What Moved The Markets This Week 📈

Apple's iPhone Sales Plunge 10%, Fed Holds Rates Steady, Unemployment Rate Rises, Anthropic Launches iOS App, Tesla's Major Win In China, and AAPL + AMZN + NET Earnings

Sunday Morning Markets

Trading Week 18, covering Monday, Apr 29 through Friday, May 3. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

US Markets 🇺🇸

Fed holds rates steady but slows its Treasury runoff

Warren Buffett slashes stake in Apple by 13%

Peloton cuts 15% of staff as CEO steps down

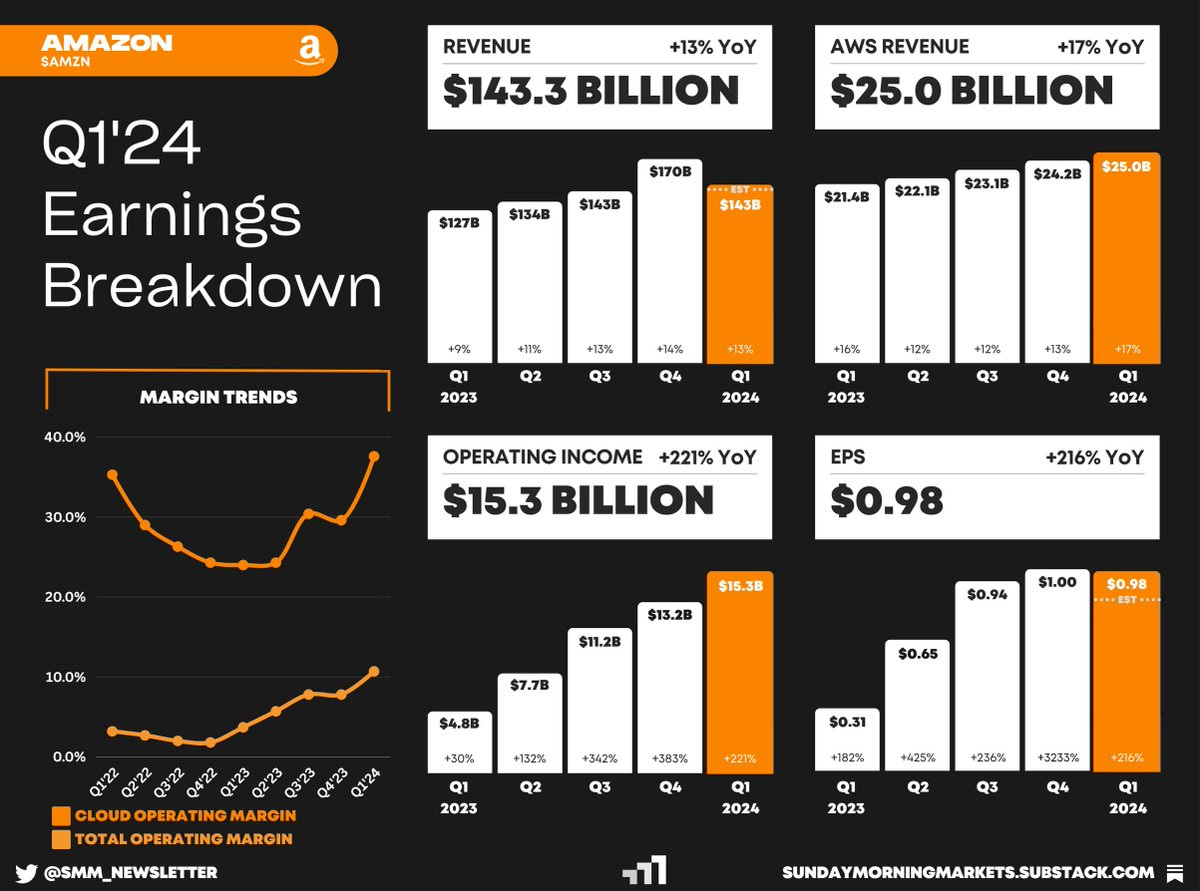

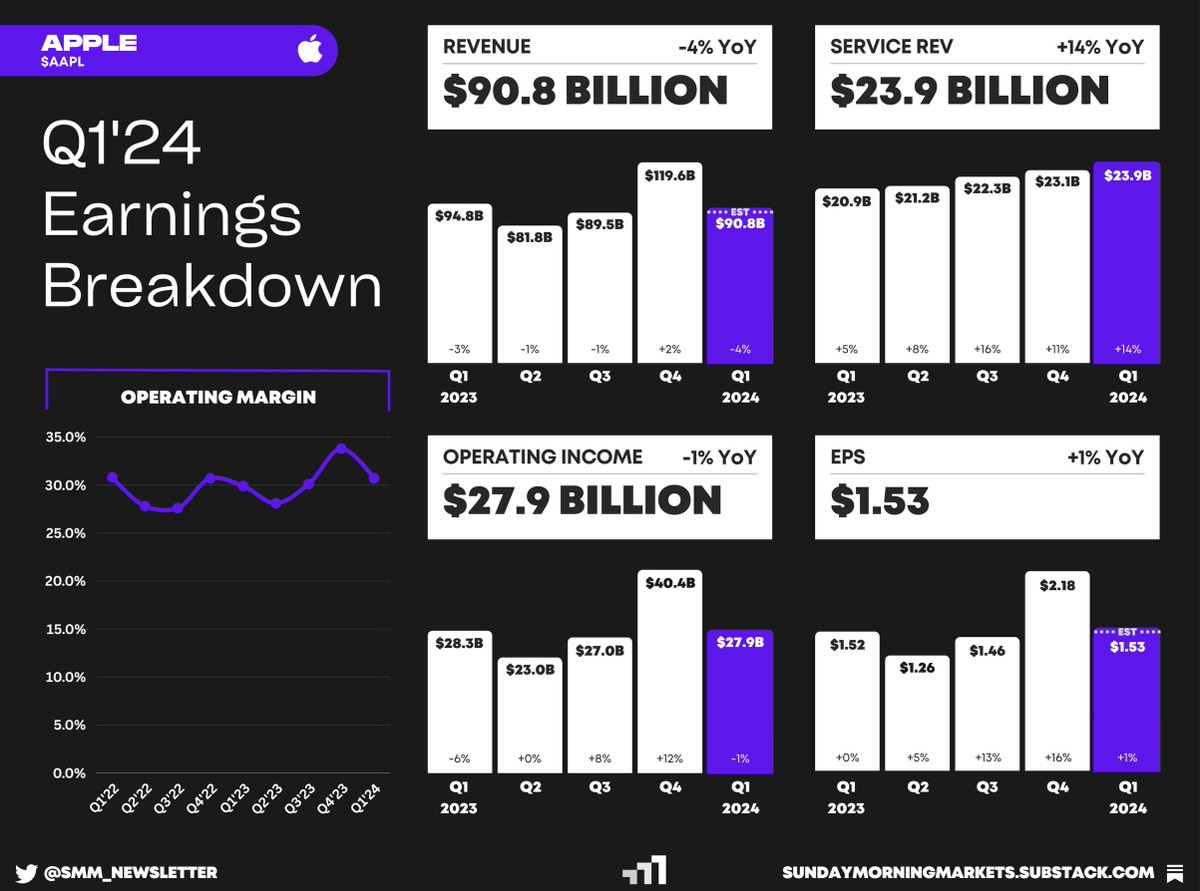

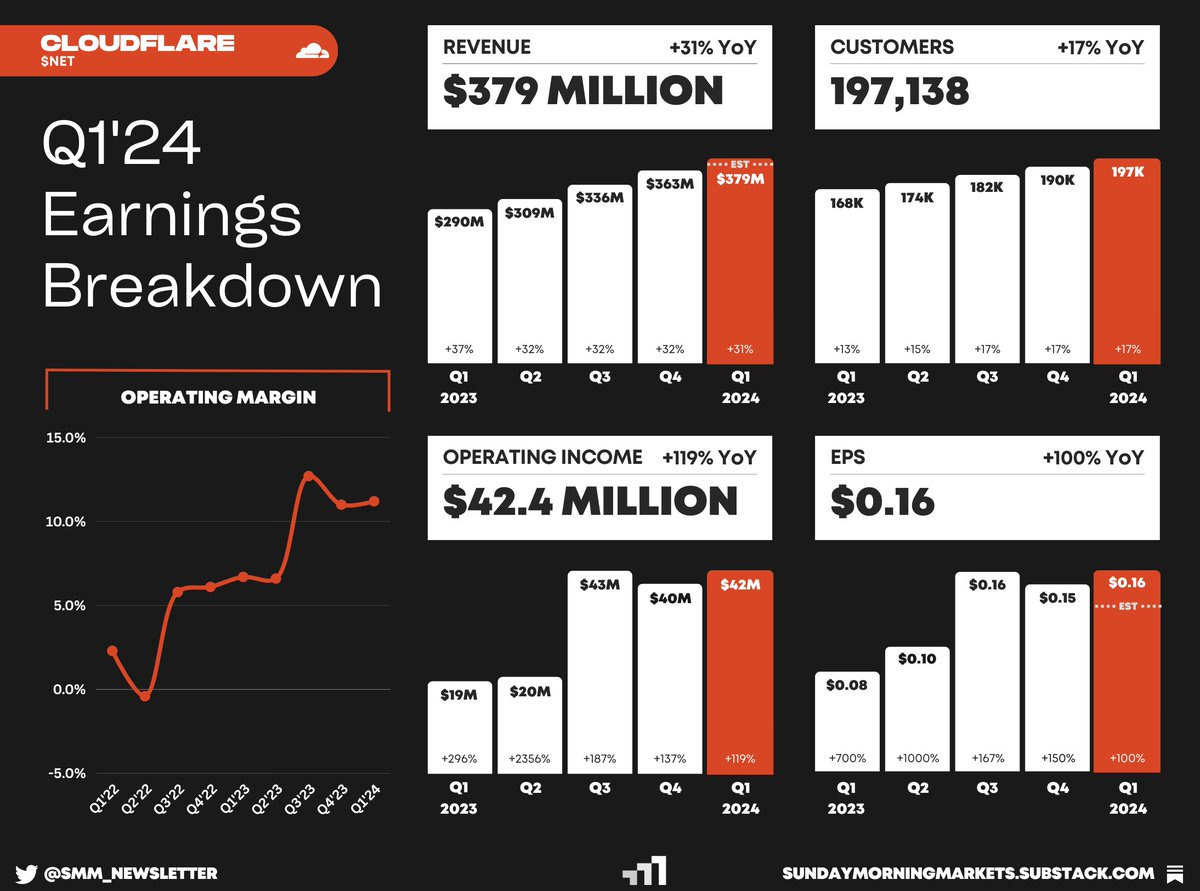

Earnings from Amazon, Apple, and Cloudflare

Global Markets 🌏

Turkey halts all trade with Israel

Bank of Japan intervenes to prop up Yen

China factory activity jumps again

Tech ⚡

Tesla gets major win in China

Anthropic launches iOS app and enterprise plan

Coinbase integrates with Bitcoin’s lightning network

OpenAI and Microsoft sued by newspapers

US Markets 🇺🇸

Fed holds interest rates at 23-year high as they noted a ‘lack of further progress’ on inflation. The FOMC did slow the pace of quantitative tightening by reducing its Treasury runoff from $60 billion to $25 billion per month.

U.S. services and manufacturing activity both contracted last month while the gauge for prices paid rose significantly. ISM’s manufacturing PMI slipped to 49.2% (prev. 50.3%) while its services PMI fell to 49.4% (prev. 51.4%).

U.S. payrolls increased just 175,000 in April as the unemployment rate rose to 3.9%. Average hourly earnings increased less than expected, up 3.9% from a year ago, an encouraging sign for inflation.

Job openings fell to the lowest level in three years to 8.49 million from last month’s reading of 8.81 million. The hiring rate dropped to 3.5%, matching the lowest since the onset of the pandemic.

Boeing taps debt markets to raise $10 billion as the planemaker burned nearly $4 billion in free cash flow last quarter amid its 737 MAX 9 crisis. The company has over $12 billion in debt coming due in 2025 and 2026.

Peloton to lay off 15% of staff and CEO to step down after joining the company just two years ago. The company aims to ‘bring spending in line with revenue’. PTON 0.00%↑ shares are down 98% from their peak.

Sony and Apollo propose $26 billion deal for Paramount, the media giant that owns CBS and MTV. The offer is a nonbinding expression of interest for an all-cash buyout with the assumption of Paramount’s debt.

Warren Buffett cuts stake in Apple by 13% in the first quarter but it remains Berkshire Hathaway’s top position. Apple’s earnings report on Thursday showed that iPhone sales plunged 10% in Q1.

Global Markets 🌏

Turkey halts all trade with Israel over the ongoing conflict in the Middle East. Trade between the two countries was worth $6.8 billion in 2023, of which 76% was Turkish exports.

Bank of Japan intervenes in forex markets to prop up the Yen against the U.S. Dollar. Data shows Japan likely spent ¥3.5 trillion ($22.5 billion) buying its own currency after the Dollar/Yen exchange rate hit 160.

G7 eyes new $50 billion funding for Ukraine in a plan that would use profits from the frozen Russian assets to repay the aid. The group aims to nail down the deal’s details by next month’s meeting in Italy.

Inflation in Europe held steady at 2.4% in April, keeping the June rate cut on the table. Excluding volatile food and energy, core CPI came in slightly above forecasts, cooling to 2.7% from 2.9%.

Eurozone economy returns to growth and speeds out of recession as GDP rises faster than expected at 0.3%. Tourism in Europe’s sunbelt powered the rebound as core manufacturing centers struggled to recover.

China’s factory activity expands at fastest pace in 14 months as the Caixin manufacturing PMI rose to 51.4 in April, an encouraging sign for an economy still struggling to recover.

China hints at property support and rate cuts as a part of a new plan to rekindle growth. The Politburo warned of “rising external uncertainties” about mounting global geopolitical and economic frictions.

Tech ⚡

Tesla wins major backing for FSD in China, raising the expectation that its Full Self-Driving technology will soon be available there. TSLA 0.00%↑ shares surged 15% following the report.

Coinbase integrates Bitcoin’s Lightning network to help facilitate instant low-cost BTC transfers for its users. The new feature is officially live through its partnership with Lightspark.

Anthropic launches new iPhone app and business tier to compete head-to-head with OpenAI’s ChatGPT. The enterprise “Team” plan will cost $30 per user per month and requires a minimum of five users.

TikTok Shop tops 500,000 sellers in the U.S. at the end of the fourth quarter. TikTok’s e-commerce platform had more than 15 million sellers worldwide in December, adding more than 6 million in the second half of the year.

8 newspapers sue OpenAI and Microsoft over copyright infringements. The suit claims that ChatGPT regularly surfaced entire text of articles without prominently linking back to the source.

Tesla axes its Supercharger team as CEO Elon Musk said on X that the company will still grow its network but “at a slower pace for new locations and more focus on 100% uptime and expansion of existing locations.”

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

UK - Retail Sales (APR)🇬🇧

EU - HCOB Composite PMI (APR)🇪🇺

AU - Retail Sales (APR)🇦🇺

Earnings: Palantir, Lucid, Hims, Spirit Airlines💰

Tuesday

US - Consumer Credit (MAR)🇺🇸

CA - Ivey PMI (APR)🇨🇦

AU - RBA Interest Rate🇦🇺

Earnings: Disney, DataDog, Rivian, Ferrari, Celsius, Toast, Twilio, Confluent, Lyft💰

Wednesday

US - Crude Oil Inventories 🇺🇸

CN - Imports & Exports🇨🇳

Earnings: Uber, Airbnb, Shopify, Arm, Toyota, TradeDesk, Affirm, Duolingo💰

Thursday

US - Jobless Claims 🇺🇸

UK - BOE Interest Rate🇬🇧

Earnings: Roblox, Plug, Unity, Warner Bros 💰

Friday

US - UMich Inflation Expectations (MAY)🇺🇸

UK - GDP (MAR)🇬🇧

CN - PPI Inflation (APR)🇨🇳

CN - CPI Inflation (APR)🇨🇳

Earnings: DigitalOcean💰

Want to partner with Sunday Morning Markets? Click here to inquire.