What Moved The Markets This Week 📈

W16 - Lyft Cuts 1200 Jobs, Apple Savings Account 4.15% APY, Microsoft AI Chips, LEI Shows Recession, Europe Passes $47B Chip Bill, Eurozone Inflation Hits Record, and Tesla + Netflix + Amex Earnings

Sunday Morning Markets

Trading Week 16, covering Monday, Apr 17 through Friday, Apr 21. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

LEI indicator shows red flag for recession

Lyft reduces its workforce by 1,200 (30%)

Apple launches savings account paying 4.15%

Samsung considers switching to Bing from Google

Some EVs lose eligibility for federal tax credits

Microsoft working on its own AI chip to rival Nvidia

Europe passes extensive $47B chip bill

Coinbase to consider moving out of the US

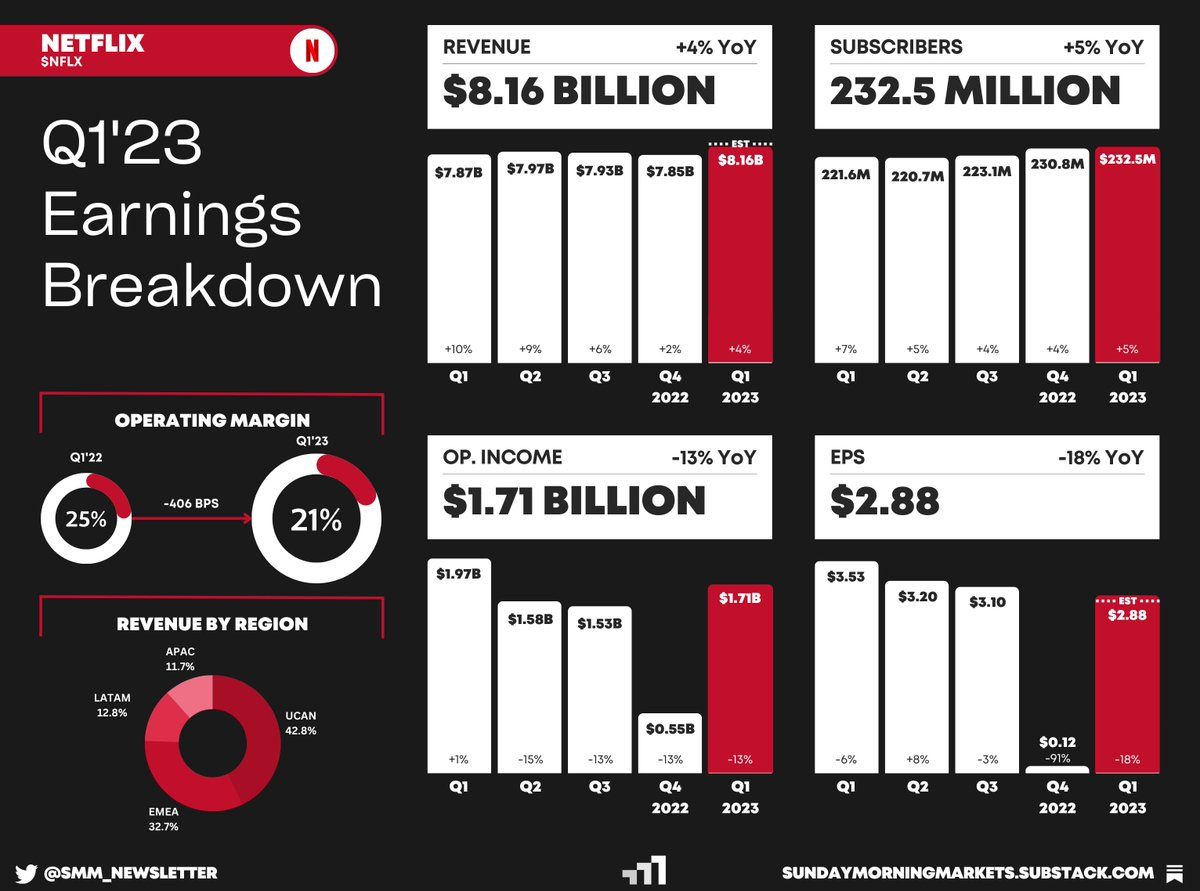

Earnings from Tesla, Netflix, and Amex — see breakdowns below

US Markets 🇺🇸

The LEI shows US economy heading into recession as the index fell another 1.2% in March. The indicator is currently down nearly 8% versus the year prior, a level only seen during the five previous recessions dating back to 1980.

US housing market sees largest decline in 11 years as the median price fell 0.9% to $375,700 in March. Existing home sales decreased 22% from the year prior, marking the 13th time out of the previous 14 months that sales have slowed.

Lyft to cut at least 1,200 jobs and joins other companies, such as Opendoor, F5, and BuzzFeed, in announcing major layoffs this week. According to layoffs.fyi, over 600 tech companies have laid off nearly 175K workers so far in 2023.

Samsung phones may switch to Microsoft Bing as their default search engine. Alphabet currently pays billions of dollars to maintain Google’s default-search status on mobile phones. GOOG 0.00%↑ shares fell 3% this week.

Several EVs lose their eligibility for federal tax credits after the Biden administration unveiled stricter rules for battery sources. Vehicles losing credits include those from BMW, Hyundai, Nissan, Rivian, Volkswagen, and Volvo.

Microsoft is working on its own AI chips with the aim of reducing its costly dependence on Nvidia. Microsoft is planning to make its chips available more broadly inside the organization and at OpenAI, as early as next year.

Apple launches savings accounts with 4.15% APY inside its Apple Card product. It requires no minimum deposit or balance, and users can set up an account from the Wallet app on their iPhones.

Rest of World 🌏

Europe approves $47B landmark chip bill in response to Biden’s CHIPS Act. In a statement, they said the new rules would aim to double the EU’s global market share in semiconductors from 10% to 20% by 2030.

Eurozone core inflation hits record high at 5.7%, keeping further rate hikes from the ECB on the table. Headline inflation eased to 6.9% from 8.5%, largely due to the rapid decline in energy prices.

China’s economy grew 4.5% in first quarter, the fastest pace in a year and above estimates of 4.0%. China’s growth has been under the spotlight as it reopens from strict Covid restrictions that were in place for nearly three years.

Crypto ⚡

Coinbase says they’ll likely end up in court with the SEC after receiving a Wells notice. Brian Armstrong noted they’d consider investing more abroad, including relocating out of the US if the regulatory situation doesn't improve.

SEC Chair testified on crypto regulations before the House Financial Services Committee. “There’s a massive amount of change that this chair (Gensler) is trying to drive and he’s given a limited amount of time for good comment.”

Intel cancels Bitcoin mining chip series after starting production of their ‘Blockscale’ chips just one year ago. No orders will be taken after Oct. 20 and the last product will be shipped no later than April 20, 2024.

Earnings Reports 💰

See more breakdowns for Bank of America, Goldman Sachs, United Airlines, ASML, Morgan Stanley, and TSMC on our Twitter page

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - Dallas Fed Manf. Index (APR)🇺🇸

Germany - Ifo Business Climate (APR)🇩🇪

Earnings Reports: Coca-Cola💰

Tuesday

US - New Home Sales (MAR)🇺🇸

Australia - Inflation Rate (Q1)🇦🇺

Earnings Reports: Microsoft, Alphabet, Visa, Pepsi, McDonald’s, UPS, Verizon, Raytheon, General Electric, General Motors, Chipotle💰

Wednesday

US - Durable Goods Orders (APR)🇺🇸

Germany - GfK Consumer Confidence (MAY)🇩🇪

Earnings Reports: Meta, Boeing, ServiceNow, Hilton, Ebay💰

Thursday

US - Jobless Claims🇺🇸

US - GDP (Q1)🇺🇸

US - Pending Home Sales (MAR)🇺🇸

Japan - BoJ Interest Rate Decision🇯🇵

Earnings Reports: Amazon, Mastercard, Eli Lilly, Merck&Co, AbbVie, Unilever, AstraZeneca, Amgen, Intel, Caterpillar, Capital One Financial, Activision, Pinterest, Snap, Cloudflare💰

Friday

US - PCE Inflation (MAR)🇺🇸

US - Personal Income (MAR)🇺🇸

Germany - Inflation Rate (APR)🇩🇪

Europe - GDP (Q1)🇪🇺

Want to partner with Sunday Morning Markets? Click here to inquire.