What Moved The Markets This Week 📈

Market Now Expects 4 Rate Cuts In 2024, Soft Inflation Data, DOJ Considers Breaking Up Alphabet, Starbucks Hires Ex-Chipotle CEO, Consumer Spending Jumps, and BABA + NU + MNDY Earnings

Sunday Morning Markets

Trading Week 33, covering Monday, Aug 12 through Friday, Aug 16. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Soft inflation data 📉

CPI: 2.9% (prev. 3.0%)

Core CPI: 3.2% (prev. 3.3%)

PPI: 2.2% (prev. 2.7%)

Core PPI: 2.4% (prev 3.0%)

4 rate cuts priced in for 2024 (~93 bps)

Starbucks hires ex-Chipotle CEO

DOJ considers breaking up Alphabet

xAI unveils Grok-2 and Grok-2 mini

Japan and UK show strong growth in Q2

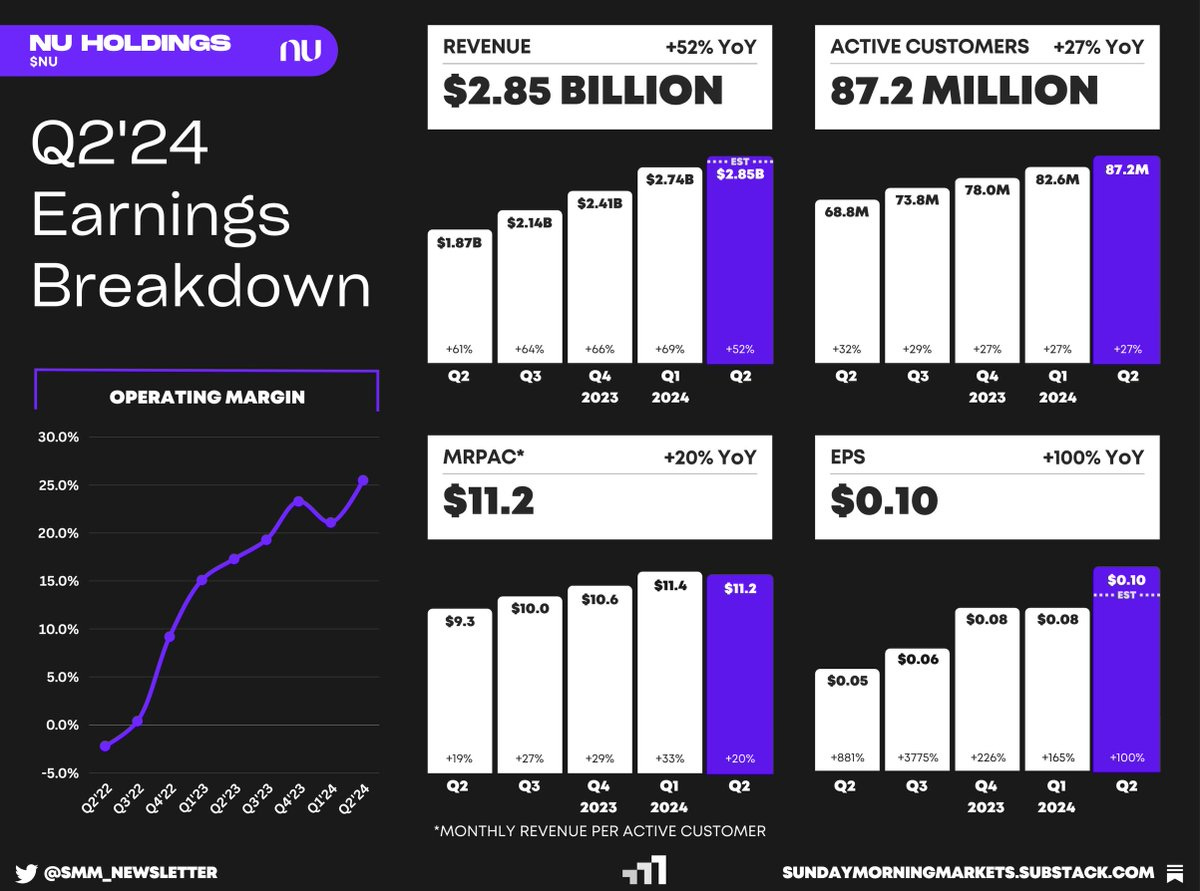

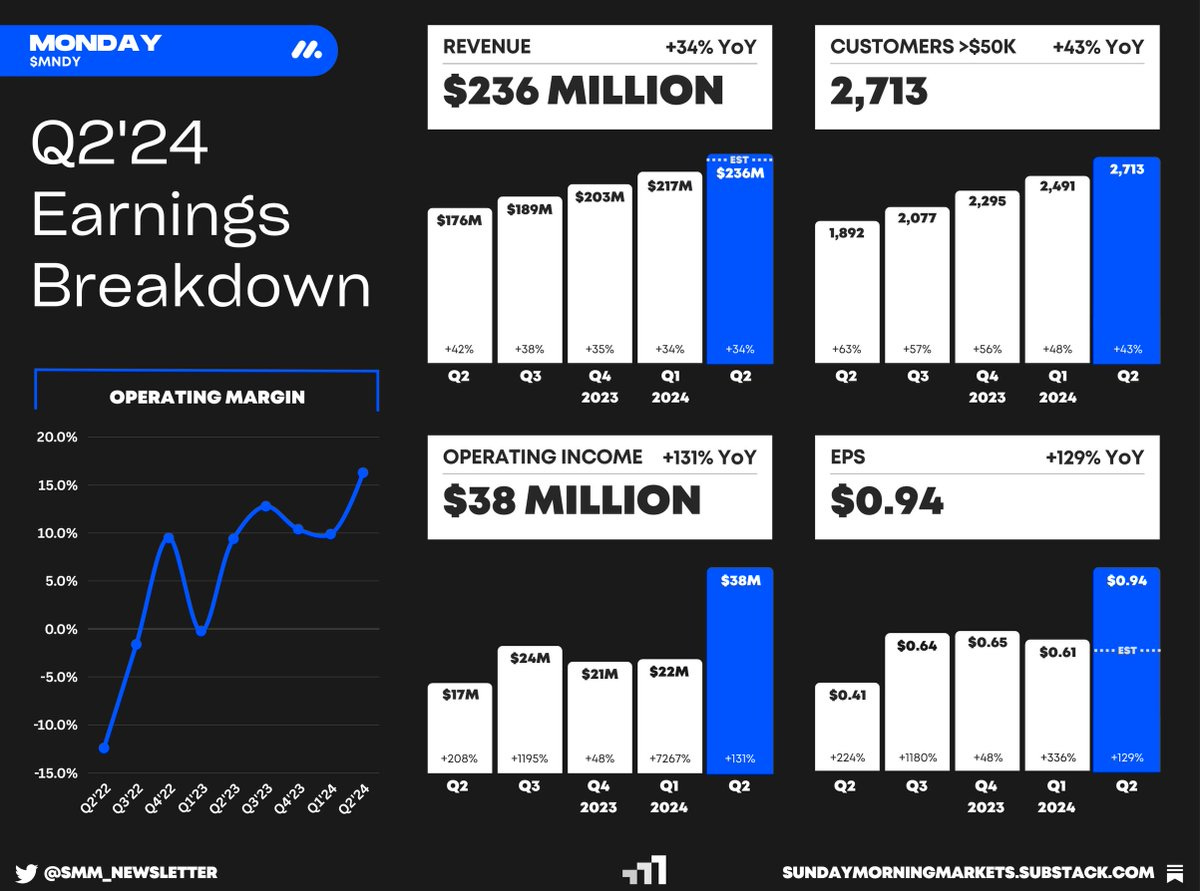

Earnings from Alibaba, Nu, Monday

US Markets 🇺🇸

The market prices in four rate cuts in 2024 according to CME’s FedWatch tool. The cuts are expected to start at the September FOMC meeting, with the market seeing a 25% chance of a 50 basis point reduction.

Inflation has slowed to its lowest level since March 2021, with the CPI easing to 2.9% in July. At the same time, wholesale inflation saw a significant drop, plunging to 2.2% — a sharp decline from June's 2.7% reading.

Consumer spending strongly outpaced forecasts in July, with retail sales growing by 1% during the month. Excluding autos, sales rose 0.4%, surpassing the 0.1% forecast.

Starbucks hires ex-Chipotle CEO Brian Niccol after firing Laxman Narasimhan, effective immediately. The news sent Starbucks shares soaring 25%, while shares of Chipotle plunged over 10%.

Texas Instruments to receive up to $1.6 billion via the CHIPS Act to support the construction of three new facilities. The company has pledged $18 billion in investments through 2029 to the projects.

Kamala Harris unveils her economic policy goals for the first 100 days in office. The policies aim to lower the cost of groceries and prescription drugs, expand affordable housing, and cut taxes for the middle class.

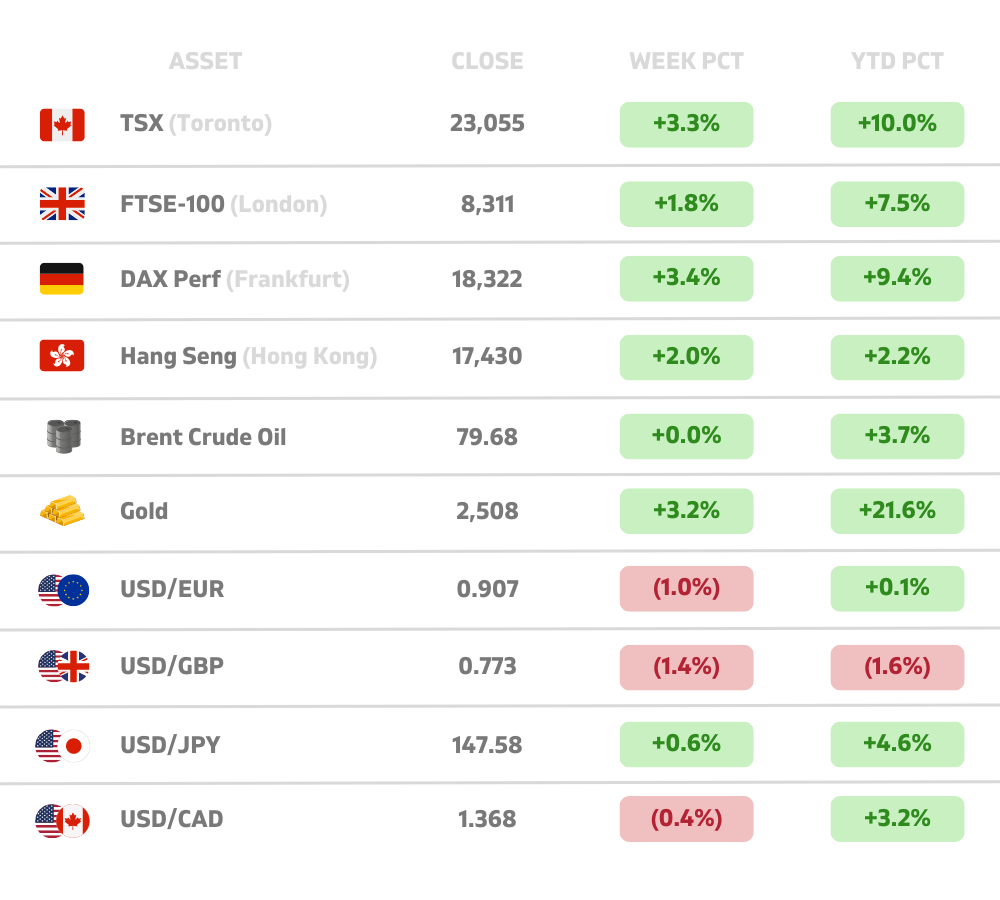

Global Markets 🌏

China's economic struggles deepen as housing market woes persist and consumer spending wavers. Despite new policies, property investment plunged 10.2% and urban unemployment rose to 5.2%.

Japan's Q2 GDP growth accelerated to 3.1%, widely beating the consensus estimate of 2.1%. The report could prompt the Bank of Japan to raise interest rates again in future meetings.

UK economy continues its recovery from recession with GDP growth of 0.6% in Q2. However, the pace of growth is unlikely to continue into the rest of the year amid weaker wage growth, high interest rates, and supply challenges.

Industrial activity in Europe contracts again, marking the third consecutive monthly decline. The manufacturing slump has been particularly felt in the eurozone’s largest economy, Germany.

Wizz Air launches €500 ‘all you can fly’ annual subscription in Europe that allows passengers to book flights to international destinations — such as Athens, Madrid, and Paris — up to three days before departure.

Tech ⚡

DOJ considers breaking up Alphabet a week after a judge ruled the tech giant illegally monopolized the online search market. Divesting from Android was a popular potential remedy discussed by DOJ attorneys.

Google launches first AI-powered Android update with its new Pixel 9 phones. The company aims to put AI in front of consumers before Apple. Here is a showcase of some of the coolest AI features.

xAI releases Grok-2 and Grok-2 mini with improved reasoning and the ability to generate images. The models are currently limited to premium users on X but should be available via API later this month.

Polymarket partners with Perplexity to display news summaries. When users of the prediction marketplace click on an event, they will now see an overview of the news related to the event, powered by Perplexity.

Epic Games launches its rival iOS app store in Europe amid regulatory changes brought by EU’s Digital Markets Act, forcing Apple to open its doors to rivals. The Epic Games Store is launching worldwide on Android.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

AU - RBA Meeting Minutes 🇦🇺

Earnings: Palo Alto Networks💰

Tuesday

US - Crude Oil Inventories 🇺🇸

CA - CPI Inflation 🇨🇦

DE - PPI Inflation 🇩🇪

JP - Balance of Trade 🇯🇵

Earnings: Lowe’s, Medtronic, Xpeng💰

Wednesday

US - Meeting Minutes 🇺🇸

JP - Jibun Composite PMI 🇯🇵

Earnings: Snowflake, Zoom, Target, TJX💰

Thursday

US - Jobless Claims 🇺🇸

US - S&P Services PMI 🇺🇸

UK - S&P Composite PMI 🇬🇧

EU - HCOB Composite PMI 🇪🇺

JP - Inflation Rate 🇯🇵

Earnings: Intuit, Workday, Cava, Bill, Peloton💰

Friday

US - Powell Speech 🇺🇸

US - New Home Sales 🇺🇸

CA - Retail Sales 🇨🇦

Want to partner with Sunday Morning Markets? Click here to inquire.