry with Elon Musk amid a booming AI race.

xAI adds memory to Grok chatbot, letting it recall past chats for more personalized replies. The feature mirrors rivals like ChatGPT and Gemini, but isn't yet available in the EU or U.K.

Claude can now access Gmail, Docs, and Calendar, offering personalized help with tasks like summarizing emails or tracking events. The AI adds in-line citations and aims to streamline planning across Google Workspace.

Lyft to buy Europe's Free Now for $200M, marking its first international expansion as it eyes a slice of the competitive EU ride-hailing market dominated by Uber, Bolt, and Gett.

Earnings Reports 💰

Weekly Poll 🗳️

Week Ahead 📅

Monday

UK, European, Other Markets Closed - Easter

US - CB Leading Index 🇺🇸

Tuesday

EU - ECB Lagarde Speaks 🇪🇺

JP - BoJ Core CPI 🇯🇵

Earnings: Tesla, Capital One, Verizon, GE, Lockheed Martin, RTX💰

Wednesday

US - New Home Sales 🇺🇸

US - Beige Book 🇺🇸

US - S&P Composite PMI 🇺🇸

UK - S&P Composite PMI 🇬🇧

EU - HCOB Composite PMI 🇪🇺

Earnings: Chipotle, Boeing, IBM, ServiceNow, AT&T, Lam Research💰

Thursday

US - Jobless Claims 🇺🇸

US - Existing Home Sales 🇺🇸

US - Durable Goods 🇺🇸

DE - Ifo Business Climate

Earnings: Alphabet, Intel, T-Mobile, American Airlines, Southwest, Pepsi💰

Friday

US - UMich Inflation Expectations 🇺🇸

CA - Retail Sales 🇨🇦

UK - Retail Sales 🇬🇧

Want to partner with Sunday Morning Markets? Click here to inquire.