What Moved The Markets This Week

Fed holds rates steady, M&A deal activity surges, Nvidia unveils Rubin AI chip, Klarna lands deals with Walmart and DoorDash ahead of IPO, BYD touts battery breakthrough, and MU + NKE + FDX earnings

Sunday Morning Markets

Trading Week 12, covering Monday, Mar 17 through Friday, Mar 21. Your weekly financial markets update, in less than 5 minutes.

The Week In Review ⏪

Monetary Pause: Fed, China, Japan, and UK hold rates amid growth risks.

M&A Surge: Google-Wiz, SoftBank-Ampere, and Pepsi-Poppi lead deal wave.

Dept. of Education: Trump signs EO to close agency, shift control to states.

Retail Sales Stall: Modest 0.2% rise misses forecasts as spending slows.

EU Tariff Delay: Postpones levies on U.S. to extend trade negotiations.

Germany Debt Shift: Eases brake, launches €500B fund for defense, infra.

Klarna Wins Big: Snags Walmart BNPL deal, adds DoorDash partnership.

Nvidia Rubin Debut: New AI chip delivers 50 petaflops for inference tasks.

BYD Battery Breakthrough: 5-min charge gives 400km range, tops Tesla.

Earnings Reports: Micron, Nike, and Fedex.

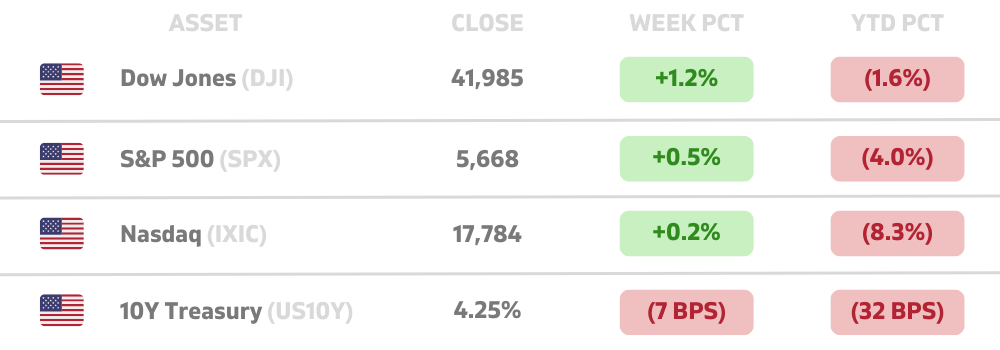

US Markets 🇺🇸

Fed holds interest rates steady, as expected, but dots in two more cuts for 2025. The SEP showed officials adjusted their growth projections lower but raised inflation expectations.

Bank of America’s CEO says economy is ‘better than people think’ and urges the Fed to keep rates on hold through 2026, pointing to resilient consumer spending and steady 2% growth ahead.

Existing home sales in the U.S. surge 4.2% in February, defying higher mortgage rates. Rising inventory and pent-up demand drove the gains, with luxury homes leading the rebound.

Retail sales grew just 0.2% last month, missing estimates after January’s sharp 1.2% drop. Growth in health, food, and online sales helped offset declines at bars, restaurants, and gas stations.

PepsiCo buys prebiotic soda brand Poppi for $1.95 billion as rival Coca-Cola rolls out its own prebiotic drink, Simply Pop. The deal boosts Pepsi’s stake in the fast-growing functional soda market.

Trump moves to shut down the Department of Education, signing an executive order but lawsuits challenge the plan. The order shifts control and funding from federal oversight to the individual states.

Global Markets 🌏

China, England, and Japan all hold rates steady this week, as global economic uncertainty forces central banks to balance sluggish growth with lingering inflation pressures. Read more: Japan, China.

OECD slashes U.S. and global growth forecasts as tariffs weigh on trade. U.S. GDP now seen at 2.2% in 2025, while global growth slows to 3.1%, with inflation staying higher for longer.

Germany passes historic debt reform to boost defense spending, easing its strict debt brake and creating a €500B infrastructure fund. The move marks a major shift in fiscal policy amid economic stagnation.

EU delays tariffs on U.S. goods until mid-April to allow more time for talks with Washington. The $28B retaliation plan targets U.S. steel, aluminum, bourbon, and other consumer goods.

Israel hits Gaza with 'extensive strikes,' killing over 400 as the ceasefire collapses. Hamas accuses Israel of derailing negotiations, while Israel says Hamas still holds nearly 60 hostages.

Canada’s inflation spikes to 8-month high as the end of a sales tax break drives February’s rate to 2.6%. Meanwhile, home sales cratered to the lowest level in nearly three years, down 10%.

China’s economy starts 2025 strong despite Trump tariffs, with retail sales up 4% and industrial production beating forecasts. But rising unemployment and a weak property sector weigh on recovery.

Tech ⚡

Google buys cloud security firm Wiz for $32B, its largest deal ever, to strengthen its position in cloud security. Wiz will stay independent, supporting all cloud providers as it scales globally.

Nvidia debuts latest Blackwell Ultra and Rubin AI chips at its GTC conference. Rubin, when paired with new Vera CPU chip, can manage 50 petaflops for inference, more than double the current Blackwell chips.

BYD unveils new EV tech that charges batteries in 5 minutes, delivering 400km of range—about as fast as a gas station stop. By contrast, Tesla’s superchargers offer 270km of range in 15 minutes.

SoftBank acquires chipmaker Ampere for $6.5B to strengthen its AI and semiconductor push. Ampere will stay an independent subsidiary, as Carlyle Group and Oracle will fully exit their stakes.

Klarna lands major BNPL deals with Walmart and DoorDash ahead of its IPO. Klarna snagged the exclusive deal with Walmart away from its top competitor, Affirm, who saw their shares drop 11% this week.

OpenAI to launch ChatGPT Connectors for Google Drive and Slack, allowing businesses to query internal data. It will be able to sync encrypted files, respect permissions, and access Docs, Slides, PDFs, and Slack channels.

Zeekr rolls out free advanced driver-assistance in China following Tesla’s launch of a free trial for FSD. The race for dominance in EV autonomy is heating up as both brands push their next-generation tech.

Earnings Reports 💰

Weekly Poll 🗳️

Week Ahead 📅

Monday

US - S&P Services PMI 🇺🇸

US - S&P Manufacturing PMI 🇺🇸

UK - S&P Composite PMI 🇬🇧

EU - HCOB Composite PMI 🇪🇺

Earnings: Intuitive Machines, Oklo💰

Tuesday

US - CB Consumer Confidence 🇺🇸

US - New Home Sales 🇺🇸

DE - Ifo Business Climate Index 🇩🇪

Earnings: Rumble, Gamestop💰

Wednesday

US - Durable Goods 🇺🇸

US - GDPNow Projection 🇺🇸

UK - CPI Inflation 🇬🇧

EU - ECB Non-Policy Meeting 🇪🇺

Earnings: Chewy💰

Thursday

US - GDP Report 🇺🇸

US - Jobless Claims 🇺🇸

EU - Economic Forecasts 🇪🇺

Earnings: Lululemon💰

Friday

US - PCE Inflation 🇺🇸

CA - GDP Report 🇨🇦

UK - GDP Report 🇬🇧

UK - Retail Sales 🇬🇧

Want to partner with Sunday Morning Markets? Click here to inquire.