What Moved The Markets This Week 📈

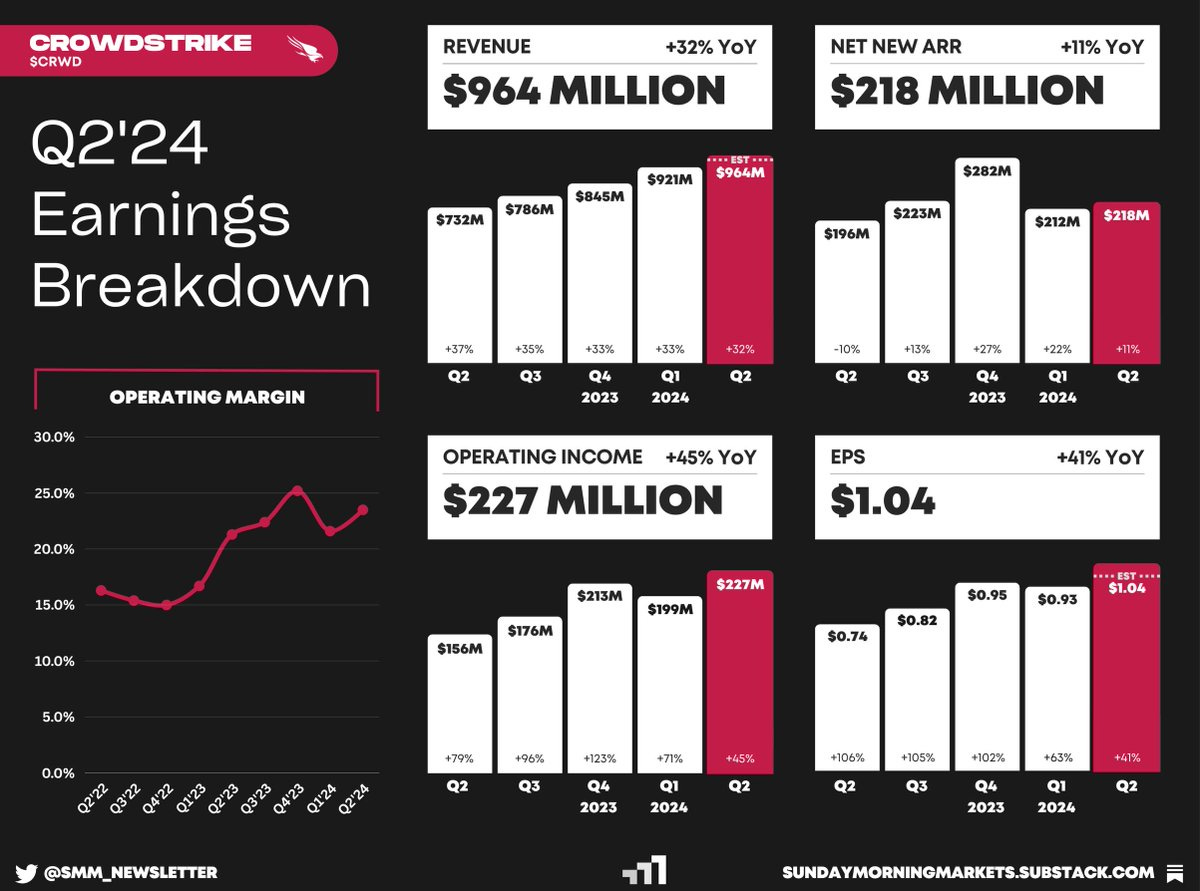

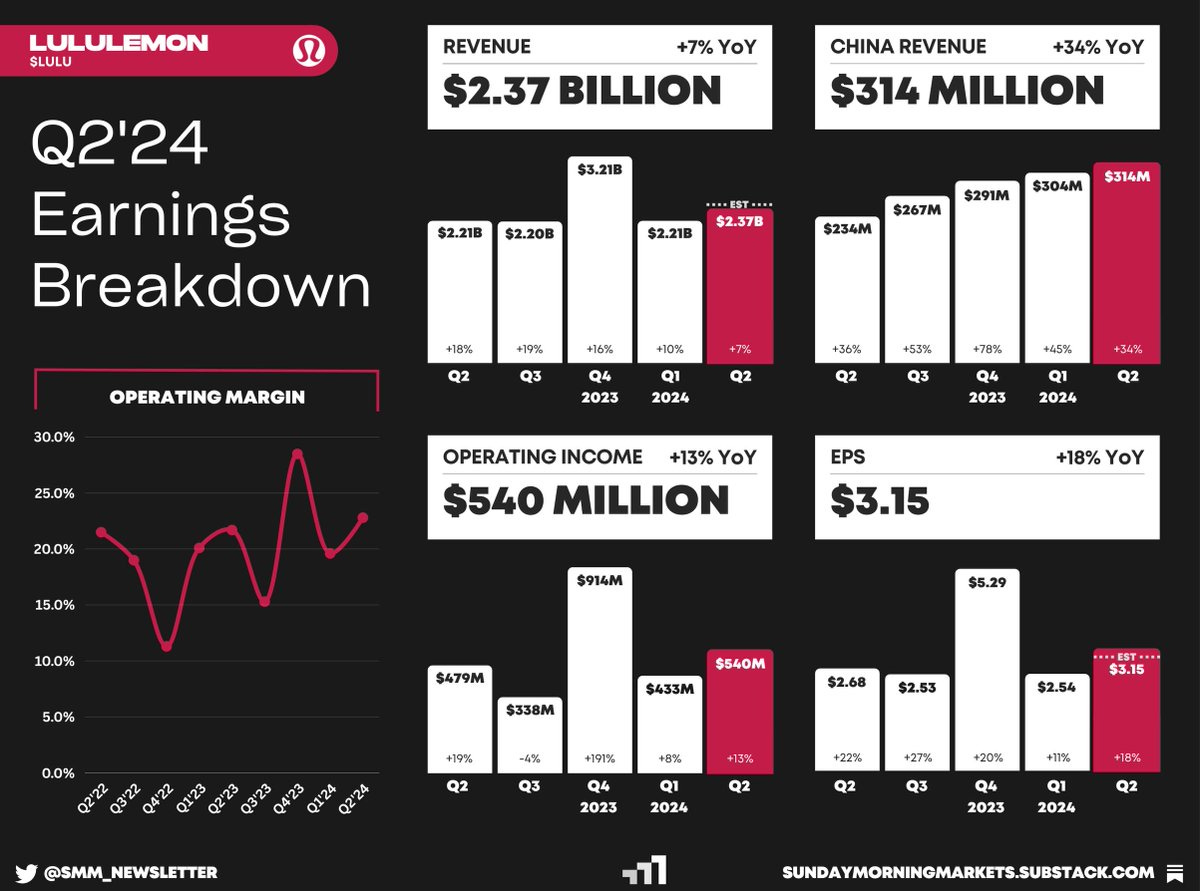

OpenAI To Raise At $100B Valuation, Home Sales Hit Record Low, Eli Lilly Slashes GLP-1 Prices In Half, Brazil Bans X Nationwide, Super Micro Short Report, and NVDA + CRWD + LULU Earnings

Sunday Morning Markets

Trading Week 35, covering Monday, Aug 26 through Friday, Aug 30. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Home sales hit a record low

Eli Lilly slashes GLP-1 prices in half

OpenAI to raise money at over $100B valuation

Super Micro accused of accounting manipulation

Brazil’s Supreme Court bans X nationwide

German inflation falls below the 2% ECB target

Canada levies 100% tariff on Chinese EVs

Earnings from Nvidia, Crowdstrike, Lululemon

US Markets 🇺🇸

The Fed's key inflation gauge rose 0.2% in July, with core PCE up 2.6% annually, slightly below estimates. Personal income edged higher, and consumer spending grew 0.5%, aligning with forecasts.

U.S. retailers continue to signal weak consumer demand as Abercrombie’s CEO warns of an ‘increasingly uncertain environment’ while Dollar General cut its outlook, blaming ‘financially constrained’ customers.

US pending home sales hit a record low in July, plunging 5.5% due to high prices and borrowing costs. The NAR reported the index fell to its lowest level since they started tracking sales in 2001.

Eli Lilly slashes the price of Zepbound in half to boost access for patients without insurance. The price of its GLP-1 drug now starts at $399 per month and aims to combat cheaper compounded knockoffs.

Zuckerberg criticizes the White House pressure on Meta to censor COVID-19 content and expressed regret over demoting the Hunter Biden story during the 2020 election, admitting it wasn't Russian disinformation.

Global Markets 🌏

Eurozone inflation falls to 2.2% in August with German inflation dropping below the ECB target. This unexpected dip, driven by lower energy prices, raises the likelihood of a rate cut at the ECB’s September meeting.

Bank of Japan reaffirms readiness for more rate hikes, stressing vigilance over market instability. He highlighted the yen's appreciation as beneficial for small firms despite its potential impact on exporters.

Canada imposes 100% tariffs on Chinese EVs and a 25% tariff on Chinese steel and aluminum. These measures aim to protect domestic industries and align with similar actions by the U.S. and EU.

Disney and Reliance secure $8.5B merger approval, overcoming cricket-related concerns. The deal creates India's largest entertainment entity, tightening Reliance’s grip on the media sector.

Telegram founder Pavel Durov was arrested in Paris by French authorities for allegedly failing to prevent criminal activities on the app, including organized crime and child exploitation.

Tech ⚡

OpenAI in talks to raise at $100 billion valuation, with Apple and Microsoft among key investors. ChatGPT now has more than 200 million weekly active users — twice as many as it had last November.

Super Micro accused of "accounting manipulation" by Hindenburg Research, causing shares to plunge 28% this week. The company then delayed its annual report, adding to investor concerns. Read the short report here.

Meta is planning new mixed-reality glasses as an alternative to its bulky Quest headsets, aiming for a 2027 release. The device, code-named "Puffin," will allow users to interact with hand gestures and eye movements.

Xpeng launches Mona M03 EV for under $17,000, offering a 320-mile range and basic driver-assist features. Competing with Tesla's Model 3, the Mona M03 aims to attract young consumers with affordability and advanced tech.

Amazon taps Anthropic’s AI for Alexa revamp, moving away from its own tech due to performance issues. The new Alexa is set to be released in October and will include a paid version with advanced features.

Brazil's Supreme Court suspends Musk's X nationwide for defying orders on content moderation and legal representation. The ruling also threatens daily fines for VPN usage to bypass the ban.

Earnings Reports 💰

See other breakdowns on our Twitter page.

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - Market Closed (Labor Day) 🇺🇸

UK - Retail Sales 🇬🇧

Tuesday

US - ISM Manufacturing PMI 🇺🇸

AU - GDP Growth 🇦🇺

CN - Caixin Services PMI 🇨🇳

Earnings: Zscaler, GitLab💰

Wednesday

US - JOLTs Job Openings 🇺🇸

US - Balance of Trade 🇺🇸

CA - BOC Interest Rate Decision 🇨🇦

Earnings: Hewlett Packard, Gamestop, C3, Asana💰

Thursday

US - Jobless Claims 🇺🇸

US - ISM Services PMI 🇺🇸

US - ADP Employment Report 🇺🇸

EU - Retail Sales 🇪🇺

Earnings: Broadcom, Samsara, DocuSign, Guidewire, Nio, UiPath, Smartsheet, Braze💰

Friday

US - Nonfarm Payrolls 🇺🇸

CA - Ivey PMI 🇨🇦

CA - Employment Report 🇨🇦

CN - Inflation 🇨🇳

Earnings: Kroger💰

Want to partner with Sunday Morning Markets? Click here to inquire.