What Moved The Markets This Week 📈

Inflation Eases To 3.5-Year Low Of 2.5%, U.S. Interest Payments Top $1 Trillion, Apple Unveils Its iPhone 16, ECB Cuts Rates Again, OpenAI Debuts 'o1', and ADBE + ORCL + RBRK

Sunday Morning Markets

Trading Week 37, covering Monday, Sep 9 through Friday, Sep 13. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Inflation hits 3.5-year low of 2.5%

Interest payments on government debt top $1T per year

Apple unveils iPhone 16, with AI features coming soon

Big tech invested over $50B in AI last quarter

OpenAI debuts ‘o1’, capable of complex reasoning

ECB cuts interest rates for second time in three months

Startup formations in China plummet over 95%

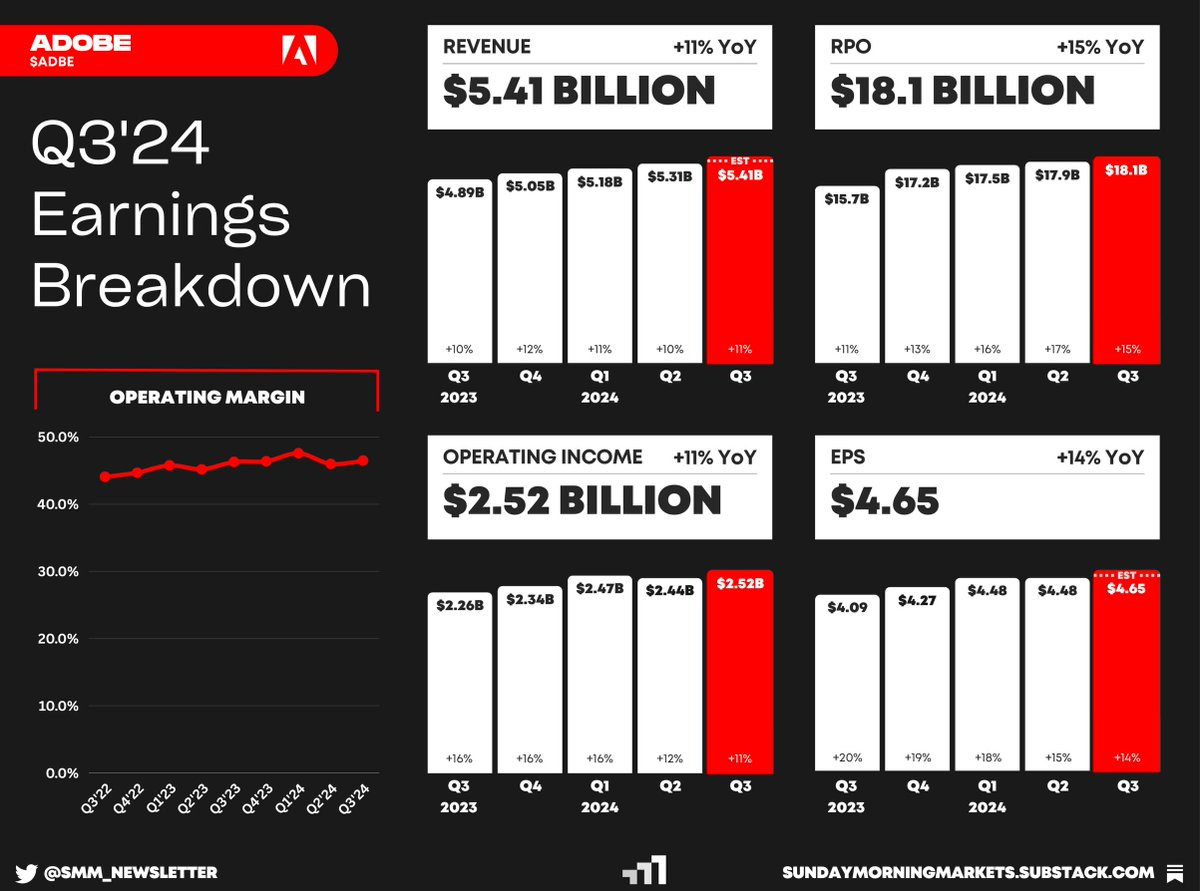

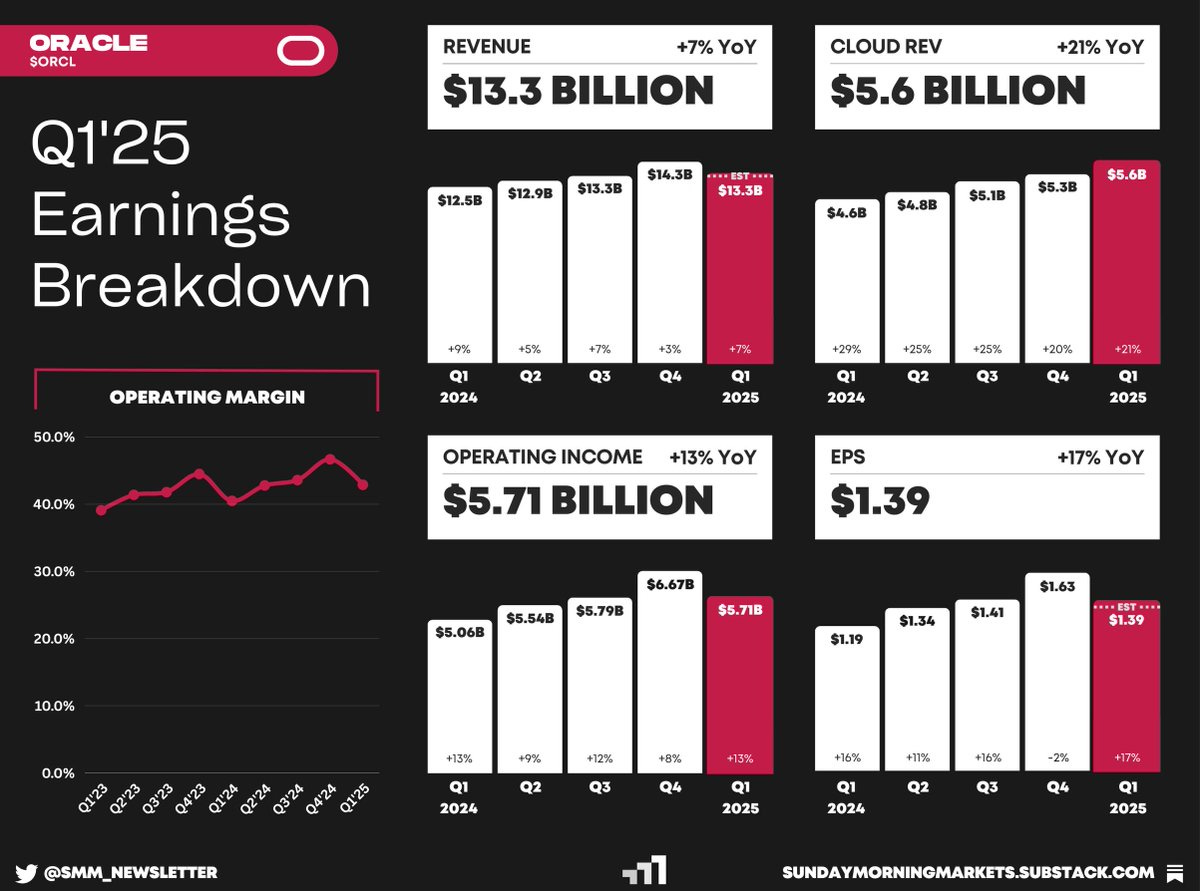

Earnings from Adobe, Oracle, Rubrik

US Markets 🇺🇸

U.S. debt interest payments top $1 trillion this year, up 30% from 2023. Interest payments have become the government’s largest spending category and are set to rise further as the annual deficit approaches $2 trillion.

Inflation hit a 3.5-year low of 2.5% in August driven by lower energy costs. However, “Core CPI” rose 0.3% during the month, complicating the Fed’s upcoming rate cut plans. Housing remains a major driver of inflation.

Consumer debt hit a record $5.1 trillion in July, far surpassing forecasts. Credit card balances surged by $10.6 billion as households faced inflation and slow wage growth. Tighter lending may curb future debt growth.

Verizon to incur up to $1.4 billion severance charge as over 4,500 employees exit in September under its voluntary separation program. The telecom giant is also exiting certain non-strategic businesses.

Amazon is opening new Fresh supermarkets after a yearlong hiatus. Amazon originally halted the expansion of the Fresh supermarket line in 2023 but currently has 22 vacant locations ready to open.

Global Markets 🌏

ECB cuts rates for the second time in three months to 3.5%, responding to slowing eurozone growth. Investors expect an aggressive series of cuts in Europe and U.S. to shore up growth as inflation moderates.

Venture capital investments in China have plummeted, with the number of new startups falling from 51,000 in 2018 to just 1,200 in 2023. Economic slowdown and political crackdowns have stifled entrepreneurial growth.

China’s inflation rose just 0.6% in August, reinforcing concerns over weak domestic demand and looming deflation. On the other hand, Chinese exports surged 8.7% during the month, its fastest growth in 17 months.

UK economy stagnates again in July, falling short of expectations. A minor uptick in services was offset by declines in production and construction, sparking concerns about future growth.

Apple must pay €13 billion in back taxes after losing its case in Europe’s top court after a 10-year legal battle. The case found Apple received "illegal" tax benefits from Ireland.

Huawei's trifold phone hits 2.7 million preorders days before Apple's iPhone 16 launch. The Mate XT preorders mark a major boost for Huawei as it challenges Apple's market share in China.

Tech ⚡

OpenAI debuts o1, its first advanced reasoning model designed to solve complex questions and tasks like coding and math. The company is rumored to be raising a new round at a $150B valuation.

Tech giants spent $52.9 billion on AI infrastructure last quarter, fueling an unprecedented AI boom. Despite massive data center and chip investments, revenue growth has yet to catch up, raising investor concerns.

Oracle partners with AWS to offer AI database services, expanding cloud access to Oracle Autonomous Database and Exadata. This follows similar partnerships with Microsoft and Google.

Apple unveils its iPhone 16 with AI features, including enhanced Siri, AI-powered text editing, and photo recognition. Despite market skepticism, Apple hopes the upgrades will revive sales amid growing competition.

Uber and Waymo to offer driverless rides in Austin and Atlanta starting in early 2025. This expansion builds on their Phoenix partnership, pushing Uber further into the robotaxi market.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - Empire State Manf. Index 🇺🇸

EU - Employment Wage Report 🇪🇺

Tuesday

US - Retail Sales 🇺🇸

CA - CPI Inflation 🇨🇦

EU - ZEW Economic Sentiment 🇪🇺

Wednesday

US - Fed Interest Rate Decision 🇺🇸

US - Housing Starts & Permits 🇺🇸

UK - CPI Inflation 🇬🇧

EU - CPI Inflation 🇪🇺

Earnings: General Mills💰

Thursday

US - Existing Home Sales 🇺🇸

US - Leading Economic Index 🇺🇸

US - Philly Fed Manf. Index 🇺🇸

UK - BoE Interest Rate Decision 🇬🇧

CN - PBoC Interest Rate Decision 🇨🇳

JP - BoJ Interest Rate Decision 🇯🇵

Earnings: FedEx, Lennar, Darden, FactSet💰

Friday

CA - Retail Sales 🇨🇦

UK - Retail Sales 🇬🇧

Want to partner with Sunday Morning Markets? Click here to inquire.