What Moved The Markets This Week 📈

‘Sahm Rule’ Signals Recession in US, Buffett Dumps Half Of Apple Stake, Intel To Cut 15% Of Workforce, BOE Cuts Rates, Meta Threads Hits 200M MAUs, and AAPL + AMZN + META + MSFT Earnings

Sunday Morning Markets

Trading Week 31, covering Monday, Jul 29 through Friday, Aug 2. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

‘Sahm Rule’ signals recession in U.S.

Unemployment rises to 4.3%

Job growth slows significantly

Fed holds rates, BOE cuts, BOJ hikes

Buffett dumps 50% of his Apple stake

Intel to cut 15% of workforce

Delta says IT outage cost them $500M

Meta Threads crosses 200M MAUs

Earnings from Amazon, Apple, Microsoft, Meta

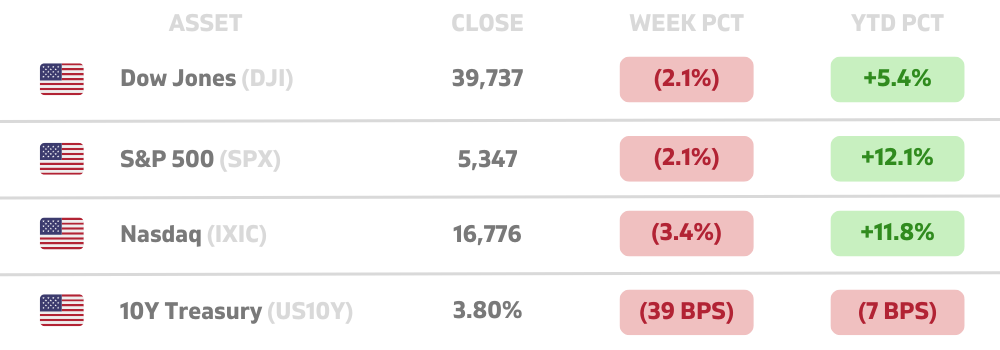

US Markets 🇺🇸

Recession warning triggered by ‘Sahm Rule’ which signals a recession when the 3-month average unemployment rate is 50 bps above the 12-month low. It’s accurately predicted the onset of every U.S. recession since 1970.

Fed holds interest rates steady but indicated that inflation is getting closer to its 2% target. CME’s FedWatch tool now predicts over 75 basis points worth of rate cuts by the end of 2024.

Job growth slowed significantly in July with payrolls growing just 114,000, well below the consensus estimate of 185,000. Average hourly earnings increased 0.2% for the month, also below forecasts.

Warren Buffett dumps half of his Apple stake, raising Berkshire Hathaway’s cash level to record $277 billion. Berkshire has been a seller of stocks for seven quarters straight, but this marks a major acceleration.

Intel to cut 15% of its workforce as part of a $10 billion restructuring plan. The company also cut its Q4 dividend and lowered its capex guidance by 20%. Shares of INTC 0.00%↑ fell over 30% this week.

US pending home sales surged in June as an improvement in supply and some moderation in mortgage rates pulled buyers in from the sidelines. The FHFA reported home prices increased 5.7% year-on-year in May.

Global Markets 🌏

Bank of England cuts interest rates for the first time in over four years, bringing its key rate down to 5%. It was a 5-4 split decision to proceed with the cut, as some felt unconvinced that inflation was sufficiently tamped down.

Bank of Japan raises benchmark interest rate to its highest level since October 2008. It will also reduce its purchases of Japanese government bonds to about 3 trillion yen ($19.6 billion) per month.

EU economy grows despite slump in Germany with GDP rising 0.3% in Q2, led higher by France and Spain. In stark contrast, the German economy contracted amid weak demand and softness in manufacturing.

China PMIs signal continued weakness in manufacturing and a slowdown in services. Chinese leaders said they would take more aggressive steps to boost consumer spending and strengthen its economy.

US to exclude certain allies from chip export restrictions causing shares of ASML to surge 10% on the news. However, chip exports from Israel, Taiwan, Singapore, and Malaysia will all still be impacted.

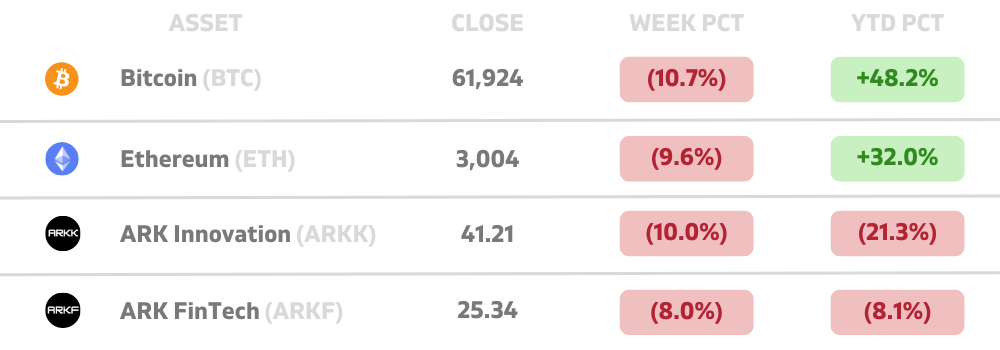

Tech ⚡

Meta’s Threads crosses 200 million active users, up nearly 30% since April 2024. For comparison, X (formerly Twitter) had more than 600 million monthly users back in May, according to owner Elon Musk.

OpenAI begins rolling out its ‘Advanced Voice Mode’ for ChatGPT Plus users. The feature allows you to have ultra-realistic conversations with ChatGPT in real-time. The company plans to do a full rollout by fall.

TikTok was paying Microsoft $20 million per month to access OpenAI’s models as of March, making up nearly a quarter of the revenue generated by its increasingly lucrative cloud division.

Uber partners with BYD to deploy 100,000 EVs into its ridehailing network. The partnership will start in the EU and Latin America and give Uber drivers “best-in-class pricing and financing” for BYD vehicles.

Delta says IT outage cost the airline $500 million after canceling more than 5,000 flights. Delta hired prominent attorney David Boies to seek damages from both CrowdStrike and Microsoft.

Meta unveils Segment Anything Model 2 (SAM2), a machine learning model that quickly and reliably identifies and outlines certain objects in images. The new SAM2 model allows you to now segment in video content.

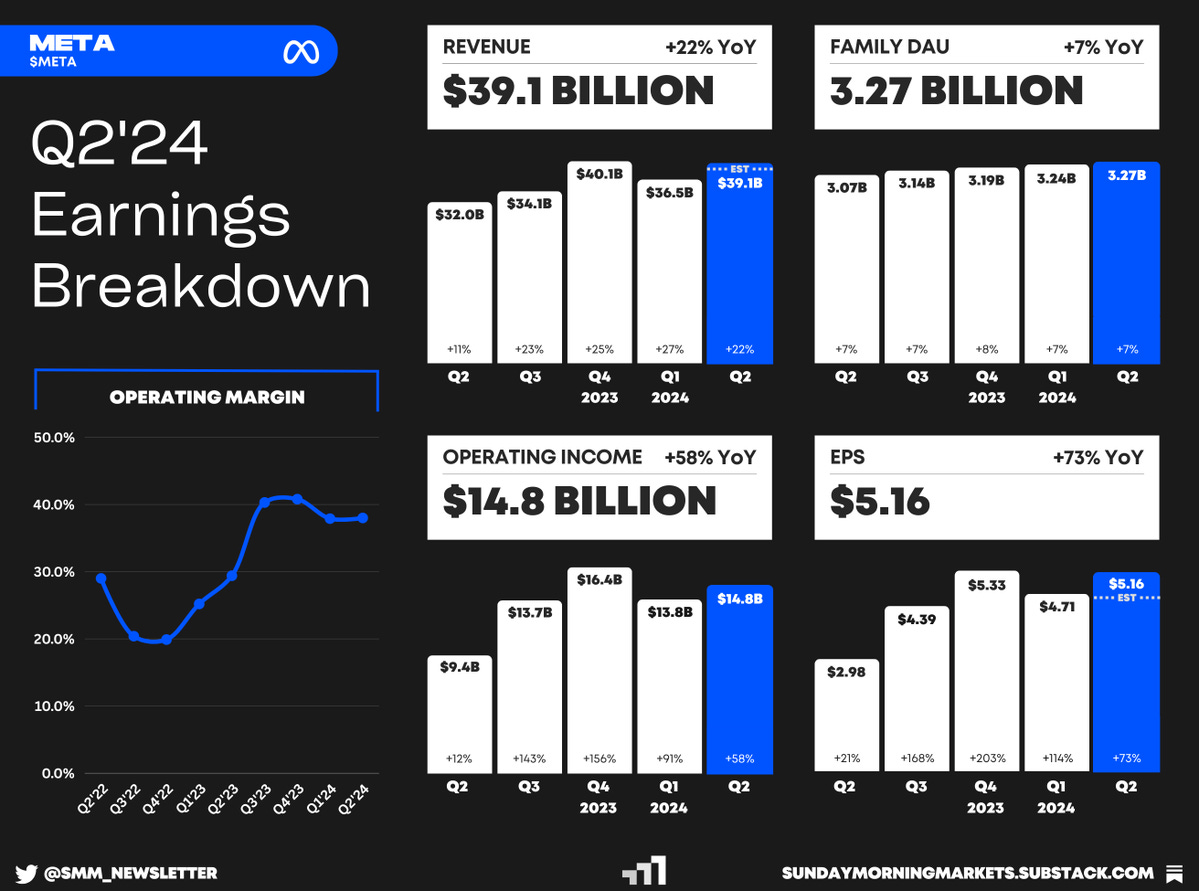

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

SMM Product Hunt 🧠

🧑💻 Alpha Vantage provides enterprise-grade financial market data through a set of powerful and developer-friendly APIs. From traditional asset classes (e.g., stocks and ETFs) to economic metrics, from foreign exchange rates to cryptocurrencies, from fundamental data to technical indicators; Alpha Vantage is your one-stop shop for real-time and historical global market data delivered through RESTful stock APIs, Excel, and Google Sheets. Alpha Vantage has recently been featured in the 10 Best Stock Options Data APIs of 2024. Read it here!

Week Ahead 📅

Monday

US - ISM Services PMI 🇺🇸

US - S&P Services PMI 🇺🇸

UK - Retail Sales 🇬🇧

UK - S&P Composite PMI 🇬🇧

EU - S&P Composite PMI 🇪🇺

CN - Services PMI 🇨🇳

Earnings: Palantir, Hims, Lucid, Berkshire, ZoomInfo💰

Tuesday

US - Imports & Exports 🇺🇸

AU - RBA Interest Rate Decision 🇦🇺

Earnings: Uber, SMCI, Airbnb, Rivian, Reddit, Caterpillar, Constellation Energy, Celsius💰

Wednesday

US - Crude Inventories 🇺🇸

US - Consumer Credit 🇺🇸

CA - Ivey PMI 🇨🇦

DE - Industrial Production 🇩🇪

CN - Imports & Exports 🇨🇳

Earnings: Shopify, Robinhood, Disney, Lyft, Hubspot💰

Thursday

US - Jobless Claims 🇺🇸

CN - CPI Inflation 🇨🇳

CN - PPI Inflation 🇨🇳

Earnings: Eli Lilly, Datadog, TradeDesk, Unity, Plug Power, Rocket Lab💰

Friday

CA - Unemployment Rate 🇨🇦

DE - CPI Inflation 🇩🇪

Want to partner with Sunday Morning Markets? Click here to inquire.